Global Aquafeed Additives Market Size, Share, and COVID-19 Impact Analysis, By Species Type (Fish, Mollusks, Crustaceans, and Others), By Additives Type (Vitamins, Minerals, Antioxidants, Amino Acids, Enzymes, Acidifiers, and More), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: AgricultureGlobal Aquafeed Additives Market Size Insights Forecasts to 2035

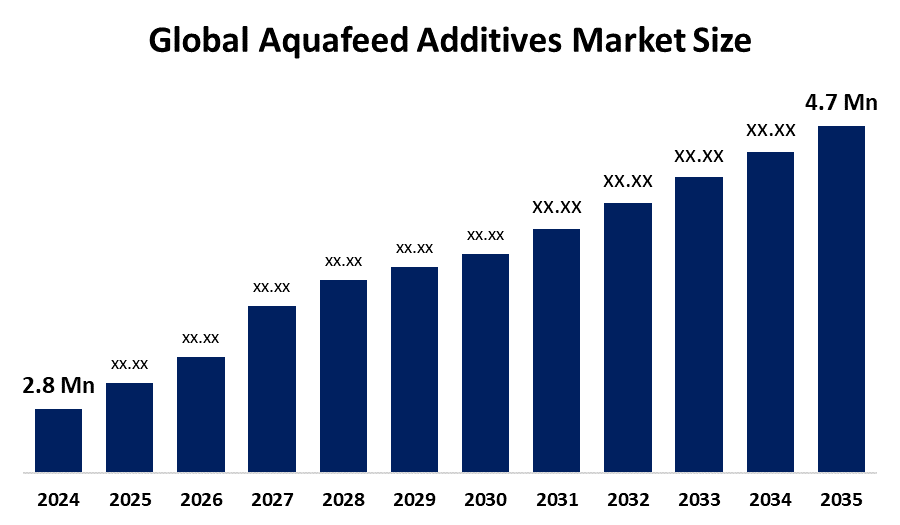

- The Global Aquafeed Additives Market Size Was Estimated at USD 2.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.82% from 2025 to 2035

- The Worldwide Aquafeed Additives Market Size is Expected to Reach USD 4.7 Million by 2035

- Europe is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Aquafeed Additives Market Size was worth around USD 2.8 Million in 2024 and is predicted to Grow to around USD 4.7 Million by 2035 with a compound annual growth rate (CAGR) of 4.82% from 2025 and 2035. The market for aquafeed additives has a number of opportunities to grow due to because they increase disease resistance & immunity, meet the growing demand for seafood and protein, improve feed efficiency, i.e. better nutrient absorption & feed conversion, and support sustainability goals, including lowering waste and environmental impact.

Market Overview

Aquafeed additives are materials that are purposefully added to fish, mollusk, and crustacean diets to enhance their nutritional content, stability, growth performance, and feed utilization. Feed formulators are responding to tightening antibiotic regulations, a growing demand for functional nutrition, and limited access to fishmeal by turning to precision engineered additive products that can improve feed conversion efficiency and help protect fish health. While the Asia Pacific production region facilitates increased volume, and Europe offers enforced legislation regarding sustainable aquaculture, the addition of novel protein sources like single cell biomass adds to the pool of high-quality additives that fit well together. Committed investment in AI feeding systems capable of 10-20% waste savings is also increasing uptake, especially for higher value shrimp and salmon producers. Upgrades remain limited by fishmeal pricing volatility and long government regulatory processes however, some risk is lessened by encouraging government programs and incentives, e.g., Vision 2030 in Saudi Arabia and Horizon grants in the EU. The global shift toward high density systems produced from robust water quality with a pre or probiotic component can be seen with the Saudi company, NAQUA, finishing development on 500 ponds to produce 250,000 metric tons by 2030. Intensive shrimp farms in China produced 2.09 million metric tons in 2022, but also represented pathogen threats and germplasm shortages driving immune compounds.

Governments all throughout the world have launched a number of programs to encourage the market expansion for aquafeed additives. To lessen reliance on fishmeal and fish oil, the NOAA USDA Alternative Feeds Initiative, for instance, encourages research into sustainable feed ingredients in the United States. Premixes, feed additives, and commercial aquafeeds must be licensed, registered, and subject to quality control in Thailand, where regulations also define the acceptable levels of additives.

Report Coverage

This research report categorizes the aquafeed additives market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aquafeed additives market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aquafeed additives market.

