Global Artificial Ear Simulator Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Standard Ear Simulator and Occluded Ear Simulator), By Application (Consumer Electronics Industry, Hearing Aid Industry, and Acoustic Research), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Artificial Ear Simulator Market Insights Forecasts to 2035

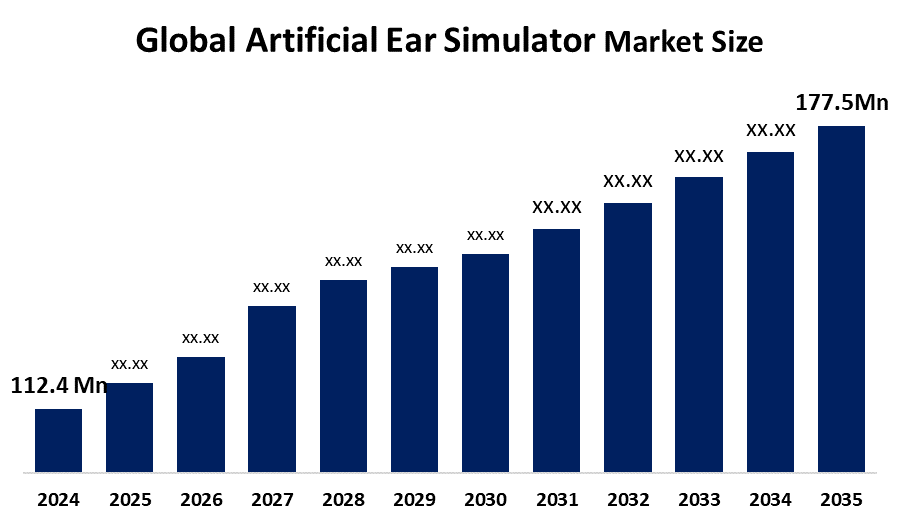

- The Global Artificial Ear Simulator Market Size Was Estimated at USD 112.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.24% from 2025 to 2035

- The Worldwide Artificial Ear Simulator Market Size is Expected to Reach USD 177.5 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global artificial ear simulator market size was worth around USD 112.4 million in 2024 and is predicted to grow to around USD 177.5 million by 2035 with a compound annual growth rate (CAGR) of 4.24% from 2025 to 2035. The artificial ear simulator market is also growing due to an increasing demand for safe and effective training tools in surgery, as there is a rising incidence of ear diseases, along with the incorporation of advanced simulation technology, which aids in training skills without the risk of injuries.

Market Overview

The worldwide Artificial Ear Simulator Market Size is an industry with firms producing simulators resembling acoustic properties in an ear. Simulators resembling acoustic properties in an ear are mainly utilized in audiology testing, hearing aid testing, and headphone and earphone testing. Factors accelerating market expansion are the surge in demand for advanced hearing aids or devices and stricter international regulations with respect to acoustic testing and certifications. Improved simulators in terms of accuracy and digital technology are also a boost.

New opportunities are found in emerging demands in consumer electronics testing, growing audiology testing demands, and substantial progress in investment and medical as well as sound lab advancements in simulators, mainly in developing countries. Another opportunity is in raising demands in the manufacture of consumer electronics and next-generation wearables, requiring high-precision testing and calibration. Some major rivalry firms in this market are Bruel & Kjær (HBK), GRAS Sound & Vibration, Norsonic, Larson-Davis, and Head Acoustics, based on innovation, precision, and international acoustic standards. In November 2025, certain countries in Europe, including Latvia, formulated their perspective on simulative educational approaches in healthcare training by 2027. These initiatives emphasize infrastructure development, standardized curricula, and wider access to medical simulation technologies, strengthening the ecosystem supporting specialized simulators, including artificial ear models.

Report Coverage

This research report categorizes the artificial ear simulator market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the artificial ear simulator market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the artificial ear simulator market.

Global Artificial Ear Simulator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 112.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.24% |

| 2035 Value Projection: | USD 177.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type |

| Companies covered:: | Cochlear Ltd., Bruel & Kjær (HBK), GRAS Acoustics, Norsonic, Larson-Davis, Head Acoustics, MED-EL GmbH, Starkey Hearing Technologies, Medtronic PLC, Durham Instruments, Sonova Holding AG, Hangzhou AIHUA Instruments, William Demant Holdings A/S, and other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Artificial Ear Simulator Market is being driven by the growing demand for sophisticated surgical training and medical education, particularly in otology and ear surgeries. Rising cases of hearing defects and ear trauma, along with middle ear surgeries, are also driving the demand for more realistic simulators. Simulators are increasingly being employed in medical colleges and teaching institutions as a step to reduce risks to patients. Technological improvements in areas of 3D print simulation, haptic simulation, and more realistic models of human ear anatomy are also contributing to more realistic training. Rising limitations on the use of cadavers and the rising incidence of less invasive ear surgeries are also boosting the demand for simulators.

