Asia Pacific High-Density Polyethylene Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Naphtha, Natural Gas, and Others), By Application (Blow Molding, Film and Sheet, Injection Molding, Pipe and Extrusion and Others), and Asia Pacific High-Density Polyethylene Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsAsia Pacific High-Density Polyethylene Market Insights Forecasts to 2035

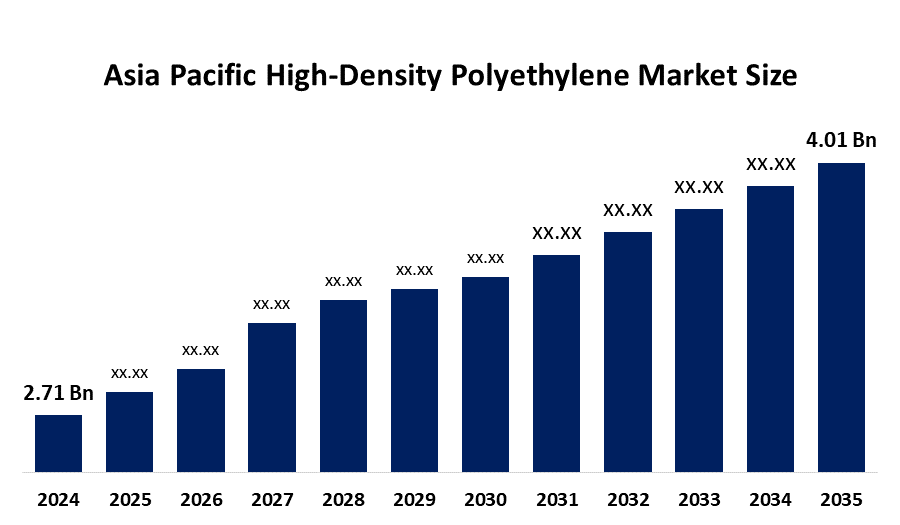

- The Asia Pacific High-Density Polyethylene Market Size Was Estimated at USD 2.71 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.52% from 2025 to 2035

- The Asia Pacific High-Density Polyethylene Market Size is Expected to Reach USD 4.01 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific High-Density Polyethylene Market Size is anticipated to reach USD 4.01 Billion by 2035, Growing at a CAGR of 6.52% from 2025 to 2035. The market is driven by rapid industrialization, strong demand in packaging and construction, the expanding automotive sector, and government initiatives promoting sustainable plastic solutions and recycling.

Market Overview

High-density polyethylene (HDPE) serves as a strong yet lightweight thermoplastic material that derives from the chemical process of turning ethylene into its base polymer. HDPE recycling capacity makes the material an excellent option to produce products that people will throw away after their first use. The UV protection of HDPE material enables the toys to maintain their original color without experiencing damage from sunlight exposure. In the forecast period, rising HDPE demand in India, Malaysia, China, and Japan is expected to lead to rapid industrial development, urban growth and rising building projects in both residential and commercial areas.

In December 2025, Guru Gobind Singh Refinery, Bathinda, operated by HPCL Mittal Energy Limited (HMEL), will witness a fresh investment of RS 2,600 crore. The investment will establish new polypropylene downstream industries and build new fine chemical production facilities.

China prohibited restaurants and stores from using single-use plastic straws and shopping bags throughout its main cities starting January 2021. The Environment Ministry of India plans to implement a plastic ban, which will stop all activities related to single-use plastic from July 2022 onwards. The introduction of stricter waste management regulations by governments presents Developing Recycled HDPE as a vital revenue opportunity.

Report Coverage

This research report categorises the Asia Pacific high-density polyethylene market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific high-density polyethylene market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific high-density polyethylene market.

