Asia Pacific Metal Cans Market Size, Share, and COVID-19 Impact Analysis, By Material (Aluminium and Steel), By Application (Food, Beverages, and Others), and Asia Pacific Metal Cans Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesAsia Pacific Metal Cans Market Insights Forecasts To 2035

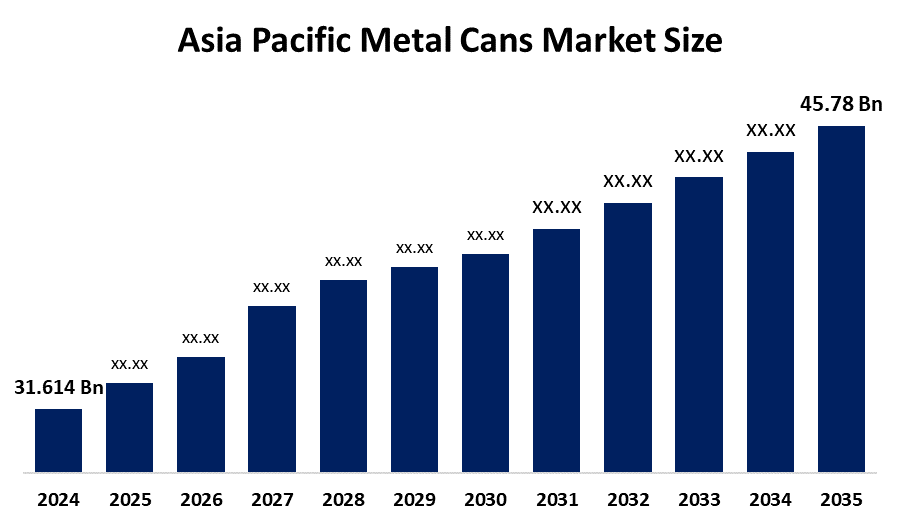

- The Asia Pacific Metal Cans Market Size Was Estimated At USD 31.614 Billion In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 3.42% From 2025 To 2035

- The Asia Pacific Metal Cans Market Size Is Expected To Reach USD 45.78 Billion By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights Consulting, The Asia Pacific Metal Cans Market Size Is Anticipated To Reach USD 45.78 Billion By 2035, Growing At A CAGR Of 3.42% From 2025 To 2035. The metal can market in Asia Pacific is driven by rising demand for sustainable packaging, increased consumption of packaged foods/beverages, and favorable government policies against plastic, with China, India, and Japan leading consumption and production, primarily focusing on aluminum cans for their recyclability and convenience

Market Overview

The Asia Pacific Metal Cans Market Size Refers To The Industry Involved In Manufacturing And Distributing Metal Containers, Primarily Made Of Aluminum Or Steel, Designed To Preserve And Protect Various Consumer Goods. These products are characterized by their superior barrier properties against light, oxygen, and moisture, which significantly extend the shelf life of food and beverages. Key trends include a paradigm shift toward sustainability, with a growing preference for infinitely recyclable materials over plastic, and the rising popularity of slim and sleek can designs for premium branding.

Government And Private Initiatives Are Play A Crucial Role In Shaping The Market Size Landscape. For Example, The Government Of India Has Announced Mandates Requiring New Non-Ferrous Metal Products To Contain At Least 5% Recycled Content By The 2027-28 Financial Year, Increasing To 10% By FY31. Private sector efforts, such as the "Can-to-Can" recycling initiative launched by Budweiser Brewing Company APAC in China, aim to boost aluminum recycling rates and reduce carbon emissions. These collaborative efforts foster a circular economy and encourage the adoption of eco-friendly packaging solutions across the region.

Technological Advancements Are Revolutionizing The Manufacturing And Functional Capabilities Of Metal Cans. Innovations such as AI-driven manufacturing processes and computer vision are being used to detect micro-defects at high speeds, while predictive analytics optimize machinery performance. Additionally, advancements in active packaging, like metal-chelating compounds and nitrogen-infused dosing, are enhancing food preservation and the consumer sensory experience. Lightweighting technologies, such as Compression Bottom Reform (CBR), are also enabling the production of thinner, lighter cans that reduce material costs and transportation emissions without compromising structural integrity.

Report Coverage

This Research Report Categorizes The Market Size For The Asia Pacific Metal Cans Market Based On Various Segments And Regions, And Forecasts Revenue Growth And Analyses Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific metal cans market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific metal cans market.

