Asia Pacific Data Pipeline Tools Market Size, Share, and COVID-19 Impact Analysis, By Type (ETL Data Pipeline, ELT Data Pipeline, Real-time Data Pipeline, and Batch Data Pipeline), By Deployment (On-Premise and Cloud Based), By Application Area (Big Data Analytics, Customer Relationship Management, Real Time Analytics, Sales and Marketing Management, and Others), and Asia Pacific Data Pipeline Tools Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyAsia Pacific Data Pipeline Tools Market Insights Forecasts to 2035

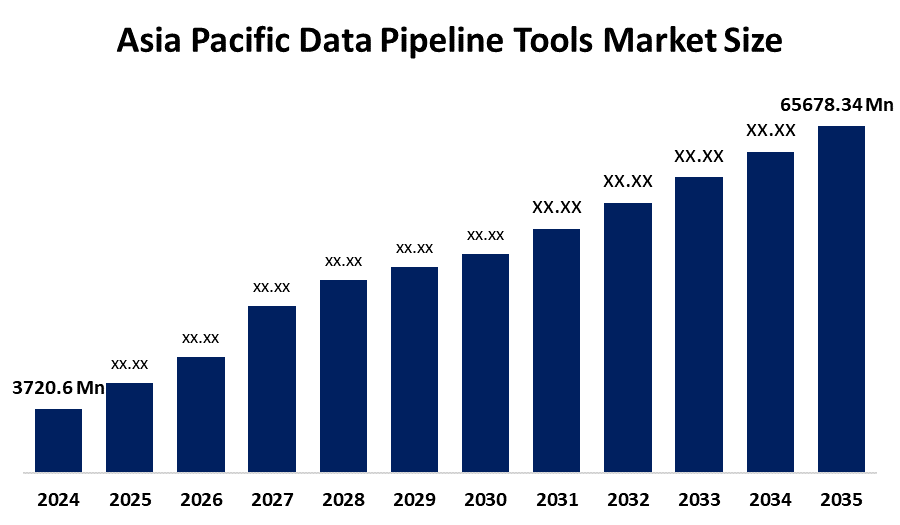

- The Asia Pacific Data Pipeline Tools Market Size Was Estimated at USD 3720.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 29.82% from 2025 to 2035

- The Asia Pacific Data Pipeline Tools Market Size is Expected to Reach USD 65,678.34 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Asia Pacific Data Pipeline Tools Market is anticipated to reach USD 65,678.34 million by 2035, growing at a CAGR of 29.82% from 2025 to 2035. The Asia Pacific data pipeline tools market is growing due to rising digital transformation, expanding cloud and IoT adoption, the need for concurrent analysis, and requirements for seamless data integration across multiple, intricate enterprise systems and platforms.

Market Overview

The Asia Pacific data pipeline tools market refers to software products that provide the automated transfer, conversion, and integration of data from different sources to targets like data warehouses, lakes, or analytics platforms. These solutions are critical for organizations to handle big data pipelines, enable concurrent analytics, and provide data quality. Some of the primary applications include ETL (Extract, Transform, Load), data migration, live streaming of data, and data integration between cloud and on-premise environments. Strengths for Asia Pacific are an advanced IT infrastructure, a high corporate focus on automation, and an emerging data culture. AI-driven data orchestration, hybrid cloud integration, and increased usage in smart cities and IoT present opportunities. Growth in the market is spurred by the fast pace of digital transformation, cloud adoption, and growing use of concurrent data processing in industry areas such as finance, manufacturing, and retail. Government sponsored DX campaigns and data governance norms improve the adoption of data pipeline software across both public and private sectors.

Report Coverage

This research report categorizes the market for the Asia Pacific data pipeline tools market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific data pipeline tools market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific data pipeline tools market.

