Argentina Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Green Hydrogen, Grey Hydrogen, Blue Hydrogen, Turquoise Hydrogen, and Yellow Hydrogen), By End Use (Ammonia, Refining, Methanol, Fuel, and Others), and Argentina Hydrogen Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsArgentina Hydrogen Market Size Insights Forecasts to 2035

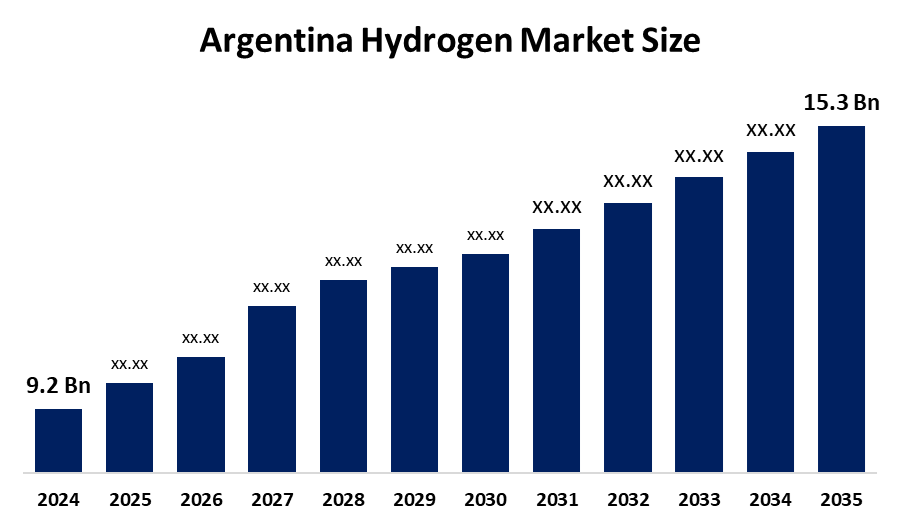

- The Argentina Hydrogen Market Size Was Estimated at USD 9.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.73% from 2025 to 2035

- The Argentina Hydrogen Market Size is Expected to Reach USD 15.3 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Argentina Hydrogen Market Size is Anticipated to reach USD 15.3 Billion by 2035, Growing at a CAGR of 4.73% from 2025 to 2035. The hydrogen market in Argentina is driven by a wealth of renewable resources, robust green hydrogen potential, favorable government regulations, export prospects, decarbonization objectives, foreign investments, and growing demand from industrial and energy-intensive sectors.

Market Overview

The Argentina Hydrogen Market Size refers to the production, storage, distribution, and utilization of hydrogen as an energy carrier and industrial input. The market includes three hydrogen types, which are produced through renewable energy and natural gas extraction methods. The main purposes of the facility include two major processes, which produce ammonia and methanol, while the plant also refines petroleum and generates electricity and supplies transportation fuels and industrial heating and green hydrogen products, which help Argentina achieve its decarbonization and clean energy transition targets.

Argentina's Hydrogen Market Size receives support from its National Hydrogen Strategy, which aims to produce 5 million tons of low-emission hydrogen by the year 2050 through tax incentives, VAT refunds, and accelerated depreciation for hydrogen projects. The main initiatives of the program include wind-to-hydrogen and green ammonia pilot projects and export-oriented production and investment promotion programs that provide tax incentives for a period of up to 30 years to attract domestic and international investors.

Recent Argentina Hydrogen Market Size developments include the Gaucho Wind to Hydrogen & Green Ammonia project, which advances with public and private backing from its launch in November 2024 to establish large-scale green hydrogen and ammonia production through wind energy. SoluForce joined the national H2ar consortium to develop the full hydrogen value chain. The future holds business prospects through green hydrogen export expansion, electrolyzer technology development, business collaborations, and hydrogen-based fuel market expansion.

Report Coverage

This research report categorizes the market for the Argentina hydrogen market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Argentina hydrogen market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Argentina hydrogen market.

