Asia Pacific N-Butanol Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Sugarcane, Corn, Cellulosic Biomass, Natural Gas, Others), By Application (Fuel, Chemical Intermediates, Coating Formulations, Solvents, Others), By End-User (Automotive, Chemical, Textile, Pharmaceutical, Others), and Asia Pacific N-Butanol Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsAsia Pacific N-Butanol Market Insights Forecasts to 2035

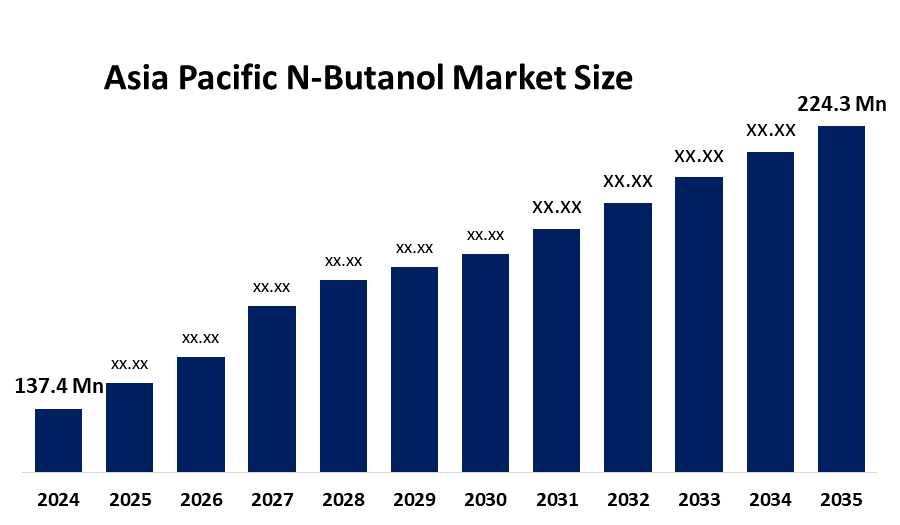

- The Asia Pacific N-Butanol Market Size Was Estimated at USD 137.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.56% from 2025 to 2035

- The Asia Pacific N-Butanol Market Size is Expected to Reach USD 224.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific N-Butanol Market Size is anticipated to reach USD 224.3 Million by 2035, Growing at a CAGR of 4.56% from 2025 to 2035. The market is driven by the increasing consumption of bio-based butanol as a green alternative to fossil fuels as well as petrochemical-derived solvents. Advanced biotechnology and fermentation techniques have increased yields and decreased production costs.

Market Overview

The n-butanol market is currently experiencing its active period because different industries are starting to use n-butanol for new applications. Butanol is an essential product produced by microbes and serves as a source of power or fuel component. N-butanol consumption is high in paints, coatings, and inks. n-butanol shows effective solubility properties due to its successful interaction with different resin materials and binder components through its special evaporation behavior. The demand for a potentially sustainable, centuries-old tradition is again growing today as environmental modern technology assumes beauty's relevance through technical advancement.

BASF SE and SINOPEC announced their decision to expand the Nanjing Verband plant, which BASF-YPC Co. Ltd. operates as a 50/50 joint venture, in August 2021. The project involves constructing a new tert-butyl acrylate plant, which will serve China's growing market while increasing production capacity at existing downstream chemical manufacturing facilities.

N-butanol continues to be the preferred biofuel because it has a higher energy density and functions with existing fuel systems. The market competition between ethanol and biodiesel will increase as both fuels enter the market as alternative energy sources. Developing nations, particularly African and Latin American countries, will increase their usage of n-butanol according to government policies. The countries in this region are investing their resources into building infrastructure while they work to advance clean energy solutions.

Report Coverage

This research report categorises the Asia Pacific n-butanol market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific n-butanol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific n-butanol market.

