Asia Pacific Butyl Acetate Market Size, Share, and COVID-19 Impact Analysis, By Application (Paints, Coatings, Chemicals, Pharmaceuticals, Perfumes and Flavors), By End User (Automotive & Transportation, Building & Construction, Healthcare, and Food & Beverage), and Asia Pacific Butyl Acetate Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Butyl Acetate Market Size Insights Forecasts to 2035

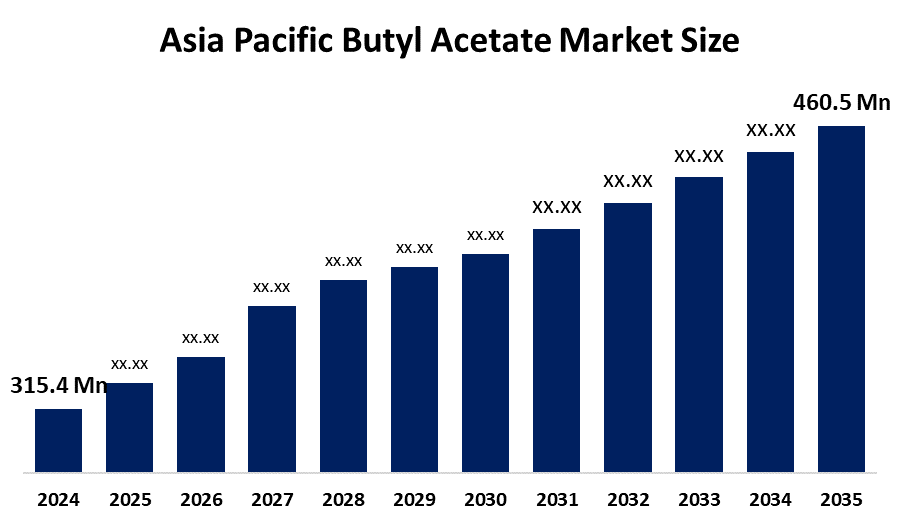

- The Asia Pacific Butyl Acetate Market Size Was Estimated at USD 315.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.5% from 2025 to 2035

- The Asia Pacific Butyl Acetate Market Size is Expected to Reach USD 460.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Asia Pacific Butyl Acetate Market Size is anticipated to Reach USD 460.5 Million by 2035, Growing at a CAGR of 3.5% from 2025 to 2035. The market is driven by the rise in water-based paint and coating use in the Asia Pacific region, rising healthcare costs and a rise in the popularity of generic medications.

Market Overview

Butyl acetate is a colorless liquid that exists in a highly flammable state, while it naturally occurs in various fruits to deliver the fruit's distinct smell. The paints and coatings sector will experience increasing butyl acetate demand because decorative coatings become more popular and the construction industry grows in different parts of the world. The paint and coatings industry shows increasing demand for isobutyl acetate because it functions as a solvent. Isobutyl acetate serves as a perfect component for various paint formulations because of its exceptional solubility properties.

BASF has strengthened its market position through the development of multiple n-butyl acetate products, which specifically serve the increasing demand for specialty solvents in the APAC region. Jiangmen Handsome Chemical (China) remains one of the world's largest producers with an annual capacity of 450 kt of acetate.

The new environmental regulations require manufacturers to replace their conventional solvents with bio-based and low-emission solvents. Southeast Asian contractors now use water-borne acrylics because they need to meet ASEAN Green Building VOC limits, which prohibit emissions above 50 g/L. APAC countries create beneficial regulatory systems that enable them to attract petrochemical firms while boosting domestic manufacturing capacity.

Report Coverage

This research report categorises the Asia Pacific butyl acetate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific butyl acetate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific butyl acetate market.

