Global Anti-Viral Nasal Spray Market Size, Share, and COVID-19 Impact Analysis, By Age Group (Pediatric, Adult, and Geriatric), By Application (Influenza, Common Cold, COVID-19, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Anti-Viral Nasal Spray Market Insights Forecasts to 2035

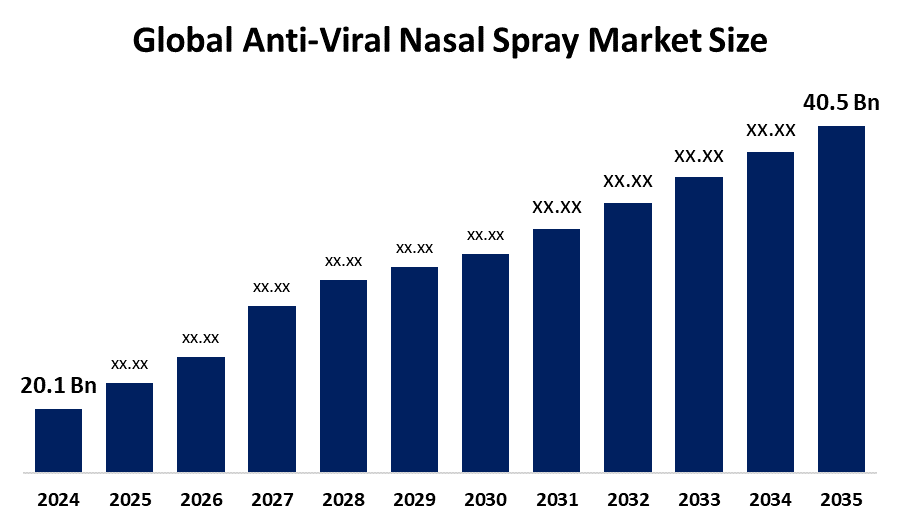

- The Global Anti-Viral Nasal Spray Market Size Was Estimated at USD 20.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.58% from 2025 to 2035

- The Worldwide Anti-Viral Nasal Spray Market Size is Expected to Reach USD 40.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Anti-Viral Nasal Spray Market Size was worth around USD 20.1 Billion in 2024 and is predicted to grow to around USD 40.5 Billion by 2035 with a compound annual growth rate (CAGR) of 6.58% from 2025 and 2035. The market for anti-viral nasal spray has a number of opportunities to grow due to increasing adoption of preventive treatment measures, with an ongoing research on anti-viral nasal sprays for preventing COVID-19.

Market Overview

The global industry of anti-viral nasal spray is focused on designing the preventative treatment to protect against viral infections like respiratory viruses by acting in the upper respiratory tract. According to the WHO report, there are 3-5 million cases of severe influenza, which is an acute respiratory infection, and causes 290,000 to 650,000 respiratory deaths annually, mostly affecting children. Antibody-based nasal sprays are providing protection against infection who are likely to be exposed to the virus. They are used in combination with other non-pharmaceutical interventions for immediate and temporary protection against viral infection, complementing active immunization strategies.

Innovation and market expansion are anticipated as a result of major players' growing emphasis on R&D for effective formulation deployment strategies and the expanding partnerships between biotech companies. For instance, NoriZite was developed by the Healthcare Technologies Institute at the University of Birmingham in 2021, and has shown that it can block infection with Omicron SARS-CoV-2 variant in cell culture. The growing adoption of naturally derived antiviral formulations is driving a huge surge in the global anti-viral nasal spray market.

Report Coverage

This research report categorizes the anti-viral nasal spray market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the anti-viral nasal spray market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the anti-viral nasal spray market.

Anti-Viral Nasal Spray Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.58% |

| 2035 Value Projection: | USD 40.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Age Group, By Application and By Region |

| Companies covered:: | Cipla, Starpharma, Glenmark Pharmaceuticals, AstraZeneca Plc, Abbott Laboratories Inc., Pfizer, Merck & Co., Inc., GSK Plc, Dr. Reddy’s Laboratories Ltd., Viatris Inc., Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Consumer increasing prioritization for needle-free antiviral therapy for the convenience of self-administration and non-invasive healthcare is driving the anti-viral nasal spray market. An increasing awareness regarding the prevention of respiratory illnesses, especially RSV, with the surging concerns of mortality rate related to respiratory infection in the developing region, is contributing to propel the market demand. It was found that nearly 3.6 million hospitalization and 100,000 deaths in children under five each year globally. For instance, in January 2025, the health minister has asked states to strengthen and review Influenza Like Illness (ILI) and severe acute respiratory surveillance (SARI) following detection of HMPV cases. The increasing product approval and commercialization of anti-viral nasal sprays, along with an increasing trend towards the use of combination therapies, are promoting market growth.

