Asia Pacific Linear Alpha Olefin Market Size, Share, and COVID-19 Impact Analysis, By Product (1-Butene, 1-Hexene, 1-Octene, 1-Decene and Others), By Application (LLDPE, HDPE, Poly Alpha Olefins, Detergent Alcohols, and Others), and Asia Pacific Linear Alpha Olefin Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Linear Alpha Olefin Market Size Insights Forecasts to 2035

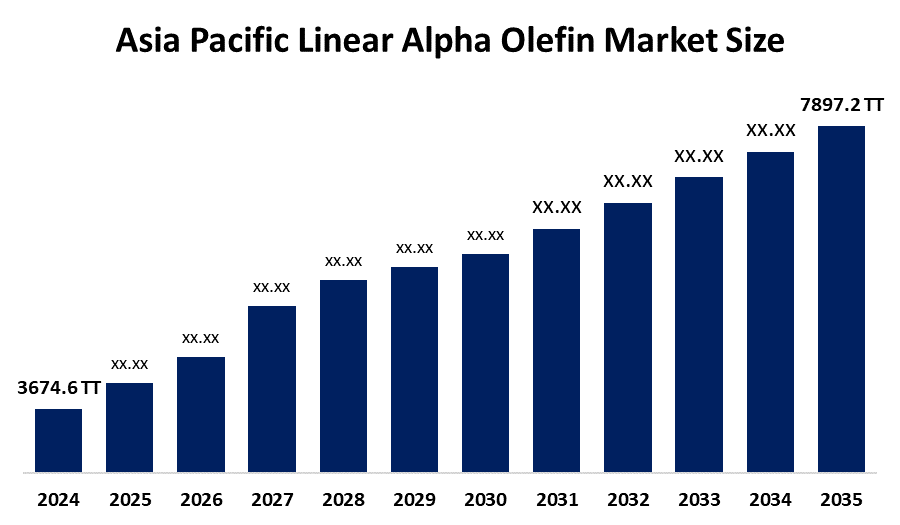

- The Asia Pacific Linear Alpha Olefin Market Size Was Estimated at 3674.6 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.2% from 2025 to 2035

- The Asia Pacific Linear Alpha Olefin Market Size is Expected to Reach 7897.2 Thousand Tonnes by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Asia Pacific Linear Alpha Olefin Market Size is anticipated to Reach 7897.2 Thousand Tonnes by 2035, Growing at a CAGR of 7.2% from 2025 to 2035. The market is driven by growing demand for high-performance plastics, energy-efficient lubricants, and bio-based surfactants, which is expanding the application base of linear alpha olefin.

Market Overview

The linear alpha olefin (LAO) market encompasses an industrial area that deals with the production, supply, and use of linear alpha olefins, which include straight-chain terminal alkenes like 1-butene, 1-hexene, and 1-octene. The increasing demand for poly alpha olefins used in producing superior synthetic linear alpha olefins represents a vital group of industrial hydrocarbons that exist as alkenes with linear molecular configurations and terminal carbon double bonds. The market is expanding because lubricants create new business opportunities. The product is used to produce both detergent alcohols and linear alkyl benzene, which serve as cleaning agents for both home and industrial use.

In April 2025, HMEL crosses record 2 million tonnes of polymer sales for FY25 and significant capacity additions at its petrochemical units. The expansion project establishes essential infrastructure needed for feedstock production, including LAO intermediated feeding polymer units.

India possesses the world's sixth-largest chemical industry, which produces more than 7% of the country's GDP. The industry creates an investment-friendly atmosphere and generates demand for intermediates such as LAOs. South Korean petrochemical companies plan to reduce their production by 3.7 million metric tons through a voluntary initiative that aims to transform their oversaturated market while enhancing their declining profit margins.

Report Coverage

This research report categorises the Asia Pacific linear alpha olefin market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific linear alpha olefin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific linear alpha olefin market.

