Asia Pacific Biodiesel Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Vegetable Oils, Animal Fats, and Others), By Application (Fuel, Power Generation and Others), and Asia Pacific Biodiesel Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Biodiesel Market Insights Forecasts to 2035

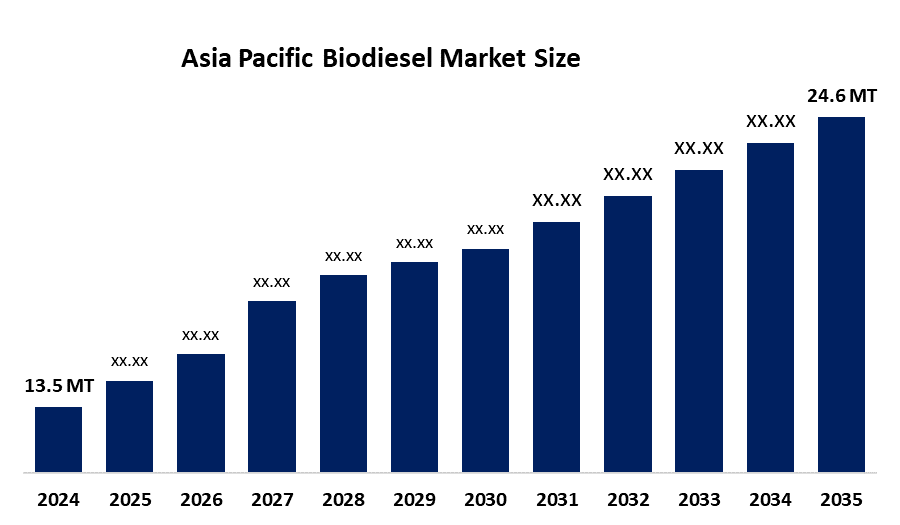

- The Asia Pacific Biodiesel Market Size Was Estimated at 13.5 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.61% from 2025 to 2035

- The Asia Pacific Biodiesel Market Size is Expected to Reach 24.6 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Biodiesel Market Size is Anticipated to reach 24.6 Million Tonnes by 2035, Growing at a CAGR of 5.61% from 2025 to 2035. The market is driven by rising demand for a biodegradable fuel alternative to lower carbon emissions in the environment, the increasing production and sales of automobiles and the widespread product utilization as a heating fuel in domestic and commercial boilers.

Market Overview

Biodiesel serves as a sustainable, renewable fuel derived from vegetable oils, animal fats and other renewable resources. The production process begins with transesterification, which converts triglycerides found in vegetable oils and animal fats into fatty acid methyl esters and glycerine. The solution provides multiple advantages, including economic savings, reduced fossil fuel usage and assistance for local agricultural production. The government started to increase its financial support for programs that aim to replace fossil fuels in order to decrease greenhouse gas emissions from industrial operations. The automotive industry requires biodiesel because it serves as a substitute fuel source.

B30 Ucome dob ARA range marine biodiesel blend assessments started at Argus after the company replaced its previous method, which calculated fob ARA range blend prices. The assessment will comprise 30pc used cooking oil methyl ester (UCOME) and 70pc very-low sulphur fuel oil (VLSFO) in 2024.

Bollore Logistics Singapore and L'Oréal Travel Retail Asia Pacific launched their biofuel solution for local trucking services in 2021, which will deliver L'Oréal products throughout the country.

The Indonesian government decided to eliminate its requirement for B50 palm oil-based diesel, which was set to start in 2026, after officials confirmed their inability to implement the new standard because of technical and funding issues, thus reducing worries about the impact on worldwide palm oil availability. The Indonesian government intends to introduce B50 grade diesel, which consists of equal parts palm oil-based biodiesel and conventional diesel, during the second half of this year.

Report Coverage

This research report categorises the Asia Pacific biodiesel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific biodiesel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific biodiesel market.

