Global Aseptic Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Cartons, Bottles, Bags & Pouches, Prefilled Syringes, and Vials & Ampoules), By Application (Food, Beverage, and Pharmaceuticals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030.

Industry: Advanced MaterialsGlobal Aseptic Packaging Market Insights Forecasts to 2030

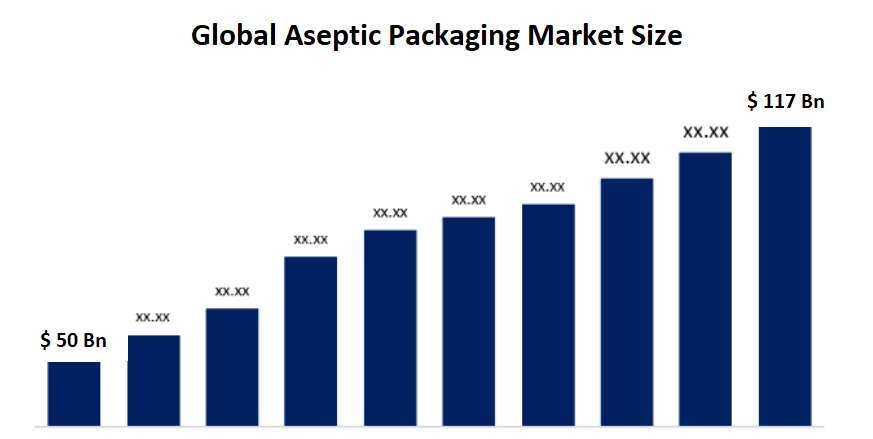

- The Global Aseptic Packaging Market Size was valued at USD 50 billion in 2021.

- The market is growing at a CAGR of 10% from 2022 to 2030

- The Global Aseptic Packaging Market Size is expected to reach USD 117 billion by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aseptic Packaging Market Size is expected to reach USD 117 billion by 2030, at a CAGR of 10% during the forecast period 2022 to 2030. The aseptic packaging market has grown due to the brisk expansion of end-use sectors like food, beverage, and pharmaceuticals in countries like China, India, Brazil, and South Africa.

Market Overview

Aseptic packaging sterilizes solid or liquid products before packing and sealing them in sterile environments. It is used to retain food's freshness, flavor, and nutritional value and to make milk, juices, yogurt, cream, liquid eggs, salads, desserts, and dressings. The primary cause driving the market growth rate is the rising urban population and changing customer preferences against food preservatives. Additionally, the changing eating patterns of consumers are leading to an increase in the preference for quick-to-prepare foods. Over the forecast period, it is predicted that growing demand for packaged goods, such as ready-to-eat meals, dairy products, frozen meals, cake mixes, and snack foods, will positively affect industry growth.

Additionally, this packaging does not require refrigeration, making it useful for consumers constantly on the go. However, the technology's higher starting cost than conventional techniques is projected to impede expansion throughout the forecast period. The demand for packaged food products is being driven by rising urbanization, particularly in China and India. Additionally, the milk and dairy product market is expanding, helping the aseptic packaging sector gain pace. A small number of companies, including Tetra Pak International S.A., SIG, and Greatview Aseptic Packaging Co., Ltd., dominate the industry, which is highly consolidated. Local and emerging competitors will probably encounter fierce rivalry from these conglomerates. Over the forecast period, rising consumer concern for the environment is anticipated to increase demand for product-specific, bio-based, recyclable aseptic packaging. As a result, it is anticipated that product development, innovation, and cost-effectiveness will be the main determinants of consumer choice. Alternative procedures, including hot fill technology, ESL, and pasteurization, are anticipated to impede market expansion. But throughout the forecast period, aseptic packaging is anticipated to give the technology a competitive edge due to its longer shelf life and excellent safety.

Global Aseptic Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 50 Billion |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 10% |

| 2030 Value Projection: | USD 117 Billion |

| Historical Data for: | 2019-2020 |

| No. of Pages: | 265 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Application, By region |

| Companies covered:: | Amcor Limited, Dickinson and Company (BD), DuPont de Nemours Inc., GreatviewAseptic Packaging Co. Ltd., I.M.A. IndustriaMacchineAutomatiche S.p.A. (SO.FI.M.A.), Reynolds Group Holdings Limited (Packaging Finance Limited), Robert Bosch GmbH, Schott AG (CarlZeiss AG), and SIG Combibloc Group AG. |

| Growth Drivers: | Expansion of end-use sectors is expected to drive the market growth over the forecast period. |

| Pitfalls & Challenges: | Covid-19 Impact Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for global aseptic packaging based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global aseptic packaging market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global aseptic packaging market sub-segments.

