Global Antifouling Coatings for Ships (Biocide-Free) Market Size, Share, and COVID-19 Impact Analysis, By Vessel Type (Cargo/Container, Tankers, Passenger/Cruise, Naval, and Offshore Vessels), By Coating Technology (Silicone/Fouling-Release, Fluoropolymer, Hydrophobic Nanocoatings, Biomimetic, and Other Eco-Friendly), By Application Method (Spray Coating, Brush/Roller Coating, Electrostatic/Advanced Coating Systems, Dry Dock Robotic Coating, and Other Methods), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Antifouling Coatings for Ships (Biocide-Free) Market Size Insights Forecasts to 2035

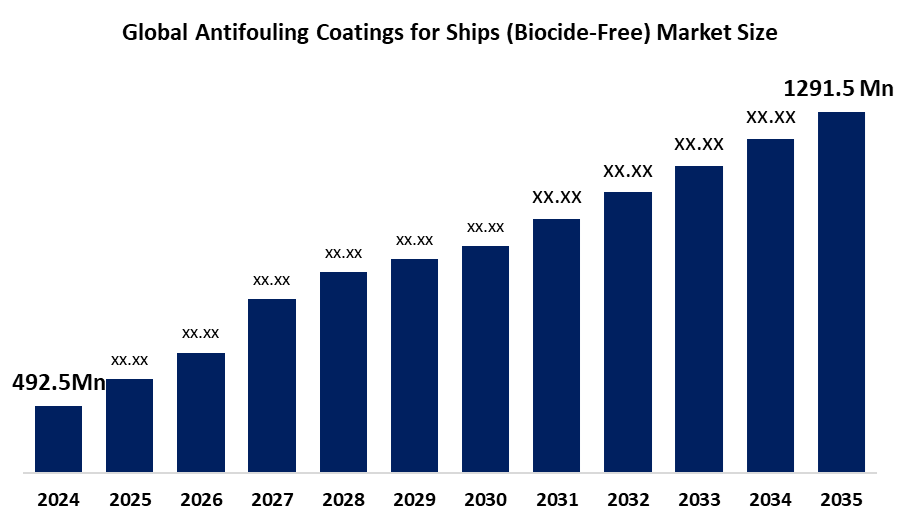

- The Global Antifouling Coatings for Ships (Biocide-Free) Market Size Was Estimated at USD 492.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.16% from 2025 to 2035

- The Worldwide Antifouling Coatings for Ships (Biocide-Free) Market Size is Expected to Reach USD 1291.5 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Antifouling Coatings for Ships (Biocide-Free) Market Size was worth around USD 492.5 Million in 2024 and is Predicted to Grow to around USD 1291.5 Million by 2035 with a compound annual growth rate (CAGR) of 9.16% from 2025 and 2035. The market for antifouling coatings for ships (biocide-free) has a number of opportunities to grow due to the rising development of innovative solutions that delivers surface entirely free of biocides.

Market Overview

The Global Antifouling Coatings for Ships (Biocide-Free) Industry is the market encompassing eco-friendly, non-toxic hull coatings that prevent marine growth (algae, barnacles) without releasing biocides into the sea, addressing strict environmental regulations. Biocide free antifouling forms a hard, protective layer that is water resistant, durable, chemically stable (inert), and non-toxic, applied in two layers below the waterline, with each layer applied to the correct thickness for optimal protection against wear and corrosion. The biocide-free antifouling is ideal for demanding applications where conventional, often biocide-rich hull coatings fall short, and its use is strictly regulated to protect the marine environment. New build ship deliveries with the expanding Asian shipbuilding capacity, as well as ship repair and maintenance activities, are promoting Antifouling Coatings for Ships (Biocide-Free) Market Size.

Innovation and market expansion are anticipated as a result of major players' growing investments and the expanding partnerships between sustainable marine technologies companies. In August 2025, Azra Tech, a sustainable marine technologies company, announced a partnership with Neptune Shipping, a European and Mediterranean short-sea car carrier operator, to promote environmentally friendly vessel performance.

