Asia Pacific Calcium Carbonate Market Size, Share, and COVID-19 Impact Analysis, By Type (Ground Calcium Carbonate and Precipitated Calcium Carbonate), By Application (Automotive, Building & Construction, Pharmaceutical, Agriculture, Pulp & Paper, and Others), and Asia Pacific Calcium Carbonate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsAsia Pacific Calcium Carbonate Market Size Insights Forecasts to 2035

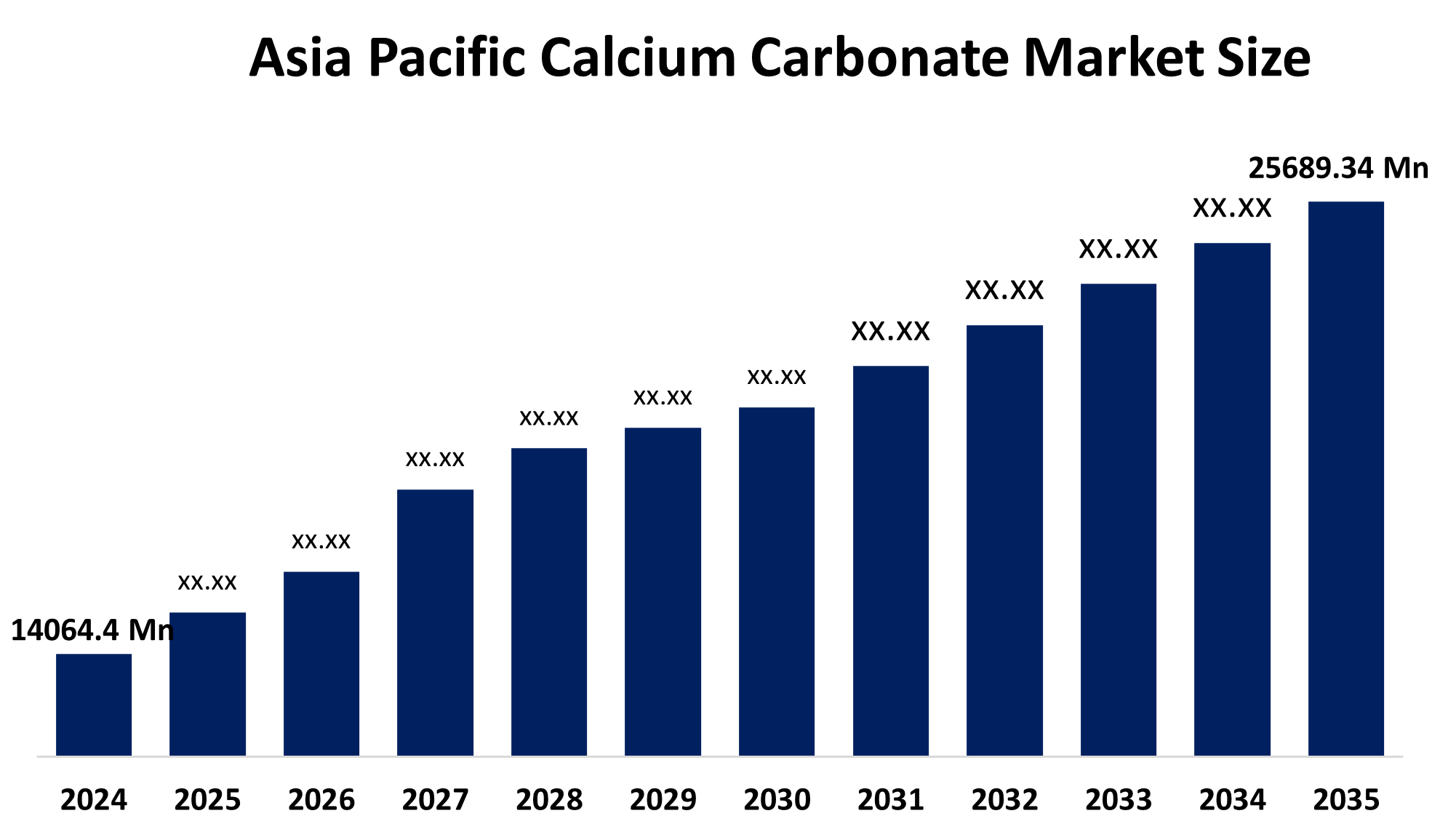

- The Asia Pacific Calcium Carbonate Market Size Was Estimated at USD 14,064.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.63% from 2025 to 2035

- The Asia Pacific Calcium Carbonate Market Size is Expected to Reach USD 25,689.34 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Calcium Carbonate Market Size is Anticipated to Reach USD 25,689.34 Million by 2035, Growing at a CAGR of 5.63% from 2025 to 2035. The calcium carbonate market in Asia Pacific is driven by rapid industrialization, construction, and demand from key sectors like paper, plastics, paints, and construction, with countries like China and India leading.

