Asia Pacific Hospital Furniture Market Size, Share, and COVID-19 Impact Analysis, By Product (Beds, Paediatric Beds, Patient Lift, Tables, Chairs, and Others), By Application (Physician Furniture, Patient’s Furniture, Staff’s Furniture), By Sales Channel (Offline and Online), By End User (Hospitals, Speciality Clinics, Ambulatory Surgical Centers, and Others), and Asia Pacific Hospital Furniture Market Insights, Industry Trends, Forecast to 2035

Industry: HealthcareAsia Pacific Hospital Furniture Market Insights Forecasts To 2035

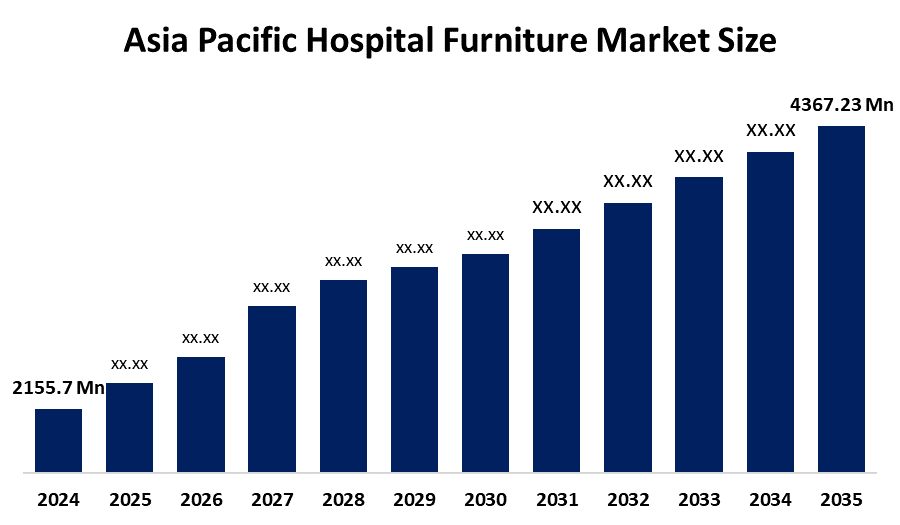

- The Asia Pacific Hospital Furniture Market Size Was Estimated at USD 2155.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.63% from 2025 to 2035

- The Asia Pacific Hospital Furniture Market Size is Expected to Reach USD 4367.23 Million by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Asia Pacific Hospital Furniture Market Size Is Anticipated To Reach USD 4367.23 Million By 2035, Growing At A CAGR Of 6.63% From 2025 To 2035. The market is driven by rising healthcare investments, an aging population, and infrastructure development, making APAC the fastest-growing region globally, with key demand for beds, examination tables, and smart, tech-integrated furniture for improving patient care and efficiency

Market Overview

Asia Pacific Hospital Furniture Market Size Refers To The Market For Specialized Furnishings (Beds, Chairs, Tables, Etc.) used in healthcare facilities across Asia, driven by rapid infrastructure development, increasing patient volume, technology integration (smart beds) and rising healthcare spending, with a focus on patient comfort, hygiene, smart features and sustainable design to meet various regional demands. Key opportunities in the Asia Pacific hospital furniture market include meeting the expanding healthcare infrastructure, growing population and growing demand for telemedicine, with niche potential in smart/tech-integrated, durable, ergonomic and specialty (ICU, bariatric) furniture for new facilities, rural areas and home care. The key growth drivers are infrastructure development and technological integration in emerging economies (India, South East Asia), creating demand for advanced, patient-centric and cost-effective solutions.

Report Coverage

This Research Report Categorizes The Market For The Asia Pacific Hospital Furniture Market Size Based On Various Segments And Regions, And Forecasts Revenue Growth And Analyses Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific hospital furniture market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific hospital furniture market.

Asia Pacific Hospital Furniture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 4367.23 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.63% |

| 2023 Value Projection: | 2155.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application By Product |

| Companies covered:: | Hospital Forniture SRL, Spacestor Healthcare, Haelvoet, JTC Furniture Group, Ocura Healthcare Furniture, Medical Innovation Solutions, Wissner Bosserhoff, Compass Group, HT Group, Lojer Group, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Hospital Furniture Market Size In Asia Pacific Is Driven By The Presence Of Chronic Diseases, Along With The Larger Healthcare Facilities That Emerged After The Pandemic. These developments and trends have in common the need for furniture that prioritizes the patient in the case of both kinds of institutions. The recent influx of patients has prompted hospitals to invest in infrastructure that will increase the capacity of the hospitals; the new medical centres that will be built in 2024 will be equipped with cutting-edge furniture systems. The nursing staff's pace got faster, and the incidence of injuries decreased due to the electric and semi-automatic beds. Installation of patient mobility aids like adjustable chairs and transfer trolleys was on the rise.

