Asia Pacific Trade Credit Insurance Market Size, Share, and COVID-19 Impact Analysis, By Enterprise Size (Large Enterprises and Small & Medium Enterprises), By Coverage (Whole Turnover Coverage and Single Buyer Coverage), and Asia Pacific Trade Credit Insurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialAsia Pacific Trade Credit Insurance Market Insights Forecasts to 2035

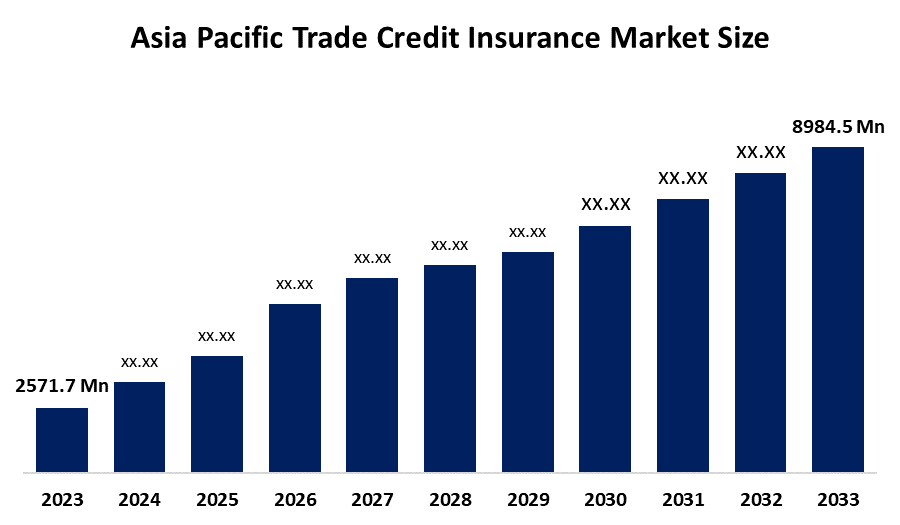

- The Asia Pacific Trade Credit Insurance Market Size Was Estimated at USD 2571.7 Million in 2024.

- The Market Size is Growing at a CAGR of 12.04% between 2025 and 2035.

- The Asia Pacific Trade Credit Insurance Market is Anticipated to Reach USD 8984.5 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Asia Pacific trade credit insurance market is anticipated to hold USD 8984.5 Million by 2035, growing at a CAGR of 12.04% from 2025 to 2035. Future opportunities in the Asia Pacific trade credit insurance market include expanding cross-border trade, SME financing growth, rising insolvency risks, digital underwriting adoption, and increasing demand for risk mitigation amid economic volatility.

Market Overview

The Asia Pacific Trade Credit Insurance Market Size is witnessing steady growth, supported by expanding regional and international trade, increasing insolvency risks, and heightened awareness of credit risk management among businesses. Companies across manufacturing, retail, and export-driven sectors are adopting trade credit insurance to safeguard receivables and improve cash flow stability. Rapid growth of small and medium-sized enterprises, especially in emerging economies such as India, China, and Southeast Asia, is further driving demand. Insurers are increasingly leveraging digital platforms, data analytics, and AI-based risk assessment tools to enhance underwriting efficiency and customer experience. Additionally, rising geopolitical uncertainties, supply chain disruptions, and fluctuating economic conditions are encouraging firms to adopt trade credit insurance as a strategic financial risk mitigation tool, supporting long-term market expansion across the region.

Report Coverage

This research report categorizes the market for the Asia Pacific trade credit insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific trade credit insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific trade credit insurance market.

Asia Pacific Trade Credit Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2571.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 12.04% |

| 2035 Value Projection: | USD 8984.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Enterprise Size, By Coverage |

| Companies covered:: | Aon PLC, American Financial Group Inc, QBE Insurance Group Ltd, Chubb Ltd, Coface SA, American International Group Inc, Allianz SE, Zurich Insurance Group AG and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key driving factors of the Asia Pacific trade credit insurance market include rising cross-border trade, increasing payment default risks, and growing awareness of receivables protection among businesses. Rapid SME expansion, volatile economic conditions, and frequent supply chain disruptions are encouraging firms to manage credit risk proactively. Additionally, supportive government trade policies, growing export activities, and adoption of digital underwriting and risk assessment technologies by insurers are improving accessibility and efficiency, further accelerating market growth across the region.

Restraining Factors

Major restraining factors include high premium costs, limited awareness among SMEs, complex policy terms, regulatory differences across countries, lengthy claim settlement processes, and dependence on accurate financial data for risk assessment.

Market Segmentation

The Asia Pacific trade credit insurance market share is classified into enterprise size and coverage.

- The large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific trade credit insurance market is segmented by enterprise size into large enterprises and small & medium enterprises. Among these, the large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The large enterprises segment dominates due to extensive cross-border trade, higher receivables, greater exposure to credit risks, structured risk management policies, and the ability to afford comprehensive trade credit insurance solutions, ensuring financial stability and operational continuity.

- The whole turnover coverage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific trade credit insurance market is segmented by coverage into whole turnover coverage and single buyer coverage. Among these, the whole turnover coverage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The whole turnover coverage segment leads due to its ability to protect all receivables, mitigate widespread credit risks, support large-scale trade operations, provide financial stability, and offer comprehensive risk management for enterprises across diverse customer portfolios.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific trade credit insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aon PLC

- American Financial Group Inc

- QBE Insurance Group Ltd

- Chubb Ltd

- Coface SA

- American International Group Inc

- Allianz SE

- Zurich Insurance Group AG

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific trade credit insurance market based on the following segments:

Asia Pacific Trade Credit Insurance Market, By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

Asia Pacific Trade Credit Insurance Market, By Coverage

- Whole Turnover Coverage

- Single Buyer Coverage

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific trade credit insurance market size?Asia Pacific trade credit insurance market size is expected to grow from USD 2571.7 Million in 2024 to USD 8984.5 Million by 2035, growing at a CAGR of 12.04% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Key driving factors of the Asia Pacific trade credit insurance market include rising cross-border trade, increasing payment default risks, and growing awareness of receivables protection among businesses.

-

What factors restrain the Asia Pacific trade credit insurance market?Major restraining factors include high premium costs, limited awareness among SMEs, complex policy terms, regulatory differences across countries, lengthy claim settlement processes, and dependence on accurate financial data for risk assessment.

-

How is the market segmented by enterprise size?The market is segmented into enterprise size into large enterprises and small & medium enterprises.

-

Who are the key players in the Asia Pacific trade credit insurance market?Key companies include Aon PLC, American Financial Group Inc, QBE Insurance Group Ltd, Chubb Ltd, Coface SA, American International Group Inc, Allianz SE, and Zurich Insurance Group AG.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?