Asia Pacific Steel Market Size, Share, and COVID-19 Impact Analysis, By Type (Flat Steel, Long Steel), By Product (Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids), By Application (Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances), and Asia Pacific Steel Market Insights, Industry Trends, Forecast to 2035

Industry: Advanced MaterialsAsia Pacific Steel Market Size Insights Forecasts to 2035

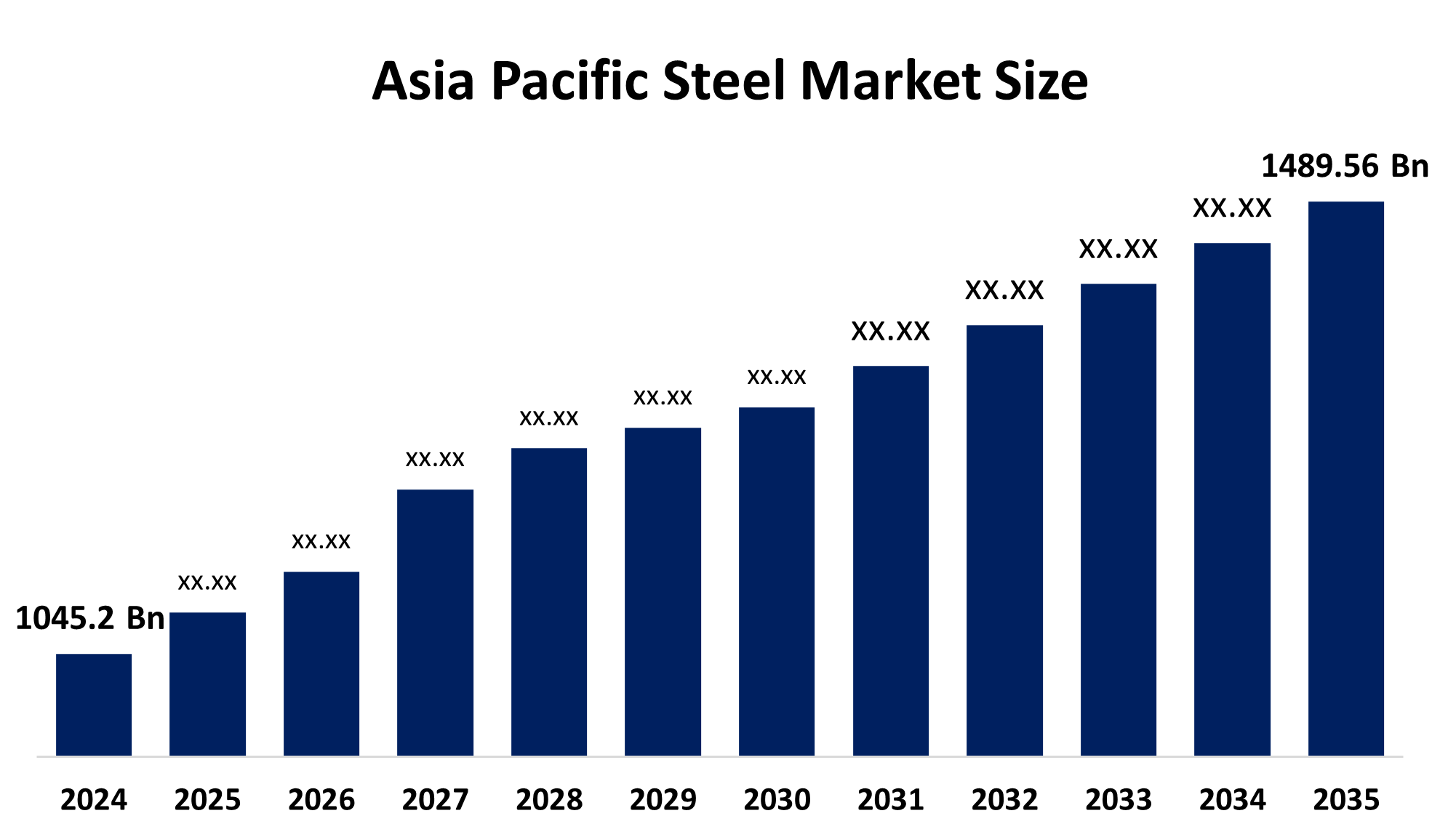

- The Asia Pacific Steel Market Size Was Estimated at USD 1045.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.27% from 2025 to 2035

- The Asia Pacific Steel Market Size is Expected to Reach USD 1489.56 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Steel Market Size is Anticipated to Reach USD 1489.56 Billion by 2035, Growing at a CAGR of 3.27% from 2025 to 2035. The market is driven by rapid urbanization, infrastructure growth (especially in China & India), and demand from automotive & construction sectors.