Global Aquafeed Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.82% |

| 2035 Value Projection: | USD 4.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Species Type, By Additives Type and COVID-19 Impact Analysis |

| Companies covered:: | Archer Daniels Midland Company, Cargill, Incorporated, Nutreco N.V., Alltech, Inc., Evonik Industries AG, DSM Nutritional Products, Kemin Industries, Inc., BIOMIN Holding GmbH, Novus International, Inc., DuPont de Nemours, Inc., Phibro Animal Health Corporation, Skretting AS, Trouw Nutrition, Adisseo France SAS, BioMar Group, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aquafeed additives market is driven by the fish have a lower fat content than other meats like cattle and poultry. The main purpose of fish is direct human ingestion, and it is a rich source of vitamins and proteins. Because more fish are becoming available in the retail market, people are eating more fish. Thus, in the upcoming years, there will probably be a greater demand for fish and fish products for direct human consumption. Furthermore, some species, such as salmon, tuna, cod liver, whale blubber, and seal blubber, are used to extract omega-3 fatty acids. Due to their ability to help reduce body fat, omega 3 supplements are expected to become more popular as obesity and other illnesses become more common.

Restraining Factors

The aquafeed additives market is restricted by factors like the scarcity of sustainable ingredients, identifying efficient substitutes to lower antibiotic use while preserving disease control, and controlling consumer attitudes and preferences around additives.

Market Segmentation

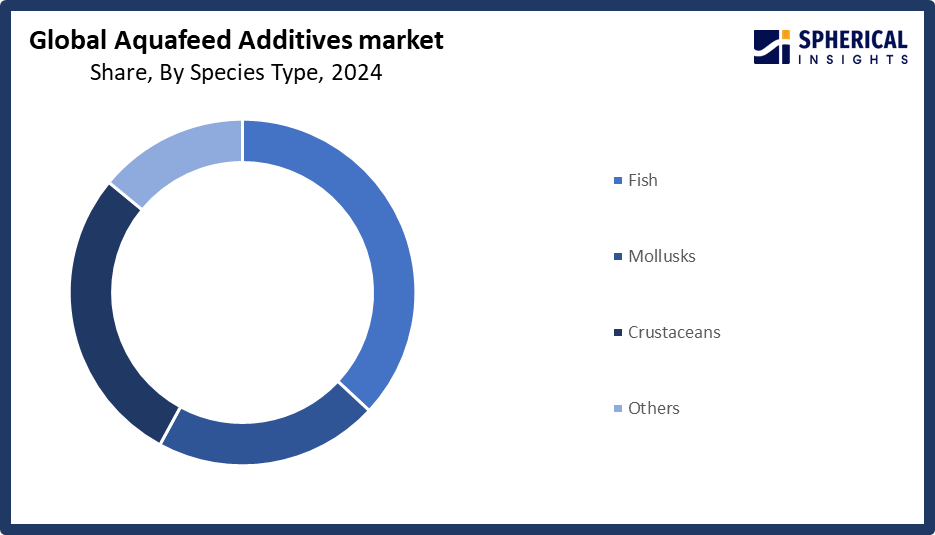

The aquafeed additives market share is classified into species type and additives type.

- The fish segment dominated the market in 2024, accounting for approximately 53.2% and is projected to grow at a substantial CAGR during the forecast period.

Based on the species type, the aquafeed additives market is divided into fish, mollusks, crustaceans, and others. Among these, the fish segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by this supremacy, translated into a projected USD 1.54 billion in 2025, representing the purchasing power of operators who have standardized additive methods to protect feed conversion ratios. Asian carp farms prioritize cost effective vitamin and enzyme packages to meet strict feed budgets, while salmon producers in Norway and Chile continue to stack functional amino acids and antioxidants that combat stress throughout high density grow out and shipping stages.

Get more details on this report -

- The amino acids segment accounted for the largest share in 2024, accounting for approximately 21.3% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the additives type, the aquafeed additives market is divided into vitamins, minerals, antioxidants, amino acids, enzymes, acidifiers, and more. Among these, the amino acids segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the 9.4% CAGR for probiotics and prebiotics reflects their widespread regulatory support and practical effectiveness. At 2 grams per kilogram, multi-strain mixes have improved Cirrhinus mrigala growth and antioxidant enzyme activity, lowering FCR by an average of 0.1 points. It is anticipated that the probiotics aquafeed additives market will grow from USD 0.34 billion in 2025 to USD 0.58 billion in 2030.

Regional Segment Analysis of the Aquafeed Additives Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 61.4% of the aquafeed additives market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share, representing nearly 61.4% of the aquafeed additives market over the predicted timeframe. In the Asia Pacific market, the region is rising due to it producing over 2 million metric tons of shrimp in 2024, generating 61.4% of worldwide revenue, and continues to propel volume growth. Changes in protein supplies and disease outbreaks push farms to incorporate immune boosting chemicals into fundamental amino acid packages. Aquaculture that is focused on exports is expanding in Vietnam and India, but price sensitivity makes it a two tiered sector where expensive additives and affordable mixes coexist.

China's aquafeed additives market is being driven by the country's expanding feed production facilities and rising seafood demand. In Guangdong Leizhou, for instance, Grobest China spent USD 37.7 million to construct a new aquaculture feed factory that can produce 250,000 tons annually.

