Asia Pacific Silane Market Size, Share, and COVID-19 Impact Analysis, By Type (Organo-functional Silane, Mono/Chloro Silane), By Function (Coupling agents, Adhesion promoters, Hydrophobing and dispersing agents, Moisture scavengers, Silicate stabilizers), and Asia Pacific Silane Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Silane Market Insights Forecasts To 2035

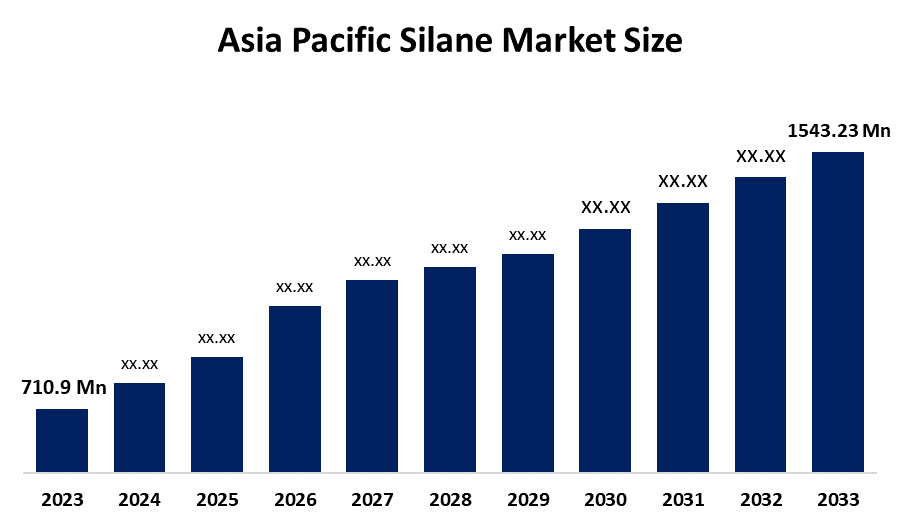

- The Asia Pacific Silane Market Size Was Estimated At USD 710.9 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 7.3% From 2025 To 2035

- The Asia Pacific Silane Market Size Is Expected To Reach USD 1543.23 Million By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Asia Pacific Silane Market Size Is Anticipated To Reach USD 1543.23 Million By 2035, Growing At A CAGR Of 7.3% From 2025 To 2035. The market is driven by rapid industrialization, massive infrastructure & construction projects, booming automotive production, and a strong Hydrophobing and dispersing agents sector (especially semiconductors) in countries like China, India, and Southeast Asia, driving demand for silane in coatings, adhesives, composites, and solar energy applications, alongside increasing focus on advanced, sustainable materials.

Market Overview

The Asia Pacific Silane Market Size Involves The Production And Application Of Silicon-Based Chemical Compounds That Serve As Essential Coupling Agents, Crosslinkers, And Adhesion Promoters Across Various Industrial Sectors. Silanes are characterized by their unique ability to form a molecular bridge between inorganic substrates (like glass or metal) and organic polymers, significantly enhancing the structural integrity and durability of materials. Current market trends indicate a shift toward high-purity silanes driven by the semiconductor industry and a growing preference for eco-friendly, water-borne silane systems in the coatings and adhesives sectors.

Government And Private Initiatives Are Playing A Pivotal Role In Shaping The Regional Landscape. Many Asian governments, particularly in China and India, are implementing strict VOC (Volatile Organic Compound) emission standards, which is encouraging private manufacturers to invest in the research and development of sustainable silane formulations. Additionally, private-sector investments in "Smart City" projects and infrastructure across Southeast Asia are boosting the demand for high-performance construction chemicals where silanes are a primary component.

Technological Advancements In The Field Are Centered On Digital Integration And Specialized Synthesis. The development of organ functional silanes and the adoption of advanced manufacturing processes have allowed for more precise molecular engineering, catering to the needs of the burgeoning electric vehicle (EV) battery and Hydrophobing and dispersing agents industries. Furthermore, innovations in packaging and delivery systems are improving the shelf-life and handling safety of these highly reactive chemicals.