Asia Pacific Data Pipeline Tools Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3720.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 29.82% |

| 2035 Value Projection: | USD 65,678.34 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 164 |

| Segments covered: | By Type,By Deployment |

| Companies covered:: | SoftBank Group Corp, Fujitsu, Matillion, Hitachi, Finatext Ltd., Airbyte, Informatica, Fivetran, Talend, IBM StreamSets, NTT Data Corporation,and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for Asia Pacific data pipeline tools is driven by surging demand for concurrent data processing, growing cloud adoption, and increasing demand for integrating data seamlessly across multiple platforms. Data-driven resolution is becoming a high priority for businesses, and this drives the demand for automated, efficient data workflows. The growing uptake of IoT, AI, and big data analytics in sectors such as finance, manufacturing, and retail further drives demand. Government incentives for digital transformation and data governance also promote the extensive use of sophisticated data pipeline solutions.

Restraining Factors

The Asia Pacific data pipeline tools market is constrained by high deployment costs, difficulties integrating with legacy systems, data privacy concerns, and a shortage of skilled professionals. These factors can cause delays in adoption, particularly among small and medium-sized enterprises.

Market Segmentation

The Asia Pacific data pipeline tools market share is classified into type, deployment, and application area.

- The ETL data pipeline segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific data pipeline tools market is segmented by type into ETL data pipeline, ELT data pipeline, real-time data pipeline, and batch data pipeline. Among these, the ETL data pipeline segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their broad applicability across industries. They efficiently extract, transform, and load large volumes of structured data, enabling seamless integration into storage systems and supporting business intelligence, analytics, and data-driven decision-making processes.

- The cloud based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific data pipeline tools market is segmented by deployment into on-premise and cloud based. Among these, the cloud based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to they provide flexibility, scalability, and cost-effectiveness, enabling organizations to process and manage large amounts of data without making heavy infrastructure investments. Their ready availability and easy integration with other cloud services also boost their attraction in multiple industries in Asia Pacific.

- The big data analytics segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific data pipeline tools market is segmented by application area into big data analytics, customer relationship management, real time analytics, sales and marketing management, and others. Among these, the big data analytics segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing demands to process and analyze enormous volumes of structured and unstructured data. Big data analytics are used across industries by organizations to obtain useful insights, improve operations, and inform strategic decisions, which makes it necessary to drive business intelligence and advanced analytics initiatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific data pipeline tools market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SoftBank Group Corp

- Fujitsu

- Matillion

- Hitachi

- Finatext Ltd.

- Airbyte

- Informatica

- Fivetran

- Talend

- IBM StreamSets

- NTT Data Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific data pipeline tools market based on the below-mentioned segments:

Asia Pacific Data Pipeline Tools Market, By Type

- ETL Data Pipeline

- ELT Data Pipeline

- Real-time Data Pipeline

- Batch Data Pipeline

Asia Pacific Data Pipeline Tools Market, By Deployment

- On-premise

- Cloud Based

Asia Pacific Data Pipeline Tools Market, By Application Area

- Big Data Analytics

- Customer Relationship Management

- Real Time Analytics

- Sales and Marketing Management

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific data pipeline tools market size?Asia Pacific data pipeline tools market is expected to grow from USD 3720.6 million in 2024 to USD 65,678.34 million by 2035, growing at a CAGR of 29.82% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?The market for Asia Pacific data pipeline tools is driven by surging demand for concurrent data processing, growing cloud adoption, and increasing demand for integrating data seamlessly across multiple platforms. Data-driven resolution is becoming a high priority for businesses, and this drives the demand for automated, efficient data workflows. The growing uptake of IoT, AI, and big data analytics in sectors such as finance, manufacturing, and retail further drives demand. Government incentives for digital transformation and data governance also promote the extensive use of sophisticated data pipeline solutions.

-

Q: What factors restrain the Asia Pacific data pipeline tools market?The Asia Pacific data pipeline tools market is constrained by high deployment costs, difficulties integrating with legacy systems, data privacy concerns, and a shortage of skilled professionals. These factors can cause delays in adoption, particularly among small and medium-sized enterprises.

Need help to buy this report?