Asia Pacific Sulphuric Acid Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Elemental Sulfur, Base Metal Smelters, Pyrite Ore and Others), By Manufacturing Process (Contact Process, Lead Chamber Process, Wet Sulfuric Acid Process), By Application (Fertilizers, Chemical Manufacturing, Automotive, Textile Industry, Metal Processing and Others), and Asia Pacific Sulphuric Acid Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsAsia Pacific Sulphuric Acid Market Insights Forecasts to 2035

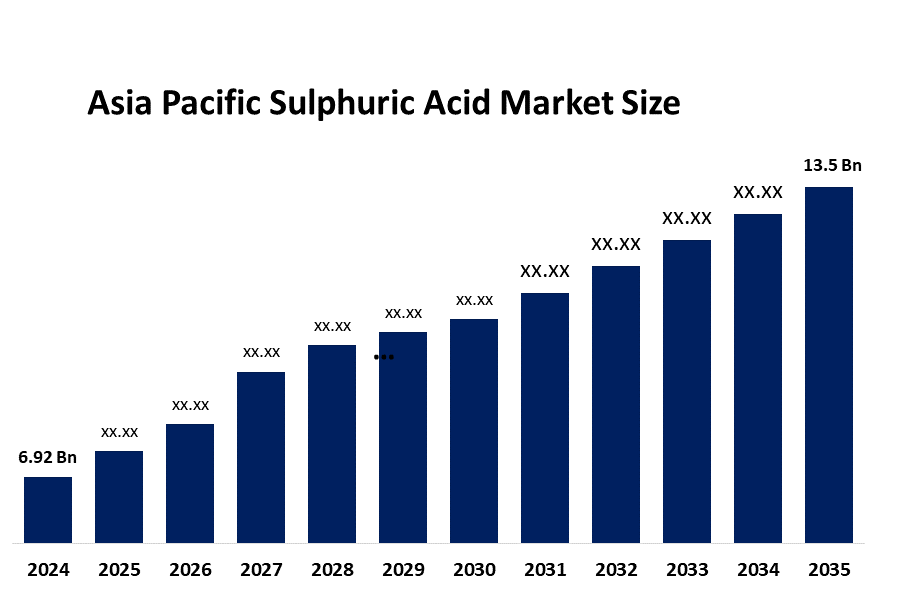

- The Asia Pacific Sulphuric Acid Market Size Was Estimated at USD 6.92 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.26% from 2025 to 2035

- The Asia Pacific Sulphuric Acid Market Size is Expected to Reach USD 13.5 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Sulphuric Acid Market Size is anticipated to reach USD 13.5 Billion by 2035, Growing at a CAGR of 6.26% from 2025 to 2035. The market is driven by increasing demand for high-quality fertilizers for crop cultivation, which boosts the Asia-Pacific sulfuric acid market, making it easier to avoid the use of hazardous chemicals and encourage innovation for the development of safe and sustainable alternatives.

Market Overview

Sulphuric acid serves as an established mineral acid which functions as an oxidizing agent, and industrial production occurs through the contact process method that transforms sulphur dioxide into sulphuric acid through the oxidation of sulphur in air. Sulphuric acid appears as a colorless substance that dissolves in water and finds multiple uses throughout the chemical industry and fertilizer sector, and pharmaceutical field. Three main factors drive the strong growth of the Asia Pacific sulfuric acid market. Fertilizer demand, which uses 60% of regional production, will grow because of population expansion and government agricultural subsidy programs.

QatarEnergy Marketing's decision to increase its November Qatar Sulphur Price (QSP) to USD 400/t fob represents a dramatic USD 76/t jump from October's USD 324/t level. The state-owned company implemented this major price change because of increasing global sulfur shortages and ongoing demand from fertilizer production companies.

The Indian government has offered incentives through its decision to decrease the Goods and Services Tax (GST) rate on ammonia and sulfuric acid from 18% to 5%, which will help the fertilizer production industry resolve its inverted duty structure. The Central Pollution Control Board (CPCB) and other Indian regulatory agencies require industrial facilities to establish emission monitoring systems that track SO2 and acid mist emissions according to their standard waste management procedures.

Report Coverage

This research report categorizes the market for the Asia Pacific sulphuric acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific sulphuric acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific sulphuric acid market.