Asia Pacific Biodiesel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 13.5 Million Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.61% |

| 2035 Value Projection: | 24.6 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Wilmar International, Neste Co., Bangchak Co., Bharat Petroleum, PetroChina, M11 Industries Private Ltd, Green Joules, Cargill, Incorporated, Archer Daniels Midland Company, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The biodiesel market in Asia Pacific is driven by increasing concerns related to air quality, with the obligations of the Paris Agreement, which need to be fulfilled, driving the transition toward cleaner-burning fuels. The research advances on enzymatic transesterification, with second-generation biofuels development, will bring about better production efficiency while eliminating the battle between food and fuel. The production of biodiesel from domestic agricultural resources decreases dependence on global crude oil prices while it boosts energy independence.

Restraining Factors

The biodiesel market in the Asia Pacific is restrained by the European Union's establishment of final anti-dumping tariffs for Chinese biodiesel, which range from 10% to 35.6% on February 2025. The struggle between food crops and fuel feedstock for agricultural land creates major difficulties for policy development.

Market Segmentation

The Asia Pacific biodiesel market share is categorised into feedstock and application.

- The vegetable oils segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific biodiesel market is segmented by feedstock into vegetable oils, animal fats, and others. Among these, the vegetable oils segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the soybean, rapeseed, palm, and sunflower oils due to these oils having become essential food items that serve as economical and accessible raw materials for biodiesel production. The widespread adoption of vegetable oils as a biofuel material occurs because these oils precisely match the requirements of current biodiesel manufacturing processes.

- The fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific biodiesel market is segmented into fuel, power generation and others. Among these, the fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by commercial vehicles, which require more fuel because their operations make them switch from using crude oil to adopting alternative fuels that create fewer Volatile Organic Compounds (VOCs) than standard diesel fuels. The growing environmental sustainability concerns among people, with the requirement to reduce greenhouse gas emissions, have driven both consumers and industries to search for cleaner fuel alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific biodiesel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wilmar International

- Neste Co.

- Bangchak Co.

- Bharat Petroleum

- PetroChina

- M11 Industries Private Ltd

- Green Joules

- Cargill, Incorporated

- Archer Daniels Midland Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In July 2025, the President 100, a 16-metre harbour ship powered entirely by 100% biodiesel (B100), was officially launched in Singapore. The vessel is equipped with two Weichai WP13C450-18BF marine engines and two CCFJ20J-W5BF generator sets, providing the core propulsion system for this milestone project.

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific biodiesel market based on the below-mentioned segments:

Asia Pacific Biodiesel Market, By Feedstock

- Vegetable Oils

- Animal Fats

- Others

Asia Pacific Biodiesel Market, By Application

- Fuel

- Power Generation

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific biodiesel market size?A: Asia Pacific biodiesel market size is expected to grow from 13.5 million tonnes in 2024 to 13.5 million tonnes by 2035, growing at a CAGR of 5.61% during the forecast period 2025-2035.

-

Q: What is biodiesel, and its primary use?A: Biodiesel serves as a sustainable, renewable fuel derived from vegetable oils, animal fats and other renewable resources. The production process begins with transesterification, which converts triglycerides found in vegetable oils and animal fats into fatty acid methyl esters and glycerine.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by increasing concerns related to air quality, with the obligations of the Paris Agreement, which need to be fulfilled, driving the transition toward cleaner-burning fuels.

-

Q: What factors restrain the Asia Pacific biodiesel market?A: The market is restrained by the European Union's establishment of final anti-dumping tariffs for Chinese biodiesel, which range from 10% to 35.6% on February 2025.

-

Q: How is the market segmented by feedstock?A: The market is segmented into vegetable oils, animal fats, and others.

-

Q: Who are the key players in the Asia Pacific biodiesel market?A: Key companies include Wilmar International, Neste Co., Bangchak Co., Bharat Petroleum, PetroChina, M11 Industries Private Ltd, Green Joules, Cargill, Incorporated, and Archer Daniels Midland Company.

Need help to buy this report?