Asia Pacific Pulp and Paper Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bleaching Agents, Fillers, Pulping Chemicals, Sizing, Specialty Pulp & Paper Additives, Binders, Blowing Agents, and Others), By Application (Printing, Packaging and Labelling, and Pulp Mills), and Asia Pacific Pulp and Paper Chemicals Market Size Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Pulp and Paper Chemicals Market Size Insights Forecasts to 2035

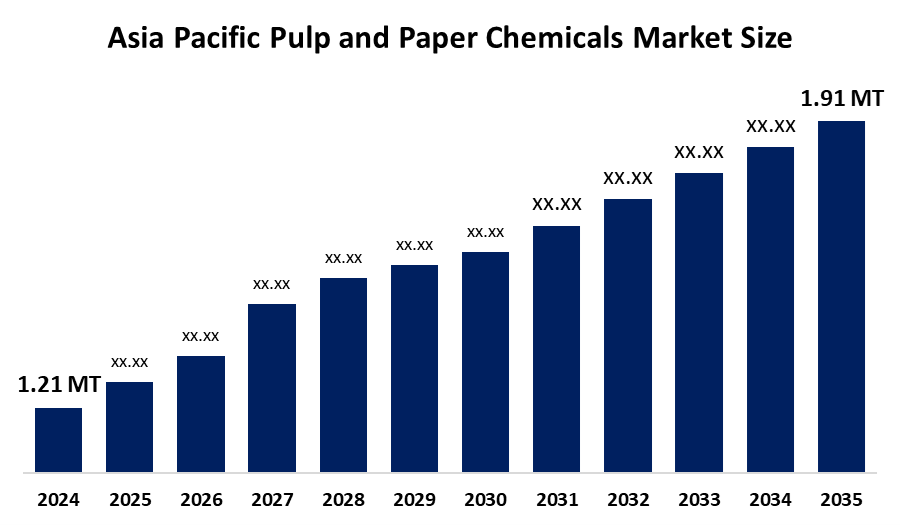

- The Asia Pacific Pulp and Paper Chemicals Market Size Was Estimated at 1.21 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.24% from 2025 to 2035

- The Asia Pacific Pulp and Paper Chemicals Market Size is Expected to Reach 1.91 Million Tonnes by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Asia Pacific Pulp and Paper Chemicals Market Size is Anticipated to Reach 1.91 Million Tonnes by 2035, growing at a CAGR of 4.24% from 2025 to 2035. The market is driven by rising urbanization and focus on the traditional way of education; the stationery sector, where paper has been consumed significantly in China and India and has historically driven the growth of the paper and pulp chemicals market.

Market Overview

The Pulp and Paper Chemicals Market Size consists of a diverse range of chemical substances used during the manufacturing of paper and paperboard. Pulp and paper chemicals are a diverse group of speciality and commodity substances used at nearly every stage of the papermaking process. Pulp and paper chemicals include speciality and functional additives that papermakers use throughout the entire papermaking process, from pulping to bleaching and sheet formation. The combined effect of increasing urbanization and the historical development of educational methods through traditional approaches has created a stationary market in China and India.

Kemira plans to expand its paper and board chemical production facilities in Thailand because they want to meet increasing demand from the Asia-Pacific market. The investment will enable Kemira to deliver its products to Southeast Asian and Indian markets because it operates as the leading producer and supplier of pulp, paper, and board chemicals in the Asia-Pacific region.

In 2024, Pakka, a manufacturer of compostable packaging solutions, introduced its first collection of flexible compostable packaging products. The product line was created to meet the growing demand for compostable flexible packaging solutions, which the food and beverages industry needs to achieve its environmental sustainability objectives.

The Indian government's NITI Aayog is proposing world-class chemical hubs that will feature shared infrastructure to enhance global value chain participation. The General Administration of Customs of China, with six other ministries, introduced new rules in October 2025, which mandate importers to specify the processing method used for imported recycled pulp between dry and wet processing.

Report Coverage

This research report categorises the Asia Pacific Pulp and Paper Chemicals Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Pulp and Paper Chemicals Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific Pulp and Paper Chemicals Market Size.

