Asia Pacific Liquid Carbon Dioxide Market Size, Share, and COVID-19 Impact Analysis, By Source (Natural and Industrial), By Application (Food & Beverages, Chemicals, Pharmaceuticals, Oil & Gas, Metal Fabrication, and Others), By Distribution Channel (Direct Sales and Distributors), and Asia Pacific Liquid Carbon Dioxide Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsAsia Pacific Liquid Carbon Dioxide Market Insights Forecasts to 2035

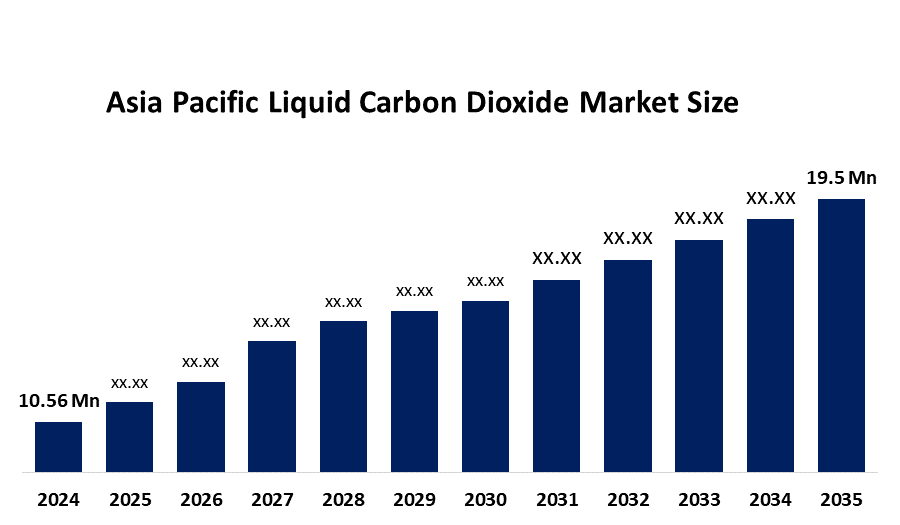

- The Asia Pacific Liquid Carbon Dioxide Market Size Was Estimated at USD 10.56 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.73% from 2025 to 2035

- The Asia Pacific Liquid Carbon Dioxide Market Size is Expected to Reach USD 19.5 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Liquid Carbon Dioxide Market Size is anticipated to reach USD 19.5 Million tonnes by 2035, Growing at a CAGR of 5.73% from 2025 to 2035. The market is driven by an increasing demand across sectors like food processing, beverage carbonation, pharmaceuticals, and environmental management.

Market Overview

The APAC liquid carbon dioxide refers to carbon dioxide stored and moved throughout the Asia-Pacific region in its liquid state. Liquid carbon dioxide exists as a dense, transparent liquid because it uses both compression and cooling methods to transform gaseous carbon dioxide into this state. The different industries that use liquid carbon dioxide include food and beverage, chemicals, agriculture, healthcare, and wastewater treatment because the substance has low viscosity, high density and low cost. The food and beverage industries use liquefied carbon dioxide as a cooling agent.

In October 2025, NTPC Energy Technology Research Alliance (NETRA) uses the licensed technology provided by Carbon Clean through its wholly owned Indian subsidiary, Carboncapture Technologies Pvt. Ltd.

The Indian government allocated RS 20,000 crore for Carbon Capture, Utilisation, and Storage funding, which will be used through the next five years of the program. The program focuses on reducing emissions from sectors that include steel manufacturing, cement production, and chemical processing. India introduced its first legally binding CCTS system in 2026, which established emission restrictions for 28 new industrial facilities to promote the use of carbon capture technologies.

Report Coverage

This research report categorises the Asia Pacific liquid carbon dioxide market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific liquid carbon dioxide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific liquid carbon dioxide market.

Asia Pacific Liquid Carbon Dioxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.56 Million tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.73% |

| 2035 Value Projection: | USD 19.5 Million tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Source, By Application |

| Companies covered:: | Air Liquide, Linde PLC, Air Products and Chemicals, Inc., Messer Group, Taiyo Nippon Sanso Co., Ace Gases, Sicgil India Ltd, Coregas, Yongde Gases, INOX Air Products Pvt. Ltd., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The liquid carbon dioxide market in Asia Pacific is driven by the growing populations and rising disposable incomes in Southeast Asia and India, which drive high demand for carbonated drinks and ready-to-eat convenience foods. The market growth stems from increasing requirements in metal fabrication, electronics manufacturing and wastewater treatment operations. The expanding healthcare infrastructure in India and China drives medical-grade CO2 usage for minimally invasive procedures and respiratory therapy treatments.

