Global Aquafeed Vitamins and Enzymes Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Vitamins and Enzymes), By Form (Dry and Liquid), By Application (Fish, Crustaceans, Mollusks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Specialty & Fine ChemicalsGlobal Aquafeed Vitamins and Enzymes Market Insights Forecasts to 2035

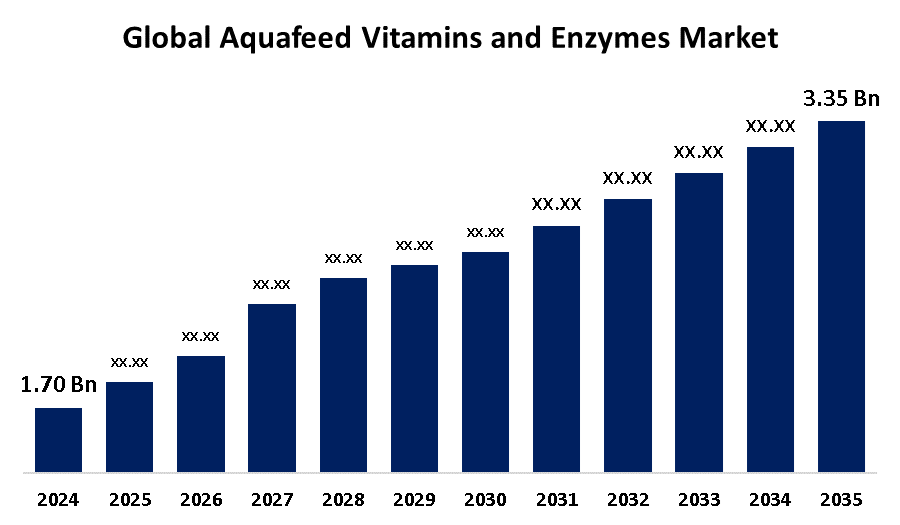

- The Global Aquafeed Vitamins and Enzymes Market Size Was Estimated at USD 1.70 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.36% from 2025 to 2035

- The Worldwide Aquafeed Vitamins and Enzymes Market Size is Expected to Reach USD 3.35 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The global aquafeed vitamins and enzymes market size was worth around USD 1.70 billion in 2024 and is predicted to grow to around USD 3.35 billion by 2035 with a compound annual growth rate (CAGR) of 6.36% from 2025 to 2035. The expanding aquaculture industry, along with the increasing global demand for seafood, is driving the global aquafeed vitamins and enzymes market.

Market Overview

The aquafeed vitamins and enzymes market refers to the market that emphasizes the production and sale of specialized additives for animal feed used in aquaculture (fish farming). Aquafeed is any feed given to the aquatic farmed animals as part of aquaculture fish (both farmed and wild) require a balanced mix of nutrients. The nutrients include vitamins (vitamin A, D, E, and B) and enzymes that aid in improving the digestibility and absorption, thereby enhancing the growth of aquaculture animals. The market encompasses the growing significance of sustainable aquaculture practices, along with the implementation of government regulations for ensuring the safety and efficacy of feed additives. The growing R&D activities for discovering new vitamins and enzymes, as well as the adoption of precision feeding techniques for optimizing feed efficiency with reduced wastage, are contributing to bolstering the market growth opportunities.

Report Coverage

This research report categorizes the aquafeed vitamins and enzymes market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aquafeed vitamins and enzymes market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aquafeed vitamins and enzymes market.

Global Aquafeed Vitamins and Enzymes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.70 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.36% |

| 2035 Value Projection: | USD 3.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product, By Form, By Application and COVID-19 Impact Analysis |

| Companies covered:: | DSM Nutritional Products, DuPont de Nemours, Inc., Cargill, Inc., Archer Daniels Midland Company, BASF SE, Nutreco N.V., Alltech Inc., BioMar Group, Skretting, Ridley Corporation Limited, Purina Animal Nutrition LLC, Evonik Industries AG, Novus International, Inc., Kemin Industries, Inc., Adisseo France SAS, Bluestar Adisseo Co., Ltd., Biomin Holding GmbH, Zeus Biotech Limited, Aker BioMarine Antarctic AS, Calysta, Inc., Others, and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aquafeed vitamins and enzymes market is primarily driven by the need for high-quality aquafeed, which is fortified with essential vitamins and enzymes. The expanding aquaculture industry, with its capacity to meet the increasing global demand for aquatic foods and prioritization towards sustainability, is driving the aquafeed vitamins and enzymes market demand. For instance, according to the State of World Fisheries and Aquaculture (SOFIA), global fisheries and aquaculture production in 2022 surged to 223.2 million tonnes, a 4.4 % increase from 2020. Further, the inclination towards pescetarianism and preference for seafood-based products over poultry and beef is contributing to propelling the market.

