Asia Pacific Breakfast Cereals Market Size, Share, and COVID-19 Impact Analysis, By Category (Ready-to-cook Cereals, Ready-to-eat Cereals), By Product Type (Corn-based Breakfast Cereals, Mixed/Blended Breakfast, Other Product Types), and Asia Pacific Breakfast Cereals Market Insights, Industry Trends, Forecast to 2035.

Industry: Food & BeveragesAsia Pacific Breakfast Cereals Market Insights Forecasts to 2035

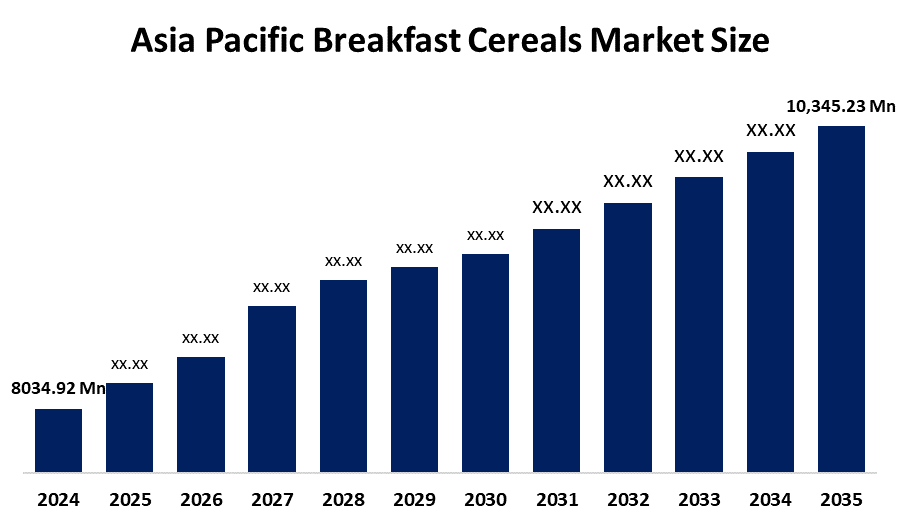

- The Asia Pacific Breakfast Cereals Market Size Was Estimated at USD 8034.92 Million in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 2.32% from 2025 to 2035.

- The Asia Pacific Breakfast Cereals Market Size is Expected to Reach USD 10,345.23 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Asia Pacific Breakfast Cereals Market Size Is Anticipated To Reach USD 10,345.23 Million By 2035, Growing At A CAGR Of 2.32% From 2025 To 2035. The market is driven by urbanization, rising incomes, and demand for convenient, healthier options.

Market Overview

The Asia Pacific Breakfast Cereals Market Size is defined by processed food products made from cereal grains like oats, wheat, corn, and rice, designed for quick consumption during breakfast or as a snack. The market is characterized by a strong shift toward Westernized dietary habits and a growing demand for "on-the-go" nutrition among urban populations. Key trends include a surge in preference for "clean label" products that are low in sugar, high in fiber, and fortified with essential vitamins. Additionally, the rising popularity of localized flavors and the integration of ancient grains such as ragi and quinoa are reshaping the competitive landscape.

Government and private initiatives play a crucial role in the expansion of this market across the region. Programs such as the Cereal Systems Initiative for South Asia (CSISA) focus on improving the productivity and quality of cereal-based cropping systems through public-private partnerships. Governments are also implementing stricter nutritional labeling regulations and health awareness campaigns to combat rising obesity and diabetes rates, which in turn encourages manufacturers to reformulate products with healthier ingredients. Private sector investments, such as WK Kellogg’s multi-million-dollar supply chain modernization, are further enhancing production capacities and regional distribution networks.

Technological advancements are revolutionizing the manufacturing of breakfast cereals through automation and smart processing. Modern extrusion technologies and high-pressure processing (HPP) are now being used to retain vitamins and minerals while extending shelf life without synthetic additives. The integration of the Internet of Things (IoT) and AI-driven monitoring systems allows for real-time quality control and precise ingredient dosing, ensuring consistent product texture and taste. Furthermore, digital transformation in the supply chain and the rise of e-commerce platforms have significantly improved product accessibility in emerging economies.