Asia Pacific Linear Alpha Olefin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 3674.6 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.2% |

| 2035 Value Projection: | 7897.2 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 91 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Sinopec, PetroChina, Idemitsu Kosan Co. Ltd, Mitsubishi Chemical Ltd, Reliance Industries Ltd, Petrochemicals Sdn., LG Chem, Shell Chemicals, ExxonMobil Chemical, SABIC, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The linear alpha olefin market in Asia Pacific is driven by the increasing requirement for synthetic lubricants with exceptional performance capabilities, which serves as the main factor driving this market. PAO-based lubricants deliver superior thermal protection and operational capabilities to contemporary engines include EV thermal management fluids. The rapid growth of cities in Vietnam and India has created a demand for particular plastic products and electrical system components that use LAO-based polymers.

Restraining Factors

The linear alpha olefin market in the Asia Pacific is restrained by the high implementation costs, with the integration difficulties that arise from implementing existing systems, and the shortage of qualified workers creates major obstacles to the project. The project faces obstacles because of data security issues and the complex requirements of regulations.

Market Segmentation

The Asia Pacific linear alpha olefin market share is categorised into product and application.

Get more details on this report -

- The 1-butene segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific linear alpha olefin market is segmented by product into 1-butene, 1-hexene, 1-octene, 1-decene and others. Among these, the 1-butene segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the manufacturing of commodity polymers and industrial use in flexible packaging and automotive production. The material shows multiple industrial applications include the production of polyethene and polypropylene commodity polymers. The process produces HDPE and LLDPE materials, which serve as primary components in flexible packaging and automotive production, thereby driving growth in the linear alpha olefins market.

- The LLDPE segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific linear alpha olefin market is segmented into LLDPE, HDPE, poly alpha olefins, detergent alcohols, and others. Among these, the LLDPE segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the polymer industry, which uses this material because of its ability to perform multiple functions. The material's key properties of high impact resistance and superior tensile strength enable its use in various applications because India, China, and Chinese and Brazilian countries maintain relaxed regulations, which benefit its market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific linear alpha olefin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sinopec

- PetroChina

- Idemitsu Kosan Co. Ltd

- Mitsubishi Chemical Ltd

- Reliance Industries Ltd

- Petrochemicals Sdn.

- LG Chem

- Shell Chemicals

- ExxonMobil Chemical

- SABIC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific linear alpha olefin market based on the below-mentioned segments:

Asia Pacific Linear Alpha Olefin Market, By Product

- 1-Butene

- 1-Hexene

- 1-Octene

- 1-Decene

- Others

Asia Pacific Linear Alpha Olefin Market, By Application

- LLDPE

- HDPE

- Poly Alpha Olefins

- Detergent Alcohols

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific linear alpha olefin market size?A: Asia Pacific linear alpha olefin market size is expected to grow from 3674.6 thousand tonnes in 2024 to 7897.2 thousand tonnes by 2035, growing at a CAGR of 7.2% during the forecast period 2025-2035.

-

Q: What is linear alpha olefin, and its primary use?A: The linear alpha olefin (LAO) market encompasses an industrial area that deals with the production, supply, and use of linear alpha olefins, which include straight-chain terminal alkenes like 1-butene, 1-hexene, and 1-octene.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing requirement for synthetic lubricants with exceptional performance capabilities, which serves as the main factor driving this market.

-

Q: What factors restrain the Asia Pacific linear alpha olefin market?A: The market is restrained by the high implementation costs, with the integration difficulties that arise from implementing existing systems, and the shortage of qualified workers creates major obstacles to the project.

-

Q: How is the market segmented by product?A: The market is segmented into 1-butene, 1-hexene, 1-octene, 1-decene and others.

-

Q: Who are the key players in the Asia Pacific linear alpha olefin market?A: Key companies include Sinopec, PetroChina, Idemitsu Kosan Co. Ltd, Mitsubishi Chemical Ltd, Reliance Industries Ltd, Petrochemicals Sdn., LG Chem, Shell Chemicals, ExxonMobil Chemical, and SABIC.

Need help to buy this report?