Asia Pacific Premium Bottled Water Market Size, Share, and COVID-19 Impact Analysis, By Product (Spring Water, Sparkling Water), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, Others), and Asia Pacific Premium Bottled Water Market Insights, Industry Trends, Forecast to 2035

Industry: Consumer GoodsAsia Pacific Premium Bottled Water Market Size Insights Forecasts to 2035

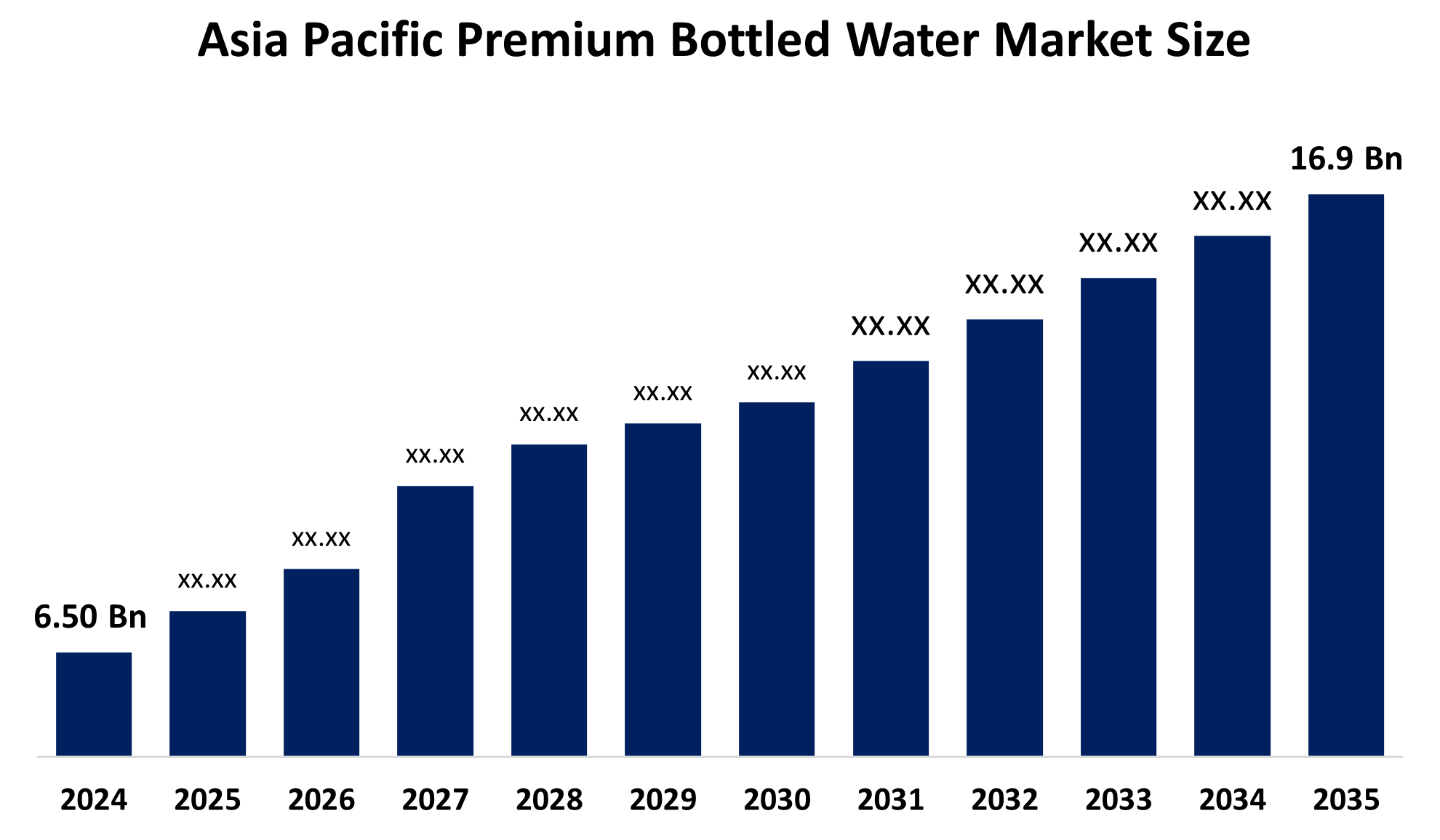

- The Asia Pacific Premium Bottled Water Market Size Was Estimated at USD 6.50 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.07% from 2025 to 2035

- The Asia Pacific Premium Bottled Water Market Size is Expected to Reach USD 16.9 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Premium Bottled Water Market Size is Anticipated to Reach USD 16.9 Billion by 2035, Growing at a CAGR of 9.07% from 2025 to 2035. The market is driven by rising health consciousness, increasing disposable income, rapid urbanization, and a growing consumer preference for natural mineral-rich hydration.

Market Overview

Asia Pacific Premium Bottled Water Market Size refers to high-end water products obtained from pristine natural locations such as springs, glaciers, or artesian wells that undergo minimal processing to retain their natural mineral composition. These products are characterized by their superior purity, uniqueness of source and elegant packaging, which often serve as a status symbol for health-conscious consumers. Current trends indicate a shift toward functional waters with added electrolytes or vitamins and an emphasis on sustainable, eco-friendly packaging such as glass and aluminium to attract environmentally conscious demographics.

