Asia Pacific Coated Fabric Market Size, Share, and COVID-19 Impact Analysis, By Product (Polymer Coated Fabric, Rubber Coated Fabric, Fabric Backed Wall Coverings), By Application (Protective Clothing, Transportation, Furniture, Industrial, and Others), and Asia Pacific Coated Fabric Market Insights, Industry Trends, Forecast to 2035

Industry: Consumer GoodsAsia Pacific Coated Fabric Market Insights Forecasts to 2035

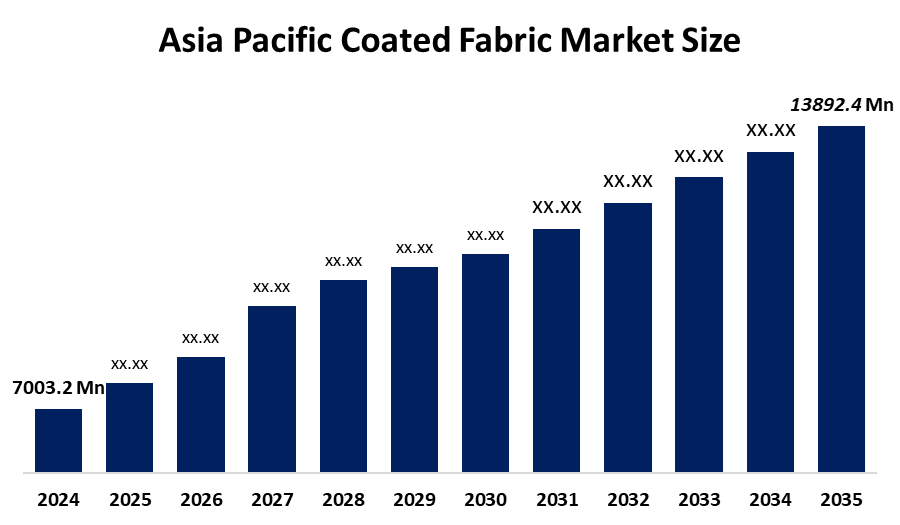

- The Asia Pacific Coated Fabric Market Size Was Estimated at USD 7003.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.43% from 2025 to 2035

- The Asia Pacific Coated Fabric Market Size is Expected to Reach USD 13892.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Coated Fabric Market Size is anticipated to reach USD 13892.4 Million by 2035, Growing at a CAGR of 6.43% from 2025 to 2035. The market is driven by rapid industrialization, urbanization in China & India, and booming automotive, construction, and consumer goods sectors, with strong demand for durable, waterproof, and high-performance materials like elastomeric and polymer-coated fabrics.

Market Overview

The Asia Pacific coated fabric market comprises textiles treated with polymers (e.g. PVC, PU) or rubber for improved performance, with the region dominated by massive growth in the automotive, construction and industrial sectors in countries such as China and India, driven by urbanization and manufacturing, with applications ranging from car interiors and tarpaulins to protective fabrics and technical textiles. Key opportunities in the Asia Pacific coated textiles market lie in the rapidly growing automotive sector (interiors, airbags), rising home furnishing demand due to urbanization, increasing use in industrial/infrastructure projects (tarpaulins, construction), and growth in protective/technical textiles driven by strong regional economic growth, supportive regulations (e.g. airbag mandate in India), and innovation in sustainable, high-performance materials.

Government initiatives in the Asia Pacific coated fabrics market are focused on promoting domestic manufacturing (e.g. Make in India), infrastructure (China), and defense (China, India, Japan, South Korea), driving demand for high performance, specialty and smart coated fabrics for automotive, construction and military uses, as well as emphasizing sustainability and technology integration. Key tasks include spending on infrastructure, defense modernisation, promoting local production and developing smart textiles, creating opportunities for growth and innovation in the sector.

Report Coverage

This research report categorizes the market for the Asia Pacific Coated Fabric market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Coated Fabric market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific Coated Fabric market.

Asia Pacific Coated Fabric Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7003.2 Million |

| Forecast Period: | 2024-2035 |

| 2035 Value Projection: | USD 13892.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | Continental AG, Trelleborg AB, Saint-Gobain, SRF Limited, Tai-Ho Textile Co., Ltd, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Asia Pacific coated fabric market is driven by rapid industrialization, major infrastructure projects, and booming automotive production, especially in China and India, increasing demand for durable, high-performance materials in sectors like construction, automotive (upholstery, airbags), protective wear, and furniture. Stringent safety regulations (ILO), rising consumer demand for quality goods, and technological advancements in eco-friendly/smart coatings further boost growth, with PVC and PU coatings seeing strong demand for waterproofing, durability, and as leather alternatives.

