Asia Pacific Crude Oil Market Size, Share, and COVID-19 Impact Analysis, By Type (Light Distillates, Light Oils, Medium Oils, Heavy Fuel Oil), By Application (Transportation Fuel, Ethylene, Acrylic, Butadiene, Benzene, and Others), and Asia Pacific Crude Oil Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Crude Oil Market Insights Forecasts to 2035

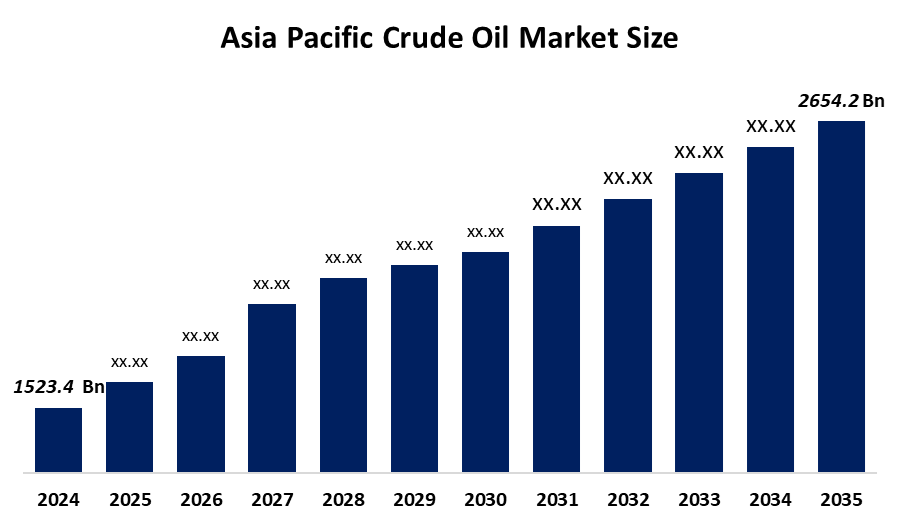

- The Asia Pacific Crude Oil Market Size Was Estimated at USD 1523.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.18% from 2025 to 2035

- The Asia Pacific Crude Oil Market Size is Expected to Reach USD 2654.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Crude Oil Market Size is anticipated to reach USD 2654.2 Billion by 2035, growing at a CAGR of 5.18% from 2025 to 2035. The market is driven by the rise in fuel consumption, expansion of petrochemical industries, rise in automotive fuel demand and industrialization in emerging economies.

Market Overview

The crude oil market develops through the process of finding and obtaining crude oil, which undergoes refinement before it is distributed and sold in international markets. The market operates based on the balance between supply and demand, with political developments and the implementation of government rules. The refining process of crude oil results in the production of various by-products, which include gasoline, diesel, jet fuel, lubricants, asphalt, petrochemicals and plastics. The substance exists as a heavy black liquid which consists mostly of hydrocarbons and serves as the primary ingredient for creating gasoline, diesel, jet fuel, heating oil, lubricants and petrochemicals.

Between 2022 and 2023, APEC's oil consumption rose significantly by 1.95 mb/d, with China hitting a record-high 16.1 mb/d in 2023. In other APEC subregions, marginal growth was noted. In 2023, the Asia Pacific region's total oil supply will be 68231246, a 70% increase. Due to decreased Russian oil exports to Europe, Russia diverted its crude and petroleum products to Asia in 2023, with China and India being the two biggest purchasers of Russian crude in Asia. China's purchases of crude oil rose by 11% in 2023.

As of March 2024, fossil fuels accounted for about 98% of the fuel utilized in the road transportation industry, with biofuels like ethanol making up only 2%. India's Ethanol Blended Petrol (EBP) Program has achieved significant success; as of September, 2024, the ethanol production capacity had more than doubled over the previous four years, reaching 1,623 crore liters.

Report Coverage

This research report categorises the Asia Pacifican crude oil market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific crude oil market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific crude oil market.