Europe is expected to grow at a rapid CAGR, representing nearly 8.3% in the aquafeed additives market during the forecast period. The European aquafeed additives market is anticipated to expand at an 8.3% CAGR from USD 0.52 billion in 2025 to USD 0.77 billion by 2030 as a result of EU laws that raise environmental requirements. The salmon sector in Norway is leading the charge in the adoption of precision feeding and is also driving research with AI supported dosing devices that improve the efficacy of using functional additives. Horizon Europe programs invest approximately EUR 6 million annually in green feed research, accelerating the commercialization of antioxidants and phytonutrients derived from algae.

North America offers a developed yet open environment for innovation. Public private infrastructures where additive developers test new proteins or bacteriophage treatments under regulated settings are supported by the US Strategic Plan for Aquaculture. Eco friendly formulations are rewarded by the addition of ESG layers brought about by Canada's involvement with indigenous rights. Shrimp owners in Mexico, meanwhile, strengthen their relationships with international suppliers, increasing the throughput of additives.

The United States dominates the global market for aquafeed additives due to its advanced aquaculture industry, particularly for species like salmon, catfish, and mollusks that require particular feed formulas. High quality feed additives are developed and implemented in the United States due to a strong regulatory framework, significant R&D expenditures, and a strong infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aquafeed additives market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company

- Cargill, Incorporated

- Nutreco N.V.

- Alltech, Inc.

- Evonik Industries AG

- DSM Nutritional Products

- Kemin Industries, Inc.

- BIOMIN Holding GmbH

- Novus International, Inc.

- DuPont de Nemours, Inc.

- Phibro Animal Health Corporation

- Skretting AS

- Trouw Nutrition

- Adisseo France SAS

- BioMar Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, IFB Agro has approved to acquisition of Cargill India’s shrimp and freshwater fish feed business, including feed formulations, manufacturing facilities, and associated resources, to strengthen its position in the aquafeed sector.

- In May 2025, BioMar Norway achieved ASC Feed Certification, ensuring its feed production meets sustainability and environmental responsibility standards and supporting Norwegian salmon farms ahead of upcoming certification requirements.

- In May 2025, Marfeed, a newly launched brand by MIAVIT GmbH and Arctic Feed Ingredients AS, introduces innovative feed additives designed to enhance aquaculture health, nutrition, and sustainability.

- In July 2024, Aker BioMarine sold its Feed Ingredients business to Aker Capital and American Industrial Partners. The move allows Aker BioMarine to sharpen its strategic focus, highlighting the unit’s value and growth potential. The transaction involved several partners and reflects strong industry interest and confidence in the company’s future.

- In July 2024, Dr. Vivi Koletsi, a global technical support specialist within Alltech’s Technology Group, emphasized that sustainable aquafeed efficiency can be maximized by using flexible plant-based formulations combined with multi enzyme technologies. These advances improve nutrient absorption, boost fish growth, reduce environmental impact, and lower costs, supporting the aquaculture industry's sustainable expansion and responsible seafood production.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aquafeed additives market based on the below-mentioned segments:

Global Aquafeed Additives Market, By Species Type

- Fish

- Mollusks

- Crustaceans

- Others

Global Aquafeed Additives Market, By Additives Type

- Vitamins

- Minerals

- Antioxidants

- Amino Acids

- Enzymes

- Acidifiers

- More

Global Aquafeed Additives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the aquafeed additives market over the forecast period?The global aquafeed additives market is projected to expand at a CAGR of 4.82% during the forecast period.

-

2. What is the market size of the aquafeed additives market?The global aquafeed additives market size is expected to grow from USD 2.8 million in 2024 to USD 4.7 million by 2035, at a CAGR of 4.82% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the aquafeed additives market?Asia Pacific is anticipated to hold the largest share of the aquafeed additives market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global aquafeed additives market?Archer Daniels Midland Company, Cargill, Incorporated, Nutreco N.V., Alltech, Inc., Evonik Industries AG, DSM Nutritional Products, Kemin Industries, Inc., BIOMIN Holding GmbH, Novus International, Inc., DuPont de Nemours, Inc., Phibro Animal Health Corporation, Skretting AS, Trouw Nutrition, Adisseo France SAS, BioMar Group, and Others.

-

5. What factors are driving the growth of the aquafeed additives market?The aquafeed additives market growth is driven by factors such as the growing demand for seafood worldwide due to the decline of wild fish stocks, more stringent regulations, consumer preference for sustainable and antibiotic free feeds, increased feed efficiency through technological advancements, e.g., probiotics, enzymes, and the increasing use of alternative, plant or insect based protein sources.

-

6. What are the market trends in the aquafeed additives market?The aquafeed additives market trends include precision nutrition & functional additives, rise of natural, sustainable ingredients, regulatory pressure & antibiotic reduction, technological innovation & delivery systems, and growing demand driven by aquaculture expansion.

-

7. What are the main challenges restricting wider adoption of the aquafeed additives market?The aquafeed additives market trends include the high and variable cost of raw ingredients, i.e., premium plant proteins, fishmeal, and fish oil makes farming unaffordable, especially for small and medium farms.

Need help to buy this report?