Asia Pacific Consumer Packaged Goods Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Food & Beverages, Personal Care Products, Household Care Products, and Health Care Products), By Distribution Channel (Supermarkets, Convenience Stores, E-Commerce, and Discount Stores), and Asia Pacific Consumer Packaged Goods Market Insights, Industry Trends, Forecast to 2035

Industry: Food & BeveragesAsia Pacific Consumer Packaged Goods Market Size Insights Forecasts to 2035

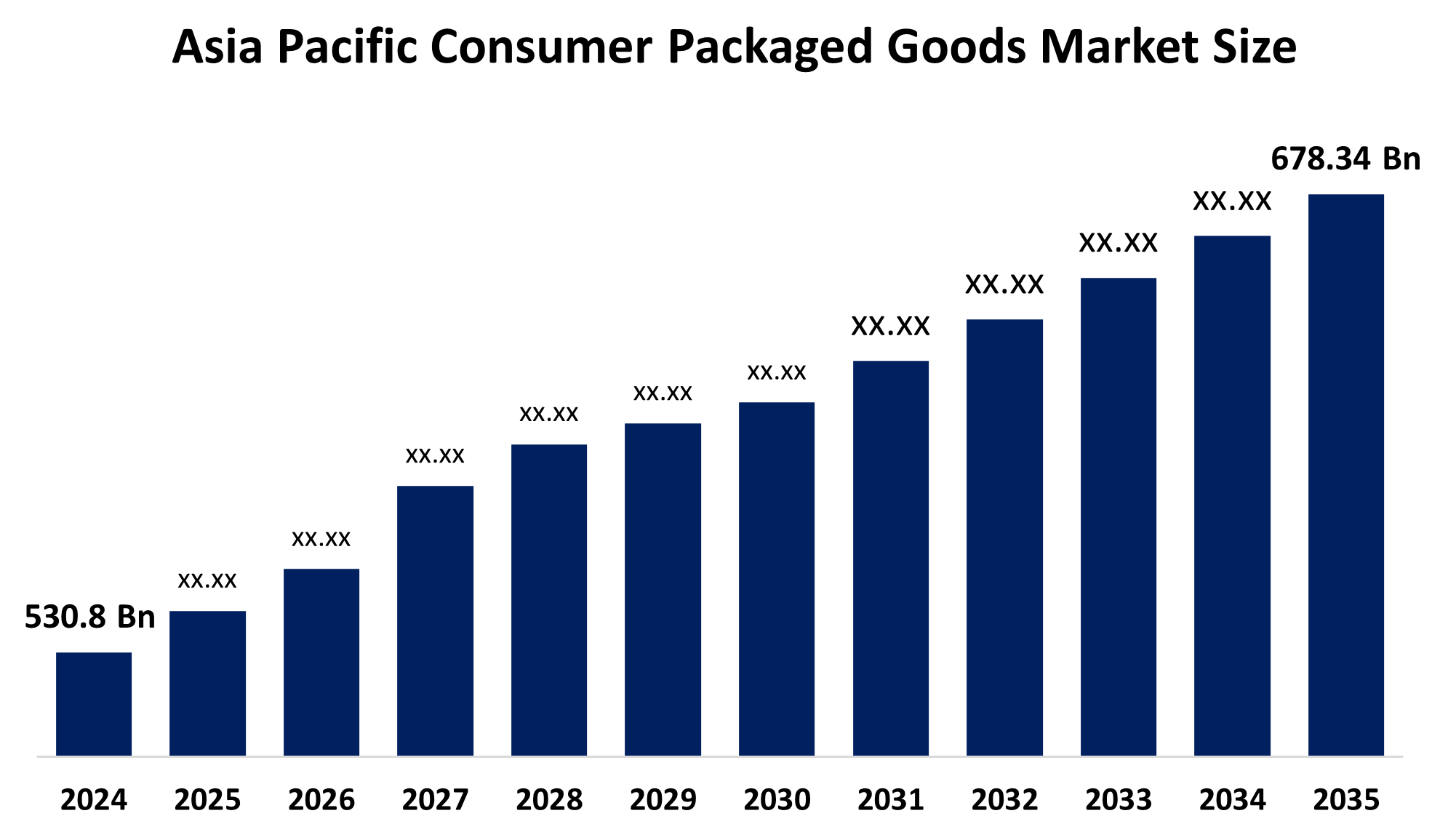

- The Asia Pacific Consumer Packaged Goods Market Size Was Estimated at USD 530.8 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 2.25% from 2025 to 2035.

- The Asia Pacific Consumer Packaged Goods Market Size is Expected to Reach USD 678.34 Billion by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Consumer Packaged Goods Market Size is expected to grow from USD 530.8 Billion in 2024 to USD 678.34 Billion by 2035, growing at a CAGR of 2.25% during the forecast period 2025-2035. The market is driven by rising incomes, rapid urbanization, and a huge, diverse population, expected to become the world's largest consumer market.

