Asia Pacific Ethanol Market Size, Share, and COVID-19 Impact Analysis, By Type (Grain-Based and Sugarcane-Based), By Application (Alcoholic Beverages, Automotive Fuel, Pharmaceuticals, Personal Care, Textiles, Fertilizers, Pesticides and Others), By Feedstock (Sugarcane, Corn, Wheat, and Barley), and Asia Pacific Ethanol Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Ethanol Market Insights Forecasts to 2035

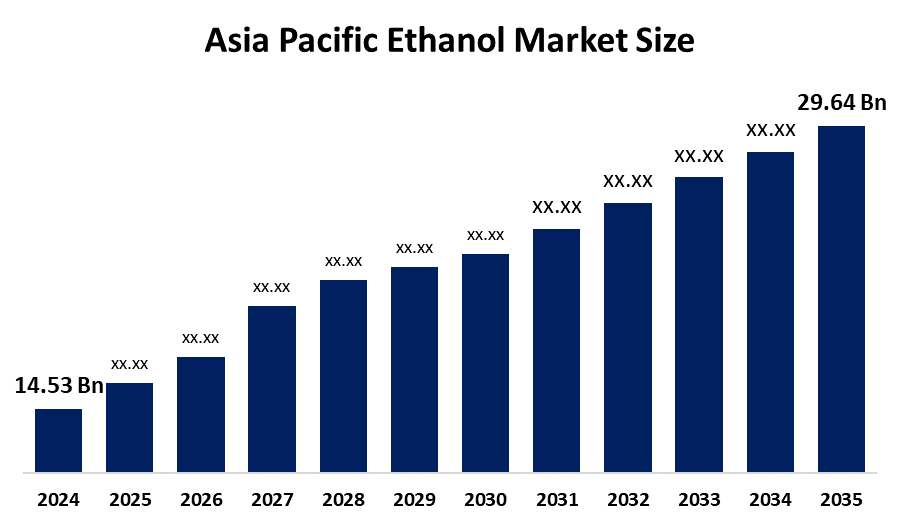

- The Asia Pacific Ethanol Market Size Was Estimated at USD 14.53 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.52% from 2025 to 2035

- The Asia Pacific Ethanol Market Size is Expected to Reach USD 29.64 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Asia Pacific Ethanol Market Size is anticipated to Reach USD 29.64 Billion by 2035, Growing at a CAGR of 6.52% from 2025 to 2035. The market is driven by technological advancements such as innovations in distillation and fermentation technologies to make ethyl alcohol more efficient, along with rapid developments in cellulosic ethanol made from plant residues.

Market Overview

The Asia-Pacific ethanol market stands as a vibrant and fast-changing industry that serves as a key component for the energy security, environmental protection, and economic growth of the region. Ethanol serves as a biofuel that petroleum companies use to create gasoline mixtures that lower greenhouse gas emissions while increasing octane levels. The market grows because the product has transformed into a sustainable fuel solution that the aviation, marine and freight logistics industries can use to achieve their challenging decarbonization requirements.

China exported unmodified ethanol to international markets during September 2025 with a 66.64% decrease from its previous month's exports. The total export volume reached 1,362.50 tons. The average export price for the month was $820.30 per ton. Papua New Guinea was the primary destination for these exports, importing the largest share at 380 tons, at an average price of $786.53 per ton.

The Union Minister Hardeep Singh Puri introduced ETHANOL 100 as a new automotive fuel in March 2024. The fuel launch event took place at the Indian Oil Retail Outlet M/s. Iewin Road Service Station.

The Australian government has introduced an A$1.1 billion incentive programme which aims to create renewable fuels through domestic agricultural and waste feedstock development. The Cleaner Fuels Programme operates for 10 years to secure private investment which will enable Australia to produce sustainable aviation fuel and renewable diesel until commercial operations start in 2029.

Report Coverage

This research report categorises the Asia Pacific ethanol market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific ethanol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific ethanol market.

Asia Pacific Ethanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 45 |

| Market Size in 45: | USD 14.53 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.52% |

| 2035 Value Projection: | USD 29.64 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 197 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Jilin Fuel Ethanol Co. Ltd, COFCO Biochemical Co. Ltd, Praj Industries Ltd, Mitr Alcohol Co. Ltd, India Glycols Ltd, Shandong Longlive Vio Technology Co., Balrampur Chini Mills Ltd, Wilmar International Limited, United Petroleum, Thai Agro Energy Public Company Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ethanol market in Asia Pacific is driven by the Chinese market size and rapid market expansion create business opportunities for organizations that operate in China. The company needs to establish local relationships and develop strategies for protecting intellectual property, and handle the complex process of obtaining regulatory approvals. The government requires bioethanol blending programs to expand their operations while the company develops complete supply chain systems to fulfil increasing renewable fuel demands. The rapid development of urban areas with the quick industrial growth and the strong renewable energy initiatives from China and India leads to environmental challenges.

