Asia Pacific Polyolefin Elastomer Market Size, Share, and COVID-19 Impact Analysis, By Type (Polypropylene and Polyethylene), By Manufacturing Method (Injection Molding and Extrusion Molding), By End User (Automotive, Electrical & Electronics, Medical, Packaging, and Others), and Asia Pacific Polyolefin Elastomer Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Polyolefin Elastomer Market Size Insights Forecasts to 2035

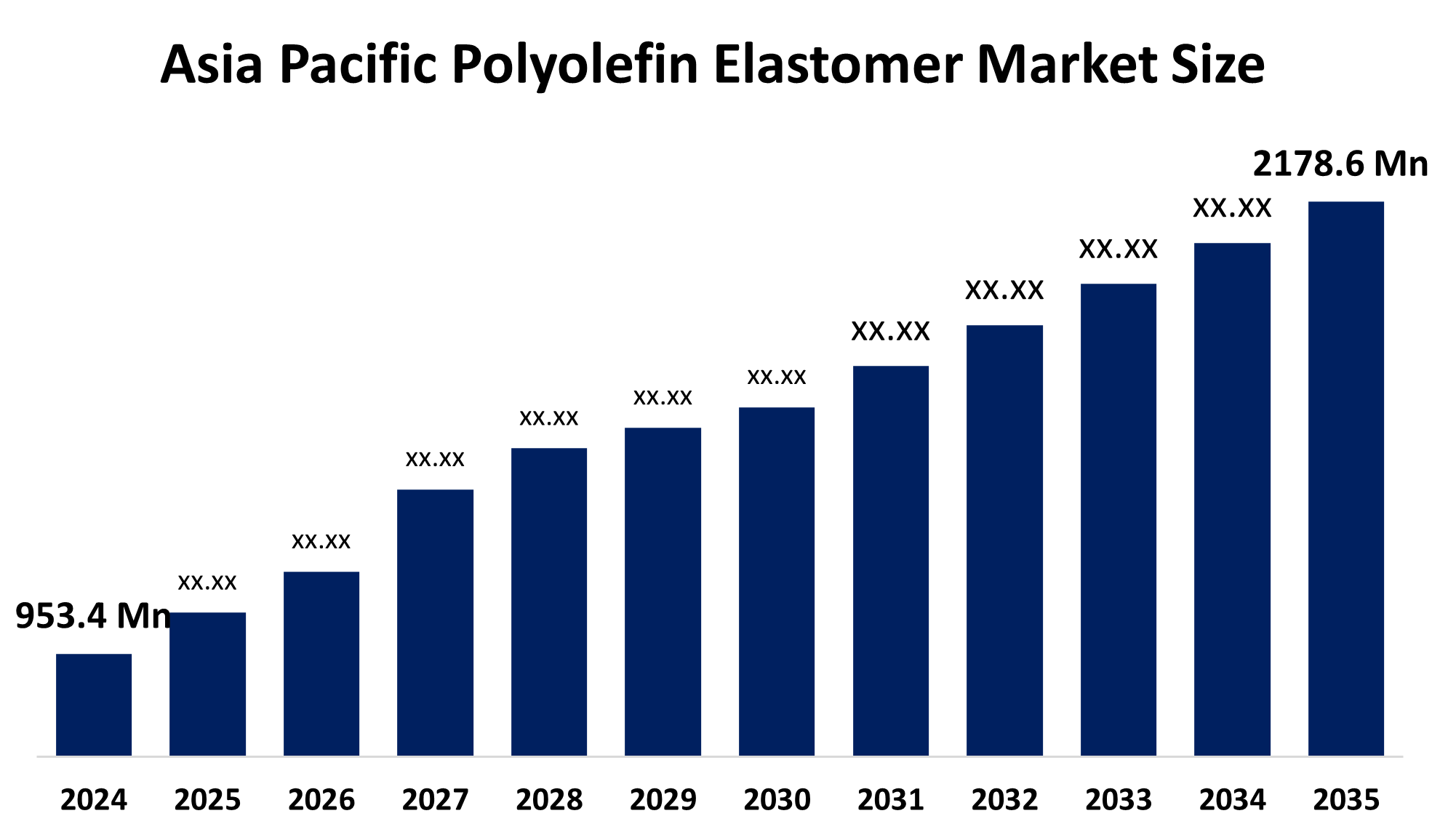

- The Asia Pacific Polyolefin Elastomer Market Size Was Estimated at 953.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.8% from 2025 to 2035

- The Asia Pacific Polyolefin Elastomer Market Size is Expected to Reach 2178.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Polyolefin Elastomer Market Size is Anticipated to Reach 2178.6 Million by 2035, Growing at a CAGR of 7.8% from 2025 to 2035. The market is driven by an increasing demand from the end-use industries, including automotive, packaging and wires & cables.

Market Overview

Polyolefins represent a polymer family developed through the polymerization of olefin-based monomers, which serve as essential building blocks for producing polyethylene and polypropylene polymers. The market growth of polyolefin elastomers results from their increasing usage in footwear production, adhesive materials, foam manufacturing, pipe systems and molded rubber products, packaging solutions and wire and cable applications. The material serves production needs for both interior and exterior components include bumpers, dashboard skins, instrument panels and door trims. The material creates flexible films, pouches and sealants through its exceptional clarity, toughness and ability to seal at low temperatures, which are essential for food and industrial products.

In March 2024, Dow introduced new polyolefin elastomers as a leather alternative for the automotive market. The company developed an innovative artificial leather solution that uses polyolefin elastomers as a replacement for traditional leather materials, which the automotive industry must begin using animal-free products.

