Asia Pacific Charcoal Market Size, Share, and COVID-19 Impact Analysis, By Type (Charcoal Briquettes, Lump Charcoal, and Others), By Application (Fuel Feedstock, Filtration Agent, Medicines, and Others), and Asia Pacific Charcoal Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Charcoal Market Size Insights Forecasts to 2035

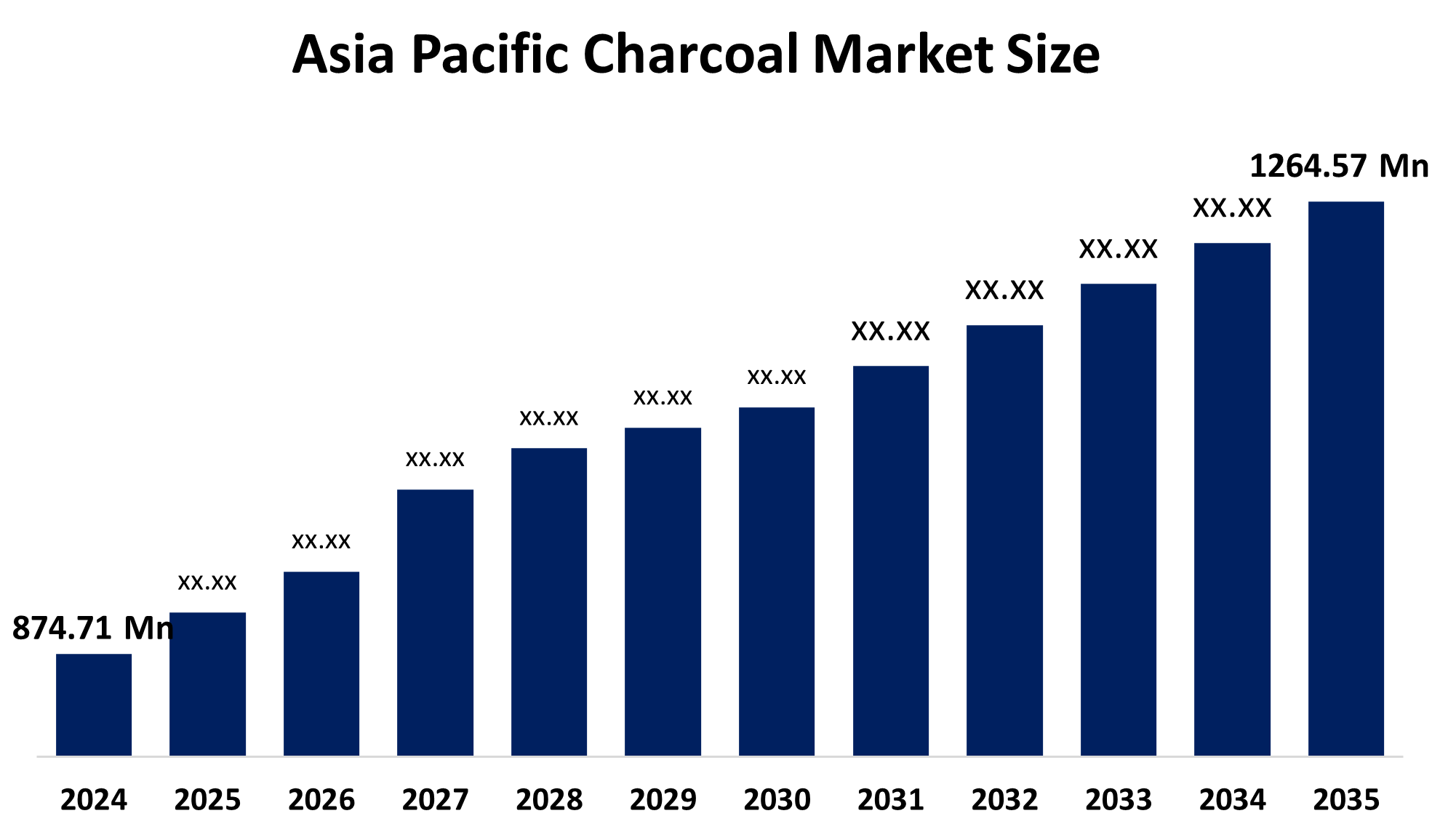

- The Asia Pacific Charcoal Market Size Was Estimated at USD 874.71 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.41% from 2025 to 2035

- The Asia Pacific Charcoal Market Size is Expected to Reach USD 1264.57 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Charcoal Market Size is Anticipated to Reach USD 1264.57 Million by 2035, Growing at a CAGR of 3.41% from 2025 to 2035. Market expansion is supported by the surge in barbecue culture, the rise in outdoor recreational activities, increasing consumer spending capacity, and heightened awareness of cleaner fuel alternatives.

