Asia Pacific Automotive Sensors Market Size, Share, and COVID-19 Impact Analysis, By Sales Channel (Original Equipment Manufacturers, and Aftermarkets), By Sensor Types (Temperature Sensors, Pressure Sensors, Oxygen Sensors, NOx Sensors, Position Sensors, Speed Sensors, Inertial Sensors, Image Sensors, and Others) By Vehicle Types (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle), and Asia Pacific Automotive Sensors Market Insights, Industry Trends, Forecast to 2035

Industry: Automotive & TransportationAsia Pacific Automotive Sensors Market Size Insights Forecasts to 2035

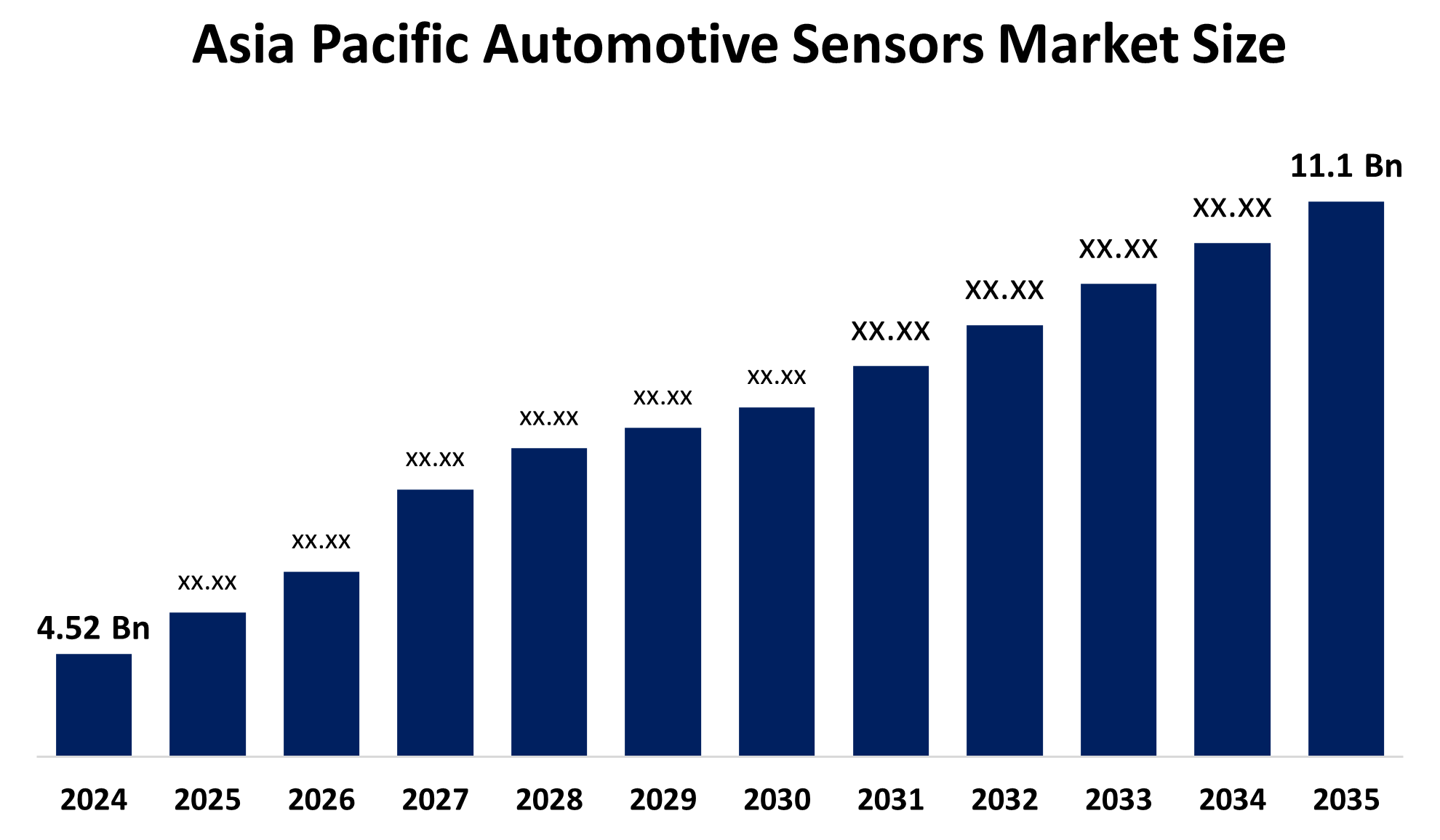

- The Asia Pacific Automotive Sensors Market Size Was Estimated at USD 4.52 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.51% from 2025 to 2035

- The Asia Pacific Automotive Sensors Market Size is Expected to Reach USD 11.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Automotive Sensors Market Size is Anticipated to Reach USD 11.1 Billion by 2035, Growing at a CAGR of 8.51% from 2025 to 2035. The market is driven by high vehicle production, rising disposable incomes, and increasing demand for advanced safety (ADAS) and powertrain systems, particularly in electric vehicles (EVs).

Market Overview

The Asia Pacific Automotive Sensors Market Size refers to the network of devices designed to detect, measure, and transmit physical or chemical changes within a vehicle to its electronic control units (ECUs). These sensors are characterized by their high precision, durability under harsh environmental conditions, and rapid response times, which are essential for the real-time operation of vehicle systems. Key trends include the transition from simple analog sensors to intelligent, digitally connected micro-electro-mechanical systems (MEMS) and the increasing integration of sensor fusion to support higher levels of vehicle automation.

Governmental bodies across the region are implementing stringent safety and emission regulations, such as China VI and India's Bharat Stage VI, which necessitate an increased number of sensors per vehicle. Private sector initiatives include heavy investments by original equipment manufacturers (OEMs) in R&D to develop next-generation sensors for electric vehicles (EVs) and autonomous driving. Furthermore, schemes like India’s Production Linked Incentive (PLI) and "Made in China 2025" are providing fiscal support to local sensor manufacturing to enhance supply chain resilience.