Antifouling Coatings for Ships (Biocide-Free) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 492.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.16% |

| 2035 Value Projection: | USD 1291.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Vessel Type, By Coating Technology |

| Companies covered:: | Akzo Nobel (International Paint), Hempel A/S, PPG Industries, Jotun, Chugoku Marine Paints, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the Antifouling Coatings for Ships (Biocide-Free) Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Antifouling Coatings for Ships (Biocide-Free) Market Size. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Antifouling Coatings for Ships (Biocide-Free) Market Size.

Driving Factors

The regulatory compliance and shipping industry’s operational calendar, along with an increased shipping demand, especially during the warmer months, drives the Antifouling Coatings for Ships (Biocide-Free) Market Size. Further, surging innovation in fouling release technologies and nanotechnology due to the upsurging demand for lowering fuel consumption and reducing carbon dioxide emissions is propelling market growth. Additionally, the company’s increased investment in R&D activities is driving the demand across various end-users, including oil & gas, with an increasing urbanization and population, thereby driving the Antifouling Coatings for Ships (Biocide-Free) Market Size.

Restraining Factors

The Antifouling Coatings for Ships (Biocide-Free) Market Size is challenging due to the long-term antifouling performance of traditional toxic systems under varied sea conditions. Further, the limited awareness and conservative specification practices, as well as fluctuating prices of raw material is challenging the market growth.

Market Segmentation

The Antifouling Coatings for Ships (Biocide-Free) Market Size share is classified into vessel type, coating technology, and application method.

- The cargo/container segment accounted for the largest market share of about 32.6% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the vessel type, the Antifouling Coatings for Ships (Biocide-Free) Market Size is divided into cargo/container, tankers, passenger/cruise, naval, and offshore vessels. Among these, the cargo/container segment accounted for the largest market share of about 32.6% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cargo tanks are usually constructed from mild steel, and they need to be protected from corrosion and from the carriage of often aggressive cargoes. Coatings play a critical role in tank protection. An increasing adoption of biocide-free antifouling coatings to meet environmental sustainability goals and compliance with stricter international regulations of harmful chemicals in the marine environment is driving the segmental market.

Get more details on this report -

- The silicone/fouling-release segment accounted for the largest market share of about 34.7% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the coating technology, the Antifouling Coatings for Ships (Biocide-Free) Market Size is divided into silicone/fouling-release, fluoropolymer, hydrophobic nanocoatings, biomimetic, and other eco-friendly. Among these, the silicone/fouling-release segment accounted for the largest market share of about 34.7% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Fouling-release coatings (FRCs) with low surface free energy and high elasticity weakly adhere to marine organisms, so they can be readily removed by the water shear force. FRCs have attracted increasing interest because they are biocide-free and hence eco-friendly. Development of advanced hybrid and nanocomposite coatings with the combined silicone’s fouling release properties and epoxy polyurethane toughness is promoting the segmental market.

- The spray coating segment dominated the market with about 44.5% share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application method, the Antifouling Coatings for Ships (Biocide-Free) Market Size is divided into spray coating, brush/roller coating, electrostatic/advanced coating systems, dry dock robotic coating, and other methods. Among these, the spray coating segment dominated the market with about 44.5% share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The efficiency and ability of spray coating to provide uniform coverage over large areas are driving the market in the spray coating segment. Recently, researchers have established a simple, effective and stable antifouling spray coating method using the sulfated polysaccharide Fucoidan.

Regional Segment Analysis of the Antifouling Coatings for Ships (Biocide-Free) Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share about 41.2% in the Antifouling Coatings for Ships (Biocide-Free) Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of about 41.2% in the Antifouling Coatings for Ships (Biocide-Free) Market Size over the predicted timeframe. The Asia Pacific area has a thriving market for antifouling coatings for ships (biocide-free) due to its stringent environmental regulations and need for fuel-efficient solutions in shipbuilding hubs, such as China, South Korea, and Japan. Further, advancement in antifouling coating technology, and inclination towards sustainable coatings with new application techniques are promoting the market. China is the dominant country in the regional market with about 50.4% regional share, owing to the country’s massive shipbuilding industry and adoption of advanced, environmentally friendly, and biocide-free formulations.