Asia Pacific N-Butanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 137.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.56% |

| 2035 Value Projection: | USD 224.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Feedstock, By Application |

| Companies covered:: | Sinopec, PetroChina Company Ltd, Luxi Chemical Company, Anhui Shuguang Chemical Group, Mitsubishi Chemical Group, KH Neochem Co, Andra Petrochemicals Ltd, Galaxy Chemicals, SABIC, BASF Petronas Chemicals, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The n-butanol market in Asia Pacific is driven by the demand for paints and coatings, which will grow because of the construction projects and infrastructure development. The n-butanol market will expand during the forecast period because of this demand. The demand for n-Butanol exists because it serves as a vital chemical component needed to create n-Butyl Acrylate, which various industries use in their production of paints, adhesives, lubricating products and varnishes. The demand for n-Butanol exists because it serves as a vital chemical component needed to create n-Butyl Acrylate, which various industries use in their production of paints and adhesives, lubricating products and varnishes.

Restraining Factors

The n-butanol market in Asia Pacific is restrained by the fermentation process using the ABE fermentation method, which faces difficulties in producing bio-butanol fuel because the microorganisms used in the process exhibit toxic properties.

Market Segmentation

The Asia Pacific n-butanol market share is categorised into feedstock, application, and end user.

- The sugarcane segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific n-butanol market is segmented by feedstock into sugarcane, corn, cellulosic biomass, natural gas, others. Among these, the sugarcane segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the operational efficiency of the system, which enables it to reach maximum production capacities at a minimal power requirement. The agricultural system based on sugarcane production achieves sustainability through its utilization of current farming infrastructure, which makes it a beneficial choice for production facilities.

- The fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific n-butanol market is segmented into fuel, chemical intermediates, coating formulations, solvents, others. Among these, the fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the energy sector, which depends on this element for its vital functions. N-butanol acts as a common fuel additive that improves gasoline efficiency through its advanced performance capabilities when compared to standard fuels.

- The automotive segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific n-butanol market is segmented by end user into automotive, chemical, textile, pharmaceutical, others. Among these, the automotive segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the chemical functions in multiple applications, including fuels and speciality solvents that boost performance and emission control capabilities. The segment achieves stability through its extensive infrastructure, which operates established supply chains.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific n-butanol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sinopec

- PetroChina Company Ltd

- Luxi Chemical Company

- Anhui Shuguang Chemical Group

- Mitsubishi Chemical Group

- KH Neochem Co

- Andra Petrochemicals Ltd

- Galaxy Chemicals

- SABIC

- BASF Petronas Chemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific n-butanol market based on the below-mentioned segments:

Asia Pacific N-Butanol Market, By Feedstock

- Sugarcane

- Corn

- Cellulosic Biomass

- Natural Gas

- Others

Asia Pacific N-Butanol Market, By Application

- Fuel

- Chemical Intermediates

- Coating Formulations

- Solvents

- Others

Asia Pacific N-Butanol Market, By End User

- Automotive

- Chemical

- Textile

- Pharmaceutical

- Others

Frequently Asked Questions (FAQ)

-

Q:What is the Asia Pacific n-butanol market size?A:Asia Pacific n-butanol market size is expected to grow from USD 137.4 million in 2024 to USD 224.3 million by 2035, growing at a CAGR of 4.56% during the forecast period 2025-2035

-

Q:What is n-butanol, and its primary use?A:The N butanol market is currently experiencing its active period because different industries are starting to use N butanol for new applications. Butanol is an essential product produced by microbes and serves as a source of power or fuel component.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the demand for paints and coatings, which will grow because of the worldwide construction projects and infrastructure development. The n-butanol market will expand during the forecast period because of this demand.

-

Q:What factors restrain the Asia Pacific n-butanol market?A:The market is restrained by the fermentation process using the ABE fermentation method, which faces difficulties in producing bio-butanol fuel because the microorganisms used in the process exhibit toxic properties.

-

Q:Who are the key players in the Asia Pacific n-butanol market?A:Key companies include Sinopec, PetroChina Company Ltd, Luxi Chemical Company, Anhui Shuguang Chemical Group, Mitsubishi Chemical Group, KH Neochem Co, Andra Petrochemicals Ltd, Galaxy Chemicals, SABIC, and BASF Petronas Chemicals.

Need help to buy this report?