Asia Pacific Fraud Detection and Prevention Market Size, Share, and COVID-19 Impact Analysis, By Solution Type (Fraud Analytics Solutions, Authentication Solutions, and Governance, Risk, and Compliance Solutions), By Application (Banking, Financial Services, and Insurance, Retail and E-Commerce, Government and Public Sector)

Industry: Information & TechnologyAsia Pacific Fraud Detection and Prevention Market Insights Forecasts to 2035

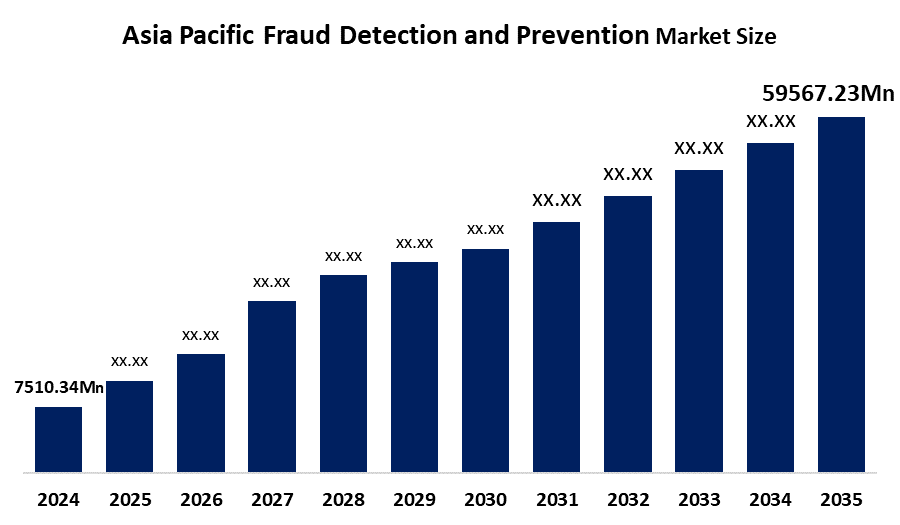

- The Asia Pacific Fraud Detection and Prevention Market Size Was Estimated at USD 7510.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 20.71% from 2025 to 2035

- The Asia Pacific Fraud Detection and Prevention Market Size is Expected to Reach USD 59567.23 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Fraud Detection and Prevention Market Size Is Anticipated To Reach USD 59567.23 Million By 2035, Growing At a CAGR Of 20.71% From 2025 to 2035. The market is driven by the robust technological infrastructure and the presence of major financial institutions. The Country’s significant e-commerce activity, along with its large-scale adoption of digital payment systems.

Market Overview

Fraud Detection and Prevention (FDP) is a collective term for the various means, instruments, and technologies that organizations implement to recognize, inhibit, and minimize the impacts of fraudulent activities. The process comprises the constant supervision of transactions, thorough data examination, and the enforcement of the controls to recognize and thwart the activities that are already being planned but not yet causing damage. Fraudulent activities like identity theft, payment fraud, unauthorized access to accounts, insurance fraud, fraud committed by employees, phishing attacks, and any other illegal actions to acquire financial benefits fall under the same category in this context.

The Asia Pacific Fraud Detection And Prevention (FDP) Market Size is experiencing rapid growth due to increasing digital transactions, e-commerce and mobile payments, with countries such as China and India leading the way. Rising fraud threats and government initiatives for enhanced security are leading to major adoption of AI, behavioural biometrics and cloud solutions, although high initial costs remain a challenge for small businesses.

Government bodies in the APAC region are enforcing stringent regulations and promoting digital initiatives, which are key drivers for the FDP market. New mandates such as the Philippines' Anti-Financial Account Scamming Act (AFASA) require automated, real-time transaction monitoring, creating demand for sophisticated FDP solutions. India's Reserve Bank of India (RBI) also mandates AI-powered transaction monitoring for the Unified Payment Interface (UPI). Countries like Japan have stringent data security laws, forcing financial institutions to invest in advanced technologies like AI and biometrics to comply with regulations.

“Digital India” and similar initiatives in Southeast Asia inspire organizations, especially in the public and BFSI sectors, to adopt scalable and affordable fraud prevention systems. Governments are encouraging collaboration to build strong anti-fraud infrastructure and strengthen regulatory frameworks, creating opportunities for private FDP solution providers to partner with public entities. Governments are specifically targeting tax evasion and grant fraud using FDP solutions, which in some cases have reduced fraudulent claims by 29% and 18% respectively, highlighting a unique opportunity in the public sector.

