Asia Pacific BOPP Film Market Size, Share, and COVID-19 Impact Analysis, By Type (Wraps, Bags and Pouches, Tapes, Labels and Others), By Thickness (Below 15 Microns, 15-30 Microns, 30-45 Microns and More Than 45 Microns), By Application (Food, Beverage, Tobacco, Personal Care, Pharmaceutical and Others), and Asia Pacific BOPP Film Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific BOPP Film Market Size Insights Forecasts to 2035

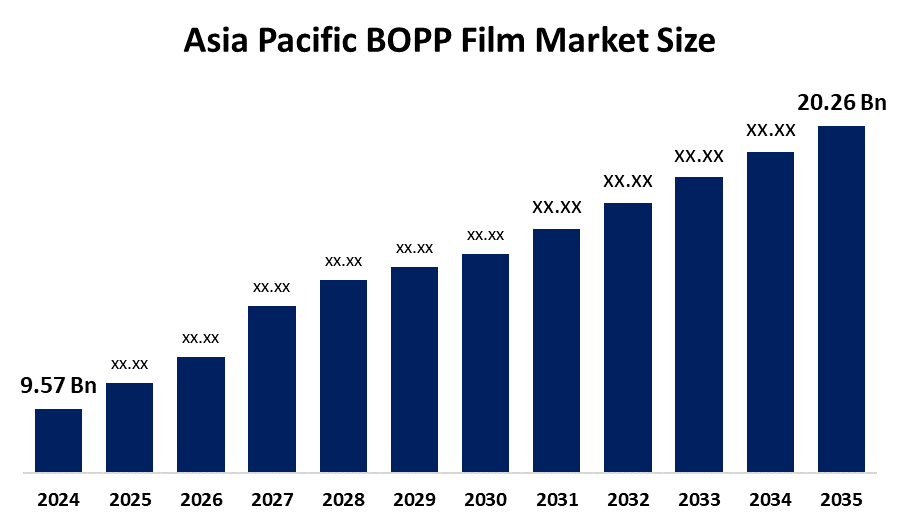

- The Asia Pacific BOPP Film Market Size Was Estimated at USD 9.57 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.06% from 2025 to 2035

- The Asia Pacific BOPP Film Market Size is Expected to Reach USD 20.26 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific BOPP Film Market Size Is Anticipated To Reach USD 20.26 Billion By 2035, Growing At A CAGR Of 7.06% From 2025 To 2035. The market is driven by growth due to the desirable properties of BOPP films, such as high clarity, moisture resistance, excellent tensile strength, and cost-effectiveness.

Market Overview

Biaxially oriented polypropylene films BOPP films serve as the ideal packaging solution for food products, consumer goods and industrial applications because of their exceptional product clarity and barrier performance and their ability to withstand high tension. BOPP films provide multiple benefits over conventional packaging materials because they decrease packaging weight and extend product shelf life, and they deliver cost savings. The material serves three main functions, which include pharmaceutical blister packaging, tobacco wrapping and manufacturing electrical capacitor-grade films.

In June 2025, Yangzhou Boheng and Bruckner Maschinenbau successfully commissioned an all-new BOPET film production line for composite current collector film technology (CCCF).

Cosmo First commissioned its new BOPP packaging manufacturing line, which utilizes the most advanced technology and has a capital expenditure of Rs 400 crores. The packaging market experiences growth because foreign direct investments (FDI) in the packaging sector increase throughout India and China, which helps develop local manufacturing plants and technological expertise. The ongoing development of stretch film technology creates better mechanical properties, which make BOPP films more useful for industrial use and increase their market share.

Report Coverage

This research report categorises the Asia Pacific BOPP film market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific BOPP film market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific BOPP film market.

Asia Pacific BOPP Film Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.57 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.06% |

| 2035 Value Projection: | USD 20.26 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Thickness, By Application |

| Companies covered:: | Jindal Poly Films Ltd, Cosmo First Ltd, UFlex Ltd, Toray Industries, Inc., SRF Ltd, Nan Ya Plastics Co., Polyplex Co. Ltd, Taghleef Industries, Mitsui Chemicals, Toppan Speciality Films Private Ltd, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The BOPP film market in Asia Pacific is driven by the demand for ready-to-eat meals and snacks, and frozen foods in China and India have increased because of urbanisation and the development of new dietary patterns. The packaging industry has shifted to recyclable mono-material polypropylene packaging because of increasing regulatory pressure to eliminate single-use plastics. The healthcare infrastructure expansion in emerging markets has created a demand for protective barrier packaging, which secures tablet and capsule products, which has led to fast growth in the packaging industry.

