Asia Pacific Assisted Living Facility Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Housing & Accommodation Services, Personal Care Services, Healthcare Services, Hospitality & Lifestyle Services, Specialized Services), By Facility Type (Standalone Assisted Living Facilities, Continuing Care Retirement Communities (CCRCs), Integrated Assisted Living with Nursing Homes, Premium Assisted Living Facilities, Affordable Assisted Living Facilities), and Asia Pacific Assisted Living Facility Market Insights, Industry Trends, Forecast to 2035.

Industry: Food & BeveragesAsia Pacific Assisted Living Facility Market Insights Forecasts to 2035

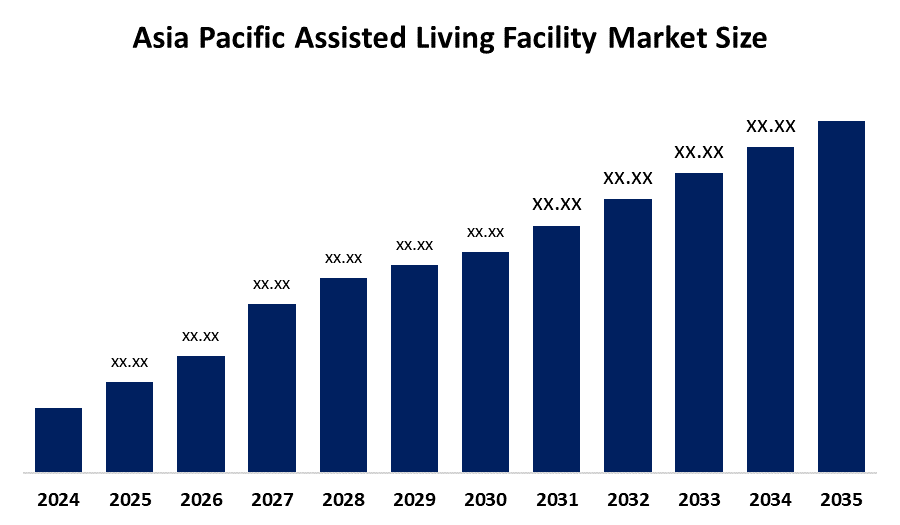

- The Asia Pacific Assisted Living Facility Market Size Is Expected to Grow at a CAGR of Around 8.1% from 2025 to 2035.

- The Asia Pacific Assisted Living Facility Market Size Is Expected to Reach a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Asia Pacific Assisted Living Facility Market Size Is Expected To Grow 8.1% CAGR From 2025 To 2035 Is Expected To Reach A Significant Share By 2035. The market is driven by aging populations, urbanization leading to smaller nuclear families, increased middle-class income, and supportive government policies, with high potential in mature markets like Japan and rapidly expanding ones in China, India, and Southeast Asia.

Market Overview

The Asia Pacific Assisted Living Facility Market Size refers to the sector providing residential services and daily activity assistance for seniors who do not require intensive medical care but need support with tasks such as meal preparation, medication management, and personal care. This market is characterized by a shift from traditional family care to community-based settings, driven by an aging population and the rise of chronic diseases. Key trends include a growing preference for independent living arrangements that offer a home-like atmosphere while providing 24/7 security and social engagement.

Government and private initiatives are pivotal in shaping the regional landscape. For instance, China has mandated all provinces to provide essential elderly care services by 2025, while Singapore’s "Healthier SG" initiative focuses on preventive care and AI-assisted wellness. Private investments are surging in Japan and India, where developers are creating upscale "silver economy" facilities to cater to affluent seniors seeking luxury retirement options.

Technological advancement is revolutionizing the market through the integration of Ambient Assisted Living (AAL) systems. Innovations such as AI-driven health monitoring, wearable devices for real-time mobility detection, and smart home systems like voice-activated lighting are enhancing resident safety and independence. Telemedicine platforms are also being deployed to provide remote medical consultations, reducing the need for hospital visits.

Report Coverage

this research report categorizes the market for the Asia Pacific Assisted Living Facility Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. the report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Assisted Living Facility Market Size. recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. the report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific assisted living facility market.

