Asia Pacific Fructose Market Size, Share, and COVID-19 Impact Analysis, By Product (High Fructose Corn Syrup, Fructose Syrups, and Fructose Solids), By Application (Beverages, Processed Foods, Dairy Products, Confectionary, and Others), and Asia Pacific Fructose Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesAsia Pacific Fructose Market Insights Forecasts to 2035

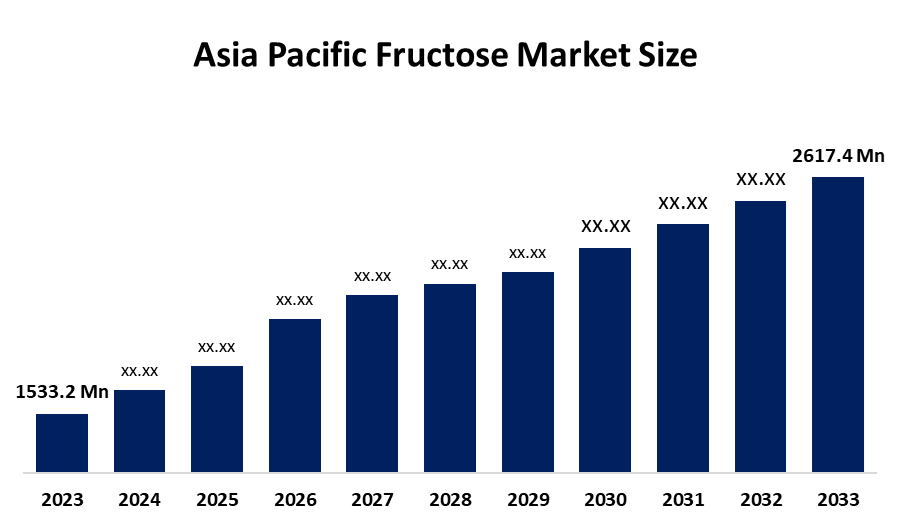

- The Asia Pacific Fructose Market Size Was Estimated at USD 1533.2 Million in 2024.

- The Market Size is Growing at a CAGR of 4.98% between 2025 and 2035.

- The Asia Pacific Fructose market is Anticipated to Reach USD 2617.4 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Asia Pacific fructose market is anticipated to Hold USD 2617.4 Million by 2035, growing at a CAGR of 4.98% from 2025 to 2035. The Asia Pacific fructose market offers future opportunities driven by rising demand for low-calorie sweeteners, expanding food and beverage processing, growth in functional foods, and increasing consumer preference for healthier sugar alternatives.

Market Overview

As health-conscious consumers continue to look for alternatives to traditional sugars, the Asia Pacific region is seeing stable growth in the demand for fructose. Because fructose is a naturally-occurring sugar in fruits and honey, it is used extensively in drinks and products, including baked goods, dairy products, and processed foods, as a more naturally sweet option with less effect on blood sugar levels compared to traditional sugars. One reason why this is happening is that consumers are shifting their eating habits toward low-calorie or natural sweetener options, which increases health-consciousness. Another reason why manufacturers are switching to using these types of sweeteners is to provide better taste and meet clean-label and reduced sugar requirements. In the growing convenience foods sector and an increase in the use of convenience food products, retail distribution expansion, and increasing investment in food processing industries will provide further support to a positive forecast for the fructose market in Asia Pacific.

Report Coverage

This research report categorizes the market for the Asia Pacific fructose market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific fructose market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific fructose market.

Asia Pacific Fructose Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1533.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.98% |

| 2035 Value Projection: | USD 2617.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By Application |

| Companies covered:: | ADM, Cargill, DuPont de Nemours Inc., Galam, Ingredion Inc., Shijiazhuang Huaxu Pharmaceutical Co., Tate & Lyle PLC, and others players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased consumer interest in lower-calorie sweetness from healthier alternatives as a result of increasing knowledge about diabetes and obesity is driving factors behind the growth of the fructose market in Asia Pacific. Another major driver of the fructose market is the rapid urbanization and change from rural lifestyles to those living more urban lifestyles. Packaging and the convenience of packaged foods that contain fructose continue to drive this market. The continued growth of the food and beverage processing industry allows fructose to be utilized more quickly in many areas such as bakery, dairy, alcoholic beverage products (i.e., beer), and functional food products. As more consumers want to support sustainable and organic products, there are increased investments made in developing natural products that use organic ingredients.

Restraining Factors

The market is restrained by growing concerns over excessive sugar consumption, fluctuating raw material prices, and increasing preference for alternative natural sweeteners such as stevia and monk fruit, which limit fructose demand.

Market Segmentation

The Asia Pacific fructose market share is classified into product and application.

- The high fructose corn syrup segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific fructose market is segmented by product into high fructose corn syrup, fructose syrups, and fructose solids. Among these, the high fructose corn syrup segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. HFCS remains dominant because of its cost-effectiveness, ease of integration in beverages and processed foods, and liquid form that simplifies manufacturing. Meanwhile, demand for fructose solids is growing as food and beverage makers especially in Asia Pacific shift toward formulations with clean-label, dry mixes, or sugar-reduced products where crystalline/powder fructose offers shelf-stability and easier storage.

- The beverages segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific fructose market is segmented by application into beverages, processed foods, dairy products, confectionary, and others. Among these, the beverages segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The beverages segment led in 2024 because fructose blends easily in liquid formulations and is widely used in soft drinks, juices, sports drinks, and flavored beverages. Dairy is set to grow fast as manufacturers use fructose to enhance sweetness, improve texture, and reduce added sugar in yogurts, flavored milk, and functional dairy products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific fructose market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADM

- Cargill

- DuPont de Nemours Inc.

- Galam

- Ingredion Inc.

- Shijiazhuang Huaxu Pharmaceutical Co.

- Tate & Lyle PLC

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific fructose market based on the following segments:

Asia Pacific Fructose Market, By Product

- High Fructose Corn Syrup

- Fructose Syrups

- Fructose Solids

Asia Pacific Fructose Market, By Application

- Beverages

- Processed Foods

- Dairy Products

- Confectionary

- Others

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific fructose market size?Asia Pacific fructose market size is expected to grow from USD 1533.2 Million in 2024 to USD 2617.4 Million by 2035, growing at a CAGR of 4.98% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Key driving factors for the Asia Pacific fructose market include rising consumer preference for healthier and low-calorie sweeteners due to increasing awareness of diabetes and obesity.

-

What factors restrain the Asia Pacific fructose market?The market is restrained by growing concerns over excessive sugar consumption, fluctuating raw material prices, and increasing preference for alternative natural sweeteners such as stevia and monk fruit, which limit fructose demand.

-

How is the market segmented by product?The market is segmented into product into high fructose corn syrup, fructose syrups, and fructose solids.

-

Who are the key players in the Asia Pacific fructose market?: Key companies include ADM, Cargill, DuPont de Nemours Inc., Galam, Ingredion Inc., Shijiazhuang Huaxu Pharmaceutical Co., and Tate & Lyle PLC.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?