Argentina Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.73% |

| 2035 Value Projection: | USD 15.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By End Use |

| Companies covered:: | YPF S.A., YPF Luz, SoluForce, Pampa Energía, Hychico, New Energy Argentina, Compañía MEGA, Genneia, Ternium Argentina, Air Liquide Argentina, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hydrogen market in Argentina is driven by the country's vast wind and solar renewable energy resources, which permit the establishment of extensive green hydrogen production facilities. The government attracts both domestic and foreign investments through its supportive policies and tax incentives, and its focus on export development. The rising industrial need for ammonia and methanol and refining processes, together with the worldwide shift towards decarbonization and Argentina's goal to become a hydrogen exporter, drive both market expansion and technological progress in production and storage, and transportation systems.

Restraining Factors

The hydrogen market in Argentina is mostly constrained by the expensive production methods and infrastructure development costs, low domestic market needs, operational difficulties with electrolysis and storage systems, and regulatory climate uncertainties, and the nation's need to rely on external financial resources and specialized knowledge.

Market Segmentation

The Argentina Hydrogen Market Size share is classified into product type and end use.

- The green hydrogen segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Argentina hydrogen market is segmented by product type into green hydrogen, grey hydrogen, blue hydrogen, turquoise hydrogen, and yellow hydrogen. Among these, the green hydrogen segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because Argentina has an abundance of renewable energy resources, especially solar and wind, which make it possible to produce green hydrogen on a big scale at a reasonable cost for both domestic and export markets. This is in line with government decarbonization and export-oriented goals.

- The ammonia segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Argentina hydrogen market is segmented by end use into ammonia, refining, methanol, fuel, and others. Among these, the ammonia segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Strong domestic and international demand for ammonia as an industrial chemical and fertilizer, hydrogen's crucial role in ammonia synthesis, and Argentina's emphasis on expanding green hydrogen-based ammonia production for international markets are the main causes of this.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Argentina hydrogen market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- YPF S.A.

- YPF Luz

- SoluForce

- Pampa Energía

- Hychico

- New Energy Argentina

- Compañía MEGA

- Genneia

- Ternium Argentina

- Air Liquide Argentina

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, a national hydrogen law that offers 30-year tax benefits and regulatory support for the expansion of the hydrogen industry is being examined by the Argentine Senate.

- In July 2025, Argentina promotes a hydrogen law to encourage investments in low-emission and renewable energy sources, positioning the nation to export clean hydrogen in the future.

Market Segment

This study forecasts revenue at the Argentina, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Argentina hydrogen market based on the below-mentioned segments:

Argentina Hydrogen Market Size, By Product Type

- Green Hydrogen

- Grey Hydrogen

- Blue Hydrogen

- Turquoise Hydrogen

- Yellow Hydrogen

Argentina Hydrogen Market Size, By End Use

- Ammonia

- Refining

- Methanol

- Fuel

- Others

Frequently Asked Questions (FAQ)

-

What is the Argentina Hydrogen Market Size?Argentina hydrogen market size is expected to grow from USD 9.2 billion in 2024 to USD 15.3 billion by 2035, growing at a CAGR of 4.73% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the country's vast wind and solar renewable energy resources, which permit the establishment of extensive green hydrogen production facilities. The government attracts both domestic and foreign investments through its supportive policies and tax incentives, and its focus on export development.

-

What factors restrain the Argentina Hydrogen Market Size?Constraints include the expensive production methods and infrastructure development costs, low domestic market needs, and operational difficulties with electrolysis and storage systems.

-

How is the market segmented by product type?The market is segmented into green hydrogen, grey hydrogen, blue hydrogen, turquoise hydrogen, and yellow hydrogen.

-

Who are the key players in the Argentina Hydrogen Market Size?Key companies include YPF S.A., YPF Luz, SoluForce, Pampa Energía, Hychico, New Energy Argentina, Compañía MEGA, Genneia, Ternium Argentina, Air Liquide Argentina, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?