Asia Pacific Polybutylene Terephthalate Market Size, Share, and COVID-19 Impact Analysis, By Type (Industrial and Commercial), By Processing Method (Injection Molding, Extrusion, Blow Molding, and Others), By End User (Automotive, Extrusion Products, Electrical and Electronics, and Others), and Asia Pacific Polybutylene Terephthalate Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Polybutylene Terephthalate Market Insights Forecasts to 2035

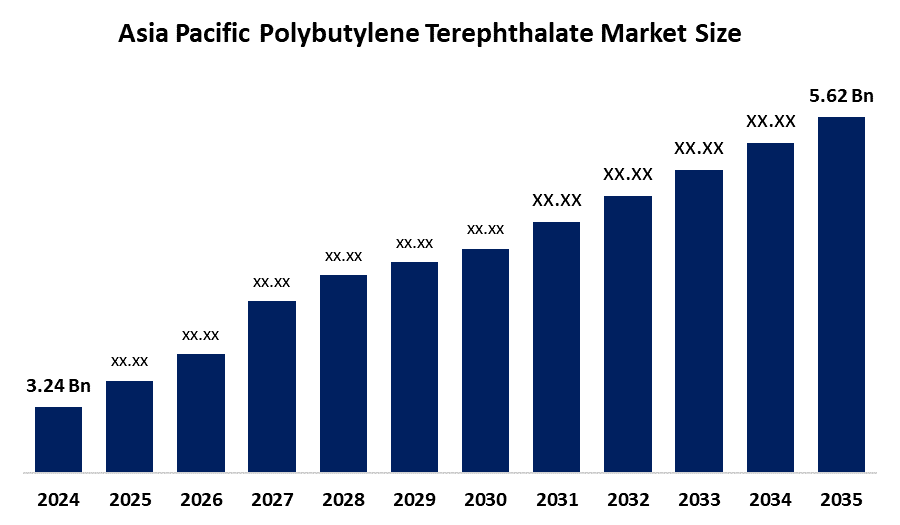

- The Asia Pacific Polybutylene Terephthalate Market Size Was Estimated at USD 3.24 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.13% from 2025 to 2035

- The Asia Pacific Polybutylene Terephthalate Market Size is Expected to Reach USD 5.62 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Asia Pacific Polybutylene Terephthalate Market size is anticipated to reach USD 5.62 Billion by 2035, growing at a CAGR of 5.13% from 2025 to 2035. The market is driven by the rapid increase in the adoption of engineered plastics in various end-use applications and the drastic improvement in the manufacturing sector.

Market Overview

Polybutylene terephthalate (PBT) belongs to the polyester family of polymers. The substance exists as a semi-crystalline engineering thermoplastic material that shares identical properties and composition with polyethylene terephthalate (PET). The textile industry uses PBT for swimwear production because of its natural elastic properties, resistance to saltwater, and its ability to retain color. PBT blends improve material performance by reducing water absorption and increasing flammability rating.

The Polyplastics Group introduced a new electrically conductive DURANEX(R) polybutylene terephthalate (PBT) grade, which serves millimetre wave radar systems used in automotive applications during February 2023.

The domestic electronics market in India has reached a value of USD 140 billion, according to Invest India, because government programs these days support recyclable material usage while they work to minimize plastic waste, which subsequently increases PBT acceptance in the market. The automotive industry will receive new PBT solutions from Covestro and SABIC through their partnership started in April 2024. PBT manufacturing research and development activities create advanced materials that include glass-fiber reinforced and halogen-free flame-retardant materials deliver better performance in challenging situations.

Report Coverage

This research report categorises the Asia Pacific polybutylene terephthalate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific polybutylene terephthalate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific polybutylene terephthalate market.

Asia Pacific Polybutylene Terephthalate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.24 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.13% |

| 2035 Value Projection: | USD 5.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Chang Chun Group, BASF SE, SABIC, Toray Industries, Inc., Mitsubishi Engineering Plastics Co., Polyplastics Co. Ltd, LG Chem, Nan Ya Plastics Corporation, Lanxess AG, Hengli Group, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The polybutylene terephthalate market in Asia Pacific is driven by the PBT is taking over the role of Polyamide 66 (PA66) because PBT offers better dimensional stability and heat resistance, which makes it suitable for use in EV battery-pack components and high-performance sensors. The electrical and electronics sector accounts for more than 50% of APAC demand. The industrial growth in China, India, and South Korea has created a need for high-speed data connectors and precision industrial gear housings, which in turn has increased the demand for reinforced PBT grades.