Restraining Factors

Factors that hinder the growth of the global artificial ear simulator market are the increased cost of new simulators, thereby discouraging their use in Tier 2 and Tier 3 countries. Lack of training expertise and expense in new emerging markets, increased procurement time within public institutions, and absence of simulators within training institutions also obstruct market growth.

Market Segmentation

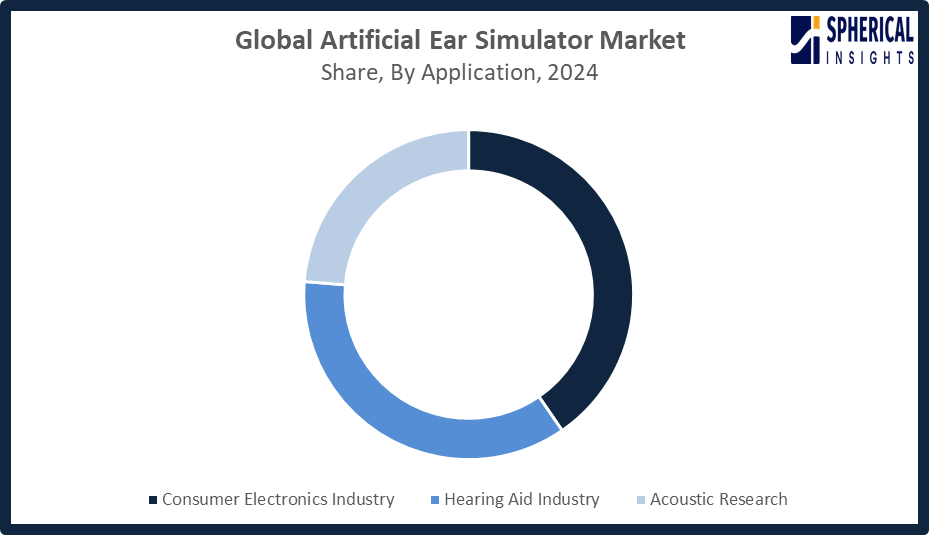

The artificial ear simulator market share is classified into product type and application.

- The standard ear simulator segment dominated the market in 2024, approximately 30% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, The Artificial Ear Simulator Market is divided into standard ear simulator and occluded ear simulator. Among these, the standard ear simulator segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Standard ear simulators are dominant due to their application in testing and calibration of headphones, microphones, and other communication instruments. The standard simulators are designed on the same acoustic properties found in the human ear and have abided by the IEC60318 specifications. Standard Ear Simulators meet the requirements set by the concerned authorities and help with the growing market for portable audio devices.

- The consumer electronics industry segment accounted for the highest market revenue in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, The Artificial Ear Simulator Market is divided into consumer electronics industry, hearing aid industry, and acoustic research. Among these, the consumer electronics industry segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Increasing requirements for accurate acoustic testing of headphones, smartphones, earbuds, and audio devices create market demand for artificial ear simulators. They are an integral part of sound pressure measurement, frequency response, and distortion measurement. They help verify the performance of devices and ensure that they meet international requirements. Increasing production of audio devices in East Asia, quality requirements in North America and Europe, and miniaturization trends also support their importance in the consumer electronics industry.

Get more details on this report -

Regional Segment Analysis of the Artificial Ear Simulator Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the artificial ear simulator market over the predicted timeframe.

North America is anticipated to hold the largest share of the artificial ear simulator market over the predicted timeframe. North America is projected to have a 40% market share of the artificial ear simulator market. This can be attributed to the advanced healthcare infrastructure, highly established audio and consumer electronics sectors, and the need for precise acoustic testing. The United States is the major contributor, being the frontrunner in R&D, and the need for headphones, earbuds, and hearing apparatuses. However, in March 2025, the Hearing Device Coverage Clarification Act of 2025 (S.983) is being presented by the Senators, introducing implanted middle ear devices as Medicare-covered prosthetics. This might increase the market size of the artificial ear simulators.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the artificial ear simulator market during the forecast period. Asia Pacific is expected to have a 25% market share of the artificial ear simulator market due to the increasing consumer electronics manufacturing business, rising use of headphones, earbuds, and the rising investments in testing equipment and technologies. China and India are major drivers for the artificial ear simulator market because of the increasing manufacturing of audio devices, rising living standards, and government efforts to promote the adoption of the latest technologies in this region. The emphasis of this region upon precision testing and adherence to global acoustic norms fuels this market even further.

