Asia Pacific Sodium Sulphate Market Size, Share, and COVID-19 Impact Analysis, By Nature (Natural, Synthetic), By End-Use (Paper & Pulp, Detergents, Glass, Food & Beverage), and Asia Pacific Sodium Sulphate Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsAsia Pacific Sodium Sulphate Market Insights Forecasts to 2035

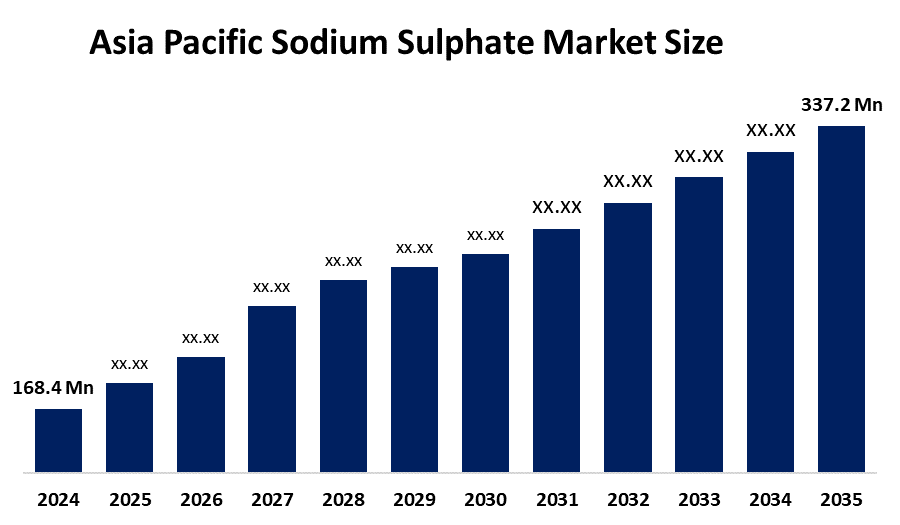

- The Asia Pacific Sodium Sulphate Market Size Was Estimated at USD 168.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.52% from 2025 to 2035

- The Asia Pacific Sodium Sulphate Market Size is Expected to Reach USD 337.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Asia Pacific Sodium Sulphate Market size is anticipated to reach USD 337.2 Million by 2035, growing at a CAGR of 6.52% from 2025 to 2035. The fast growth of emerging markets throughout the Asia Pacific region has created major benefits for multiple industrial sectors.

Market Overview

Sodium sulphate is a white crystalline solid which is used as a fundamental material to produce various items such as glass, detergents, kraft paper, cardboard and chemical compounds. The soap and detergent industries make use of sodium sulphate. Sodium sulfate functions as a feed additive for animals because it helps livestock improve their digestion and nutrient absorption. The increasing implementation of sustainable farming methods, together with the growing preference for environmentally safe agricultural chemicals and fertilizers has resulted in increased demand for sodium sulfate.

Grasim Industries Ltd. launched EcoSodium in May 2024 as an innovative, sustainable product that uses recycled Sodium Sulphate (SS) from Viscose Staple Fibre (VSF) manufacturing.

Shandong company in China launched an MVR plant in May 2025 to improve recovery efficiency and reduce emissions in industrial chemical processes, which follows the sustainable manufacturing trends. The Ministry of Employment and Labor (MoEL) of South Korea is enforcing a new amendment that requires all chemical substances to comply with updated standards for classification, labeling, and MSDS documentation, which includes Safety Data Sheets (MSDS) that must be completely updated by July 2026.

Report Coverage

This research report categorises the Asia Pacific sodium sulphate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific sodium sulphate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific sodium sulphate market.