Technological progress in the market is highlighted by the development of advanced driver-assistance systems (ADAS) that integrate radar, LiDAR, and camera-based sensors to enhance road safety. Innovations in semiconductor technology have led to the miniaturization of sensors, allowing for more compact and energy-efficient designs suitable for battery management systems in EVs. Additionally, the emergence of AI-enabled sensors and vehicle-to-everything (V2X) communication is transforming how vehicles interact with their surroundings, enabling predictive maintenance and real-time situational awareness.

Report Coverage

This research report categorizes the market for the Asia Pacific Automotive Sensors Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific automotive sensors market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific automotive sensors market.

Asia Pacific Automotive Sensors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.52 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.51% |

| 2035 Value Projection: | USD 11.1 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Sales Channel, By Sensor Types |

| Companies covered:: | DENSO Corporation, Panasonic Corporation, Hyundai Mobis, Murata Manufacturing Co., Ltd., Hitachi Automotive Systems, MinebeaMitsumi Inc., Pricol Ltd., Aisin Corporation, Fujikura Ltd., Hella India Automotive Pvt. Ltd., and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The market is primarily driven by the rising demand for enhanced vehicle safety and the integration of advanced driver-assistance systems (ADAS) such as lane departure warnings and collision avoidance. Additionally, the accelerating shift toward electric vehicles (EVs) necessitates sophisticated sensors for battery thermal management and energy efficiency. Stringent government regulations aimed at reducing carbon emissions and improving fuel efficiency also force manufacturers to adopt high-precision sensors for engine and exhaust monitoring across all vehicle segments.

Restraining Factors

Market growth is hindered by the high development and installation costs associated with advanced sensor technologies, which can impact the affordability of mid-range vehicles. Furthermore, the complexity of sensor calibration and integration within complex vehicle architectures poses significant technical challenges for manufacturers. Persistent semiconductor supply chain bottlenecks also continue to restrain production timelines and overall market momentum.

