Asia Pacific Polyamide Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyamide 6, Polyamide 66, Bio-Based Polyamide, Specialty Polyamides), By Application (Automotive, Electrical & Electronics, Household Goods & Appliances, and Others), and Asia Pacific Polyamide Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Polyamide Market Insights Forecasts to 2035

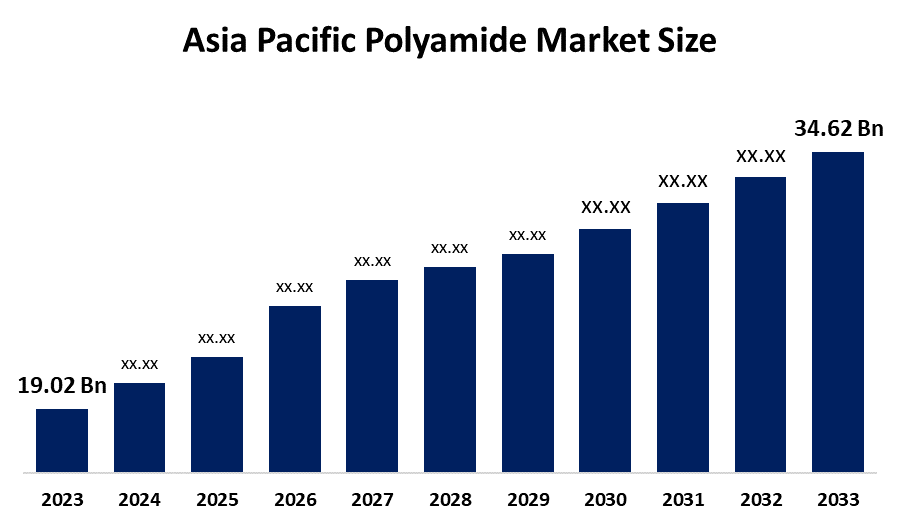

- The Asia Pacific Polyamide Market Size Was Estimated at USD 19.02 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.6% from 2025 to 2035

- The Asia Pacific Polyamide Market Size is Expected to Reach USD 34.62 Billion by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Asia Pacific Polyamide Market Size Is Anticipated To Reach USD 34.62 Billion By 2035, Growing At A CAGR Of 5.6% From 2025 To 2035. The Market Is Driven By An Increase In The Preference For Lightweight And Long-Lasting Materials In The Automotive And Electrical Industries.

Market Overview

A polyamide (PA) is a sort of a polymer that consists of repeated units of amide linkages that form an essential part of the main polymer chain. Such materials can be found in nature or made artificially. Polymers of amides have come up as the go-to choice for a variety of different automotive applications mainly because of their light weight, which translates to less fuel consumed and increased performance of both ICEs and EVs. Applications are exhaust covers, air intake manifolds, fuel lines, and battery parts. Polyamides with the best electrical insulating and flame-retardant properties are used in the manufacturing of connectors, switches, cable insulation, and miniature electronic components.

In April 2024, the company DOMO Chemicals, which is recognized as the world's top manufacturer of engineered technical materials, opens the latest plant in Haiyan, Jiaxing, Zhejiang, China. This remarkable achievement not only cements but also illustrates DOMO's willingness to cater to the growing demand in the Chinese market for its TECHNYL polyamide-based smart solutions.

In India and Southeast Asian countries, government initiatives and Production Linked Incentive (PLI) schemes are leading to a considerable increase in investments in the manufacturing sector, thus, driving the demand. The program is in line with the national objectives such as Atmanirbhar Bharat and India's ambition of a $5 trillion economy. It enhances the Make in India campaign by rejuvenating the domestic manufacturing industry on a large scale.

Report Coverage

This research report categorizes the market for the Asia Pacific polyamide market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific polyamide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific polyamide market.

Asia Pacific Polyamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.02 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.6% |

| 2035 Value Projection: | USD 34.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Highsun Holding Group, Shenma Industrial Co. Ltd, Toray Industries, Inc., Mitsui Chemicals, Inc, Asahi Kasei Corporation, UBE Corporation, Guangdong Xinhui Meida Nylon Co., Ltd., Formosa Plastics Corporation, DSM Firmenich AG, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The polyamide market in Asia Pacific is driven by China and India’s upswing in Electric Vehicles (EVs), which is the main factor driving the requirement of specialized polyamides in battery housings, high-voltage connectors, and e-mobility components. Stemming from the demands of the market, the bio-based polyamides are gradually being accepted by the manufacturers as the brands’ carbon footprints are getting smaller. The quick progress in India and Southeast Asia is laying a strong foundation for industrial yarns, carpets, and construction-grade composites. The increase in the purchasing power of consumers in China and India is turning the textile and consumer appliance industries around.

