Asia Pacific Shipbuilding Market Size, Share, and COVID-19 Impact Analysis, By Type (Vessel, Container, Passenger, and Other Types), By End User (Transport Companies, Military, and Other End Users), and Asia Pacific Shipbuilding Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseAsia Pacific Shipbuilding Market Size Insights Forecasts to 2035

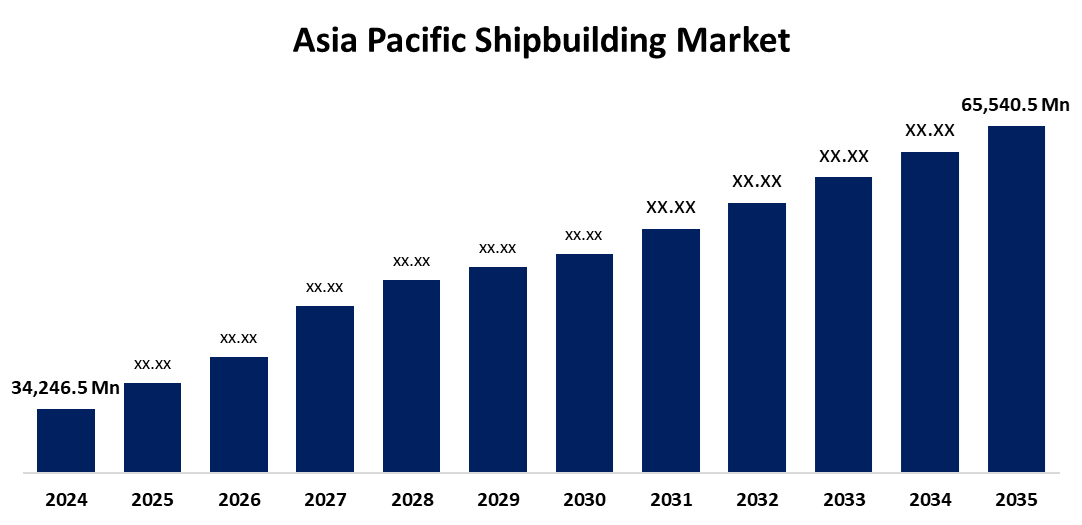

- The Asia Pacific Shipbuilding Market Size was estimated at USD 34.246.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.08% from 2025 to 2035

- The Asia Pacific Shipbuilding Market Size is Expected to Reach USD 65,540.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Asia Pacific Shipbuilding Market Size is anticipated to reach USD 65,540.5 million by 2035, growing at a CAGR of 6.08% from 2025 to 2035. The increasing international seaborne trade, along with the rising demand for green shipping technologies, is driving the shipbuilding market in the Asia Pacific region.

Market Overview

The Asia Pacific shipbuilding market refers to the industry emphasizing the designing, construction, repairing, and maintenance of large watercraft, including commercial vessels and naval vessels for military purposes. Shipbuilding refers to the construction of ships and other floating vessels, which normally takes place in a specialized facility known as a shipyard. The government's increasing expenditure on naval and defense capabilities is driving the demand for military vessels, like warships, submarines, and patrol boats. Integration of robotics and automated systems in the ship manufacturing industry is becoming prevalent. Further, smart manufacturing solutions are being implemented in shipyards to enhance the efficiency and precision within the major shipyards. Increasing international maritime traffic is driving the demand for shipbuilding due to increasing requirements for new vessels for cargo, container, and liquified natural gas (LNG) transport, providing a market growth opportunity.

Report Coverage

This research report categorizes the market for the Asia Pacific shipbuilding market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific shipbuilding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific shipbuilding market.