Restraining Factors

The anti-viral nasal spray market is restricted by challenges associated with regulatory approval from health authorities like the FDA and a lack of sufficient clinical evidence regarding nasal spray formulation. Further, increased competition and brand differentiation are challenging the market growth.

Market Segmentation

The anti-viral nasal spray market share is classified into age group and application.

- The adult segment is anticipated to dominate the anti-viral nasal spray market with a 42.1% share and is anticipated to grow at a significant CAGR during the projected period.

Based on the age group, the anti-viral nasal spray market is divided into pediatric, adult, and geriatric. Among these, the adult segment is anticipated to dominate the anti-viral nasal spray market with a 42.1% share and is anticipated to grow at a significant CAGR during the projected period. Adult age group consumers primarily use nasal spray as a first-line treatment of viral infection for rapid symptom relief. An increasing approval of nasal spray products, along with their increased manufacturing approval, is driving the market. For instance, in February 2022, Glenmark Pharmaceuticals and its partner Canadian biotech firm SaNOtize Research launched Nitric Oxide nasal spray, named FabriSpray, for the treatment of adult patients with COVID-19.

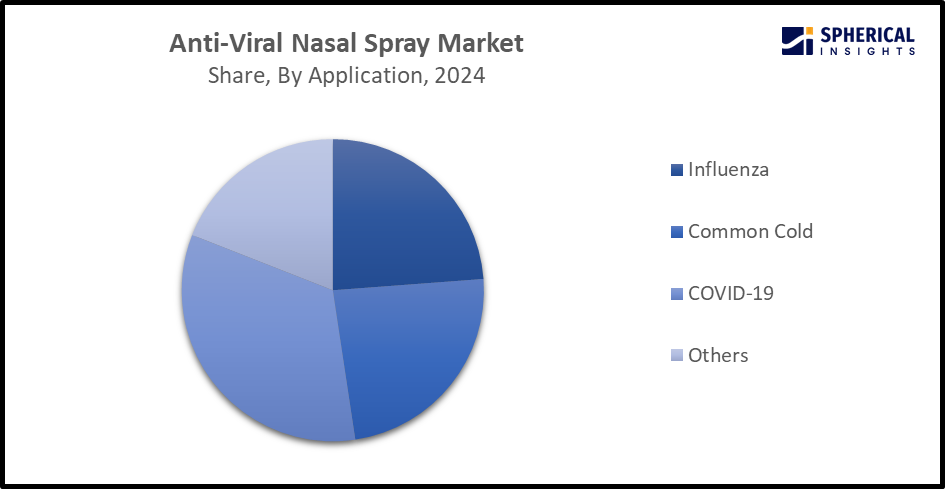

- The COVID-19 segment dominated the market with the largest market revenue share of 34.9% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the anti-viral nasal spray market is divided into influenza, common cold, COVID-19, and others. Among these, the COVID-19 segment dominated the market with the largest market revenue share of 34.9% in 2024 and is projected to grow at a substantial CAGR during the forecast period. There is an increasing public health initiatives that emphasizes public education about viral infections, including COVID-19. For instance, in April 2022, the Russian Health Ministry registered the nasal version of Sputnik V, which is the world’s first nasal vaccine against COVID-19.

Get more details on this report -

Regional Segment Analysis of the Anti-Viral Nasal Spray Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the anti-viral nasal spray market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of 41.6% in the anti-viral nasal spray market over the predicted timeframe. The market ecosystem in North America is strong, due to the surging development of innovative technology for preventing viral infections. For instance, in April 2022, SK Bioscience announced that the company would initiate preclinical development of an innovative binder protein compound designed to prevent and treat COVID-19 when sprayed into the nasal passages. The demand for anti-viral nasal spray has been driven by the region's strong regulatory standards and availability of new treatments. The United States dominates the anti-viral nasal spray market in the North American region, with a major share of approximately 70-90%, attributed to ongoing concerns related to COVID-19 viruses that drive demand for antiviral treatments.