Report Coverage

This Research Report Categorizes The Market Size For The Asia Pacific Silane Market Based On Various Segments And Regions, And Forecasts Revenue Growth And Analyses Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific silane market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific silane market.

Asia Pacific Silane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 710.9 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 7.3% |

| 2023 Value Projection: | USD 1543.23 Million |

| Historical Data for: | 2020 - 2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type By Function |

| Companies covered:: | Shin-Etsu Chemical Co., Ltd., Mitsubishi Chemical Group Corporation, Hubei Jingzhou Jianghan Fine Chemical Co., Ltd., WD Silicone Co., Ltd. (China), Zhejiang Xinan Chemical Industrial Group Co., Ltd., and Others,Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Asia Pacific Silane Market Size Is Primarily Driven By The Rapid Expansion Of The Hydrophobing And Dispersing Agents And Automotive Industries, Particularly In China, Japan, And South Korea. As the global hub for semiconductor manufacturing, this region sees a constant demand for high-purity silanes used in chemical vapor deposition. Furthermore, the surging production of electric vehicles requires specialized silanes for tire manufacturing and battery components to improve performance and energy efficiency. The booming construction sector, fueled by urbanization, also necessitates silane-based sealants and coatings for weatherproofing and structural reinforcement.

Restraining Factors

Market Size Growth Is Hindered By The High Volatility Of Raw Material Prices And The Complex Environmental Regulations Governing Chemical Manufacturing. Additionally, the specialized equipment and high energy consumption required for silane synthesis can lead to significant operational costs. Supply chain vulnerabilities and the need for specialized handling due to the hazardous nature of certain silane compounds also pose challenges for smaller regional players.

Market Segmentation

The Asia Pacific silane market share is categorised into type and function.

- The mono/chloro silane segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Silane Market Size Is Segmented By Type Into Organo-Functional Silane, Mono/Chloro Silane. Among these, the mono/chloro silane segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It dominated due to its foundational role as a precursor for silicones, essential in booming sectors like construction (adhesives, sealants) and electronics (solar panels), while also being cost-effective and versatile for various chemical syntheses.

- The coupling agents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based On Function, The Asia Pacific Silane Market Size Is Segmented Into Coupling Agents, Adhesion Promoters, Hydrophobing And Dispersing Agents, Moisture Scavengers, Silicate Stabilizers. Among these, the coupling agents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The primary reason for this dominance is the extensive use of coupling agents in the region's large and rapidly expanding manufacturing sectors, particularly in China and India.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Asia Pacific Silane Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and Silane. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shin-Etsu Chemical Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Hubei Jingzhou Jianghan Fine Chemical Co., Ltd.

- WD Silicone Co., Ltd. (China)

- Zhejiang Xinan Chemical Industrial Group Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific silane market based on the below-mentioned segments:

Asia Pacific Silane Market, By Type

- Organo-functional Silane

- Mono/Chloro Silane

Asia Pacific Silane Market, By Function

- Coupling agents

- Adhesion promoters

- Hydrophobing and dispersing agents

- Moisture scavengers

- Silicate stabilizers

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific silane market size?The Asia Pacific silane Market size is expected to grow from USD 710.9 Million in 2024 to USD 1543.23 Million by 2035, growing at a CAGR of 7.3% during the forecast period 2025-2035

-

What are the key growth drivers of the market?The Asia Pacific silane market is primarily driven by the rapid expansion of the Hydrophobing and dispersing agents and automotive industries, particularly in China, Japan, and South Korea. As the global hub for semiconductor manufacturing, this region sees a constant demand for high-purity silanes used in chemical vapor deposition.

-

What factors restrain the Asia Pacific silane market?Market growth is hindered by the high volatility of raw material prices and the complex environmental regulations governing chemical manufacturing. Additionally, the specialized equipment and high energy consumption required for silane synthesis can lead to significant operational costs.

-

How is the market segmented by function?The market is segmented into coupling agents, adhesion promoters, hydrophobing and dispersing agents, moisture scavengers, silicate stabilizers.

Need help to buy this report?