Asia Pacific High-Density Polyethylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.71 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.52% |

| 2035 Value Projection: | USD 4.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Feedstock, By Application |

| Companies covered:: | Sinopec, PetroChina, Reliance Industries Ltd, Indian Oil Co. Ltd, LG Chem, Lotte Chemical Co., SCG Chemicals, Formosa Plastics Co., Petronas Chemicals Group, Qenos Pty Ltd, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The high-density polyethylene market in Asia Pacific is driven by the material, which is highly utilized for both rigid packaging and flexible packaging due to its lightweight properties, its ability to withstand damage and its capacity to keep moisture out. The rising e-commerce market, with the packaged food industry, drives the demand for this product. The environmental awareness among people and the government regulations that support circular economy practices have led to greater use of recycled HDPE and bio-based alternatives. The development of advanced catalyst systems with new production methods enables manufacturers to create advanced performance products.

Restraining Factors

The high-density polyethylene market in Asia Pacific is restrained by the company's production costs and profit margins experience direct fluctuations because its manufacturing process relies heavily on petrochemical feedstocks, which include ethylene, and it depends on crude oil and natural gas prices. The governments throughout the region enforce stringent regulations together with tax measures to control plastic usage and waste management practices as a solution to plastic pollution problems.

Market Segmentation

The Asia Pacific high-density polyethylene market share is categorised into feedstock and application.

- The naphtha segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific high-density polyethylene market is segmented by feedstock into naphtha, natural gas, and others. Among these, the naphtha segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the primary feedstock used to manufacture HDPE products, which constitutes the largest market segment. The continuous development of cracking technologies has improved naphtha-derived ethylene production through better yield and product quality, which maintains its market position. The existing naphtha production facilities and the operational links between refineries and petrochemical plants together create a strong market presence for this product.

- The blow molding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific high-density polyethylene market is segmented into blow molding, film and sheet, injection molding, pipe and extrusion and others. Among these, the blow molding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the manufacturing process of containers and bottles, and drums rest primarily on the use of HDPE through blow molding which serves as the leading method for all applications. The process starts with heating a plastic tube until operators inflates it to fill a mold which then creates the intended shape. The packaging industry requires blow-molded HDPE products because they need products that combine durability with lightweight properties and chemical resistance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific high-density polyethylene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sinopec

- PetroChina

- Reliance Industries Ltd

- Indian Oil Co. Ltd

- LG Chem

- Lotte Chemical Co.

- SCG Chemicals

- Formosa Plastics Co.

- Petronas Chemicals Group

- Qenos Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In November 2024, BASF launched EasiplasTM, a new brand of High-Density Polyethylene (HDPE), alongside reaching significant construction milestones at the HDPE plant at the Zhanjiang Verbund site.

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific high density polyethylene market based on the below-mentioned segments:

Asia Pacific High-Density Polyethylene Market, By Feedstock

- Naphtha

- Natural Gas

- Others

Asia Pacific High-Density Polyethylene Market, By Application

- Blow Molding

- Film and Sheet

- Injection Molding

- Pipe and Extrusion

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific high density polyethylene market size?A: Asia Pacific high-density polyethylene market size is expected to grow from USD 2.71 billion in 2024 to USD 4.01 billion by 2035, growing at a CAGR of 6.52% during the forecast period 2025-2035.

-

Q: What is high density polyethylene, and its primary use?A: High-density polyethylene (HDPE) serves as a strong yet lightweight thermoplastic material that derives from the chemical process of turning ethylene into its base polymer. HDPE recycling capacity makes the material an excellent option to produce products that people will throw away after their first use.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the material, which is highly utilized for both rigid packaging and flexible packaging because of its lightweight properties, its ability to withstand damage and its capacity to keep moisture out.

-

Q: What factors restrain the Asia Pacific high density polyethylene market?A: The market is restrained by the company's production costs and profit margins experience direct fluctuations because its manufacturing process relies heavily on petrochemical feedstocks, which include ethylene, and it depends on crude oil and natural gas prices.

-

Q: How is the market segmented by feedstock?A: The market is segmented into naphtha, natural gas, and others.

-

Q: Who are the key players in the Asia Pacific high density polyethylene market?A: Key companies include Sinopec, PetroChina, Reliance Industries Ltd, Indian Oil Co. Ltd, LG Chem, Lotte Chemical Co., SCG Chemicals, Formosa Plastics Co., Petronas Chemicals Group, and Qenos Pty Ltd.

Need help to buy this report?