Asia Pacific Polycarbonate Market Size, Share, and COVID-19 Impact Analysis, By Product Form (Sheets, Films, and Others), By End-User (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, and Others), and Asia Pacific Polycarbonate Market Size Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Polycarbonate Market Size Insights Forecasts to 2035

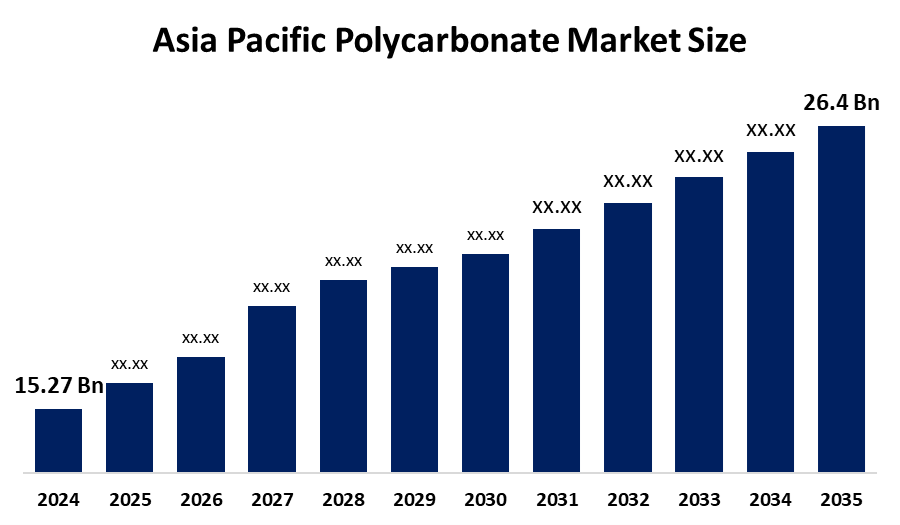

- The Asia Pacific Polycarbonate Market Size Was Estimated at USD 15.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The Asia Pacific Polycarbonate Market Size is Expected to Reach USD 26.4 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Asia Pacific Polycarbonate Market Size is anticipated to reach USD 26.4 Billion by 2035, Growing at a CAGR of 5.1% from 2025 to 2035. The market is driven by an expansion of electronics manufacturing, increasing use of polycarbonate in glazing applications, and the availability of injection molding technologies.

Market Overview

The polycarbonate market consists of sales of clear polycarbonate, abrasion-resistant polycarbonate, mirrored polycarbonate, anti-static and others. The material known as polycarbonate (PC) functions as an amorphous thermoplastic polymer that contains carbonate functional groups. The rising use of PC/PET and PC/ABS combinations helps businesses achieve cost savings while maintaining their ability to withstand high temperatures and chemical exposure. The market value is the revenue that enterprises gain from the sales of goods and services within the specified market and geography through sales, grants or donations in terms of the currency.

Haldia Petrochemicals Ltd (HPL) will decide in March 2025 about a polycarbonate plant construction project, which needs more than $1 billion for its development in Bengal.

China Launches the World's Largest CO2-Based Polycarbonate Polyol Production Line in April 2025. Anhui Putan's 300,000 tons per year CO2-based polycarbonate polyol project establishes the first industrial production facility for this product and process, which operates at a capacity of 10,000 tons. The project has received total funding of about 2 billion yuan.

Report Coverage

This research report categorises the Asia Pacific Polycarbonate Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Polycarbonate Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific Polycarbonate Market Size.

Asia Pacific Polycarbonate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.1% |

| 2035 Value Projection: | USD 26.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Form, By End-User |

| Companies covered:: | Covestro AG, Mitsubishi Chemicals Co., Lotte Chemicals Co., LG Chem, SABIC, Idemitsu Kosan Co., Teijin Ltd, Chimei Co., Formosa Chemicals & Fibre Co., Idemitsu Kosan Co. Ltd, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The polycarbonate market in Asia Pacific is driven by polycarbonate material for use in battery pack enclosures and charging infrastructure due to its fire-resistant capabilities and lightweight construction. The electric vehicle market expansion, the sustainable building material requirements, the demand for high-performance plastics, the development of circular plastics systems and the rising spending on modern polymer processing technologies.

Restraining Factors

The polycarbonate market in the Asia Pacific is restrained by Asia Pacific countries are enforcing more stringent rules about non-biodegradable plastics. Japan and South Korea have established more stringent regulations on microplastic discharge. The region faces increasing problems with overcapacity because China has built more production capacity than its current market needs.

Market Segmentation

The Asia Pacific Polycarbonate Market Size share is categorised into product form and end-user.

- The sheets segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Polycarbonate Market Size is segmented by product form into sheets, films, and others. Among these, the sheets segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Sheets accounted for 45.58% of the Asia-Pacific polycarbonate market share in 2025, driven by strong demand from architectural skylights, machine guards and automotive glazing, which required both mechanical rigidity and optical clarity.

- The electrical and electronics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end-user, the Asia Pacific Polycarbonate Market Size is segmented into aerospace, automotive, building and construction, electrical and electronics, industrial and machinery, packaging, and others. Among these, the electrical and electronics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The electronics industry obtained 47.05% of the Asia-Pacific polycarbonate market share during 2025 due to continuous demand for camera lenses, laptop housings and 5G radio covers, which needed heat stability and light transmission.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Polycarbonate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Covestro AG

- Mitsubishi Chemicals Co.

- Lotte Chemicals Co.

- LG Chem

- SABIC

- Idemitsu Kosan Co.

- Teijin Ltd

- Chimei Co.

- Formosa Chemicals & Fibre Co.

- Idemitsu Kosan Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In December 2025, SABIC, a leading global player in the chemical industry, announced the launch of an innovative medical-grade material that marks a significant step forward in product safety and regulatory compliance.

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Polycarbonate Market Size based on the below-mentioned segments:

Asia Pacific Polycarbonate Market Size, By Product Form

- Sheets

- Films

- Others

Asia Pacific Polycarbonate Market Size, By End-User

- Aerospace

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

- Others

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific Polycarbonate Market Size?Asia Pacific Polycarbonate Market Size is expected to grow from USD 15.27 billion in 2024 to USD 26.4 billion by 2035, growing at a CAGR of 5.1% during the forecast period 2025-2035.

-

What is polycarbonate, and its primary use?The polycarbonate market consists of sales of clear polycarbonate, abrasion-resistant polycarbonate, mirrored polycarbonate, anti-static and more. The material known as polycarbonate (PC) functions as an amorphous thermoplastic polymer that contains carbonate functional groups.

-

What are the key growth drivers of the market?Market growth is driven by the polycarbonate material, which is gaining popularity for use in battery pack enclosures and charging infrastructure because of its fire-resistant capabilities and lightweight construction.

-

What factors restrain the Asia Pacific Polycarbonate Market Size?The market is restrained by Asia Pacific countries are enforcing more stringent rules about non-biodegradable plastics. Japan and South Korea have established more stringent regulations on microplastic discharge.

-

How is the market segmented by product form?The market is segmented into sheets, films, and others

-

Who are the key players in the Asia Pacific Polycarbonate Market Size?Key companies include Covestro AG, Mitsubishi Chemicals Co., Lotte Chemicals Co., LG Chem, SABIC, Idemitsu Kosan Co., Teijin Ltd, Chimei Co., Formosa Chemicals & Fibre Co., and Idemitsu Kosan Co.

Need help to buy this report?