Segmentation Analysis

- In 2021, the cartons segment dominated the market with the largest market share of 29% and market revenue of 14.5 billion.

Based on the product, the global aseptic packaging market is categorized into Cartons, Bottles, Bags & Pouches, Prefilled Syringes, and Vials & Ampoules. In 2021, the cartons segment dominated the market with the largest market share of 29% and market revenue of 14.5 billion. Paperboard, thin layers of aluminum, and thin layers of plastic are the main materials used to make aseptic cartons. Over the forecast period, the market is anticipated to increase favorably as a result of the expansion of the beverage, dairy, and dairy substitute industries as a result of population growth and shifting consumer dietary preferences.

- In 2021, the beverage segment accounted for the largest share of the market, with 38% and a market revenue of 19 billion.

Based on the application, the aseptic packaging market is categorized into Food, Beverage, and Pharmaceuticals. In 2021, the beverage segment accounted for the largest share of the market, with 38% and market revenue of 19 billion. It is because of the rise in demand for more ready-to-eat foods such as fruit juices, dairy products, jams, and coconut goods. Additionally, rising consumer preference for health and an increase in purchasing power is anticipated to positively boost industry growth.

Regional Segment Analysis of the Aseptic Packaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

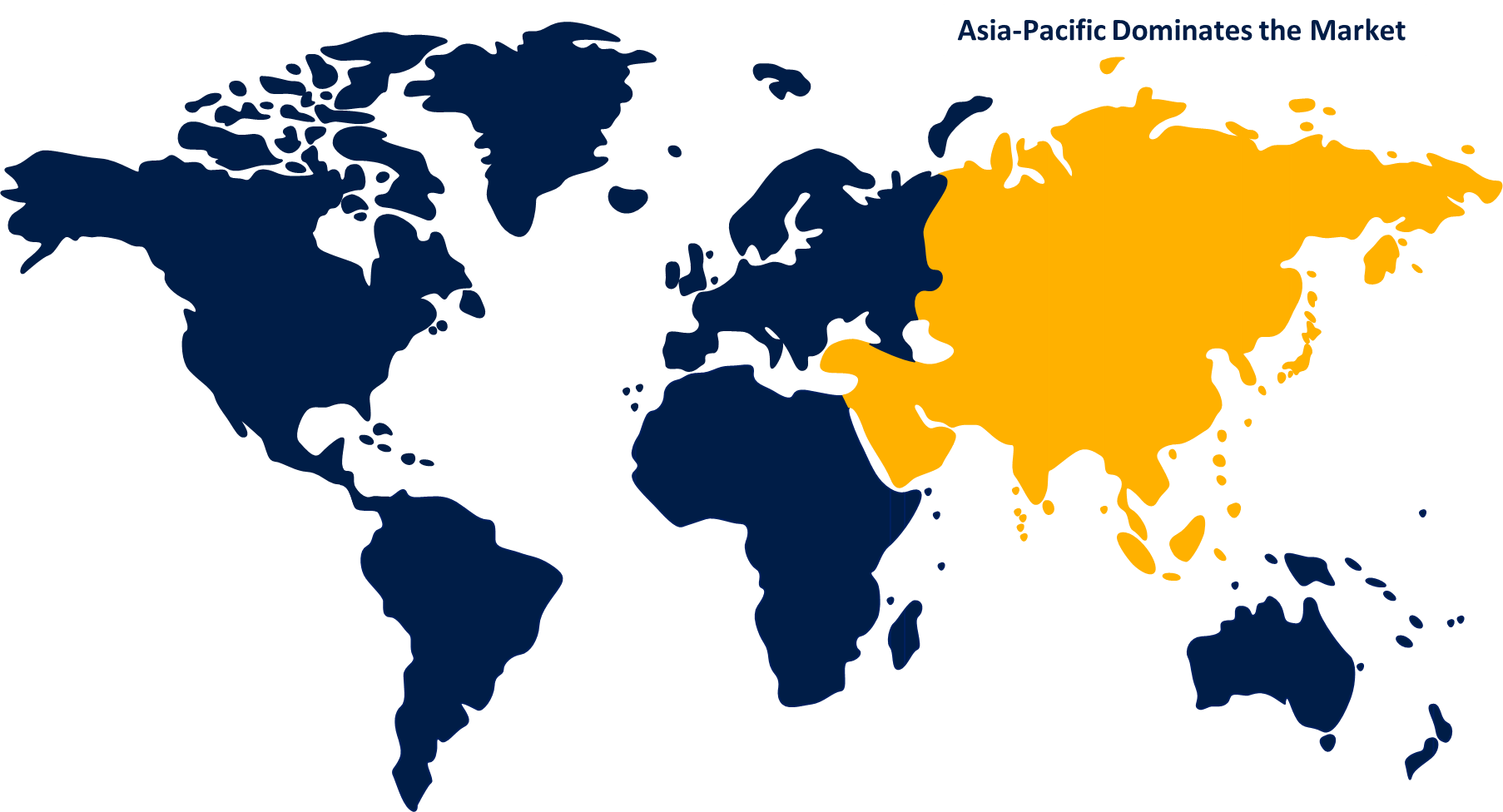

Asia-Pacific emerged as the largest market for the global aseptic packaging market, with a market share of around 35% and 50 billion of the market revenue in 2021.

- In 2021, Asia-Pacific emerged as the largest market for the global aseptic packaging market, with a market share of around 35% and 50 billion of the market revenue. Due to changing consumer lifestyles and rising purchasing power among Asian consumers, this is projected to have a favorable impact on the expansion of the packaged food and beverage business. To meet the growing end-user demand, manufacturers from developed economies are likely to relocate their production facilities to the area. With the highest demand in the food and beverage sector, India is anticipated to be a significant market throughout the forecast period. Over the course of the forecast period, the region's expanding demand for natural products with no additives, such as liquor, juices, and flavored milk, is anticipated to positively affect industry growth.

- The North America market is expected to grow at the fastest CAGR between 2021 and 2030, due to the region's high adoption rate and availability of a variety of aseptic packaging manufacturers.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global aseptic packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Amcor Limited