Report Coverage

This research report categorizes the market for the Asia pacific Breakfast Cereals Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. the report analyses the key growth drivers, opportunities, and challenges influencing the Asia pacific breakfast cereals market. recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. the report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia pacific breakfast cereals market.

Asia Pacific Breakfast Cereals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8034.92 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 2.32% |

| 2035 Value Projection: | USD 10,345.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Category |

| Companies covered:: | Nestle S.A. The Kellogg Company General Mills, Inc. PepsiCo, Inc. (Quaker Oats) Marico Limited Bagrry’s India Limited Tata Group (Soulfull) Parle Products MTR Foods (Orkla ASA) Sanitarium Health Others & Wellbeing And Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is primarily driven by rapid urbanization and the increasingly hectic lifestyles of Gen Z and Millennial consumers, who prioritize time-saving, ready-to-eat breakfast options. Rising disposable incomes across emerging economies like India and China have enabled a shift toward premium, branded nutritional products. Furthermore, heightened health consciousness and awareness of the benefits of fiber-rich and whole-grain diets are pushing consumers away from traditional oily breakfasts toward fortified cereals.

Restraining Factors

Market growth is significantly hindered by rising concerns over the high sugar content in many commercial cereal brands, which alienates health-conscious demographics. Additionally, many consumers in the region still maintain a strong preference for traditional, fresh, and homemade breakfast dishes over processed alternatives.

Market Segmentation

The Asia Pacific breakfast cereals market share is categorised into category and product type.

- The ready-to-eat cereals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Breakfast Cereals Market Size is segmented by category into ready-to-cook cereals and ready-to-eat cereals. Among these, the ready-to-eat cereals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. due to urbanization, faster lifestyles, and consumer demand for convenience, while also offering variety in flavors and health benefits (high fiber, multigrain) that align with growing health consciousness and a blend of traditional tastes with modern options.

- The corn-based breakfast cereals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product type, the Asia Pacific Breakfast Cereals Market Size is segmented into corn-based breakfast cereals, mixed/blended breakfast, and other product types. Among these, the corn-based breakfast cereals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The shift from traditional breakfasts towards Westernized, convenient, and nutritious options fuels RTE growth, with corn being a popular base for its versatility, flavor, and affordability, but oats and ancient grains are rapidly expanding.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific breakfast cereals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and Titanium Dioxide. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestlé S.A.

- The Kellogg Company

- General Mills, Inc.

- PepsiCo, Inc. (Quaker Oats)

- Marico Limited

- Bagrry's India Limited

- Tata Group (Soulfull)

- Parle Products

- MTR Foods (Orkla ASA)

- Sanitarium Health & Wellbeing

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Breakfast Cereals Market Size based on the below-mentioned segments:

Asia Pacific Breakfast Cereals Market, By Category

- Ready-to-cook Cereals

- Ready-to-eat Cereals.

Asia Pacific Breakfast Cereals Market, By

- Corn-based Breakfast Cereals

- Mixed/Blended Breakfast

- Other Product Types

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific breakfast cereals market size?The Asia Pacific breakfast cereals market size is expected to grow from USD 8034.92 Million in 2024 to USD 10,345.23 Million by 2035, growing at a CAGR of 2.32% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?The market is primarily driven by rapid urbanization and the increasingly hectic lifestyles of Gen Z and Millennial consumers, who prioritize time-saving, ready-to-eat breakfast options. Rising disposable incomes across emerging economies like India and China have enabled a shift toward premium, branded nutritional products. Furthermore, heightened health consciousness and awareness of the benefits of fiber-rich and whole-grain diets are pushing consumers away from traditional oily breakfasts toward fortified cereals.

-

What factors restrain the Asia Pacific breakfast cereals market?Market growth is significantly hindered by rising concerns over the high sugar content in many commercial cereal brands, which alienates health-conscious demographics. Additionally, many consumers in the region still maintain a strong preference for traditional, fresh, and homemade breakfast dishes over processed alternatives.

-

How is the market segmented by Product type?The market is segmented into corn-based breakfast cereals, mixed/blended breakfast, and other.

Need help to buy this report?