Restraining Factors

The polybutylene terephthalate market in Asia Pacific is restrained by the prices of these commodities experiencing fluctuations because of geopolitical tensions and supply chain disruptions, creating direct effects on production costs and market stability. The world is increasingly focusing on sustainability and the circular economy, which results in more stringent regulations that control plastic production and plastic waste disposal.

Market Segmentation

The Asia Pacific polybutylene terephthalate market share is categorised into type, processing method, and end user.

- The commercial segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific polybutylene terephthalate market is segmented by type into industrial and commercial. Among these, the commercial segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the bottles, which serve as the main product of the company control an estimated 60% of the total market share in 2024. The product provides benefits through its lightweight design and durable construction, which results in affordable pricing and complete recyclability, making it suitable for use in beverages and food packaging.

- The injection molding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on processing method, the Asia Pacific polybutylene terephthalate market is segmented into injection molding, extrusion, blow molding and others. Among these, the injection molding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by PBT, which serves as the primary material that manufacturers use to create complex parts through mass production while maintaining high precision and consistent results. The Asia Pacific region requires this material for manufacturing automotive electronics and connectors, switches and circuit boards, which represent high-demand products. The market share of this material first follows the usage patterns of injection molding. The material serves its main purpose through the production of cable liners and fiber optic tube jackets.

- The electrical and electronics segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific polybutylene terephthalate market is segmented by end user into automotive, extrusion products, electrical and electronics, and others. Among these, the electrical and electronics segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The electrical and electronics segment generated the highest revenue share of 45.59% during 2022. The devices, which include data communications equipment, cameras, millimetre-wave radars, and Light Detection and Ranging (LiDAR) systems, use PBT to seal, encapsulate, and insulate their microelectronic components and printed circuit boards. The material provides excellent insulation properties that protect electronics from all forms of damage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific polybutylene terephthalate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chang Chun Group

- BASF SE

- SABIC

- Toray Industries, Inc.

- Mitsubishi Engineering Plastics Co.

- Polyplastics Co. Ltd

- LG Chem

- Nan Ya Plastics Corporation

- Lanxess AG

- Hengli Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific polybutylene terephthalate market based on the below-mentioned segments:

Asia Pacific Polybutylene Terephthalate Market, By Type

- Industrial

- Commercial

Asia Pacific Polybutylene Terephthalate Market, By Processing Method

- Blow Molding

- Film and Sheet

- Injection Molding

- Pipe and Extrusion

- Others

Asia Pacific Polybutylene Terephthalate Market, By End User

- Industrial

- Commercial

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific polybutylene terephthalate market size?A: Asia Pacific polybutylene terephthalate market size is expected to grow from USD 3.24 billion in 2024 to USD 5.62 billion by 2035, growing at a CAGR of 5.13% during the forecast period 2025-2035.

-

Q: What is polybutylene terephthalate, and its primary use?A: Polybutylene terephthalate (PBT) belongs to the polyester family of polymers. The substance exists as a semi-crystalline engineering thermoplastic material that shares identical properties and composition with polyethylene terephthalate (PET).

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the PBT is taking over the role of Polyamide 66 (PA66) because PBT offers better dimensional stability and heat resistance, which makes it suitable for use in EV battery-pack components and high-performance sensors.

-

Q: What factors restrain the Asia Pacific polybutylene terephthalate market?A: The market is restrained by the prices of these commodities, which experience fluctuations because of geopolitical tensions and supply chain disruptions which create direct effects on production costs and market stability.

-

Q: How is the market segmented by type?A: The market is segmented into industrial and commercial

-

Q: Who are the key players in the Asia Pacific polybutylene terephthalate market?A: Key companies include Chang Chun Group, BASF SE, SABIC, Toray Industries, Inc., Mitsubishi Engineering Plastics Co., Polyplastics Co. Ltd, LG Chem, Nan Ya Plastics Corporation, Lanxess AG, and Hengli Group.

Need help to buy this report?