Asia Pacific Metal Cans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 31.614 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 3.42% |

| 2023 Value Projection: | USD 45.78 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Material, By Application |

| Companies covered:: | Ball Corporation, Crown Holdings, Inc., Toyo Seikan Group Holdings, Ltd., CPMC Holdings Limited, ORG Technology Co., Ltd., Kian Joo Can Factory Berhad, Can-One Berhad, Daiwa Can Company, Tata Steel Packaging, Showa Aluminum Can Corporation, and Others, key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Market Size Is Primarily Driven By The Rising Demand For Convenient, Shelf-Stable Food And Beverages Among The Expanding Urban Middle Class In China, India, And Southeast Asia. Increasing environmental awareness is pushing brands to shift from plastic to infinitely recyclable aluminum and steel cans to meet sustainability goals. Furthermore, the rapid growth of the e-commerce sector and organized retail has improved product accessibility, while the popularity of ready-to-drink (RTD) beverages and craft drinks is fueling the demand for premium can formats.

Restraining Factors

Market Growth Is Hindered By The High Volatility In Raw Material Prices For Aluminum And Steel, Which Impacts Production Margins For Manufacturers. Furthermore, intense competition from alternative packaging solutions, such as lightweight plastic bottles and flexible pouches, poses a significant challenge. Stringent environmental regulations and the high cost of implementing advanced recycling infrastructure also restrain market expansion.

Market Segmentation

The Asia Pacific metal cans market share is classified into material and applications.

- The aluminium segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Metal Cans Market Size Is Segmented By Material Into Aluminium And Steel. Among these, the aluminium segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Aluminium is the most widely used material for beverage cans due to its lightweight, corrosion resistance, and excellent barrier properties. Aluminium cans are primarily used for carbonated soft drinks, energy drinks, and beer, offering excellent shelf life and sustainability credentials.

- The beverages segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Asia Pacific Metal Cans Market Size Is Segmented By Application Into Tilapia, Catfish, Sea Bass, And Groupers. Among these, the beverages segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The beverage segment is the largest application segment for metal cans and includes both alcoholic and non-alcoholic drinks such as beer, carbonated soft drinks, energy drinks, juices, and sparkling water. Additionally, Beverage brands often favour metal cans for their aesthetic appeal and ability to retain carbonation and freshness over extended periods.

Competitive Analysis

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Asia Pacific Metal Cans Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ball Corporation

- Crown Holdings, Inc.

- Toyo Seikan Group Holdings, Ltd.

- CPMC Holdings Limited

- ORG Technology Co., Ltd.

- Kian Joo Can Factory Berhad

- Can-One Berhad

- Daiwa Can Company

- Tata Steel Packaging

- Showa Aluminum Can Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific metal cans market based on the below-mentioned segments:

Asia Pacific Metal Cans Market, By Material

- Aluminium

- Steel

Asia Pacific Metal Cans Market, By Application

- Food

- Beverages

- Others

Frequently Asked Questions (FAQ)

-

What is the expected growth rate of the Asia Pacific metal cans market during 2025–2035?The Asia Pacific metal cans market is expected to grow at a CAGR of 3.42% from 2025 to 2035, increasing from USD 3,210.4 billion in 2024 to USD 5,280.5 billion by 2035.

-

What factors are driving the growth of the Asia Pacific metal cans market?The market is primarily driven by the rising demand for convenient, shelf-stable food and beverages among the expanding urban middle class in China, India, and Southeast Asia. Increasing environmental awareness is pushing brands to shift from plastic to infinitely recyclable aluminum and steel cans to meet sustainability goals. Furthermore, the rapid growth of the e-commerce sector and organized retail has improved product accessibility, while the popularity of ready-to-drink (RTD) beverages and craft drinks is fueling the demand for premium can formats.

-

Which application segment accounted for the largest market share in 2024?The beverages segment held the largest market share in 2024, driven by the high consumption of beer, carbonated soft drinks, energy drinks, and juices, as well as growing preference for metal cans’ aesthetic and functional advantages.

-

What are the key restraints affecting market growth?Market growth is hindered by the high volatility in raw material prices for aluminum and steel, which impacts production margins for manufacturers. Furthermore, intense competition from alternative packaging solutions, such as lightweight plastic bottles and flexible pouches, poses a significant challenge. Stringent environmental regulations and the high cost of implementing advanced recycling infrastructure also restrain market expansion.

-

Who is the target audience for this market report?The report is targeted at market players, investors, government authority es, end-users, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?