Restraining Factors

The ethanol market in the Asia Pacific is restrained by the unpredictable weather patterns and climate change effects, which lead to crop yield fluctuations, resulting in higher production expenses that diminish profitability for smaller manufacturers. The practice of using food crops as fuel sources creates two main problems, which are food security threats and rising prices that particularly affect developing countries.

Market Segmentation

The Asia Pacific ethanol market share is categorised into type, application, and feedstock.

Get more details on this report -

- The sugarcane-based segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific ethanol market is segmented by type into grain-based and sugarcane-based. Among these, the sugarcane-based segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The sugarcane-based segment dominated the market because it controlled 44% of market share in 2025. The dominance of the segment can be attributed to the growing demand for cleaner transportation fuels and a surge in energy security concerns. Cleaner transportation fuels show better energy efficiency because they produce higher energy output.

- The automotive fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific ethanol market is segmented into alcoholic beverages, automotive fuel, pharmaceuticals, personal care, textiles, fertilizers, pesticides and others. Among these, the automotive fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by The government implements mandatory ethanol blending requirements which increase gasoline blending requirements. The government raises blending requirements to decrease fossil fuel dependence while achieving lower tailpipe emissions. The new policy will lead to higher ethanol consumption for use in transportation fuels.

- The sugarcane segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific ethanol market is segmented by feedstock into sugarcane, corn, wheat, and barley. Among these, the sugarcane segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the availability of sugarcane juice, and molasses guarantees production of ethanol in large quantities at very cheap production costs. The government biofuel requirements and blending schemes have increased its importance as a biofuel. The process of expanding the facility and increasing fermentation yields has enabled sugarcane-ethanol to become a major source of global bioethanol production by the year 2025.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific ethanol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jilin Fuel Ethanol Co. Ltd

- COFCO Biochemical Co. Ltd

- Praj Industries Ltd

- Mitr Alcohol Co. Ltd

- India Glycols Ltd

- Shandong Longlive Vio Technology Co.

- Balrampur Chini Mills Ltd

- Wilmar International Limited

- United Petroleum

- Thai Agro Energy Public Company Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2025, Airbus and Cathay Pacific launched a historic $70 Million co-investment to accelerate sustainable aviation fuel production across the Asia-Pacific.

- In April 2025, the Madhya Pradesh government launched its Scheme for Implementation of biofuel projects in Madhya Pradesh, under the Madhya Pradesh Renewable Energy Policy.

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific ethanol market based on the below-mentioned segments:

Asia Pacific Ethanol Market, By Type

- Grain-Based

- Sugarcane-Based

Asia Pacific Ethanol Market, By Application

- Alcoholic Beverages

- Automotive Fuel

- Pharmaceuticals

- Personal Care

- Textiles

- Fertilizers

- Pesticides

- Others

Asia Pacific Ethanol Market, By Feedstock

- Sugarcane

- Corn

- Wheat

- Barley

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific ethanol market size?A: Asia Pacific ethanol market size is expected to grow from USD 14.53 billion in 2024 to USD 29.64 billion by 2035, growing at a CAGR of 6.52% during the forecast period 2025-2035.

-

Q: What is ethanol, and its primary use?A: The Asia-Pacific ethanol market stands as a vibrant and fast-changing industry that serves as a key component for the energy security, environmental protection, and economic growth of the region. Ethanol serves as a biofuel that petroleum companies use to create gasoline mixtures that lower greenhouse gas emissions while increasing octane levels.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the Chinese market size and rapid market expansion create business opportunities for organizations that operate in China. The company needs to establish local relationships and develop strategies for protecting intellectual property, and handle the complex process of obtaining regulatory approvals.

-

Q: What factors restrain the Asia Pacific ethanol market?A: The market is restrained by the unpredictable weather patterns and climate change effects, which lead to crop yield fluctuations, resulting in higher production expenses that diminish profitability for smaller manufacturers.

-

Q: How is the market segmented by type?A: The market is segmented into grain-based and sugarcane-based

-

Q: Who are the key players in the Asia Pacific ethanol market?A: Key companies include Jilin Fuel Ethanol Co. Ltd, COFCO Biochemical Co. Ltd, Praj Industries Ltd, Mitr Alcohol Co. Ltd, India Glycols Ltd, Shandong Longlive Vio Technology Co., Balrampur Chini Mills Ltd, Wilmar International Limited, United Petroleum, and Thai Agro Energy Public Company Limited.

Need help to buy this report?