Asia Pacific is expected to grow at a rapid CAGR in the anti-viral nasal spray market during the forecast period. The Asia Pacific area has a thriving market for anti-viral nasal spray due to the region’s complex regulations, along with increasing healthcare knowledge and disposable income. Increasing technological advancements and strategic alliances are promoting the market growth of anti-viral nasal spray. For instance, in May 2022, Birmingham Biotech Ltd, an innovator in diagnostic tests, protective nasal sprays and mobile medical facilities, announced the Singapore launch of its latest technology, BHM Anti-Viral Nasal Spray. China is dominating the Asia Pacific anti-viral nasal spray market, with an anticipated CAGR of 6.75% during the forecast period, driven by increasing emphasis on improving the healthcare system in medical institutions and community settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the anti-viral nasal spray market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cipla

- Starpharma

- Glenmark Pharmaceuticals

- AstraZeneca Plc

- Abbott Laboratories Inc.

- Pfizer

- Merck & Co., Inc.

- GSK Plc

- Dr. Reddy’s Laboratories Ltd.

- Viatris Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Dutch biotech Leyden Laboratories B.V. announced €30 million in new equity financing from the European Innovation Council (EIC) Fund and Invest-NL to advance the Company’s clinical development of its pan-influenza nasal spray (PanFlu) and broader mucosal pipeline and platform activities.

- In September 2025, Azelastine, commonly used in nasal sprays to combat allergies, was found to reduce the incidence of SARS-CoV-2 among healthy controls in a phase 2 trial. New results from a phase 2 double-blind, placebo-controlled, single-center study published by investigators in JAMA Internal Medicine demonstrate that azelastine nasal spray reduced the risk of SARS-CoV-2 respiratory infections, which cause the COVID-19 virus.

- In August 2025, AstraZeneca launched FluMist Home, the first of its kind, at-home delivery service for FLUMIST (Influenza Vaccine Live, Intranasal). It is the first and only seasonal influenza vaccine approved to be self-administered by adults 18 to 49 years of age or administered by a parent or caregiver to individuals 2-17 years of age.

- In March 2025, Flanders Red Cross advanced research on a nasal spray to prevent virus transmission. The spray is based on convalescent blood plasma from people who have recovered, which contains virus-specific antibodies.

- In February 2022, Glenmark Pharmaceuticals Limited (Glenmark), a global, innovation-driven pharmaceutical company and Canadian pharmaceutical company SaNOtize Research & Development Corp. announced the launch of its Nitric Oxide Spray under the brand name FabiSpray in India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the anti-viral nasal spray market based on the below-mentioned segments:

Global Anti-Viral Nasal Spray Market, By Age Group

- Pediatric

- Adult

- Geriatric

Global Anti-Viral Nasal Spray Market, By Application

- Influenza

- Common Cold

- COVID-19

- Others

Global Anti-Viral Nasal Spray Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the anti-viral nasal spray market?The global anti-viral nasal spray market size is expected to grow from USD 20.1 Billion in 2024 to USD 40.5 Billion by 2035, at a CAGR of 6.58% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the anti-viral nasal spray market?North America is anticipated to hold the largest share of the anti-viral nasal spray market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Anti-Viral Nasal Spray Market from 2024 to 2035?The market is expected to grow at a CAGR of around 6.58% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Anti-Viral Nasal Spray Market?Key players include Cipla, Starpharma, Glenmark Pharmaceuticals, AstraZeneca Plc, Abbott Laboratories Inc., Pfizer, Merck & Co., Inc., GSK Plc, Dr. Reddy’s Laboratories Ltd., and Viatris Inc.

-

5. Can you provide company profiles for the leading anti-viral nasal spray manufacturers?Yes. For example, Cipla is an Indian multinational pharmaceutical company headquartered in Mumbai, primarily focuses on developing medication to treat respiratory disease, cardiovascular disease, arthritis, diabetes, depression, paediatric and various other medical conditions. Starpharma is an innovative biotechnology company with two decades of experience in advancing dendrimer technology from the lab to the patient.

-

6. What are the main drivers of growth in the anti-viral nasal spray market?The changing inclination towards needle-free antiviral therapy for the convenience of self-administration and non-invasive healthcare are major market growth drivers of the anti-viral nasal spray market.

-

7. What challenges are limiting the anti-viral nasal spray market?The regulatory complexities, increased competition, and brand differentiation remain key restraints in the anti-viral nasal spray market.

Need help to buy this report?