Market Overview

Charcoal is a carbon-rich solid residue produced through the pyrolysis of organic materials like wood, coconut shells, or agricultural waste in a low-oxygen environment. It is characterized by high energy density, low smoke emission during combustion, and versatility in both domestic and industrial applications. Current market trends show a significant shift toward the adoption of charcoal briquettes over traditional lump charcoal due to their uniform burning properties and steady heat output. Additionally, the surging popularity of barbecue and outdoor grilling culture, particularly in urban centers, is a key trend shaping consumer demand.

Government and Private Initiatives Governments across the Asia Pacific region are implementing initiatives to promote sustainable charcoal production and reduce the environmental impact of traditional methods. For instance, several nations have introduced stricter environmental regulations and certification programs like the Forest Stewardship Council (FSC) to curb illegal deforestation. Private sectors are also contributing by investing in clean cookstove projects and developing eco-friendly charcoal alternatives, such as bamboo or coconut shell-based briquettes, to align with global sustainability goals.

Technological Advancements The market is witnessing significant technological advancements, particularly in kiln design and production efficiency. Modern retorts and improved kilns are being deployed to capture greenhouse gases during the carbonization process, making production more environmentally friendly. Innovations in briquetting technology have allowed for the utilization of diverse agricultural residues, such as sawdust and rice husks, into high-calorific value fuel. Furthermore, digital tracking systems are being introduced to ensure the transparency and traceability of raw materials in the supply chain.

Report Coverage

This research report categorizes the market for the Asia Pacific Charcoal Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific charcoal market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific charcoal market.

Asia Pacific Charcoal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 874.71 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.41% |

| 2035 Value Projection: | USD 1264.57 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Nippon Carbon, Haycarb PLC, Evergreen Fuel, Subur Tiasa Holdings Berhad, PT Aboitiz Power, Sagar Charcoal and Firewood Depot, Linyi Guotai Charcoal, Mesjaya Abadi Sdn Bhd, PT. Siantan Suryatama, Bali Boo, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The market is primarily driven by the rising demand for efficient and low-smoke cooking fuels in urban and peri-urban areas, which has significantly increased the adoption of charcoal briquettes. Additionally, the expansion of the metallurgical industry, where charcoal is used as a reducing agent in smelting processes, further bolsters market growth. Growing consumer interest in outdoor recreational activities and the thriving barbecue restaurant industry in countries like China and India are also key contributors.

Restraining Factors

Market growth is hindered by strict government regulations regarding forest preservation and the control of illegal logging for raw material sourcing. Furthermore, the increasing availability of alternative energy sources like LPG and natural gas for residential cooking poses a significant challenge.

Market Segmentation

The Asia Pacific charcoal market share is categorised into type and application.

- The lump charcoal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Charcoal Market Size is segmented by type into charcoal briquettes, lump charcoal, and others. Among these, the lump charcoal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the ability to burn rapidly, reach a higher temperature rate, produce comparatively little carbon emissions, and have a high calorific value, making it superior to other forms of charcoal. Additionally, lump charcoal reacts favorably with oxygen to control heat through chimneys and vents. The most natural BBQ fuel is lump charcoal. It is anticipated that this aspect would sustain lump charcoal's supremacy.

- The fuel feedstock segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific Charcoal Market Size is segmented into fuel feedstock, filtration agent, medicines, and others. Among these, the fuel feedstock segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the need for heating and cooking in Asia Pacific. In Asia Pacific, it is the most preferred fuel for outdoor cooking. The market is increasing due to consumers' choice for grilled food. The market will continue to grow in the near future owing to the rapid growth of the hospitality sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Charcoal Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Carbon

- Haycarb PLC

- Evergreen Fuel

- Subur Tiasa Holdings Berhad

- PT Aboitiz Power

- Sagar Charcoal and Firewood Depot

- Linyi Guotai Charcoal

- Mesjaya Abadi Sdn Bhd

- PT. Siantan Suryatama

- Bali Boo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Charcoal Market Size based on the below-mentioned segments:

Asia Pacific Charcoal Market, By Type

- Charcoal Briquettes

- Lump Charcoal

- Others

Asia Pacific Charcoal Market, By Application

- Fuel Feedstock

- Filtration Agent

- Medicines

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific charcoal market size?A: Asia Pacific charcoal market size is expected to grow from USD 874.71 Million in 2024 to USD 1264.57 Million by 2035, growing at a CAGR of 3.41% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: The market is primarily driven by the rising demand for efficient and low-smoke cooking fuels in urban and peri-urban areas, which has significantly increased the adoption of charcoal briquettes. Additionally, the expansion of the metallurgical industry, where charcoal is used as a reducing agent in smelting processes, further bolsters market growth. Growing consumer interest in outdoor recreational activities and the thriving barbecue restaurant industry in countries like China and India are also key contributors.

-

Q: What factors restrain the Asia Pacific charcoal market?A: Market growth is hindered by strict government regulations regarding forest preservation and the control of illegal logging for raw material sourcing. Furthermore, the increasing availability of alternative energy sources like LPG and natural gas for residential cooking poses a significant challenge.

-

Q: How is the market segmented by type?A: The market is segmented into charcoal briquettes, lump charcoal, and others.

Need help to buy this report?