Market Overview

Consumer packaged goods (CPG) refer to items used daily by average consumers that require routine replacement or replenishment, such as food, beverages, clothes, tobacco, makeup, and household products. The market is characterized by a high turnover rate, low consumer engagement (due to frequent purchases), and intensive distribution through various retail channels. Current trends highlight a significant shift toward sustainability and health-conscious consumption, with consumers increasingly seeking organic, eco-friendly, and ethically sourced products. Additionally, the rise of digital disruption and direct-to-consumer (D2C) models is transforming how brands engage with their customer base.

Government bodies across the Asia Pacific are implementing stricter regulations regarding packaging waste and single-use plastics to promote environmental sustainability. Private initiatives are also surging, with multinational and local companies investing in biodegradable packaging plants and carbon offset programs to meet these regulatory standards. Furthermore, public-private partnerships are fostering digital infrastructure development, enhancing e-commerce accessibility in rural and semi-urban areas to boost local consumption.

Technological progress is a primary catalyst for growth, with Artificial Intelligence (AI) and the Internet of Things (IoT) being integrated into supply chains for better demand forecasting and inventory management. Advanced robotics and automation in manufacturing are improving operational efficiency and reducing production waste. Additionally, smart packaging technologies like QR codes and NFC tags are increasingly used to provide consumers with real-time product traceability and ingredient transparency.

Report Coverage

This research report categorizes the market for the Asia Pacific Consumer Packaged Goods Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. the report analyses the key growth drivers, opportunities, and challenges influencing the Asia pacific consumer packaged goods market. recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. the report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia pacific consumer packaged goods market.

Asia Pacific Consumer Packaged Goods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 530.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.25% |

| 2035 Value Projection: | USD 678.34 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Nestlé SA, Meiji Holdings Co Ltd, Mondelez International Inc, Unilever PLC, PepsiCo Inc, Ajinomoto Co. Inc., ITC Limited, Hindustan Unilever Limited, Marico Limited, NH Foods Ltd, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The market is primarily driven by rapid urbanization and the expansion of the middle class in emerging economies like China and India, which has significantly increased spending on convenience-oriented personal and household care. Additionally, the powerful influence of social media and digital marketing has heightened brand awareness among Gen Z and Millennial consumers. The rapid growth of e-commerce channels and on-demand delivery platforms has further improved product accessibility across underserved rural and semi-urban areas.

Restraining Factors

Market growth is hindered by high production costs and raw material price volatility, which impact manufacturer margins. Furthermore, increasing regulatory compliance regarding product labeling and environmental standards poses significant operational challenges. Intense competition from local players and the prevalence of counterfeit goods also erode brand equity and consumer trust.

Market Segmentation

The Asia Pacific consumer packaged goods market share is categorised into product type and distribution channel.

- The personal care products segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Consumer Packaged Goods Market Size is segmented by product type into food and beverages, personal care products, household care products, and health care products. Among these, the personal care products segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is driven by rising incomes, urbanization, and a strong focus on hygiene and wellness, particularly in emerging economies like China, India, and Southeast Asia.

- The supermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the Asia Pacific Consumer Packaged Goods Market Size is segmented into supermarkets, convenience stores, e-commerce, and discount stores. Among these, the supermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Supermarkets/Hypermarkets have historically dominated due to one-stop shopping, vast selections, and bulk buying.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Consumer Packaged Goods Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and Titanium Dioxide. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestlé SA

- Meiji Holdings Co Ltd

- Mondelez International Inc

- Unilever PLC

- PepsiCo Inc

- Ajinomoto Co. Inc.

- ITC Limited

- Hindustan Unilever Limited

- Marico Limited

- NH Foods Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Consumer Packaged Goods Market Size based on the below-mentioned segments:

Asia Pacific Consumer Packaged Goods Market, By Product Type

- Food and Beverages

- Personal Care Products

- Household Care Products

- Health Care Products

Asia Pacific Consumer Packaged Goods Market, By Distribution Channel

- Supermarkets

- Convenience Stores

- E-commerce

- Discount Stores

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific consumer packaged goods market size?The Asia Pacific consumer packaged goods market size is expected to grow from USD 530.8 Billion in 2024 to USD 678.34 Billion by 2035, growing at a CAGR of 2.25% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?The market is primarily driven by rapid urbanization and the expansion of the middle class in emerging economies like China and India, which has significantly increased spending on convenience-oriented personal and household care. Additionally, the powerful influence of social media and digital marketing has heightened brand awareness among Gen Z and Millennial consumers. The rapid growth of e-commerce channels and on-demand delivery platforms has further improved product accessibility across underserved rural and semi-urban areas.

-

Q: What factors restrain the Asia Pacific consumer packaged goods market?Market growth is hindered by high production costs and raw material price volatility, which impact manufacturer margins. Furthermore, increasing regulatory compliance regarding product labeling and environmental standards poses significant operational challenges. Intense competition from local players and the prevalence of counterfeit goods also erode brand equity and consumer trust.

-

Q: How is the market segmented by distribution channel?A: The market is segmented into supermarkets, convenience stores, e-commerce, and discount stores.

Need help to buy this report?