Restraining Factors

Volatility in raw material prices and supply chain disruptions due to changes in demand and geopolitical issues are challenging the market growth. Further, the rapidly evolving technology and intense competition among market players are hampering the market.

Market Segmentation

The aquafeed vitamins and enzymes market share is classified into product type, form, and application.

- The vitamins segment dominated the market with a significant share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the aquafeed vitamins and enzymes market is divided into vitamins and enzymes. Among these, the vitamins segment dominated the market with a significant share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Vitamins aid in enhancing the fish's health, growth, and overall productivity. For instance, vitamin C has therapeutic applications for activating the healing of wounds by stimulating collagen formation. The growing demand for preventing deficiencies and enhancing the health & productivity of farmed fish and other aquatic organisms is contributing to driving the market demand in the vitamins segment.

- The dry segment accounted for a significant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the aquafeed vitamins and enzymes market is divided into dry and liquid. Among these, the dry segment accounted for a significant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Dry aquafeed vitamins and enzymes are commonly used owing to their longer shelf life and ease of incorporation into feed manufacturing processes. The widespread adoption of aquafeed vitamins and enzymes due to their outstanding palatability and efficiency for enhancing fish performance is driving the market in the dry segment.

- The fish segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the aquafeed vitamins and enzymes market is divided into fish, crustaceans, mollusks, and others. Among these, the fish segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. There is an extensive farming practices of species like salmon, tilapia, and carp requiring high-quality feed enriched with vitamins and enzymes. The introduction of automated feeding systems and digital fish farming tools that aid in optimising feed use and increasing output is driving the market in the fish segment.

Regional Segment Analysis of the Aquafeed Vitamins and Enzymes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the aquafeed vitamins and enzymes market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the aquafeed vitamins and enzymes market over the predicted timeframe. An increasing demand for seafood, driving the need for fortified aquafeed, is propelling the market for aquafeed vitamins and enzymes. Further, the improvement in fish farming technologies, the expanding number of fish mills, along with the Indian government initiatives for promoting the aquaculture feed, is bolstering the market growth.

North America is expected to grow at a steady CAGR in the aquafeed vitamins and enzymes market during the forecast period. An increasing advancement in aquaculture practices with a strong emphasis on sustainable feed solutions is driving the market growth. The inclination towards more efficient feed ingredients utilization methods, along with the development of innovative enzyme formulations for enhancing nutrient absorption, is propelling the market.

Europe is anticipated to witness significant CAGR growth in the aquafeed vitamins and enzymes market during the predicted timeframe. Region’s extensive salmon farming activities, along with increasing concerns over sustainable farming practices, are driving the market of aquafeed vitamins and enzymes. The growing investment in research and development for creating more targeted enzyme formulations catering to specific animal needs and regional feed ingredients variations is propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aquafeed vitamins and enzymes market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DSM Nutritional Products

- DuPont de Nemours, Inc.

- Cargill, Inc.

- Archer Daniels Midland Company

- BASF SE

- Nutreco N.V.

- Alltech Inc.

- BioMar Group

- Skretting

- Ridley Corporation Limited

- Purina Animal Nutrition LLC

- Evonik Industries AG

- Novus International, Inc.

- Kemin Industries, Inc.

- Adisseo France SAS

- Bluestar Adisseo Co., Ltd.

- Biomin Holding GmbH

- Zeus Biotech Limited

- Aker BioMarine Antarctic AS

- Calysta, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aquafeed vitamins and enzymes market based on the below-mentioned segments:

Global Aquafeed Vitamins and Enzymes Market, By Product Type

- Vitamins

- Enzymes

Global Aquafeed Vitamins and Enzymes Market, By Form

- Dry

- Liquid

Global Aquafeed Vitamins and Enzymes Market, By Application

- Fish

- Crustaceans

- Mollusks

- Others

Global Aquafeed Vitamins and Enzymes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the aquafeed vitamins and enzymes market over the forecast period?The global aquafeed vitamins and enzymes market is projected to expand at a CAGR of 6.36% during the forecast period.

-

2. What is the market size of the aquafeed vitamins and enzymes market?The global aquafeed vitamins and enzymes market size is expected to grow from USD 1.70 Billion in 2024 to USD 3.35 Billion by 2035, at a CAGR of 6.36% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the aquafeed vitamins and enzymes market?Asia Pacific is anticipated to hold the largest share of the aquafeed vitamins and enzymes market over the predicted timeframe.

Need help to buy this report?