Restraining Factors

Restraining factors for the Asia Pacific coated fabric market include rising raw material costs, strict environmental regulations (like VOC limits) adding compliance costs, competition from substitutes (leather, uncoated fabrics, sustainable options), supply chain vulnerabilities, increasing labor costs, and the need for high capital investment, all pressuring manufacturers' profitability and growth, despite strong demand drivers like automotive and construction.

Market Segmentation

The Asia Pacific coated fabric market share is categorised into product and application.

- The polymer coated fabric segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific coated fabric market is segmented by product into polymer coated fabric, rubber coated fabric, fabric backed wall coverings. Among these, the polymer coated fabric segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is due to their versatility, durability, cost-effectiveness, and wide application in booming sectors like automotive (airbags, interiors) and protective clothing, especially in manufacturing-heavy nations like China and India, with high demand driven by automotive growth and increasing safety regulations.

- The transportation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific coated fabric market is segmented into protective clothing, transportation, furniture, industrial, and others. Among these, the transportation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market primarily driven by booming automotive sales and infrastructure growth, with applications in vehicle interiors (seats, airbags, headliners) and exteriors (truck covers) due to benefits like durability, light weight, and weather resistance. While Protective Clothing is a strong growth area due to safety regulations, Transportation consistently holds the largest market share in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific coated fabric market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Continental AG

- Trelleborg AB

- Saint-Gobain

- SRF Limited

- Tai-Ho Textile Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific coated fabric market based on the below-mentioned segments:

Asia Pacific Coated Fabric Market, By Product

- Polymer Coated Fabric

- Rubber Coated Fabric

- Fabric Backed Wall Coverings

Asia Pacific Coated Fabric Market, By Application

- Protective Clothing

- Transportation

- Furniture

- Industrial

Others

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific coated fabric market size?The Asia Pacific coated fabric market size is expected to grow from USD 7003.2 million in 2024 to USD 13892.4 million by 2035, growing at a CAGR of 6.43% during the forecast period 2025-2035

-

What are the key growth drivers of the market?The Asia Pacific coated fabric market is driven by rapid industrialization, major infrastructure projects, and booming automotive production, especially in China and India, increasing demand for durable, high-performance materials in sectors like construction, automotive (upholstery, airbags), protective wear, and furniture. Stringent safety regulations (ILO), rising consumer demand for quality goods, and technological advancements in eco-friendly/smart coatings further boost growth, with PVC and PU coatings seeing strong demand for waterproofing, durability, and as leather alternatives.

-

What factors restrain the Asia Pacific coated fabric market?Restraining factors for the Asia Pacific coated fabric market include rising raw material costs, strict environmental regulations (like VOC limits) adding compliance costs, competition from substitutes (leather, uncoated fabrics, sustainable options), supply chain vulnerabilities, increasing labor costs, and the need for high capital investment, all pressuring manufacturers' profitability and growth, despite strong demand drivers like automotive and construction

-

How is the market segmented by application?The market is segmented into protective clothing, transportation, furniture, industrial, and others

-

What is the Asia Pacific coated fabric market size?The Asia Pacific coated fabric market size is expected to grow from USD 7003.2 million in 2024 to USD 13892.4 million by 2035, growing at a CAGR of 6.43% during the forecast period 2025-2035

-

What are the key growth drivers of the market?The Asia Pacific coated fabric market is driven by rapid industrialization, major infrastructure projects, and booming automotive production, especially in China and India, increasing demand for durable, high-performance materials in sectors like construction, automotive (upholstery, airbags), protective wear, and furniture. Stringent safety regulations (ILO), rising consumer demand for quality goods, and technological advancements in eco-friendly/smart coatings further boost growth, with PVC and PU coatings seeing strong demand for waterproofing, durability, and as leather alternatives.

-

What factors restrain the Asia Pacific coated fabric market?Restraining factors for the Asia Pacific coated fabric market include rising raw material costs, strict environmental regulations (like VOC limits) adding compliance costs, competition from substitutes (leather, uncoated fabrics, sustainable options), supply chain vulnerabilities, increasing labor costs, and the need for high capital investment, all pressuring manufacturers' profitability and growth, despite strong demand drivers like automotive and construction

-

How is the market segmented by application?The market is segmented into protective clothing, transportation, furniture, industrial, and others

Need help to buy this report?