Restraining Factors

The liquid carbon dioxide market in the Asia Pacific is restrained by the specialized cryogenic tanks and insulated pipelines system needs to operate at liquid storage temperatures below -56.6°C and maintain high operational pressure, which results in higher operational costs. The manufacturing sector faces higher compliance expenses because Singapore and China both enforce carbon tax regulations with emission control standards.

Market Segmentation

The Asia Pacific liquid carbon dioxide market share is categorised into source, application, and distribution channel.

- The industrial segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific liquid carbon dioxide market is segmented by source into natural and industrial. Among these, the industrial segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by applications in manufacturing, chemical, oil and gas industries. While fermentation serves as the primary natural source, industrial by-product capture, with chemical plant operations and fossil fuel usage, provides the majority of the supply.

- The food & beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific liquid carbon dioxide market is segmented into food & beverages, chemicals, pharmaceuticals, oil & gas, metal fabrication, and others. Among these, the food & beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The food and beverage application segment held the largest revenue share, accounting for over 54.9% of the Asia Pacific carbon dioxide market in 2024. The surging demand for liquid carbon dioxide arises from the increased production of convenience foods, frozen foods and meat packaging operations, which require liquid carbon dioxide for freezing and chilling and modified atmosphere packaging to extend product shelf life.

- The direct sales segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific liquid carbon dioxide market is segmented by distribution channel into direct sales and distributors. Among these, the direct sales segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the industrial sector, which requires specific solutions that must deliver high-volume products that maintain high-purity standards and provide continuous supply to meet the needs of its massive manufacturing and food processing operations in the region. Liquid CO2 requires storage at extremely low temperatures of -56.6°C, combined with storage under high pressure due to its high density.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific liquid carbon dioxide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Liquide

- Linde PLC

- Air Products and Chemicals, Inc.

- Messer Group

- Taiyo Nippon Sanso Co.

- Ace Gases

- Sicgil India Ltd

- Coregas

- Yongde Gases

- INOX Air Products Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific liquid carbon dioxide market based on the below-mentioned segments:

Asia Pacific Liquid Carbon Dioxide Market, By Source

- Natural

- Industrial

Asia Pacific Liquid Carbon Dioxide Market, By Application

- Food & Beverages

- Chemicals

- Pharmaceuticals

- Oil & Gas

- Metal Fabrication

- Others

Asia Pacific Liquid Carbon Dioxide Market, By Distribution Channel

- Direct Sales

- Distributors

Frequently Asked Questions (FAQ)

-

Q:What is the Asia Pacific liquid carbon dioxide market size?A:Asia Pacific liquid carbon dioxide market size is expected to grow from USD 10.56 million tonnes in 2024 to USD 19.5 million by 2035, growing at a CAGR of 5.73% during the forecast period 2025-2035.

-

Q:What is liquid carbon dioxide, and its primary use?A:The term APAC liquid carbon dioxide describes carbon dioxide stored and moved throughout the Asia-Pacific region in its liquid state. Liquid carbon dioxide exists as a dense, transparent liquid because people must use both compression and cooling methods to transform gaseous carbon dioxide into this state.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the growing populations and rising disposable incomes in Southeast Asia and India, which drive high demand for carbonated drinks and ready-to-eat convenience foods.

-

Q:What factors restrain the Asia Pacific liquid carbon dioxide market?A:The market is restrained by the specialized cryogenic tanks and insulated pipelines system, which needs to operate at liquid storage temperatures below −56.6°C and maintain high operational pressure which results in higher operational costs.

-

Q:How is the market segmented by source?A:The market is segmented into natural and industrial.

-

Q:Who are the key players in the Asia Pacific liquid carbon dioxide market?A:Key companies include Air Liquide, Linde PLC, Air Products and Chemicals, Inc., Messer Group, Taiyo Nippon Sanso Co., Ace Gases, Sicgil India Ltd, Coregas, Yongde Gases, and INOX Air Products Pvt. Ltd.

Need help to buy this report?