Wanhua Chemical expects its planned No 2 cracker and derivative plants in Yantai, Shandong province, to start operations in October 2024. The growth in the electronics sector of India results from three main factors, which include government initiatives, rising consumer demand and the expanding middle class. The National Green Development Initiative requires companies to decrease plastic waste while increasing their use of recyclable materials, which creates higher demand for POE in packaging and automotive industries.

Report Coverage

This research report categorises the Asia Pacific Polyolefin Elastomer Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific polyolefin elastomer market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific polyolefin elastomer market.

Asia Pacific Polyolefin Elastomer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 953.4 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.8% |

| 2035 Value Projection: | 2178.6 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Manufacturing Method |

| Companies covered:: | Bhimrajka Impex Group, Sai Industries, Hanwha, Mitsui Chemicals Inc, LG Chem, OMV AG, Braskem SA ADR, Sumitomo Chemical Co., Ltd, Reliance Industries Ltd, Sinopec Beijing Yanshan Company and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The polyolefin elastomer market in Asia Pacific is driven by the rising demand for POEs because electric vehicles (EVs) and fuel-efficient internal combustion engines have become mainstream vehicles. The growing e-commerce industry and consumer interest in recyclable materials make POEs the preferred choice for flexible packaging solutions. POEs have emerged as the preferred material for Photovoltaic (PV) module encapsulation because they provide superior electrical efficiency, durability, and protection against potential-induced degradation (PID).

Restraining Factors

The polyolefin elastomer market in the Asia Pacific is restrained by the changing crude oil prices, which will reduce product adoption rates. The production costs of ethylene and propylene feedstocks face direct exposure to crude oil and natural gas price fluctuations, which result in margin reduction.

Market Segmentation

The Asia Pacific polyolefin elastomer market share is categorised into type, manufacturing method, and end user.

- The polyethylene segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Polyolefin Elastomer Market Size is segmented by type into polypropylene and polyethylene. Among these, the polyethylene segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Polyethylene was the largest segment with a revenue share of 53.23% in 2023. The characteristics of polyethylene material which include its ability to resist moisture and its capacity to withstand impacts, make it suitable for use in manufacturing both interior and exterior automotive components. The thermoplastic polymer polyethylene (PE) has gained popularity because of its ability to resist chemicals and its low price and diverse applications.

- The injection molding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on manufacturing method, the Asia Pacific Polyolefin Elastomer Market Size is segmented into injection molding and extrusion molding. Among these, the injection molding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the requirements of applications needs to create complex shapes to produce automotive parts and consumer products, and industrial components need to be fulfilled through this process. The performance of polyolefin elastomers designed for injection molding reaches optimal levels because they demonstrate efficient flow properties, fast cooling abilities and convenient demolding processes, which result in precise molded part production.

- The automotive segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Polyolefin Elastomer Market Size is segmented by end user into automotive, electrical & electronics, medical, packaging, and others. Among these, the automotive segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The automotive segment, which holds a share 54% of the Asia Pacific POE market, will lead the market during the upcoming forecast period. The demand for automobiles from emerging Asia-Pacific countries, especially India and China, is experiencing rapid growth. The Indian automotive industry is the world's fourth largest, according to the Indian Brand Equity Foundation IBEF and it will reach a value of USD 1 trillion by 2035.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Polyolefin Elastomer Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bhimrajka Impex Group

- Sai Industries

- Hanwha

- Mitsui Chemicals Inc

- LG Chem

- OMV AG

- Braskem SA ADR

- Sumitomo Chemical Co., Ltd

- Reliance Industries Ltd

- Sinopec Beijing Yanshan Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Nordmann partner WANHUA Chemical announced its latest innovation in polyolefin elastomers (POE). Designed to enhance plastics, WANSUPER serves as an exceptional modifier and enhancer for polyolefin products, including polyethene, polypropylene, and others.

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Polyolefin Elastomer Market Size based on the below-mentioned segments:

Asia Pacific Polyolefin Elastomer Market, By Type

- Polypropylene

- Polyethylene

Asia Pacific Polyolefin Elastomer Market, By Manufacturing Method

- Injection Molding

- Extrusion Molding

Asia Pacific Polyolefin Elastomer Market, By End User

- Automotive

- Electrical & Electronics

- Medical

- Packaging

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific polyolefin elastomer market size?A: Asia Pacific polyolefin elastomer market size is expected to grow from 953.4 million in 2024 to 2178.6 million by 2035, growing at a CAGR of 7.8% during the forecast period 2025-2035.

-

Q: What is polyolefin elastomer, and its primary use?A: Polyolefins represent a polymer family that develops through the polymerization of olefin-based monomers, which serve as essential building blocks for producing polyethylene and polypropylene polymers.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising demand for POEs because electric vehicles (EVs) and fuel-efficient internal combustion engines have become mainstream vehicles.

-

Q: What factors restrain the Asia Pacific polyolefin elastomer market?A: The market is restrained by the production costs of ethylene and propylene feedstocks, which face direct exposure to crude oil and natural gas price fluctuations, which result in margin reduction.

-

Q: How is the market segmented by type?A: The market is segmented into polypropylene and polyethene.

-

Q: Who are the key players in the Asia Pacific polyolefin elastomer market?A: Key companies include Bhimrajka Impex Group, Sai Industries, Hanwha, Mitsui Chemicals Inc, LG Chem, OMV AG, Braskem SA ADR, Sumitomo Chemical Co., Ltd, Reliance Industries Ltd, and Sinopec Beijing Yanshan Company.

Need help to buy this report?