Asia Pacific Hyperkalemia Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Novel Oral Potassium Binders, Traditional Cation-Exchange Resins, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Asia Pacific Hyperkalemia Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareAsia Pacific Hyperkalemia Drugs Market Insights Forecasts to 2035

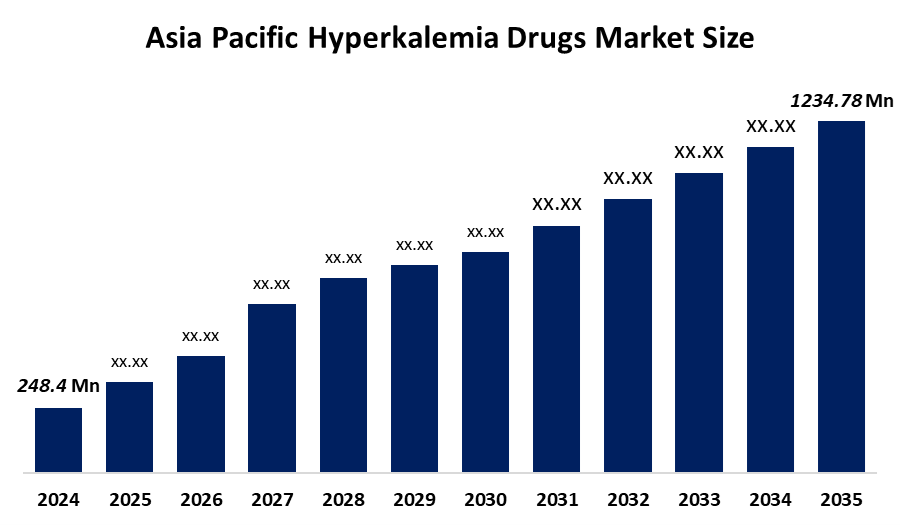

- The Asia Pacific Hyperkalemia Drugs Market Size Was Estimated at USD 248.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 15.69% from 2025 to 2035

- The Asia Pacific Hyperkalemia Drugs Market Size is Expected to Reach USD 1234.78 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Hyperkalemia Drugs Market size is Expected to Grow from USD 248.4 Million in 2024 to USD 1234.78 Million by 2035, Growing at a CAGR of 15.69% during the forecast period 2025-2035. The hyperkalemia drugs market in Asia Pacific is driven by rising chronic kidney disease, heart failure, and an aging population.

Market Overview

Hyperkalemia is a medical condition characterized by abnormally high levels of potassium in the blood, typically exceeding 5.0 to 5.5 mmol/L. It often arises when the kidneys are unable to effectively excrete excess potassium, a common occurrence in patients with chronic kidney disease or those taking certain medications like RAAS inhibitors. Key characteristics of this market include a shift from traditional resins to more tolerable novel oral potassium binders and an increasing focus on chronic management to prevent fatal cardiac arrhythmias. Current trends highlight the rapid expansion of home-based care and the integration of digital monitoring tools to track potassium levels in real-time.

Government bodies across Asia Pacific are increasingly focusing on the early diagnosis and management of chronic diseases like CKD and diabetes, which are primary precursors to hyperkalemia. For instance, the Asian Pacific Society of Nephrology has collaborated on multidisciplinary consensus statements to standardize hyperkalemia management guidelines for healthcare providers in the region. Private pharmaceutical companies are also playing a critical role through strategic alliances, such as the partnership between Astellas Pharma and Sanwa Kagaku Kenkyusho in Japan, to distribute innovative treatments and improve patient access to specialty drugs.

Technological advancements in the hyperkalemia drugs market are centered on formulation innovation and the development of highly selective potassium-removing agents. Modern treatments like sodium zirconium cyclosilicate (SZC) and patiromer offer improved gastrointestinal tolerability and faster onset of action compared to older cation-exchange resins. Furthermore, the industry is witnessing the rise of AI-driven diagnostic tools and patient-monitoring platforms that help clinicians optimize treatment decisions and reduce the risk of emergency hospitalizations through predictive analytics.