Asia Pacific Shipbuilding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 34,246.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.08% |

| 2035 Value Projection: | USD 65,540.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Samsung Heavy Industries Co., Ltd. (Samsung Group), Huntington Ingalls Industries, Inc., Sumitomo Heavy Industries, Ltd., BAE Systems PLC, Damen Shipyards Group, China State Shipbuilding Corporation, Korea Shipbuilding & Offshore Engineering Co., Ltd., Mitsubishi Heavy Industries Ltd., and Other key vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The high seaborne trade in the region is responsible for driving the shipbuilding market demand. The Asia Pacific region handles a significant portion of global container trade and is central to global international seaborne trade. The green transformation in the shipbuilding industry, especially in the oil & gas industry, with the increasing environmental concerns and emphasis on reducing carbon emissions & fuel consumption, is propelling the market growth. Innovative technologies, including 3D printing in commercial and military shipbuilding for producing complex, custom parts quickly and cost-effectively, are propelling the market growth.

Restraining Factors

The challenges associated with the maintenance and increased operational costs are hampering the shipbuilding market. Further, the environmental regulations and fluctuation in raw material prices are challenging the market growth.

Market Segmentation

Get more details on this report -

The Asia Pacific shipbuilding market share is classified into type and end user.

- The vessel segment held the dominant market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific shipbuilding market is segmented by type into vessel, container, passenger, and other types. Among these, the vessel segment held the dominant market share in 2024 and is expected to grow at a significant CAGR during the forecast period. An increasing emphasis on developing eco-friendly vessels equipped with alternative propulsion systems and energy-efficient technologies is supporting the market growth.

- The transport companies segment dominated the market with the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific shipbuilding market is segmented by end user into transport companies, military, and other end users. Among these, the transport companies segment dominated the market with the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The advancements in fuel efficiency and multi-fuel engines in the shipping companies are contributing to driving the market in the transport companies segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific shipbuilding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Heavy Industries Co., Ltd. (Samsung Group)

- Huntington Ingalls Industries, Inc.

- Sumitomo Heavy Industries, Ltd.

- BAE Systems PLC

- Damen Shipyards Group

- China State Shipbuilding Corporation

- Korea Shipbuilding & Offshore Engineering Co., Ltd.

- Mitsubishi Heavy Industries Ltd.

- Others

Recent Developments:

- In August 2024, Vietnam-based Asia Pacific Shipping decided to expand its fleet by ordering two liquefied petroleum gas (LPG) carriers from China’s Jiangnan Shipyard, as reported by Offshore Energy. The company has contracted Jiangnan Shipyard to build two 50,500 cubic meter LPG carriers, with each vessel valued at $102 million.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Shipbuilding Market based on the below-mentioned segments:

Asia Pacific Shipbuilding Market, By Type

- Vessel

- Container

- Passenger

- Other Types

Asia Pacific Shipbuilding Market, By End User

- Transport Companies

- Military

- Other End Users

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the Asia Pacific Shipbuilding Market over the forecast period?The Asia Pacific Shipbuilding Market is projected to expand at a CAGR of 6.08% during the forecast period.

-

2.What is the market size of the Asia Pacific Shipbuilding Market?The Asia Pacific Shipbuilding Market size is expected to grow from USD 34,246.5 Million in 2024 to USD 65,540.5 Million by 2035, at a CAGR of 6.08% during the forecast period 2025-2035.

-

3.Who are the top companies operating in the Asia Pacific Shipbuilding Market?Key players include Samsung Heavy Industries Co., Ltd. (Samsung Group), Huntington Ingalls Industries, Inc., Sumitomo Heavy Industries, Ltd., BAE Systems PLC, Damen Shipyards Group, China State Shipbuilding Corporation, Korea Shipbuilding & Offshore Engineering Co., Ltd., and Mitsubishi Heavy Industries Ltd.

-

4.What are the main drivers of growth in the Asia Pacific Shipbuilding Market?High seaborne trade, green transformation, and technological innovation are major market growth drivers of the shipbuilding market.

-

5.What challenges are limiting the Asia Pacific Shipbuilding Market?Maintenance and increased operational costs, as well as increasing environmental concerns, remain key restraints in the market.

Need help to buy this report?