Asia Pacific Titanium Dioxide Market Size, Share, and COVID-19 Impact Analysis, By Grade (Anatase and Rutile), By Process (Sulphate and Chloride), and Asia Pacific Titanium Dioxide Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Titanium Dioxide Market Insights Forecasts To 2035

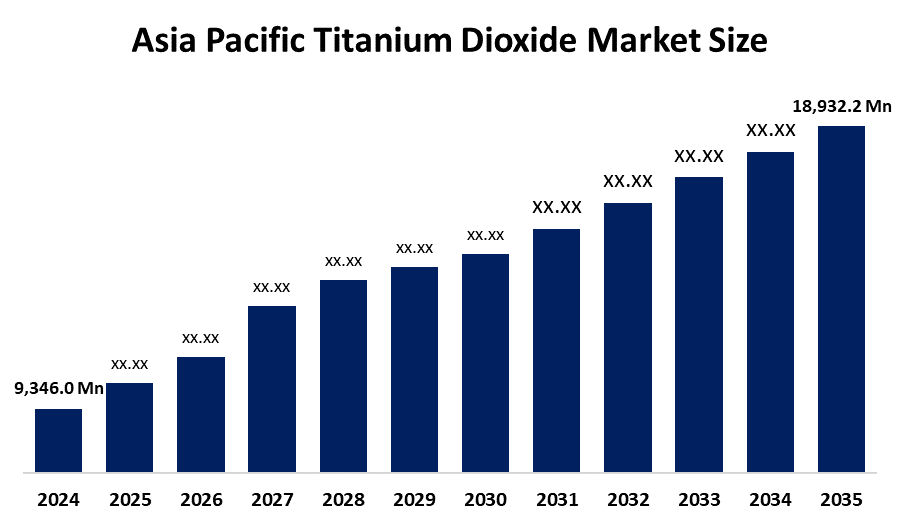

- The Asia Pacific Titanium Dioxide Market Size Was Estimated At USD 9,346.0 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 6.63% From 2025 To 2035

- The Asia Pacific Titanium Dioxide Market Size Is Expected To Reach USD 18,932.2 Million By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Asia Pacific Titanium Dioxide Market Size Is Expected To Grow From Usd 9,346.0 Million In 2024 To Usd 18,932.2 Million By 2035, Growing At A Cagr Of 6.63% During The Forecast Period 2025-2035. The market is driven by rapid industrialization, especially in China and India, fueling demand in construction (paints & coatings) and plastics; urbanization, boosting infrastructure and housing projects; and a rising middle class leading to more demand for consumer goods, cosmetics, and packaged foods.

Market Overview

Titanium Dioxide (Tio2) Is A Naturally Occurring White Inorganic Pigment Known For Its Exceptional Brightness And Very High Refractive Index, Making It The Most Widely Used White Pigment In The World. Key characteristics include its ability to scatter visible light, providing opacity, whiteness, and durability to various materials. Current market trends show a significant rise in demand for high-performance coatings in the construction and automotive sectors, as well as an increasing preference for UV-resistant compounds in cosmetics and sunscreens.

Governments Across The Asia-Pacific Region Are Actively Promoting Domestic Manufacturing Through Initiatives Like India's "Make In India" And China's Substantial Grants For High-Tech Manufacturing, Which Aim To Boost Local Tio2 Production Capacity. In the private sector, companies are increasingly focusing on sustainability, such as Chemours launching bio-based organic surface treatments and using renewable electricity for production. Additionally, private-public partnerships are emerging to develop eco-friendly chloride-route production facilities to meet stricter environmental standards.

Technological Progress In The Asia-Pacific Tio2 Market Size Is Centered On Nanotechnology, Enabling The Production Of Nano-Sized Particles That Offer Superior UV Resistance And Self-Cleaning Properties For High-End Coatings. Innovations in sulfate and chloride manufacturing processes are improving energy efficiency and reducing the environmental footprint of production. Furthermore, the emergence of 3D-printed titanium dioxide is revolutionizing the construction and automotive industries by offering enhanced design flexibility and structural durability.

