Asia Pacific Credit Insurance Market Size, Share, and COVID-19 Impact Analysis, By Enterprise Size (Large Enterprises, Small and Medium Enterprises), By Coverage (Whole Turnover Coverage, Single Buyer Coverage), By Application (Domestic, International), By End User (Food & Beverage, IT & Telecom, Healthcare, Energy, and Others), and Asia Pacific Credit Insurance Market Insights Forecasts to 2035

Industry: Banking & FinancialAsia Pacific Credit Insurance Market Insights Forecasts to 2035

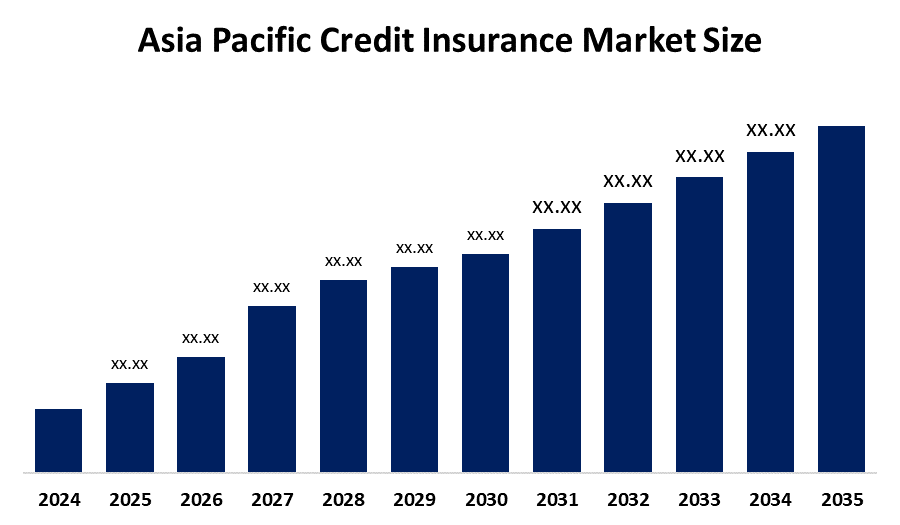

- The Asia Pacific Credit Insurance Market Size Is Expected to Grow at a CAGR of Around 5.78% from 2025 to 2035.

- The Asia Pacific Credit Insurance Market Size Is Expected to Reach a Significant Share By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Credit Insurance Market size is expected to Grow 5.78% CAGR from 2025 to 2035 is expected to reach a significant share by 2035. The market is driven by the growing occurrences of business bankruptcies lead to a rising trend in the adoption of trade credit insurance among companies as a measure to protect themselves against bankruptcy and to keep their cash flow running.

Market Overview

Trade credit insurance is an effective way to handle the credit risk of a company. It ensures that the firm can continue to progress without the fear of losing income from unpaid invoices. Thus, it is a major factor contributing to a secure business environment. The rising number of corporate liquidations leads to the usage of trade credit insurance for credit management, lowering bad debt, and improving cash flow, which in turn is a driving factor for the market. Europe is the largest market for trade credit insurance, as the companies there are more inclined to use the product to support their customer relations through timely payments.

In the year 2024, trade credit insurance experienced an unprecedented exposure of nearly £3.07 trillion. The insurance for export credits aids the exporters in receiving payments and signing commercial deals with foreign clients as well as staying present in the market, due to it offers protection to either the exporter or the bank that is providing the loan to the buyer.

The trade credit insurance business was launched by Dual Europe. The development is attributed to growing corporate failures and the increased sensitivity towards credit risks. Additionally, this growth is reinforced by the embrace of technology and the establishment of friendly government policies.

Report Coverage

This research report categorizes the market for the Asia Pacific credit insurance market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific credit insurance market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific credit insurance market.

Asia Pacific Credit Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.78% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Chubb Ltd, Allianz SE, Zurich Insurance Group AG, EFCIS Limited, Bridge Insurance Brokers, Credit Man, Thomas Carroll Group Plc, Sace Simest, UK Export Finance, ICBA Trade Finance, Others, and key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The trade credit insurance market in Europe is driven by the rising occurrence of businesses going bankrupt has led to a corresponding rise in the adoption of trade credit insurance by companies which serving as a protective measure against insolvency and also ensuring smooth cash flow. A 7% rise in the number of bankruptcies was witnessed in 2023, and a further 9% increase by the end of 2024 is predicted. The firm also foresaw that the number of bankruptcies would continue to be high through the end of 2025, mainly due to the delays in construction and real estate projects. The continued digital transformation of the insurance sector and the introduction of governmental regulations that are consumer-friendly and support business ethics are the major factors behind the anticipated market expansion in the coming years.