Government and private initiatives are significantly shaping the market landscape. Governments in countries like India and Australia are imposing bans or bans on single-use plastics, forcing brands to innovate with biodegradable materials and recycled PET (rPET). Private players are investing in large-scale production facilities and regional sourcing strategies to meet local demand while maintaining high quality standards. Additionally, initiatives such as the "Healthy Life Expectancy" policy in Japan encourage the consumption of healthy, additive-free beverages over sugary alternatives.

Technological advancements in the premium bottled water sector primarily focus on advanced purification and sustainable production. Companies are adopting sophisticated filtration methods such as reverse osmosis, UV sterilization and ozonation to ensure the highest safety standards without altering the natural mineral profile. Additionally, the integration of smart packaging such as QR codes for origin traceability and the development of lightweight, bio-based bottle materials are increasing both consumer engagement and operational efficiency.

Report Coverage

This research report categorizes the market for the Asia Pacific Premium Bottled Water Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Premium Bottled Water market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific Premium Bottled Water market.

Asia Pacific Premium Bottled Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.50 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.07% |

| 2035 Value Projection: | USD 16.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Nongfu Spring Co., Ltd. (China), Tata Consumer Products Limited (India), Suntory Beverage & Food Ltd. (Japan), Hangzhou Wahaha Group (China), Bisleri International (India), Asahi Group Holdings Ltd. (Japan), Tibet Water Resources Ltd. (China/Tibet), Kirin Holdings Co., Ltd. (Japan), Vitasoy International (Hong Kong), Nongshim Co., Ltd. (South Korea), and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The market is primarily driven by increasing health awareness and rising disposable incomes across emerging economies like China and India. Consumers are shifting away from sugary drinks toward premium bottled water, which is perceived as a safer, more purified, and status-enhancing alternative to tap water. Rapid urbanization and a growing middle class further fuel demand for convenient, portable, and high-quality hydration solutions in densely populated cities where local water quality may be inconsistent.

Restraining Factors

High production and distribution costs associated with premium packaging and remote sourcing often result in high retail prices, limiting the consumer base. Stringent environmental regulations regarding plastic waste and complex cross-border supply chain logistics also pose significant challenges to market expansion in several developing nations.

Market Segmentation

The Asia Pacific premium bottled water market share is categorised into product and distribution channel.

- The spring water segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Premium Bottled Water Market Size is segmented by product into spring water, sparkling water. Among these, the spring water segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Spring water currently holds a significant share due to its natural origin, while sparkling water is expected to grow rapidly as a healthy alternative to carbonated soft drinks.

- The supermarkets & hypermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the Asia Pacific Premium Bottled Water Market Size is segmented into supermarkets & hypermarkets, specialty stores, online, others. Among these, the supermarkets & hypermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. due to their one-stop-shop convenience, wide product variety (premium to budget), strong urban presence, and ability to offer discounts, attracting high foot traffic and catering to diverse consumer needs for easy comparison and impulsive purchases at checkout, making them a primary channel for both standard and premium brands.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Premium Bottled Water Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and Premium Bottled Water. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nongfu Spring Co., Ltd. (China)

- Tata Consumer Products Limited (India)

- Suntory Beverage & Food Ltd. (Japan)

- Hangzhou Wahaha Group (China)

- Bisleri International (India)

- Asahi Group Holdings Ltd. (Japan)

- Tibet Water Resources Ltd. (China/Tibet)

- Kirin Holdings Co., Ltd. (Japan)

- Vitasoy International (Hong Kong)

- Nongshim Co., Ltd. (South Korea)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Premium Bottled Water Market Sizet based on the below-mentioned segments:

Asia Pacific Premium Bottled Water Market, By Product

- Spring Water

- Sparkling Water

Asia Pacific Premium Bottled Water Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific premium bottled water market size?A: The Asia Pacific premium bottled water Market size is expected to grow from USD 6.50 billion in 2024 to USD 16.9 billion by 2035, growing at a CAGR of 9.07% during the forecast period 2025-2035

-

Q: What are the key growth drivers of the market?A: The market is primarily driven by increasing health awareness and rising disposable incomes across emerging economies like China and India. Consumers are shifting away from sugary drinks toward premium bottled water, which is perceived as a safer, more purified, and status-enhancing alternative to tap water. Rapid urbanization and a growing middle class further fuel demand for convenient, portable, and high-quality hydration solutions in densely populated cities where local water quality may be inconsistent.

-

Q: What factors restrain the Asia Pacific premium bottled water market?A: High production and distribution costs associated with premium packaging and remote sourcing often result in high retail prices, limiting the consumer base. Stringent environmental regulations regarding plastic waste and complex cross-border supply chain logistics also pose significant challenges to market expansion in several developing nations.

-

Q: How is the market segmented by distribution channel?A: The market is segmented into supermarkets and hypermarkets, specialty stores, online, others.

Need help to buy this report?