Market Segmentation

The Asia Pacific automotive sensors market share is categorised into sales channel, sensor types, and vehicle types.

- The original equipment manufacturers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Automotive Sensors Market Size is segmented by sales channel into original equipment manufacturers and aftermarkets. Among these, the original equipment manufacturers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by its established connections with automakers. OEMs are closely tied to the car industry's supply chain, making sure that the sensors comply with certain manufacturer specifications. Sensors manufacturers' direct or indirect sales to automakers are their main distribution channels. The category enjoys long-term agreements and the constant demand for sensors designed specifically for the new car models.

- The temperature sensors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on sensor types, the Asia Pacific Automotive Sensors Market Size is segmented into temperature sensors, pressure sensors, oxygen sensors, NOx sensors, position sensors, speed sensors, inertial sensors, image sensors, and others. Among these, the temperature sensors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by various automotive applications that have extensively employed them for keeping track of engine performance and efficiency. They are dependable and found in almost all kinds of vehicles. Temperature sensors are becoming more and more important in the automotive industry as it shifts mainly to electric and hybrid technologies, and thus they are being used for energy management.

- The passenger car segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Automotive Sensors Market Size is segmented by vehicle types into passenger car, light commercial vehicle, and heavy commercial vehicle. Among these, the passenger car segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the broad-scale acceptance and great utilization of sophisticated driver-assistance systems (ADAS) as a part of the vehicle. The latter ones are getting more and more fitted with sensors that improve the overall safety, performance, and comfort, thus leading to a better position in the market for cars equipped with such technology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Automotive Sensors Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DENSO Corporation

- Panasonic Corporation

- Hyundai Mobis

- Murata Manufacturing Co., Ltd.

- Hitachi Automotive Systems

- MinebeaMitsumi Inc.

- Pricol Ltd.

- Aisin Corporation

- Fujikura Ltd.

- Hella India Automotive Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Automotive Sensors Market Size based on the below-mentioned segments:

Asia Pacific Automotive Sensors Market, By Sales Channel

- Original Equipment Manufacturers

- Aftermarkets

Asia Pacific Automotive Sensors Market, By Sensor Types

- Temperature Sensors

- Pressure Sensors

- Oxygen Sensors

- NOx Sensors

- Position Sensors

- Speed Sensors

- Inertial Sensors

- Image Sensors

- Others

Asia Pacific Automotive Sensors Market, By Vehicle Types

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Frequently Asked Questions (FAQ)

-

Q: What is the Asia Pacific automotive sensors market size?A: Asia Pacific automotive sensors market size is expected to grow from USD 4.52 billion in 2024 to USD 11.1 billion by 2035, growing at a CAGR of 8.51% during the forecast period 2025-2035

-

Q: What are the key growth drivers of the market?A: The market is primarily driven by the rising demand for enhanced vehicle safety and the integration of advanced driver-assistance systems (ADAS) such as lane departure warnings and collision avoidance. Additionally, the accelerating shift toward electric vehicles (EVs) necessitates sophisticated sensors for battery thermal management and energy efficiency. Stringent government regulations aimed at reducing carbon emissions and improving fuel efficiency also force manufacturers to adopt high-precision sensors for engine and exhaust monitoring across all vehicle segments.

-

Q: What factors restrain the Asia Pacific automotive sensors market?A: Market growth is hindered by the high development and installation costs associated with advanced sensor technologies, which can impact the affordability of mid-range vehicles. Furthermore, the complexity of sensor calibration and integration within complex vehicle architectures poses significant technical challenges for manufacturers. Persistent semiconductor supply chain bottlenecks also continue to restrain production timelines and overall market momentum.

-

Q: How is the market segmented by sales channel?A: The market is segmented into original equipment manufacturers and aftermarkets.

Need help to buy this report?