Market Overview

Calcium carbonate is a versatile naturally occurring mineral found in rocks such as limestone, marble, and chalk, widely utilized as a functional additive in various industrial sectors. In the Asia Pacific region, the market is characterized by its significant role as a low-cost, multi-purpose industrial mineral essential for improving product quality, sustainability, and cost efficiency. Key trends include a shifting focus toward sustainable practices, the adoption of eco-friendly production methods, and an evolving demand for high-performance materials in automotive and consumer goods sectors.

Government and private initiatives are significantly bolstering the market; for instance, India's Smart Cities Mission has allocated funds for infrastructure requiring high-quality materials, while China's industrial policies provide subsidies for green manufacturing. Private players like Asian Paints are launching safety-focused campaigns that boost demand for coatings, and companies like Omya AG are investing heavily in expanding expertise through large-scale research and development facilities.

Technological advancements are focused on enhancing particle size uniformity and surface modification, which unlock new opportunities in high-performance specialty applications. Innovation in the development of nano-precipitated calcium carbonate (NPCC) is gaining traction, offering superior surface area and reinforcement properties for lightweight automotive components. Furthermore, the integration of AI-powered quality control systems and predictive maintenance in manufacturing plants is revolutionizing production efficiency and ensuring exact customer requirements are met.

Report Coverage

This research report categorizes the market for the Asia Pacific Calcium Carbonate Market Size based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific calcium carbonate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific calcium carbonate market.

Asia Pacific Calcium Carbonate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14064.4 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.63% |

| 2035 Value Projection: | USD 25689.34 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Application |

| Companies covered:: | GCCP Resources Limited, Gulshan Polyols Ltd., OKUTAMA KOGYO CO., LTD., Yuncheng Chemical Industrial Co., Ltd., Changzhou Calcium Carbonate Co. Ltd, Fimatec Ltd., Guangdong Qiangda New Materials Technology Co., Ltd., Neelkanth Finechem LLP, Shree Narayan Enterprise, Chemical & Mineral Industries Pvt. Ltd., and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The market is primarily driven by the booming construction and infrastructure sectors in emerging economies like China and India, where calcium carbonate is a critical additive for cement and concrete. Additionally, the expanding paper and packaging industry utilizes the mineral to improve printability and reduce production costs. Rising demand for lightweight, durable plastics in the automotive and electronics industries further fuels market revenue as manufacturers seek cost-effective, high-performance fillers.

Restraining Factors

Market growth is hindered by strict environmental regulations regarding limestone mining and the high energy consumption required during processing. Fluctuating raw material prices and competition from synthetic alternatives also pose significant challenges. Additionally, high operational and transportation expenses can impact production margins for regional manufacturers.

Market Segmentation

The Asia Pacific calcium carbonate market share is classified into type and application.

- The ground calcium carbonate segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Asia Pacific Calcium Carbonate Market Size is segmented by type into ground calcium carbonate and precipitated calcium carbonate. Among these, the ground calcium carbonate segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The ground calcium carbonate is comparatively inexpensive, has minimal water and oil absorption, and is better in whiteness, inertness, and incombustibility. It is frequently used to increase workability and physical characteristics in polymer composites.

- The pulp & paper segment accounted for the largest market share and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Calcium Carbonate Market Size is segmented by application into automotive, building & construction, pharmaceutical, agriculture, pulp & paper, and others. Among these, the pulp & paper segment accounted for the largest market share and is expected to grow at a significant CAGR during the forecast period. This is due to calcium carbonate can be applied as a coating pigment or as a filler to the paper pulp. Its inclusion improves the paper's opacity and brightness. The need for paper in other sectors, such as packaging and tissue paper, was unaffected by the internet, despite its influence on the print media market.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Calcium Carbonate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GCCP Resources Limited

- Gulshan Polyols Ltd.

- OKUTAMA KOGYO CO., LTD.

- Yuncheng Chemical Industrial Co., Ltd.

- Changzhou Calcium Carbonate Co. Ltd

- Fimatec Ltd.

- Guangdong Qiangda New Materials Technology Co., Ltd.

- Neelkanth Finechem LLP

- Shree Narayan Enterprise

- Chemical & Mineral Industries Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Calcium Carbonate Market Size based on the below-mentioned segments:

Asia Pacific Calcium Carbonate Market, By Type

- Ground Calcium Carbonate

- Precipitated Calcium Carbonate

Asia Pacific Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the current size of the Asia Pacific calcium carbonate market?A: The Asia Pacific calcium carbonate market size was estimated at USD 2,620.4 million in 2024 and is projected to reach USD 5,500.2 million by 2035, growing at a CAGR of 5.63% during 2025–2035.

-

Q: What are the main types of calcium carbonate analysed in this market?A: The market is segmented into ground calcium carbonate (GCC) and precipitated calcium carbonate (PCC) based on production type.

-

Q: Which segment dominated the Asia Pacific calcium carbonate market in 2024?A: The ground calcium carbonate (GCC) segment dominated the market in 2024 due to its cost-effectiveness, high whiteness, and wide industrial usability.

-

Q: Which application segment holds the largest market share in Asia Pacific?A: The pulp & paper segment accounted for the largest market share, driven by rising demand for packaging and hygiene-related paper products.

Need help to buy this report?