Report Coverage

This research report categorizes the market for the Asia Pacific hyperkalemia drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific hyperkalemia drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific hyperkalemia drugs market.

Asia Pacific Hyperkalemia Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 248.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 15.69% |

| 2035 Value Projection: | USD 1234.78 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Distribution Channel |

| Companies covered:: | AstraZeneca Pharma India, Kowa Company, Ltd., Astellas Pharma Inc., Sanwa Kagaku Kenkyusho Co., Ltd., Steadfast MediShield Pvt. Ltd., RSM Kilitch Pharma Pvt. Ltd., Klarvoyant Biogenics Pvt. Ltd., Takeda Pharmaceutical Company Limited, Dr. Reddy’s Laboratories, Sun Pharmaceutical Industries Ltd., and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is primarily driven by the escalating prevalence of chronic kidney disease (CKD) and cardiovascular disorders, which significantly increase the risk of elevated potassium levels. As the aging population grows in countries like Japan and China, the incidence of these comorbidities is rising. Furthermore, the increasing use of RAAS inhibitor therapies for managing hypertension and heart failure necessitates effective potassium-lowering treatments. Improved diagnostic rates and growing healthcare spending across emerging economies also support broader market expansion.

Restraining Factors

Market growth is hindered by the high cost of novel potassium binders, which limits accessibility for many patients. Additionally, traditional therapies often have poor gastrointestinal tolerability, leading to low patient compliance. Limited awareness regarding the long-term risks of chronic hyperkalemia in certain underserved areas also restricts market adoption.

Market Segmentation

The Asia Pacific hyperkalemia drugs market share is classified into drug class and distribution channel

- The novel oral potassium binders segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Asia Pacific hyperkalemia drugs market is segmented by drug class into novel oral potassium binders, traditional cation-exchange resins, and others. Among these, the novel oral potassium binders segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to its Novel oral potassium binders are cutting-edge pharmacological products designed to treat hyperkalemia by binding potassium ions specifically in the gastrointestinal system. This prevents absorption and encourages excretion of the ions through the faeces.

- The retail pharmacies segment held the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Asia Pacific hyperkalemia drugs market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the retail pharmacies segment held the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to outstanding visibility and ease of access. The main drivers of this segment's growth are cost-effectiveness, ease of access, and the wide range of products offered by top industry players. Additionally, retail pharmacies present themselves as a handy and favoured choice for people by providing a wide variety of pharmaceuticals.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific hyperkalemia drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca Pharma India

- Kowa Company, Ltd.

- Astellas Pharma Inc.

- Sanwa Kagaku Kenkyusho Co., Ltd.

- Steadfast MediShield Pvt. Ltd.

- RSM Kilitch Pharma Pvt. Ltd.

- Klarvoyant Biogenics Pvt. Ltd.

- Takeda Pharmaceutical Company Limited

- Dr. Reddy’s Laboratories

- Sun Pharmaceutical Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific hyperkalemia drugs market based on the below-mentioned segments:

Asia Pacific Hyperkalemia Drugs Market, By Drug Class

- Novel Oral Potassium Binders

- Traditional Cation-Exchange Resins

- Others

Asia Pacific Hyperkalemia Drugs Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Frequently Asked Questions (FAQ)

-

What is the current size of the Asia Pacific hyperkalemia drugs market?Asia Pacific hyperkalemia drugs market size is expected to grow from USD 248.4 million in 2024 to USD 1234.78 million by 2035, growing at a CAGR of 15.69% during the forecast period 2025-2035

-

Which drug class dominates the market?Novel oral potassium binders dominated the market in 2024 due to their targeted mechanism, improved safety profile, and suitability for long-term management.

-

What are traditional hyperkalemia treatments?Traditional treatments include cation-exchange resins like sodium polystyrene sulfonate (SPS), which bind potassium in the gastrointestinal tract but may have gastrointestinal side effects.

-

Which distribution channel holds the largest market share?Retail pharmacies accounted for the largest revenue share in 2024 due to accessibility, affordability, and wide product availability.

Need help to buy this report?