Asia Pacific Sodium Sulphate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 168.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.52% |

| 2035 Value Projection: | USD 337.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Nature, By End-Use |

| Companies covered:: | China Nafine Group International Co., Ltd, Jiangsu Yinzhu Chemical Group Co. Ltd, Shikoku Chemicals Co., Nippon Chemical Industrial Co. Ltd, Grasim Industries, Tokyo Chemical Industry Pvt Ltd, Godavari Biorefineries, Sichuan Hongya Qingyijiang Sodium Sulfate Co., Ltd., Tata Chemicals Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sodium sulphate market in Asia Pacific is driven by the increasing need for sodium sulfate as a low-cost filler and flow agent for powdered detergents, as more people understand hygiene and urban areas continue to adopt washing machines. The fashion and apparel industries in China, India, and Bangladesh show strong growth, which creates higher demand for their products. Sodium sulfate serves as a fluxing and fining agent in glass production to eliminate air bubbles and produce transparent, high-quality glass products.

Restraining Factors

The sodium sulphate market in Asia Pacific is restrained by the growing use of concentrated liquid and tablet detergents, which require fewer or no sodium sulphate materials as industrial filler compared to standard powder detergents. The market prices of essential raw materials, together with fluctuations in energy costs, create unpredictable patterns that directly affect manufacturers' production costs and their ability to make profits.

Market Segmentation

The Asia Pacific sodium sulphate market share is categorised into nature and end use.

- The natural segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific sodium sulphate market is segmented by nature into natural, synthetic. Among these, the natural segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its existence in abundance across regions that experience dry weather conditions. Glauber's salt provides eco-friendly advantages in textile dyeing because it decreases pollution and total dissolved solids (TDS) and effluent load.

- The detergents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Asia Pacific sodium sulphate market is segmented into paper & pulp, detergents, glass, food & beverage. Among these, the detergents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by sodium sulphate, which functions as an essential component within the detergent industry because manufacturers use it to produce powdered detergents. The high-water solubility of the substance enables it to function as a detergent booster, which improves cleaning efficiency. The increase in infectious diseases, such as COVID-19, has raised global hygiene awareness results in greater needs for cleaning products, hand sanitizers and laundry detergents.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific sodium sulphate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China Nafine Group International Co., Ltd

- Jiangsu Yinzhu Chemical Group Co. Ltd

- Shikoku Chemicals Co.

- Nippon Chemical Industrial Co. Ltd

- Grasim Industries

- Tokyo Chemical Industry Pvt Ltd

- Godavari Biorefineries

- Sichuan Hongya Qingyijiang Sodium Sulfate Co., Ltd.

- Tata Chemicals Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Sodium Sulphate Market based on the below-mentioned segments:

Asia Pacific Sodium Sulphate Market, By Nature

- Natural

- Synthetic

Asia Pacific Sodium Sulphate Market, By End Use

- Paper & Pulp

- Detergents

- Glass

- Food & Beverage

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific sodium sulphate market size?A: Asia Pacific sodium sulphate market size is expected to grow from USD 168.4 million in 2024 to USD 337.2 million by 2035, growing at a CAGR of 6.52% during the forecast period 2025-2035.

-

Q: What is sodium sulphate, and its primary use?A: Sodium sulphate is a white crystalline solid which is used as a fundamental material to produce various items such as glass, detergents, kraft paper, cardboard and chemical compounds. The soap and detergent industries make use of sodium sulphate.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing need for sodium sulfate as a low-cost filler and flow agent for powdered detergents, which exists because more people understand hygiene, and urban areas continue to adopt washing machines.

-

Q: What factors restrain the Asia Pacific sodium sulphate market?A: The market is restrained by the growing use of concentrated liquid and tablet detergents, which require fewer or no sodium sulphate materials as industrial filler compared to standard powder detergents.

-

Q: How is the market segmented by nature?A: The market is segmented into natural, synthetic.

-

Q: Who are the key players in the Asia Pacific sodium sulphate market?A: Key companies include China Nafine Group International Co., Ltd, Jiangsu Yinzhu Chemical Group Co., Ltd., Shikoku Chemicals Co., Nippon Chemical Industrial Co., Ltd., Grasim Industries, Tokyo Chemical Industry Pvt Ltd, Godavari Biorefineries, Sichuan Hongya Qingyijiang Sodium Sulfate Co., Ltd. and Tata Chemicals Ltd.

Need help to buy this report?