Restraining Factors

The Hospital Furniture Market Size In Asia Pacific Is Restrained By An Estimated Average Lifespan Of 8 To 12 Years, Which Causes Prolonged Replacement Cycles That Restrict The Recurring Demand. More than half (62%) of small & mid-sized hospitals postpone furniture renewals because of large capital costs. Smart hospital beds and ergonomic chairs with built-in features can be up to 40% pricier than standard models, thus discouraging institutions with budget constraints. Hospitals in underdeveloped areas heavily depend on used furniture for their cost management, thus slowing the process of new-product adoption.

Market Segmentation

The Asia Pacific hospital furniture market share is categorised into product, application, sales channel, and end user.

- The beds segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Hospital Furniture Market Size Is Segmented By Product Into Beds, Paediatric Beds, Patient Lift, Tables, Chairs, And Others. Among these, the beds segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the older population needing frequent medical care. They are made for the comfort of the patient and provide various functions that are necessary for the recovery process. Among these beds, there are those with adjustable height and electronic positions that can be used for different medical purposes. Consequently, they have dominated the market of healthcare institutions.

- The patient’s furniture segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based On Application, The Asia Pacific Hospital Furniture Market Size Is Segmented Into Physician Furniture, Patient’s Furniture, Staff’s Furniture. Among these, the patient’s furniture segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the chronic diseases problems have led to an increase in number of patients in long-term care, an increase in hospital admissions, and the need for specialized furniture according to their unique requirements.

- The offline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Hospital Furniture Market Size Is Segmented By Sales Channel Into Offline And Online. Among These, The Offline Segment Accounted For The Largest Revenue Market Share In 2024 And Is Expected To Grow At A Significant CAGR During The Forecast Period. The growth of the segment is driven by the concrete, practical experience that it brings, which enables medical practitioners to do an actual evaluation of the hospital's furniture in terms of quality and usability. Furthermore, the offline buying process has personalized consultations and direct communications with sales reps that are suited to the uniqueness of hospital furniture purchasing.

- The hospitals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based On End User, The Asia Pacific Hospital Furniture Market Size Is Segmented Into Hospitals, Speciality Clinics, Ambulatory Surgical Centers, And Others. Among these, the hospitals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the increasing number of hospitals, which in turn is due to the rising demand for furniture. The hospitals' competition for furniture has led to the technological advancements in furniture-attached devices, which have subsequently increased the demand for different styles of furniture in the market.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Asia Pacific Hospital Furniture Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hospital Forniture SRL

- Spacestor Healthcare

- Haelvoet

- JTC Furniture Group

- Ocura Healthcare Furniture

- Medical Innovation Solutions

- Wissner Bosserhoff

- Compass Group

- HT Group

- Lojer Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In June 2025, Stryker, one of the world’s leading medical technology companies, announced the launch of its advanced ICU air mattress, APAISER X1, at ANEiCON 2025, the annual conference of the Association of Nurse Executives (ANEi) India, held in Kochi.

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific hospital furniture market based on the below-mentioned segments:

Asia Pacific Hospital Furniture Market, By Product

- Beds

- Paediatric Beds

- Patient Lift

- Tables

- Chairs

- Others

Asia Pacific Hospital Furniture Market, By Application

- Physician Furniture

- Patient’s Furniture

- Staff’s Furniture

Asia Pacific Hospital Furniture Market, By Sales Channel

- Offline

- Online

Asia Pacific Hospital Furniture Market, By End User

- Hospitals

- Speciality Clinics

- Ambulatory Surgical Centers

- Others

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific hospital furniture market size?Asia Pacific hospital furniture market size is expected to grow from USD 2155.7 million in 2024 to USD 4367.23 million by 2035, growing at a CAGR of 6.63% during the forecast period 2025-2035

-

What is hospital furniture, and its primary use?The hospital furniture encompasses all the specific furnishings and tools that are necessary for a proper functioning healthcare facility, such as hospitals, clinics, nursing homes, and medical centres. Hospital furniture has come to be a major focus of the medical industry, with the goals of patient care, hygiene, safety, and ergonomics as its foremost considerations.

-

What are the key growth drivers of the market?Market growth is driven by the presence of chronic diseases along with the larger healthcare facilities that emerged after the pandemic. These developments and trends have in common the need for furniture that prioritizes the patient in the case of both kinds of institutions. The recent influx of patients has made hospitals invest in infrastructure that will increase the capacity of the hospitals

-

What factors restrain the Asia Pacific hospital furniture market?The market is restrained by an estimated average lifespan of 8 to 12 years, which causes prolonged replacement cycles that restrict the recurring demand. More than half (62%) of small & mid-sized hospitals postpone furniture renewals because of large capital costs.

-

How is the market segmented by application?The market is segmented into physician furniture, patient’s furniture, staff’s furniture.

-

Who are the key players in the Asia Pacific hospital furniture market?Key companies include Hospital Forniture SRL, Spacestor Healthcare, Haelvoet, JTC Furniture Group, Ocura Healthcare Furniture, Medical Innovation Solutions, Wissner Bosserhoff, Compass Group, HT Group, and Lojer Group.

Need help to buy this report?