Restraining Factors

The trade credit insurance market in Europe is restrained by loss ratios, and the lack of awareness among small to middling enterprises (SMEs) is still the main hindrance to the trade credit insurance sector. Economic downturns drive insurers to adopt tighter underwriting practices and charge higher premiums as a result of rising defaults and changing claim patterns, which are under profitability pressure. The resultant volatility not only dissuades taking risks but also confines market growth. Furthermore, a good number of SMEs do not know the advantages of trade credit insurance and consider it as an extra cost; thus, non-usage is induced.

Market Segmentation

The Asia Pacific credit insurance market share is categorised into enterprise size, coverage, application, and end user.

- The large enterprises segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific credit insurance market is segmented by enterprise size into large enterprises, small and medium enterprises. Among these, the large enterprises segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Large enterprises were the largest segment with a revenue share of 61.57% in 2023. The segmental growth is driven by the growing demand for trade credit insurance policies from large corporations to reduce non-payment risks. Moreover, insurance companies like Allianz Trade are actively participating in the issuance of trade credit insurance suitable for large corporations as a means of safeguarding their cash flows and receivables.

- The whole turnover coverage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on coverage, the Asia Pacific credit insurance market is segmented into whole turnover coverage, single buyer coverage. Among these, the whole turnover coverage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market growth is driven they provide comprehensive coverage for the entire receivables portfolio, thereby simplifying risk management, offering greater value to large corporations, and facilitating banking loans.

- The international segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific credit insurance market is segmented by application into domestic, international. Among these, the international segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by providing the seller with a guarantee of payment, even if the foreign buyer defaults, which in turn builds trust and facilitates smoother international transactions. Besides, there has been an increase in the issuance of trade credit insurance policies specifically for exporters.

- The food & beverage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Asia Pacific credit insurance market is segmented into food & beverage, IT & telecom, healthcare, energy, and others. Among these, the food & beverage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the low margins, changing consumer expectations that include high-quality ingredients, and unstable agricultural commodity pricing. The need for cash flow protection is what is driving the trade credit insurance purchases in the food & beverage industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific credit insurance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chubb Ltd

- Allianz SE

- Zurich Insurance Group AG

- EFCIS Limited

- Bridge Insurance Brokers

- Credit Man

- Thomas Carroll Group Plc

- Sace Simest

- UK Export Finance

- ICBA Trade Finance

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Credit Insurance Market based on the below-mentioned segments:

Asia Pacific Credit Insurance Market, By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

Asia PacificCredit Insurance Market, By Coverage

- Whole Turnover Coverage

- Single Buyer Coverage

Asia PacificCredit Insurance Market, By Application

- Domestic

- International

Asia PacificCredit Insurance Market, By End User

- Food & Beverage

- IT & Telecom

- Healthcare

- Energy

- Others

Frequently Asked Questions (FAQ)

-

Q: What is trade credit insurance, and its primary use?A: Trade credit insurance is an effective way to handle the credit risk of a company. It ensures that your firm can continue to progress without the fear of losing income from unpaid invoices. Thus, it is a major factor contributing to a secure business environment. The rising number of corporate liquidations leads to the usage of trade credit insurance for credit management, lowering bad debt, and improving cash flow, which in turn is a driving factor for the market.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising occurrence of businesses going bankrupt has led to a corresponding rise in the adoption of trade credit insurance by companies which serving as a protective measure against insolvency and also ensuring smooth cash flow. A 7% rise in the number of bankruptcies was witnessed in 2023, and a further 9% increase by the end of 2024 is predicted

-

Q: What factors restrain the Asia Pacific credit insurance market?A: The market is restrained by the loss ratios and the lack of awareness among small to middling enterprises (SMEs) are still the main hindrances to the trade credit insurance sector. Economic downturns drive insurers to adopt tighter underwriting practices and charge higher premiums as a result of rising defaults and changing claim patterns, which are under profitability pressure.

-

Q: How is the market segmented by enterprise size?A: The market is segmented into large enterprises, small and medium enterprises.

-

Q: Who are the key players in the Asia Pacific credit insurance market?A: Key companies include Chubb Ltd, Allianz SE, Zurich Insurance Group AG, EFCIS Limited, Bridge Insurance Brokers, Credit Man, Thomas Carroll Group Plc, Sace Simest, UK Export Finance, and ICBA Trade Finance.

Need help to buy this report?