Report Coverage

This research report categorizes the market for the Asia Pacific Fraud Detection And Prevention Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific fraud detection and prevention market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific fraud detection and prevention market.

Asia Pacific Fraud Detection and Prevention Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7510.34 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 20.71% |

| 2035 Value Projection: | USD 59567.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | IBM Experian SAS FICO ACI Worldwide SAP And Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Fraud Detection And Prevention Market in Asia Pacific is driven by the digital transition of sectors such as healthcare, finance, and government has been a factor that has made the use of digital services widespread, thus increasing the risk of fraud and the necessity for strong prevention methods. The finance, retail, and healthcare businesses have to constantly enhance their security practices so as to fight against the increasingly sophisticated cyber threats. In 2020, the monetary losses due to cybercrime reached $4.2 billion, which was a significant rise when compared to previous years. The increase in e-commerce and mobile banking transactions is the fastest-growing factor among others.

Restraining Factors

The Fraud Detection And Prevention Market in Asia Pacific is restrained by the constantly changing and upgrading of the fraud methods that cybercriminals are using. The type of activities being done to exploit the weaknesses in systems owing to technology is blocking the increase in the market. The Federal Bureau of Investigation's report for 2021 showed more than 847000 incidents of fraud reported and over $6.9 billion in losses, thus pointing out a continual and escalating danger. Concerns over data privacy are the second challenge. A poll conducted by the International Association of Privacy Professionals indicated that 70% of companies faced difficulties in finding a way to meet the requirements of the privacy laws while still implementing effective fraud detection.

Market Segmentation

The Asia Pacific fraud detection and prevention market share is categorised into solution type and application.

- The fraud analytics solutions segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Fraud Detection And Prevention Market Size is segmented by solution type into fraud analytics solutions, authentication solutions, and governance, risk, and compliance solutions. Among these, the fraud analytics solutions segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is expected to grow by 45.2% in 2024 as a result of the increasing demand for organizations to use data-driven insights for the proper identification and mitigation of fraudulent activities. The Association of Certified Fraud Examiners has reported that companies that apply fraud analytics can cut their fraud losses by as much as 50%.

- The banking, financial services, and insurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, The Asia Pacific Fraud Detection And Prevention Market Size is segmented into banking, financial services, and insurance, retail and e-commerce, government and public sector. Among these, the banking, financial services, and insurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Market growth is the key factor for the segment to grow and to gain a share of 50.3% in the year 2024. The primary reason for this supremacy comes from the large sums of money moved through financial transactions and the high security of the customer data that is involved. The Federal Trade Commission pointed out that more than $3.3 billion was lost due to financial fraud in 2021, which highlights the necessity of having fraud detection solutions that work perfectly in this particular sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Asia Pacific Fraud Detection And Prevention Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Experian

- SAS

- FICO

- ACI Worldwide

- SAP

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Fraud Detection and Prevention Market based on the below-mentioned segments:

Asia Pacific Fraud Detection and Prevention Market, By Solution Type

- Fraud Analytics Solutions

- Authentication Solutions

- Governance, Risk, and Compliance Solutions

Asia Pacific Fraud Detection and Prevention Market, By Application

- Banking, Financial Services, and Insurance

- Retail and E-Commerce

- Government and Public Sector

Frequently Asked Questions (FAQ)

-

What is fraud detection and prevention, and its primary use?Fraud Detection and Prevention (FDP) is a collective term for the various means, instruments, and technologies that organizations implement to recognize, inhibit, and minimize the impacts of fraudulent activities. The process comprises the constant supervision of transactions, thorough data examination, and the enforcement of the controls to recognize and thwart the activities that are already being planned but not yet causing damage

-

What are the key growth drivers of the market?Market growth is driven by the finance, retail, and healthcare businesses have to constantly enhance their security practices to fight against the increasingly sophisticated cyber threats. In 2020, the monetary losses due to cybercrime reached $4.2 billion, which was a significant rise when compared to previous years.

-

What factors restrain the Asia Pacific fraud detection and prevention marketThe market is restrained by the constantly changing and upgrading of the fraud methods that cybercriminals are using. The type of activities being done to exploit the weaknesses in systems owing to technology is blocking the increase in the market. The Federal Bureau of Investigation's report for 2021 showed more than 847000 incidents of fraud reported and over $6.9 billion in losses, thus pointing out a continual and escalating danger

-

How is the market segmented by solution type?The market is segmented into fraud analytics solutions, authentication solutions, and governance, risk, and compliance solutions.

Need help to buy this report?