Asia Pacific Pulp and Paper Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 1.21 Million Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.24% |

| 2035 Value Projection: | 1.91 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | BASF SE, AkzoNobel N.V., Ashland Inc., Buckman Laboratories International, Inc., Evonik Industries AG, Kemira Oyj, SNF Floerger, Solenis LLC, Ecolab Inc., Clariant AG, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Pulp and Paper Chemicals Market Size in Asia Pacific is driven by the rapid development of online shopping which first appeared in China and India, has created a rising need for corrugated boxes, paper bags and shipping materials. The process results in higher usage of functional chemicals which include sizing agents and strength additives. Biodegradable paper-based packaging solutions have become necessary because of rising environmental awareness and government restrictions against single-use plastic items.

Restraining Factors

The Pulp and Paper Chemicals Market Size in the Asia Pacific is restrained by an environmental authority now require stricter wastewater treatment standards which mandate facilities to upgrade their systems for compliance with these new regulations. The price changes of wood pulp and chemical materials lead to unpredictable production expenses which result in lower profit margins for the company.

Market Segmentation

The Asia Pacific Pulp and Paper Chemicals Market Size share is categorised into product type and application.

- The speciality pulp & paper additives segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Pulp and Paper Chemicals Market Size is segmented by product type into bleaching agents, fillers, pulping chemicals, sizing, speciality pulp & paper additives, binders, blowing agents, and others. Among these, the speciality pulp & paper additives segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the textile and pulp industry, which uses this material. Speciality pulp and paper serve the purpose of enhancing both paper and mesh material properties and quality. Water treatment processes use speciality additives, which include Defoamers, retention aids and flocculant polymers to decrease biodegradable waste.

- The packaging and labelling segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific Pulp and Paper Chemicals Market Size is segmented into printing, packaging and labelling, and pulp mills. Among these, the packaging and labelling segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the packaging and labeling sector, which requires pulp and paper chemicals because speciality pulp and paper chemicals produce excellent print contrast results and create smooth finishes for lamination and vacuum metalizing processes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Pulp and Paper Chemicals Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- AkzoNobel N.V.

- Ashland Inc.

- Buckman Laboratories International, Inc.

- Evonik Industries AG

- Kemira Oyj

- SNF Floerger

- Solenis LLC

- Ecolab Inc.

- Clariant AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In February 2026, BASF is expanding its dispersions production capacity at its Mangalore site with the addition of a new production line. The expansion underscores BASF’s confidence in India’s long-term growth and its continued commitment to supporting customers across architectural paints, construction chemicals and paper applications.

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Pulp and Paper Chemicals Market Size based on the below-mentioned segments:

Asia Pacific Pulp and Paper Chemicals Market Size, By Product Type

- Bleaching Agents

- Fillers

- Pulping Chemicals

- Sizing

- Specialty Pulp & Paper Additives

- Binders

- Blowing Agents

- Others

Asia Pacific Pulp and Paper Chemicals Market Size, By Application

- Printing

- Packaging and Labelling

- Pulp Mills

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific Pulp and Paper Chemicals Market Size?Asia Pacific Pulp and Paper Chemicals Market Size is expected to grow from 1.21 million tonnes in 2024 to 1.91 million tonnes by 2035, growing at a CAGR of 4.24% during the forecast period 2025-2035

-

What are pulp and paper chemicals, and their primary use?The Pulp and Paper Chemicals Market Size consists of a diverse range of chemical substances used during the manufacturing of paper and paperboard. Pulp and paper chemicals are a diverse group of speciality and commodity substances used at nearly every stage of the papermaking process

-

What are the key growth drivers of the market?Market growth is driven by the rapid development of online shopping which first appeared in China and India, has created a rising need for corrugated boxes, paper bags and shipping materials.

-

What factors restrain the Asia Pacific Pulp and Paper Chemicals Market Size?The market is restrained by environmental authorities now requiring stricter wastewater treatment standards which mandate facilities to upgrade their systems for compliance with these new regulations.

-

How is the market segmented by product type?The market is segmented into bleaching agents, fillers, pulping chemicals, sizing, speciality pulp & paper additives, binders, blowing agents, and others.

-

Who are the key players in the Asia Pacific Pulp and Paper Chemicals Market Size?Key companies include BASF SE, AkzoNobel N.V., Ashland Inc., Buckman Laboratories International, Inc., Evonik Industries AG, Kemira Oyj, SNF Floerger, Solenis LLC, Ecolab Inc., and Clariant AG.

Need help to buy this report?