Restraining Factors

The polyamide market in Asia Pacific is hindered by the price fluctuations and disturbances in the supply chain, which affect the price of such raw materials, so it is impossible for the manufacturers to hold steady prices and also maintain their profit margins. These substitutes are often selected because of their lower cost or, in some cases, due to characteristics that are better in particular applications, such as thermal or chemical resistance. The production of high-performance polyamides requires the use of specialized and expensive machinery and processing techniques to ensure the quality and to prevent problems such as moisture absorption and warping.

Market Segmentation

The Asia Pacific polyamide market share is categorised into product and application.

- The polyamide 6 segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific polyamide market is segmented by product into polyamide 6, polyamide 66, bio-based polyamide, specialty polyamides. Among these, the polyamide 6 segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Polyamide 6 holds the 59.90% of the Asia-Pacific polyamide market in 2025 due to the established supply chains and competitive cost structures in films, fibers, and engineering parts. Polyamide 66 is backed by glass-reinforced compounds used for intake manifolds and torque mounts. Polyphthalamide is still the least in demand, but its volume grows at a double-digit rate as the trend of miniaturization and high-temperature electronics' need drives its demand.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America polyamide market is segmented into automotive, electrical & electronics, household goods & appliances, and others. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In 2025, the automotive sector accounted the 32.25% of the Asia-Pacific market for polyamides due to outstanding strength-to-weight properties, which were primarily used in under-the-hood, fuel system, and structural applications. Also, it is employed in the production of headlamp bezels, hydraulic clutch lines, auto cooling systems, airbag containers, and air intake manifolds. External parts like wheel coverings, fuel caps, tailgate handles, doors, front-end grills, and exterior mirrors are also examples of polyamide applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific polyamide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Highsun Holding Group

- Shenma Industrial Co. Ltd

- Toray Industries, Inc.

- Mitsui Chemicals, Inc

- Asahi Kasei Corporation

- UBE Corporation

- Guangdong Xinhui Meida Nylon Co., Ltd.

- Formosa Plastics Corporation

- DSM Firmenich AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Polyamide Market based on the below-mentioned segments:

Asia Pacific Polyamide Market, By Product

- Polyamide 6

- Polyamide 66

- Bio-Based Polyamide

- Specialty Polyamides

Asia Pacific Polyamide Market, By Application

- Automotive

- Electrical & Electronics

- Household Goods & Appliances

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific polyamide market size?A: The Asia Pacific Polyamide Market size is expected to grow from USD 19.02 billion in 2024 to USD 34.62 billion by 2035, growing at a CAGR of 5.6% during the forecast period 2025-2035.

-

Q: What is polyamide, and its primary use?A: A polyamide (PA) is a sort of a polymer that consists of repeated units of amide linkages that form an essential part of the main polymer chain. Such materials can be found in nature (like wool and silk) or made artificially.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the by China and India’s upswing in Electric Vehicles (EVs) is the main factor driving the requirement of specialized polyamides in battery housings, high-voltage connectors, and e-mobility components

-

Q: What factors restrain the Asia Pacific polyamide market?A: The market is restrained by the price fluctuations and disturbances in the supply chain, which affect the price of such raw materials, so it is impossible for the manufacturers to hold steady prices and also get their profit margins.

-

Q: How is the market segmented by product?A: The market is segmented into polyamide 6, polyamide 66, bio-based polyamide, specialty polyamides.

-

Q: Who are the key players in the Asia Pacific polyamide market?A: Key companies include Highsun Holding Group, Shenma Industrial Co. Ltd, Toray Industries, Inc., Mitsui Chemicals, Inc, Asahi Kasei Corporation, UBE Corporation, Guangdong Xinhui Meida Nylon Co., Ltd., and Formosa Plastics Corporation.

-

Q: What is the Asia Pacific polyamide market size?A: The Asia Pacific Polyamide Market size is expected to grow from USD 19.02 billion in 2024 to USD 34.62 billion by 2035, growing at a CAGR of 5.6% during the forecast period 2025-2035.

-

Q: What is polyamide, and its primary use?A: A polyamide (PA) is a sort of a polymer that consists of repeated units of amide linkages that form an essential part of the main polymer chain. Such materials can be found in nature (like wool and silk) or made artificially.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the by China and India’s upswing in Electric Vehicles (EVs) is the main factor driving the requirement of specialized polyamides in battery housings, high-voltage connectors, and e-mobility components

-

Q: What factors restrain the Asia Pacific polyamide market?A: The market is restrained by the price fluctuations and disturbances in the supply chain, which affect the price of such raw materials, so it is impossible for the manufacturers to hold steady prices and also get their profit margins.

-

Q: How is the market segmented by product?A: The market is segmented into polyamide 6, polyamide 66, bio-based polyamide, specialty polyamides.

-

Q: Who are the key players in the Asia Pacific polyamide market?A: Key companies include Highsun Holding Group, Shenma Industrial Co. Ltd, Toray Industries, Inc., Mitsui Chemicals, Inc, Asahi Kasei Corporation, UBE Corporation, Guangdong Xinhui Meida Nylon Co., Ltd., and Formosa Plastics Corporation.

Need help to buy this report?