Asia Pacific Sulphuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.92 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.26% |

| 2035 Value Projection: | USD 13.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Raw Material,By Manufacturing Process |

| Companies covered:: | Jiangsu Saiboat Petrochemical, Atotech China, China Petrochemical Corp., Sumitomo Chemical, Mitsubishi Gas Chemical, Kanto Chemical Co., Coromandel International, Hindustan Zinc, Gujarat Narmada Valley Fertilizers and Chemicals, Sun Metals Co., Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sulphuric acid market in Asia Pacific is driven by needs phosphate-based fertilizers because it requires them to produce more food for its expanding population. The infrastructure development and electric vehicle battery manufacturing require metals such as copper, zinc and nickel from mining operations, which creates a rising demand for these metals. The demand for high-purity sulfuric acid is increasing because it serves three purposes: semiconductor manufacturing, printed circuit board production, and e-waste recycling which extracts valuable metals.

Restraining Factors

The sulphuric acid market in Asia Pacific is hindered by the highly corrosive nature of sulfuric acid, with its health and environmental dangers. The production costs and profit margins of a business experience direct effects from changes in crude oil and natural gas prices and availability which result from geopolitical conflicts and supply chain interruptions.

Market Segmentation

The Asia Pacific sulphuric acid market share is categorised into raw material, manufacturing process and application.

- The elemental sulfur segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific sulphuric acid market is segmented by raw material into elemental sulfur, base metal smelters, pyrite ore and others. Among these, the elemental sulfur segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the availability of a widely accessible and economically viable source; elemental sulfur enables more efficient production processes. This is supported by rising product demand which fertilizer and chemical production and petroleum refinery operations. The agricultural sector needs sulfur-based fertilizers which include ammonium sulfate and phosphates, so they create additional demand for elemental sulfur.

- The contact process segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on manufacturing process, the Asia Pacific sulphuric acid market is segmented into contact process, lead chamber process, wet sulfuric acid process. Among these, the contact process segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the process that generates concentrated acid at 99.5% conversion efficiency, which serves as the essential requirement for modern industrial and electronics applications. The process serves as the exclusive method that can produce the necessary industrial quantities needed to satisfy the fertilizer industry, which accounts for more than 50-60% of total fertilizer production.

- The fertilizers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific sulphuric acid market is segmented by application into fertilizers, chemical manufacturing, automotive, textile industry, metal processing and others. Among these, the fertilizers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the fertilizers maintain their vital role because they improve soil fertility while increasing crop production capacity, which has become essential for satisfying the growing worldwide demand for food. The worldwide population growth, with the necessity to increase agricultural output in developing countries, has created a fertilizer demand that drives the usage of sulfuric acid.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific sulphuric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jiangsu Saiboat Petrochemical

- Atotech China

- China Petrochemical Corp.

- Sumitomo Chemical

- Mitsubishi Gas Chemical

- Kanto Chemical Co.

- Coromandel International

- Hindustan Zinc

- Gujarat Narmada Valley Fertilizers and Chemicals

- Sun Metals Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Sulphuric Acid Market based on the below-mentioned segments:

Asia Pacific Sulphuric Acid Market, By Raw Material

- Elemental Sulfur

- Base Metal Smelters

- Pyrite Ore

- Others

Asia Pacific Sulphuric Acid Market, By Manufacturing Process

- Contact Process

- Lead Chamber Process

- Wet Sulfuric Acid Process

Asia Pacific Sulphuric Acid Market, By Application

- Fertilizers

- Chemical Manufacturing

- Automotive

- Textile Industry

- Metal Processing

- Others

Frequently Asked Questions (FAQ)

-

Q:What is the Asia Pacific sulphuric acid market size?A: The Asia Pacific Sulphuric Acid Market size is expected to grow from USD 6.92 billion in 2024 to USD 13.5 billion by 2035, growing at a CAGR of 6.26% during the forecast period 2025-2035.

-

Q:What is sulphuric acid, and its primary use?A:Sulphuric Acid exists as an established mineral acid which functions as an oxidizing agent and industrial production occurs through the contact process method that transforms sulphur dioxide into sulphuric acid through the oxidation of sulphur in air.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by needs phosphate-based fertilizers due to it requires them to produce more food for its expanding population.

-

Q:What factors restrain the Asia Pacific sulphuric acid market?A:The market is restrained by the highly corrosive nature of sulfuric acid, together with its health and environmental dangers produces serious risks.

-

Q:How is the market segmented by manufacturing process?A:The market is segmented into the contact process, lead chamber process, wet sulfuric acid process.

-

Q:Who are the key players in the Asia Pacific Sulphuric Acid market?A:Key companies include Jiangsu Saiboat Petrochemical, Atotech China, China Petrochemical Corp., Sumitomo Chemical, Mitsubishi Gas Chemical, Kanto Chemical Co., Coromandel International, Hindustan Zinc, Gujarat Narmada Valley Fertilizers and Chemicals, and Sun Metals Co.

Need help to buy this report?