Asia Pacific Butyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 315.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.5% |

| 2035 Value Projection: | USD 460.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 164 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application, By End User and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Yangtze River Acetyles Co., Petronas, Mitsubishi Chemical Co., Celanese Co., Dow Inc., Eastman Chemical Company, Yip’s Chemical Holdings Ltd, Shandong Jinyimeng Group Co., Ltd, Jiangsu Baichuan High Tech New Materials Co., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The butyl acetate market in the Asia Pacific is driven by the demand for butyl acetate as a solvent, which exists because of three main factors, and continues to increase. The increasing demand for architectural coatings, protective coatings, automotive coatings, industrial coatings, oil coatings, coatings for packaging, and wood coatings. The automotive and construction industries require high-performance coatings, which drives demand for the product across all surfaces, including passenger vehicles and architectural windowpanes.

Restraining Factors

The butyl acetate market in the Asia Pacific is restrained by the production costs are highly sensitive to the prices of feedstocks, specifically n-butanol and acetic acid. Manufacturers face increasing pressure to reduce Volatile Organic Compound (VOC) emissions, which requires them to spend money on more expensive advanced production processes that help them meet environmental standards.

Market Segmentation

The Asia Pacific butyl acetate market share is categorised into application and end user.

Get more details on this report -

- The coatings segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific butyl acetate market is segmented by application into paints, coatings, chemicals, pharmaceuticals, perfumes and flavors. Among these, the coatings segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the butyl acetate serves as a solvent solution for paint and varnish and industrial coating production. Butyl acetate delivers exceptional solvent abilities with rapid evaporation rates and minimal health hazards make it a suitable option for both decorative and protective coatings.

- The automotive fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Asia Pacific butyl acetate market is segmented into alcoholic beverages, automotive fuel, pharmaceuticals, personal care, textiles, fertilizers, pesticides and others. Among these, the automotive fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the automotive industry, which requires durable and visually appealing coatings together with their adhesive and sealing solutions. The material serves as a permanent substance that manufacturers use to produce automotive refinishing and repair coatings, paints, and adhesives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific butyl acetate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Yangtze River Acetyles Co.

- Petronas

- Mitsubishi Chemical Co.

- Celanese Co.

- Dow Inc.

- Eastman Chemical Company

- Yip’s Chemical Holdings Ltd

- Shandong Jinyimeng Group Co., Ltd

- Jiangsu Baichuan High Tech New Materials Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific butyl acetate market based on the below-mentioned segments:

Asia Pacific Butyl Acetate Market, By Application

- Paints

- Coatings

- Chemicals

- Pharmaceuticals

- Perfumes

- Flavors

Asia Pacific Butyl Acetate Market, By End User

- Alcoholic Beverages

- Automotive Fuel

- Pharmaceuticals

- Personal Care

- Textiles

- Fertilizers

- Pesticides

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific butyl acetate market size?A: Asia Pacific butyl acetate market size is expected to grow from USD 315.4 million in 2024 to USD 460.5 million by 2035, growing at a CAGR of 3.5% during the forecast period 2025-2035.

-

Q: What is butyl acetate, and its primary use?A: Butyl acetate is a colorless liquid that exists in a highly flammable state, while it naturally occurs in various fruits to deliver the fruit's distinct smell.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the demand for butyl acetate as a solvent, which exists because of three main factors, and continues to increase. The increasing demand for architectural coatings, protective coatings, automotive coatings, industrial coatings, oil coatings, coatings for packaging, and wood coatings.

-

Q: What factors restrain the Asia Pacific butyl acetate market?A: The market is restrained by the production costs, which are highly sensitive to the prices of feedstocks, specifically n-butanol and acetic acid.

-

Q: How is the market segmented by application?A: The market is segmented into paints, coatings, chemicals, pharmaceuticals, perfumes and flavors.

-

Q: Who are the key players in the Asia Pacific butyl acetate market?A: Key companies include BASF SE, Yangtze River Acetyles Co., Petronas, Mitsubishi Chemical Co., Celanese Co., Dow Inc., Eastman Chemical Company, Yip’s Chemical Holdings Ltd, Shandong Jinyimeng Group Co., Ltd, and Jiangsu Baichuan High Tech New Materials Co.

Need help to buy this report?