Asia Pacific Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid and Gas), By Application (Fertilizers, Textile, Mining, Pharmaceutical, Refrigeration, and Others), and Asia Pacific Ammonia Market Size Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsAsia Pacific Ammonia Market Size Insights Forecasts to 2035

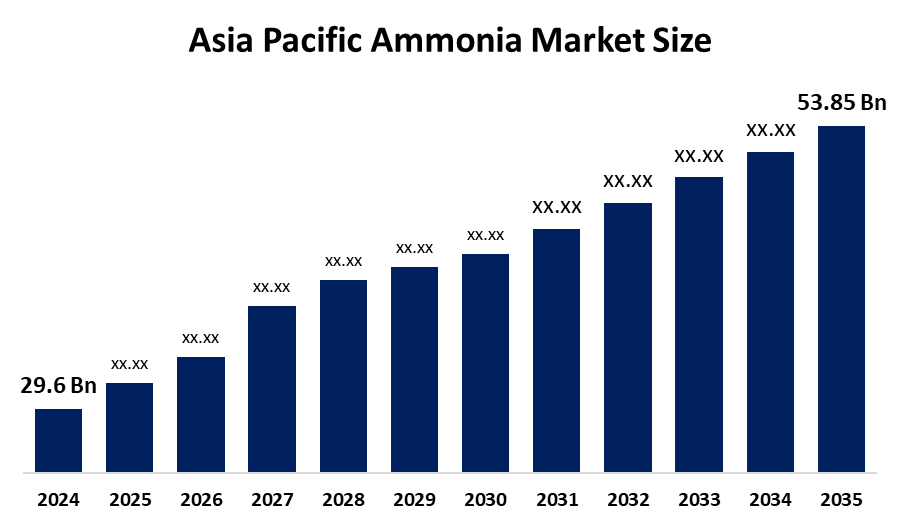

- The Asia Pacific Ammonia Market Size Was Estimated at USD 29.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.59% from 2025 to 2035

- The Asia Pacific Ammonia Market Size is Expected to Reach USD 53.85 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Asia Pacific Ammonia Market Size is anticipated to reach USD 53.85 Billion by 2035, Growing at a CAGR of 5.59% from 2025 to 2035. The market is driven by the increasing adoption of green ammonia, the expansion of ammonia as a hydrogen carrier, and the growing adoption of ammonia production capacity, which are expanding the market.

Market Overview

The APAC ammonia market includes all activities related to producing, selling, and distributing ammonia which exists as a colorless gas that contains one nitrogen atom and three hydrogen atoms. Ammonium sulphate and ammonia serve as essential components for nitrogen-based fertilizers which include urea and ammonium nitrate. These fertilizers are essential for raising soil fertility and crop yield. Due to their extensive agricultural industries, China and India make enormous investments in fertilizer manufacture. Over 80% of the ammonia generated by industry is utilized as agricultural fertilizer. Additionally, ammonia is utilized as a refrigerant gas, to purify water, and to make textiles, plastics, explosives, insecticides, dyes, and other compounds.

TFC conducts industrial transformation in 2024 through its ammonia energy partnerships with Japan and South Korea, while it invests USD 91 million into two new liquid ammonia storage tanks. Mitsubishi Heavy Industries Asia Pacific and PTT established an MoU agreement in 2024 to study the pre-feasibility of implementing 100% ammonia usage in gas turbine power generation systems throughout Thailand to support the country's decarbonization efforts.

Government policies lead to increased ammonia demand through fertilizer subsidies and their support for sustainable agriculture practices. The Chinese government announced plans to make Xinjiang a hotbed for textile and apparel manufacturing and has invested USD 8 billion in recent years. By 2030, the northwest region of China will become the largest textile production center in the country.

Report Coverage

This research report categorises the Asia Pacific Ammonia Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Ammonia Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific Ammonia Market Size.