Market Overview

Steel is an extraordinarily adaptable metal made of iron and carbon, mainly, while different elements such as manganese, chromium, vanadium, and tungsten are added. The different kinds of steel are carbon steel, alloy steel, stainless steel, and tool steel. Before reaching its final form, steel goes through a series of processes starting from the ore to the finished product; iron ore is transformed into molten iron and then blended with additives for the desired properties of the steel. Eventually, it is formed and cooled into different shapes. Steel finds its way into almost every aspect of life, ranging from construction and automotive to power generation and even cutlery and packaging materials, among others.

The Asia Pacific Steel Market Size is the world's largest steel market, defined primarily by rapid urbanization and infrastructure development in China and India, strong production capacity, intense competition and huge demand from fast-growing construction, automotive and manufacturing sectors with an increasing focus on advanced, sustainable steel products. It encompasses diverse steel types (structural, stainless, galvanized) and applications, facing challenges like overcapacity but benefiting from regional economic development and government investment.

Report Coverage

This research report categorizes the market for the Asia Pacific Steel Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific steel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific steel market.

Asia Pacific Steel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1045.2 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.27% |

| 2035 Value Projection: | USD 1489.56 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Product |

| Companies covered:: | Nippon Steel (Japan), POSCO (South Korea), ArcelorMittal, China Baowu Steel Group, JFE Steel (Japan), Tata Steel (India), Hyundai Steel (South Korea), and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The steel market in Asia Pacific is driven by the need for metal, and in Asia Pacific continues to be high, particularly in the case of the car and building industries. Steel is still very much sought after in the Asia Pacifican market, particularly in the automotive and construction industries. The automotive sector, in particular, requires lighter, stronger materials that are good for the environment, and thus, the demand for special steel grades is increasing.

Restraining Factors

The steel market in Asia Pacific is restrained by the fluctuating raw material prices provide a challenge to the growth of the industry, high energy prices, and low demand, all affect the prices of materials and led to a decrease in the visible use of steel, rigid environmental rules, less competition, and fewer innovations.

Market Segmentation

The Asia Pacific steel market share is categorised into type, product, and application.

- The flat steel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Steel Market Size is segmented by type into flat steel, long steel. Among these, the flat steel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the Asia Pacific steel market was dominated by the flat steel segment with a 60.5% share. Its quality and wide applicability in different sectors, e.g., automotive, construction, and household appliances, are the main reasons for its popularity. Germany is leading the flat steel production; thanks to the modern rolling technologies it uses. Besides, the introduction of regulatory incentives for clean production not only leads to compliance with environmental standards but also attracts environmentally conscious customers.

- The structural steel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product, the Asia Pacific Steel Market Size is segmented into structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, braids. Among these, the structural steel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the widely remarked to be the most significant category in the wider list of products that were provided by you, correlated to the building and infrastructure segment.

- The building and construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Steel Market Size is segmented by application into building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, domestic appliances. Among these, the building and construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the year 2024, the building and construction segment was the leading sector in the Asia Pacifican steel market, taking a share of 45.3% of the total. The building and construction sector's predominance is based on the quality of the material, its multiple use cases, and its wide range of applications in pillars, bridges, and heavy works. Building and construction in Germany is the largest consumer of steel due to its quick adoption of modern fabrication techniques and its capability of controlling the weight of the structure at the same time.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Steel Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Steel (Japan)

- POSCO (South Korea)

- ArcelorMittal

- China Baowu Steel Group

- JFE Steel (Japan)

- Tata Steel (India)

- Hyundai Steel (South Korea)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, ArcelorMittal Nippon Steel India (AM/NS India) on announced the launch of two products, Optigal Prime and Optigal Pinnacle, in its premium colour-coated steel portfolio, Optigal.

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Steel Market Size based on the below-mentioned segments:

Asia Pacific Steel Market, By Type

- Flat Steel

- Long Steel

Asia Pacific Steel Market, By Product

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes, Braids

Asia Pacific Steel Market, By Application

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific steel market size?A: Asia Pacific steel market size is expected to grow from USD 1045.2 billion in 2024 to USD 1489.56 billion by 2035, growing at a CAGR of 3.27% during the forecast period 2025-2035

-

Q: What is Steel, and its primary use?A: Steel is an extraordinarily adaptable metal made of iron and carbon, mainly, while different elements such as manganese, chromium, vanadium, and tungsten are added. The different kinds of steel are carbon steel, alloy steel, stainless steel, and tool steel.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the need for metal, and in Asia Pacific continues to be high, particularly in the case of the car and building industries. Steel is still very much sought after in the Asia Pacifican market, particularly in the automotive and construction industries. The automotive sector, in particular, requires lighter, stronger materials that are good for the environment, and thus, the demand for special steel grades is increasing.

-

Q: What factors restrain the Asia Pacific steel market?A: The market is restrained by the fluctuating raw material prices provide a challenge to the growth of the industry, high energy prices, and low demand, all affect the prices of materials and lead to a decrease in the visible use of steel, rigid environmental rules, less competition, and fewer innovations.

-

Q: How is the market segmented by type?A: The market is segmented into flat steel, long steel

Need help to buy this report?