- Dickinson and Company (BD)

- DuPont de Nemours Inc.

- GreatviewAseptic Packaging Co. Ltd.

- I.M.A. IndustriaMacchineAutomatiche S.p.A. (SO.FI.M.A.)

- Reynolds Group Holdings Limited (Packaging Finance Limited)

- Robert Bosch GmbH

- Schott AG (CarlZeiss AG)

- SIG Combibloc Group AG

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In Oct 2021: Tetra Pak and Poka, a Canadian provider of worker platforms, have begun a new strategic partnership. According to Tetra Pak, this will give employees the equipment and training they need to hasten the zero-waste process in the food production industry. This new training and support solution from Tetra Pak is the company's first scalable, connected workforce service available globally.

- In September 2021, Saputo Inc. purchased the companies of Carolina Aseptic and Carolina Dairy. Out of a plant in Troy, North Carolina, Carolina Aseptic specializes in creating, producing, packing, and distributing aseptic shelf-stable food goods and beverages. In Biscoe, North Carolina, Carolina Dairy concentrates on producing, packaging, and selling chilled yogurt in spouted pouches.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global aseptic packaging market based on the below-mentioned segments:

Global Aseptic Packaging Market, By Product

- Cartons

- Bottles

- Bags & Pouches

- Prefilled Syringes

- Vials & Ampoules

Global Aseptic Packaging Market, By Application

- Food

- Beverage

- Pharmaceuticals

Global Aseptic Packaging Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Aseptic Packaging market?As per Spherical Insights, the size of the Aseptic Packaging market was valued at USD 50 billion in 2022 to USD 117 billion by 2030.

-

What is the market growth rate of the Aseptic Packaging market?The Aseptic Packaging market is growing at a CAGR of 10% from 2022 to 2030.

-

Which country dominates the Aseptic Packaging market?Asia-Pacific emerged as the largest market for Aseptic Packaging.

-

Who are the key players in the Aseptic Packaging market?Key players in the Aseptic Packaging market are Amcor Limited, Dickinson and Company (BD), DuPont de Nemours Inc., GreatviewAseptic Packaging Co. Ltd., I.M.A.IndustriaMacchineAutomatiche S.p.A. (SO.FI.M.A.), Reynolds Group Holdings Limited (Packaging Finance Limited), Robert Bosch GmbH, Schott AG (CarlZeiss AG), and SIG Combibloc Group AG.

-

Which factor drives the growth of the Aseptic Packaging market?Expansion of end-use sectors is expected to drive the market's growth over the forecast period.

Need help to buy this report?