North America is expected to grow at a rapid CAGR of about 9.1% in the Antifouling Coatings for Ships (Biocide-Free) Market Size during the forecast period. The market ecosystem in North America is strong, with the industry’s strong adoption of advanced, eco-friendly antifouling solutions. For instance, in November 2024, Hempel launched a silicone hull paint recharger for the Yacht market, Hempel’s Infinity, revolutionizing boat maintenance. The United States is the leading country in the North America Antifouling Coatings for Ships (Biocide-Free) Market Size, with an estimated CAGR of 8.2%, owing to the increasing demand for assisting solutions related to the adverse effects of fouling on vessel performance and efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Antifouling Coatings for Ships (Biocide-Free) Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Akzo Nobel (International Paint)

- Hempel A/S

- PPG Industries

- Jotun

- Chugoku Marine Paints

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Carnival Corporation applied the Aquaterras biocide-free coating to its 16th vessel, the AIDAdiva, following the ship’s latest drydock. The coating, provided by Nippon Paint Marine, is part of the company’s ongoing commitment to sustainability and environmental protection across its fleet.

- In October 2024, LR awarded the maritime industry’s first enhanced antifouling type approval to GIT Coatings. Lloyd’s Register (LR) has awarded the maritime industry’s first Enhanced Antifouling Type Approval to GIT Coatings. The development of this new type of approval sets a new standard for antifouling coatings to address the growing need for effective biofouling management.

- In March 2024, PPG announced the launch of PPC NEXEON 810 coating, an innovative copper-free antifouling developed with a strong emphasis on vessel performance, emissions reduction and sustainability.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Antifouling Coatings for Ships (Biocide-Free) Market Size based on the below-mentioned segments:

Global Antifouling Coatings for Ships (Biocide-Free) Market Size, By Vessel Type

- Cargo/Container

- Tankers

- Passenger/Cruise

- Naval

- Offshore Vessels

Global Antifouling Coatings for Ships (Biocide-Free) Market Size, By Coating Technology

- Silicone/Fouling-Release

- Fluoropolymer

- Hydrophobic Nanocoatings

- Biomimetic

- Other Eco-Friendly

Global Antifouling Coatings for Ships (Biocide-Free) Market Size, By Application Method

- Spray Coating

- Brush/Roller Coating

- Electrostatic/Advanced Coating Systems

- Dry Dock Robotic Coating

- Other Methods

Global Antifouling Coatings for Ships (Biocide-Free) Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Antifouling Coatings for Ships (Biocide-Free) Market Size?The global Antifouling Coatings for Ships (Biocide-Free) Market Size is expected to grow from USD 492.5 Million in 2024 to USD 1291.5 Million by 2035, at a CAGR of 9.16% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the Antifouling Coatings for Ships (Biocide-Free) Market Size?Asia Pacific is anticipated to hold the largest share of the Antifouling Coatings for Ships (Biocide-Free) Market Size over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Antifouling Coatings for Ships (Biocide-Free) Market Size from 2024 to 2035?The market is expected to grow at a CAGR of around 9.16% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Antifouling Coatings for Ships (Biocide-Free) Market Size?Key players include Akzo Nobel (International Paint), Hempel A/S, PPG Industries, Jotun, and Chugoku Marine Paints.

-

5. Can you provide company profiles for the leading antifouling coatings for ships (biocide-free) manufacturers?Yes. For example, Akzo Nobel (International Paint) is a chemical company, that manufactures, distributes, and sells decorative paints, performance coatings and specialty coatings, including marine coatings, offering the products under the brand Sikkens, Dulux, Interpon, International, Butanox, Dissolvine, Dry-Flo, Elostex, Kramasil, Levasil and Resicoat. Hempel A/S is a world-leading supplier of trusted coating solutions, is a global company with strong values, working with customers in the decorative, marine, infrastructure, and energy industries.

-

6. What are the main drivers of growth in the Antifouling Coatings for Ships (Biocide-Free) Market Size?Regulatory compliance and the shipping industry’s operational calendar, innovation in fouling-releasing technology, and increased R&D investments are major market growth drivers of the Antifouling Coatings for Ships (Biocide-Free) Market Size.

-

7. What challenges are limiting the Antifouling Coatings for Ships (Biocide-Free) Market Size?The long-term antifouling performance of traditional toxic systems, limited awareness, and fluctuating raw material prices remain key restraints in the Antifouling Coatings for Ships (Biocide-Free) Market Size.

Need help to buy this report?