Asia Pacific Virtual Cards Market Size, Share, and COVID-19 Impact Analysis, By Card Type (Debit Card and Credit Card), By Product Type (B2B Virtual Cards, B2C Remote Payment Virtual Cards, and C2B POS Virtual Cards), and Asia Pacific Virtual Cards Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialAsia Pacific Virtual Cards Market Insights Forecasts to 2035

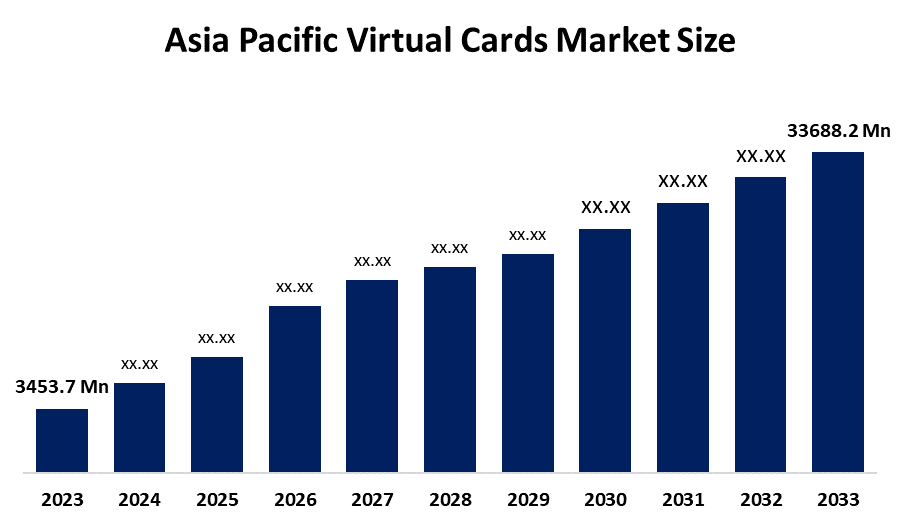

- The Asia Pacific Virtual Cards Market Size Was Estimated at USD 3453.7 Million in 2024.

- The Market Size is Growing at a CAGR of 23.01% between 2025 and 2035.

- The Asia Pacific Virtual Cards Market is Anticipated to Reach USD 33688.2 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Asia Pacific virtual cards market is anticipated to hold USD 33688.2 Million by 2035, growing at a CAGR of 23.01% from 2025 to 2035. Future opportunities in the Asia Pacific virtual cards market include rapid digital payment adoption, fintech and bank collaborations, mobile wallet integration, expanded use in e-commerce and B2B, enhanced security tech, loyalty rewards, and inclusion of underbanked populations.

Market Overview

The Asia Pacific Virtual Cards Market Size is experiencing strong growth, driven by rapid digitalization, expanding e-commerce, and rising demand for secure cashless payment solutions. Virtual cards offer enhanced security, flexibility, and real-time control, making them attractive for both consumers and enterprises. Increasing smartphone penetration, widespread internet access, and supportive government initiatives promoting digital payments are accelerating adoption across countries such as China, India, Japan, and Southeast Asia. Financial institutions and fintech companies are actively launching innovative virtual card solutions integrated with mobile wallets and corporate expense management platforms. Additionally, growing cross-border trade, subscription-based services, and B2B transactions are boosting usage. As cybersecurity concerns rise, virtual cards are gaining preference due to tokenization and fraud reduction benefits, positioning the market for sustained expansion.

Report Coverage

This research report categorizes the market for the Asia Pacific virtual cards market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific virtual cards market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific virtual cards market.

Asia Pacific Virtual Cards Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3453.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 23.01% |

| 2035 Value Projection: | USD 33688.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 85 |

| Segments covered: | By Card Type, By Product Type |

| Companies covered:: | Stripe, Skrill, Paysafe, Wise, Mastercard, JPMorgan Chase & Co, WEX, Marqeta and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key driving factors of the Asia Pacific virtual cards market include rapid growth of digital payments, expanding e-commerce platforms, and rising smartphone and internet penetration. Increasing concerns over payment security and fraud prevention are encouraging adoption of virtual cards. Supportive government initiatives promoting cashless economies, growth of fintech ecosystems, and integration of virtual cards with mobile wallets and corporate expense management systems are further accelerating market growth across both consumer and B2B segments.

Restraining Factors

Key restraining factors include limited awareness in developing economies, regulatory complexities, cybersecurity risks, lack of digital infrastructure, resistance to change from traditional payment methods, and integration challenges with legacy banking systems.

Market Segmentation

The Asia Pacific virtual cards market share is classified into card type and product type.

- The credit card segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific virtual cards market is segmented by card type into debit card and credit card. Among these, the credit card segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The credit card segment dominates due to higher acceptance in online transactions, widespread use in corporate and cross-border payments, better reward structures, strong fraud protection features, and seamless integration with e-commerce platforms and digital wallets across Asia Pacific markets.

- The B2B virtual cards segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific virtual cards market is segmented by product type into B2B virtual cards, B2C remote payment virtual cards, and C2B POS virtual cards. Among these, the B2B virtual cards segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The B2B virtual cards segment leads due to growing corporate adoption for secure supplier payments, automated expense management, improved cash flow control, reduced fraud risk, and increasing cross-border transactions across enterprises in the Asia Pacific region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Virtual Cards market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stripe

- Skrill

- Paysafe

- Wise

- Mastercard

- JPMorgan Chase & Co

- WEX

- Marqeta

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific virtual cards market based on the following segments:

Asia Pacific Virtual Cards Market, By Card Type

- Debit Card

- Credit Card

Asia Pacific Virtual Cards Market, By Product Type

- B2B Virtual Cards

- B2C Remote Payment Virtual Cards

- C2B POS Virtual Cards

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific virtual cards market size?Asia Pacific virtual cards market size is expected to grow from USD 3453.7 Million in 2024 to USD 33688.2 Million by 2035, growing at a CAGR of 23.01% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Key driving factors of the Asia Pacific virtual cards market include rapid growth of digital payments, expanding e-commerce platforms, and rising smartphone and internet penetration.

-

What factors restrain the Asia Pacific virtual cards market?Key restraining factors include limited awareness in developing economies, regulatory complexities, cybersecurity risks, lack of digital infrastructure, resistance to change from traditional payment methods, and integration challenges with legacy banking systems.

-

How is the market segmented by card type?The market is segmented into card type into debit card and credit card.

-

Who are the key players in the Asia Pacific virtual cards market?Key companies include Stripe, Skrill, Paysafe, Wise, Mastercard, JPMorgan Chase & Co, WEX, and Marqeta.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?