Restraining Factors

The BOPP film market in the Asia Pacific is restrained by the fluctuations in crude oil prices and geopolitical tensions, which directly impact production costs, compelling manufacturers to either accept financial losses or make contract changes. The growing government examination of single-use plastics and waste management systems in China and India serves as the primary obstacle.

Market Segmentation

The Asia Pacific BOPP film market share is categorised into type, thickness, and application.

- The bags and pouches segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific BOPP film market is segmented by type into wraps, bags and pouches, tapes, labels and others. Among these, the bags and pouches segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the growing need of customers who want packaging solutions that provide both easy-to-use and portable and adaptable options. Bags and pouches benefit from the superior properties of films, such as clarity, strength, and barrier resistance, making them ideal for a variety of products ranging from food to personal care items.

- The below 15 microns segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on thickness, the Asia Pacific BOPP film market is segmented into below 15 microns, 15-30 microns, 30-45 microns and more than 45 microns. Among these, the below 15 microns segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the industry's push towards sustainability and cost reduction. BOPP films market demand. The BOPP films market demand exists because film technology advancements create better mechanical and barrier properties, which enable the films to meet advanced packaging requirements.

- The food segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific BOPP film market is segmented by application into food, beverage, tobacco, personal care, pharmaceutical and others. Among these, the food segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the films are widely used in food packaging because of their barrier properties, transparent nature and durable characteristics. The films are used to maintain freshness and extend the shelf life of different food items, which include snacks, confectionery and bakery products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific BOPP film market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jindal Poly Films Ltd

- Cosmo First Ltd

- UFlex Ltd

- Toray Industries, Inc.

- SRF Ltd

- Nan Ya Plastics Co.

- Polyplex Co. Ltd

- Taghleef Industries

- Mitsui Chemicals

- Toppan Speciality Films Private Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In June 2025, Dhunseri Ventures Limited announced the official commencement of the BOPP film manufacturing plant at Kathua, Jammu. A major project of Dhunseri Ventures’ wholly owned subsidiary, Dhunseri Poly Films Private Limited (DPFPL), the foundation stone of the project was laid by His Excellency, Lieutenant Governor of J&K.

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific BOPP film market based on the below-mentioned segments:

Asia Pacific BOPP Film Market, By Type

- Wraps

- Bags and Pouches

- Tapes

- Labels

- Others

Asia Pacific BOPP Film Market, By Thickness

- Below 15 Microns

- 15-30 Microns

- 30-45 Microns

- More Than 45 Microns

Asia Pacific BOPP Film Market, By Application

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific BOPP film market size?A: Asia Pacific BOPP film market size is expected to grow from 9.57 billion in 2024 to 20.26 billion by 2035, growing at a CAGR of 7.06% during the forecast period 2025-2035.

-

Q: What is BOPP film, and its primary use?A: Biaxially oriented polypropylene films BOPP films serve as the ideal packaging solution for food products, consumer goods and industrial applications because of their exceptional product clarity and barrier performance and their ability to withstand high tension.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the demand for ready-to-eat meals and snacks, and frozen foods in China and India have increased because of urbanisation and the development of new dietary patterns.

-

Q: What factors restrain the Asia Pacific BOPP film market?Q: What factors restrain the Asia Pacific BOPP film market?

-

Q: How is the market segmented by type?A: The market is segmented into wraps, bags and pouches, tapes, labels and others.

-

Q: Who are the key players in the Asia Pacific BOPP film market?A: Key companies include Jindal Poly Films Ltd, Cosmo First Ltd, UFlex Ltd, Toray Industries, Inc., SRF Ltd, Nan Ya Plastics Co., Polyplex Co. Ltd, Taghleef Industries, Mitsui Chemicals, and Toppan Speciality Films Private Ltd.

Need help to buy this report?