The European artificial ear simulator market is growing at a substantial pace owing to a strong healthcare infrastructure, significant research work in audiology, a high level of consumer electronics standards, and a higher need for sophisticated acoustic analysis. Germany and the UK are leading in this field because of their need for regulatory requirements, R&D work, and significant manufacturers of audio systems. In 2024, Germany spent about EUR 1.2 billion on refurbishing their healthcare education infrastructure, upgrading simulation centres, and upgrading the practical skills of healthcare professionals, thereby fueling growth in this region as well.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the artificial ear simulator market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cochlear Ltd.

- Bruel & Kjær (HBK)

- GRAS Acoustics

- Norsonic

- Larson-Davis

- Head Acoustics

- MED-EL GmbH

- Starkey Hearing Technologies

- Medtronic PLC

- Durham Instruments

- Sonova Holding AG

- Hangzhou AIHUA Instruments

- William Demant Holdings A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Cochlear and GN expanded their R&D partnership within the Smart Hearing Alliance, building on a decade of collaboration. The enhanced alliance aims to advance research and develop integrated, cutting-edge hearing solutions for cochlear implant and hearing aid users worldwide.

- In June 2022, GRAS Sound & Vibration, part of Axiometrix Solutions, announced that all its ear simulator test platforms now feature TEDS calibration functionality. Alongside sister company Audio Precision, this ensures reliable data and simplifies installation and setup for accurate acoustic testing.

- In July 2021, HEAD acoustics achieved ITU-T standardization for its human, like ear canal (HEC) artificial ear, now classified as Type 4.4 in Recommendation ITU-T P.57. It not only meets Type 4.4 requirements but is also the first ITU-T artificial ear to fulfill low-noise standards in Chapter 7.

- In April 2021, HEAD acoustics launched a new generation of artificial head measurement systems for telecom and audio testing. Featuring modular artificial ears, improved ear canal geometry, fullband artificial mouth, and extensive accessories, the system is future-proof, easily extendable, and upgradeable, enhancing convenience for acoustics engineers.

- In March 2020, GRAS Sound & Vibration expanded its ear simulator lineup with the RA0403/04 Hi-Res Ear Simulator. Building on the RA0401/02 model, it extends the frequency range to 50 kHz, supporting high-resolution audio headphone testing and compliance with IEC 60318-4 standards.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the artificial ear simulator market based on the below-mentioned segments:

Global Artificial Ear Simulator Market, By Product Type

- Standard Ear Simulator

- Occluded Ear Simulator

Global Artificial Ear Simulator Market, By Application

- Consumer Electronics Industry

- Hearing Aid Industry

- Acoustic Research

Global Artificial Ear Simulator Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the artificial ear simulator market over the forecast period?The global artificial ear simulator market is projected to expand at a CAGR of 4.24% during the forecast period.

-

2. What is the market size of the artificial ear simulator market?The global artificial ear simulator market size is expected to grow from USD 112.4 million in 2024 to USD 177.5 million by 2035, at a CAGR of 4.24% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the artificial ear simulator market?North America is anticipated to hold the largest share of the artificial ear simulator market over the predicted timeframe

-

4. What is the artificial ear simulator market?The artificial ear simulator market involves devices replicating human ear anatomy and acoustics for testing, calibration, and audiology research

-

5. Who are the top 10 companies operating in the global artificial ear simulator market?Cochlear Ltd., Bruel & Kjær (HBK), GRAS Acoustics, Norsonic, Larson-Davis, Head Acoustics, MED-EL GmbH, Starkey Hearing Technologies, Medtronic PLC, Durham Instruments, and Others.

-

6. What factors are driving the growth of the artificial ear simulator market?The artificial ear simulator market is primarily driven by technological advancements in audio devices, the rising global prevalence of hearing loss, and the increasing focus on research and development (R&D) in the audiology industry

-

7. What are the market trends in the artificial ear simulator market?Key trends include rising demand in consumer electronics, technological advancements, Asia Pacific growth, integration with simulation tools, and standard compliance focus

-

8. What are the main challenges restricting wider adoption of the artificial ear simulator market?The main challenges restricting the wider adoption of the artificial ear simulator market include high costs, significant technical and performance limitations, complex regulatory environments, and a general lack of user awareness and skilled professionals

Need help to buy this report?