Asia Pacific Ethylene Vinyl Acetate Market Size, Share, and COVID-19 Impact Analysis, By Grade (Low-Density, Medium-Density, and High-Density), By Application (Films, Adhesives, Foams, Solar Cell Encapsulation, and Others), and Asia Pacific Ethylene Vinyl Acetate Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Ethylene Vinyl Acetate Market Insights Forecasts to 2035

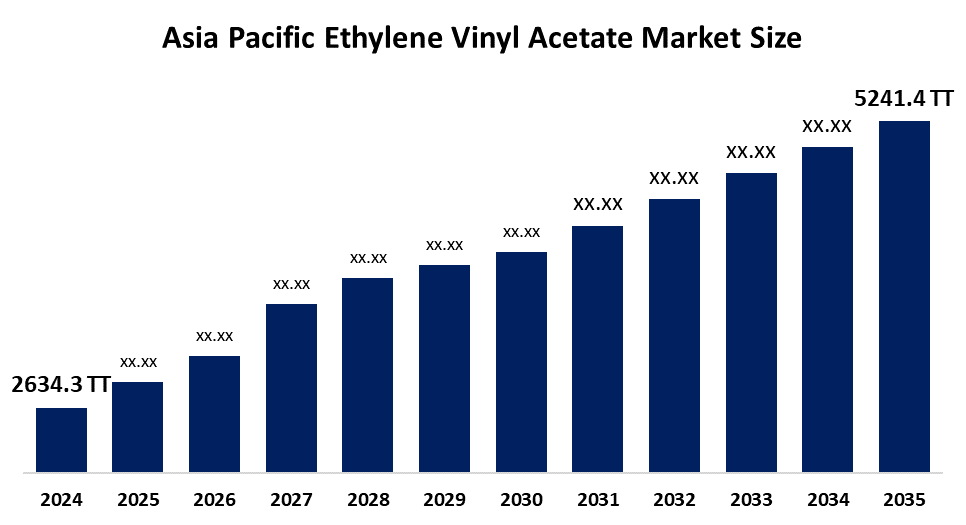

- The Asia Pacific Ethylene Vinyl Acetate Market Size Was Estimated at 2634.3 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.45% from 2025 to 2035

- The Asia Pacific Ethylene Vinyl Acetate Market Size is Expected to Reach 5241.4 Thousand Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Ethylene Vinyl Acetate Market Size Is Anticipated To Reach 5241.4 Thousand Tonnes By 2035, Growing At A CAGR Of 6.45% From 2025 To 2035. The market is driven by a growing trend towards sustainable and bio-based materials. EVA produced from sugarcane is a bio-based alternative to conventional petroleum-based EVA.

Market Overview

The production of ethylene vinyl acetate (EVA) thermoplastic copolymer starts with the copolymerization process that combines ethylene with vinyl acetate (VA). China is the world's largest consumer of this application due to aggressive renewable energy targets. The product serves to create flexible packaging films that provide low-temperature flexibility for frozen food products and medical supplies. The solar sector faces two major challenges, which include fluctuations in raw material prices and competition from polyolefin elastomers.

Mitsui & Dow Polychemicals begins to sell its biomass ethylene vinyl acetate copolymer (EVA) and biomass low-density polyethene (LDPE) products through the mass balance method starting September 2024.

The Indian Ministry of Chemicals and Fertilizers issued an amendment for the Ethylene Vinyl Acetate Copolymers quality control order in October 2025, under the Bureau of Indian Standards Act 2016. South Korea's Ministry of Climate, Energy, and Environment will implement a new regulation on November 28 2025, which mandates solar power systems in all public parking facilities that exceed 1000 square meters after the cabinet approved an amendment to the country's renewable energy law.

Report Coverage

This research report categorises the Asia Pacific ethylene vinyl acetate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific ethylene vinyl acetate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific ethylene vinyl acetate market.