Asia Pacific Assisted Living Facility Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 8.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Service Type , By Facility Type |

| Companies covered:: | Panasonic Care Solutions (Japan) Nichii Gakkan Co., Ltd. (Japan) Benesse Style Care Co., Ltd. (Japan) Keppel Ltd. (Sindora Living) (Singapore) Eldercare Exhibition & Conference Asia (Singapore) Columbia Pacific Communities (India) Antara Senior Care (India) Ta (Taikang) Insurance Group (China) SK Telecom (Digital Elderly Care) (South Korea) KT Corporation (South Korea) Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The primary driver is the rapidly aging geriatric population across countries like Japan, China, and India, which is significantly increasing the demand for long-term care services. Changing family dynamics, specifically the rise of nuclear families and the migration of young professionals for work, have reduced the availability of informal at-home caregivers. Furthermore, increasing disposable incomes in emerging economies allow more families to afford professional assisted living, while advancements in smart technologies make these facilities more appealing by enhancing resident safety and quality of life.

Restraining Factors

High construction and operational costs in developed markets often result in premium pricing, making these facilities inaccessible to the middle-income segment. Additionally, a critical shortage of skilled geriatric care professionals and nurses hampers service quality and expansion. Strict and inconsistent regional regulations also pose significant hurdles for new market entrants.

Market Segmentation

The Asia Pacific assisted living facility market share is categorised into service type and facility type.

- The personal care services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Assisted Living Facility Market Size is segmented by service type into housing & accommodation services, personal care services, healthcare services, hospitality & lifestyle services, and specialized services. Among these, the personal care services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Personal Care Services typically dominate due to the fundamental need for help with daily activities (bathing, dressing, medication) for an aging population

- The continuing care retirement communities (CCRCs) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on facility type, the Asia Pacific Assisted Living Facility Market Size is segmented into standalone assisted living facilities, continuing care retirement communities (ccrcs), integrated assisted living with nursing homes, premium assisted living facilities, and affordable assisted living facilities. Among these, the continuing care retirement communities (CCRCs) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. dominate due to growing nuclear families, urbanization, and demand for professional care, while CCRCs gain traction for flexibility, but Affordable & Integrated Models are emerging to meet diverse needs, driven by aging populations and cultural shifts from traditional family care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific assisted living facility market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Panasonic Care Solutions (Japan)

- Nichii Gakkan Co., Ltd. (Japan)

- Benesse Style Care Co., Ltd. (Japan)

- Keppel Ltd. (Sindora Living) (Singapore)

- Eldercare Exhibition & Conference Asia (Singapore)

- Columbia Pacific Communities (India)

- Antara Senior Care (India)

- Ta (Taikang) Insurance Group (China)

- SK Telecom (Digital Elderly Care) (South Korea)

- KT Corporation (South Korea)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific assisted living facility market based on the below-mentioned segments:

Asia Pacific Assisted Living Facility Market, By Service Type

- Housing & Accommodation Services

- Personal Care Services

- Healthcare Services

- Hospitality & Lifestyle Services

- Specialized Services.

Asia Pacific Assisted Living Facility Market, By Facility Type

- Standalone Assisted Living Facilities

- Continuing Care Retirement Communities (CCRCs)

- Integrated Assisted Living with Nursing Homes

- Premium Assisted Living Facilities

- Affordable Assisted Living Facilities

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific assisted living facility market size?The Asia Pacific assisted living facility market size is expected to grow 8.1% CAGR from 2025 to 2035 is expected to reach a significant share by 2035.

-

What are the key growth drivers of the market?The primary driver is the rapidly aging geriatric population across countries like Japan, China, and India, which is significantly increasing the demand for long-term care services. Changing family dynamics, specifically the rise of nuclear families and the migration of young professionals for work, have reduced the availability of informal at-home caregivers. Furthermore, increasing disposable incomes in emerging economies allow more families to afford professional assisted living, while advancements in smart technologies make these facilities more appealing by enhancing resident safety and quality of life.

-

What factors restrain the Asia Pacific assisted living facility market?High construction and operational costs in developed markets often result in premium pricing, making these facilities inaccessible to the middle-income segment. Additionally, a critical shortage of skilled geriatric care professionals and nurses hampers service quality and expansion. Strict and inconsistent regional regulations also pose significant hurdles for new market entrants.

-

How is the market segmented by facility type?The market is segmented into Standalone Assisted Living Facilities, Continuing Care Retirement Communities (CCRCs), Integrated Assisted Living with Nursing Homes, Premium Assisted Living Facilities, and Affordable Assisted Living Facilities.

Need help to buy this report?