Asia Pacific Crude Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1523.4 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.18% |

| 2035 Value Projection: | USD 2654.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type |

| Companies covered:: | China National Petroleum Corporation, Sinopec, CNOOC Limited, Petronas, Indian Oil Corporation Ltd., ONGC, PTT Public Company Ltd, SK Holdings / SK Lubricants, ENEOS Holdings, Reliance Industries Ltd, and Other, key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The crude oil market in Asia Pacific is driven by the demand for industrial products and services, which rises because of the combination of industrial growth in developing nations and rising population numbers and higher demands for transportation services. The India Brand Equity Foundation IBEF reported in January 2024 that the Indian government established policies that permit complete foreign direct investment in essential industries that include the natural gas sector and refineries. The Asia Pacific region sees governments and businesses invest large amounts of money into building new refineries and expanding existing ones to satisfy local demand while decreasing their reliance on imported products.

Restraining Factors

The crude oil market in Asia Pacific is restrained by the crude oil market experiences high sensitivity toward geopolitical events because major oil-producing areas encounter political unrest and armed conflicts, as well as government regulations, which create disruptions in worldwide supply networks. Oil-importing countries establish new trade agreements with various producing nations to reduce their geopolitical risk through enhanced supply source diversification.

Market Segmentation

The Asia Pacific crude oil market share is categorised into type and application.

- The light distillates segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific crude oil market is segmented by type into light distillates, light oils, medium oils, heavy fuel oil. Among these, the light distillates segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Light Distillates is the leading segment as the consumer of crude oil. This industry consumed approximately 33% of the market in 2022 and will remain the leading consumer until 2032. The primary industrial applications of light distillates come from their production during the first distillation process of crude oil.

- The transportation fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific crude oil market is segmented into transportation fuel, ethylene, acrylic, butadiene, benzene, and others. Among these, the transportation fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the extensive network of worldwide transportation systems, which includes roadways and air travel and sea shipping operations, and continues to use large amounts of processed crude oil products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific crude oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China National Petroleum Corporation

- Sinopec

- CNOOC Limited

- Petronas

- Indian Oil Corporation Ltd.

- ONGC

- PTT Public Company Ltd

- SK Holdings / SK Lubricants

- ENEOS Holdings

- Reliance Industries Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In May 2025, Motul Launched new NGEN Hybrid in the Asia Pacific. A tailor-made solution with faster oil circulation, quicker pressure build-up, and low-speed pre-ignition protection that exceeds API SQ and ILSAC GF-7 standards

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Crude Oil Market based on the below-mentioned segments:

Asia Pacific Crude Oil Market, By Type

- Light Distillates

- Light Oils

- Medium Oils

- Heavy Fuel Oil

Asia Pacific Crude Oil Market, By Application

- Transportation Fuel

- Ethylene

- Acrylic

- Butadiene

- Benzene

- Others

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific crude oil market size?Asia Pacific crude oil market size is expected to grow from USD 1523.4 billion in 2024 to USD 2654.2 billion by 2035, growing at a CAGR of 5.18% during the forecast period 2025-2035

-

What is crude oil, and its primary use?The crude oil industry develops through the process of finding and obtaining crude oil which undergoes refinement before it is distributed and sold in international markets

-

What are the key growth drivers of the market?Market growth is driven by the demand for industrial products and services rises because of the combination of industrial growth in developing nations and rising population numbers and higher demands for transportation services.

-

What factors restrain the Asia Pacific crude oil market?The market is restrained by the Oil-importing countries establish new trade agreements with various producing nations to reduce their geopolitical risk through enhanced supply source diversification.

-

How is the market segmented by application?The market is segmented into transportation fuel, ethylene, acrylic, butadiene, benzene, and others.

-

Who are the key players in the Asia Pacific crude oil market?Key companies include China National Petroleum Corporation, Sinopec, CNOOC Limited, Petronas, Indian Oil Corporation Ltd., ONGC, PTT Public Company Ltd, SK Holdings / SK Lubricants, ENEOS Holdings, and Reliance Industries Ltd.

Need help to buy this report?