Asia Pacific Ethylene Vinyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 2634.3 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.45% |

| 2035 Value Projection: | 5241.4 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | Hanwha Total Petrochemical, BASF-YPC Company Limited, LG Chem Ltd., Formosa Plastics Corporation, Jiangsu Hongjing New Material Co. Ltd., TPI Polene Public Company Limited, Asia Polymer Corporation, Wacker Chemie AG, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ethylene vinyl acetate market in Asia Pacific is driven by the solar industry, which comes from solar cell encapsulation serving as its primary growth engine. EVA serves as the primary encapsulating material, which protects photovoltaic (PV) cells from damage caused by both moisture and ultraviolet light. Government authorities in India and Japan provide substantial financial incentives to enhance domestic solar panel production facilities creates increased demand for high-VA content EVA. The growing public awareness about health, combined with the increase in sports activities like trail running and basketball, results in a 10.34% CAGR for running shoe demand until 2031.

Restraining Factors

The ethylene vinyl acetate market in the Asia Pacific is restrained by the polyolefin elastomers (POE) have become the preferred material for bifacial and glass-glass solar modules because their moisture protection capabilities exceed those of EVA materials. The recyclability and circular economy regulations that manufacturers must follow have increased their operational expenses.

Market Segmentation

The Asia Pacific ethylene vinyl acetate market share is categorised into grade and application.

- The high-density segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific ethylene vinyl acetate market is segmented by grade into low-density, medium-density, and high-density. Among these, the high-density segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its superior strength, higher stiffness and enhanced thermal stability. The combination of these properties makes the material the top choice for solar PV encapsulants, durable foams, multilayer packaging and high-performance industrial components. The solar photovoltaic sector is the largest demand center for high-density EVA because it provides strong cross-linking capabilities.

- The foams segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific ethylene vinyl acetate market is segmented into films, adhesives, foams, solar cell encapsulation, and others. Among these, the foams segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by foams that are used in the midsoles of footwear, sports equipment, automotive interiors and packaging inserts. The footwear industry remains the major driver, particularly in Asia. The segment continues to grow because people demand comfort materials together with fitness products and impact-resistant packaging.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific ethylene vinyl acetate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanwha Total Petrochemical

- BASF-YPC Company Limited

- LG Chem Ltd.

- Formosa Plastics Corporation

- Jiangsu Hongjing New Material Co. Ltd.

- TPI Polene Public Company Limited

- Asia Polymer Corporation

- Wacker Chemie AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Ethylene Vinyl Acetate Market based on the below-mentioned segments:

Asia Pacific Ethylene Vinyl Acetate Market, By Grade

- Low-Density

- Medium-Density

- High-Density

Asia Pacific Ethylene Vinyl Acetate Market, By Application

- Films

- Adhesives

- Foams

- Solar Cell Encapsulation

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific ethylene vinyl acetate market size?A: Asia Pacific ethylene vinyl acetate market size is expected to grow from 2634.3 thousand tonnes in 2024 to 5241.4 thousand tonnes by 2035, growing at a CAGR of 6.45% during the forecast period 2025-2035

-

Q: What is ethylene vinyl acetate, and its primary use?A: The production of ethylene vinyl acetate (EVA) thermoplastic copolymer starts with the copolymerization process that combines ethylene with vinyl acetate (VA). China is the world's largest consumer of this application due to aggressive renewable energy targets.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the solar industry, which comes from solar cell encapsulation serving as its primary growth engine. EVA serves as the primary encapsulating material, which protects photovoltaic (PV) cells from damage caused by both moisture and ultraviolet light.

-

Q: What factors restrain the Asia Pacific ethylene vinyl acetate market?A: The market is restrained by the Polyolefin elastomers (POE) have become the preferred material for bifacial and glass-glass solar modules because their moisture protection capabilities exceed those of EVA materials.

-

Q: How is the market segmented by grade?A: The market is segmented into low-density, medium-density, and high-density.

-

Q: Who are the key players in the Asia Pacific ethylene vinyl acetate market?A: Key companies include Hanwha Total Petrochemical, BASF-YPC Company Limited, LG Chem Ltd., Formosa Plastics Corporation, Jiangsu Hongjing New Material Co. Ltd., TPI Polene Public Company Limited, Asia Polymer Corporation, and Wacker Chemie AG.

Need help to buy this report?