Report Coverage

This Research Report Categorizes The Market Size For The Asia Pacific Titanium Dioxide Market Based On Various Segments And Regions, And Forecasts Revenue Growth And Analyses Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific titanium dioxide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific titanium dioxide market.

Asia Pacific Titanium Dioxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9,346.0 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.63% |

| 2023 Value Projection: | USD 18,932.2 Million |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Grade, By Process |

| Companies covered:: | LB Group (China), Ishihara Sangyo Kaisha, Ltd., Tayca Corporation, CNNC Hua Yuan Titanium Dioxide Co., Ltd., The Kerala Minerals & Metals Limited (India), Tata Chemicals (India), V.V. Titanium Pigments Pvt. Ltd. (India), CATHAY INDUSTRIES (Hong Kong/China), and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Market Size Is Primarily Driven By Rapid Urbanization And Massive Infrastructure Projects In Emerging Economies Like China And India, Which Boost Demand For Architectural Paints And Coatings. The booming automotive industry also fuels consumption as TiO2 provides essential durability and aesthetic appeal for vehicle finishes. Additionally, the expanding plastics and cosmetics sectors utilize TiO2 for its superior opacity and UV protection, further accelerating regional market growth during the forecast period.

Restraining Factors

Market Growth Is Hindered By High Volatility In Raw Material Prices, Particularly For Ilmenite And Rutile Ores. Stringent environmental regulations regarding hazardous waste disposal and energy-intensive manufacturing processes also pose significant operational challenges for producers.

Market Segmentation

The Asia Pacific titanium dioxide market share is categorised into grade and process.

- The rutile segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Titanium Dioxide Market Size Is Segmented By Grade Into Anatase And Rutile. Among these, the rutile segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rutile grade dominates due to its superior properties like higher opacity, UV resistance, and durability, making it ideal for high-performance paints, coatings (especially for construction and automotive), plastics, and inks, driven by rapid industrialization and urbanization in the region.

- The chloride processes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based On Process, The Asia Pacific Titanium Dioxide Market Size Is Segmented Into Sulphate And Chloride Processes. Among these, the chloride processes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. It is due to its use of cheaper, lower-grade ores (ilmenite/slag), simpler technology, and lower initial capital costs, making it cost-effective despite higher waste generation. While the chloride process produces higher-quality rutile and is cleaner, sulfate's raw material flexibility and established, less complex tech secured its market leadership, though environmental concerns are pushing towards chloride process innovations.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Asia Pacific Titanium Dioxide Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and Titanium Dioxide. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LB Group (China)

- Ishihara Sangyo Kaisha, Ltd.

- Tayca Corporation

- CNNC Hua Yuan Titanium Dioxide Co., Ltd.

- The Kerala Minerals & Metals Limited (India)

- Tata Chemicals (India)

- V.V. Titanium Pigments Pvt. Ltd. (India)

- CATHAY INDUSTRIES (Hong Kong/China)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific titanium dioxide market based on the below-mentioned segments:

Asia Pacific Titanium Dioxide Market, By Grade

- Anatase

- Rutile

Asia Pacific Titanium Dioxide Market, By Process

- Sulphate

- Chloride processes

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific titanium dioxide market size?The Asia Pacific titanium dioxide market size is expected to grow from USD 9,346.0 Million in 2024 to USD 18,932.2 Million by 2035, growing at a CAGR of 6.63% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?The market is primarily driven by rapid urbanization and massive infrastructure projects in emerging economies like China and India, which boost demand for architectural paints and coatings. The booming automotive industry also fuels consumption as TiO2 provides essential durability and aesthetic appeal for vehicle finishes. Additionally, the expanding plastics and cosmetics sectors utilize TiO2 for its superior opacity and UV protection, further accelerating regional market growth during the forecast period.

-

What factors restrain the Asia Pacific titanium dioxide market?Market growth is hindered by high volatility in raw material prices, particularly for ilmenite and rutile ores. Stringent environmental regulations regarding hazardous waste disposal and energy-intensive manufacturing processes also pose significant operational challenges for producers.

-

How is the market segmented by process?The market is segmented into sulphate and chloride processes.

Need help to buy this report?