Asia Pacific Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 29.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.59% |

| 2035 Value Projection: | USD 53.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Yara International ASA, CF Industries Holdings, Inc., OCI N.V., PT Pupuk Kalimantan Timur, Pupuk Kujang, Pupuk Iskandar Muda, Mitsubishi Gas Chemical Company, Inc., Indian Farmers Fertiliser Cooperative Limited, Brunei Fertilizer Industries, Sinopec Group, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ammonia market in Asia Pacific is driven by the rising population, which needs food crops to meet its increasing demand. The agricultural industry faces its most critical challenge because developed nations are losing their farmland. Ammonia-based fertilizers provide an incomplete solution to agricultural challenges because they boost crop production while solving three main environmental issues, which include water conservation, soil pollution and climate change.

Restraining Factors

The ammonia market in the Asia Pacific is restrained by the geopolitical events, including the Russia-Ukraine conflict, and worldwide supply chain problems, causing these commodities to experience major price shifts which affect both production expenses and business profitability. The governments implemented more stringent regulations to control industrial emissions, nitrogen runoff and water pollution.

Market Segmentation

The Asia Pacific Ammonia Market Size share is categorised into type and application.

- The liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific Ammonia Market Size is segmented by product into liquid and gas. Among these, the liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the Asia-Pacific region, which uses liquid ammonia as a primary component in fertilizers and chemicals, and refrigeration systems. The substance functions as an essential raw material used to produce nitrogen-based fertilizers which help agricultural productivity. The substance operates in two main functions: industrial cooling systems and chemical synthesis processes, which support efficient manufacturing and processing operations.

- The fertilizers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Asia Pacific Ammonia Market Size is segmented into fertilizers, textile, mining, pharmaceutical, refrigeration, and others. Among these, the fertilizers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth in the Asia-Pacific region relies on ammonia-based fertilizers to maintain its agricultural food security needs. Ammonia usage receives government backing through subsidy programs, while farmers select high-performance fertilizers which results in greater ammonia usage for their agricultural needs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Ammonia Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yara International ASA

- CF Industries Holdings, Inc.

- OCI N.V.

- PT Pupuk Kalimantan Timur

- Pupuk Kujang

- Pupuk Iskandar Muda

- Mitsubishi Gas Chemical Company, Inc.

- Indian Farmers Fertiliser Cooperative Limited

- Brunei Fertilizer Industries

- Sinopec Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Ammonia Market Size based on the below-mentioned segments:

Asia Pacific Ammonia Market Size, By Type

- Liquid

- Gas

Asia Pacific Ammonia Market Size, By Application

- Fertilizers

- Textile

- Mining

- Pharmaceutical

- Refrigeration

- Others

Frequently Asked Questions (FAQ)

-

What is the Asia Pacific Ammonia Market Size?Asia Pacific Ammonia Market Size is expected to grow from USD 29.6 billion in 2024 to USD 53.85 billion by 2035, growing at a CAGR of 5.59% during the forecast period 2025-2035.

-

What is ammonia, and its primary use?The APAC ammonia market includes all activities related to producing, selling, and distributing ammonia which exists as a colorless gas that contains one nitrogen atom and three hydrogen atoms. Ammonium sulphate and ammonia serve as essential components for nitrogen-based fertilizers which include urea and ammonium nitrate.

-

What are the key growth drivers of the market?Market growth is driven by the rising population, which needs food crops to meet its increasing demand. The global agricultural industry faces its most critical challenge because developed nations are losing their farmland.

-

What factors restrain the Asia Pacific Ammonia Market Size?The market is restrained by the geopolitical events, including the Russia-Ukraine conflict, and worldwide supply chain problems, causing these commodities to experience major price shifts which affect both production expenses and business profitability.

-

How is the market segmented by type?The market is segmented into liquid and gas.

-

Who are the key players in the Asia Pacific Ammonia Market Size?Key companies include Yara International ASA, CF Industries Holdings, Inc., OCI N.V., PT Pupuk Kalimantan Timur, Pupuk Kujang, Pupuk Iskandar Muda, Mitsubishi Gas Chemical Company, Inc., Indian Farmers Fertiliser Cooperative Limited, Brunei Fertilizer Industries, and Sinopec Group.

Need help to buy this report?