Global Animal Blood Bank Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Companion Animals, Livestock, and Others), By End User (Veterinary Hospitals & Clinics, Animal Research Institutes & Universities, and Mobile Veterinary Units / Field Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Veterinary Blood Bank for Pets Market Insights Forecasts to 2035

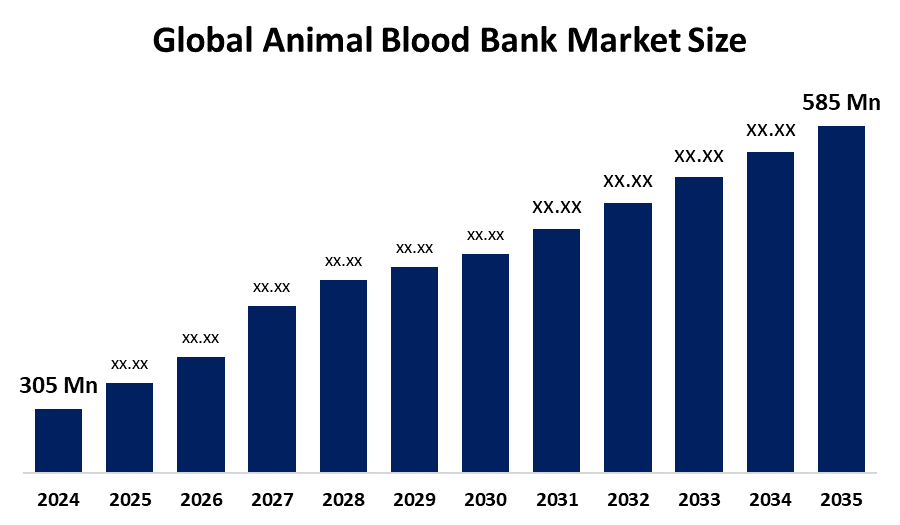

- The Global Animal Blood Bank Market Size Was Estimated at USD 305 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.1% from 2025 to 2035

- The Worldwide Veterinary Blood Bank for Pets Market Size is Expected to Reach USD 585 Million by 2035

- Asia Pacific is Expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Animal Blood Bank Market Size was worth around USD 305 Million in 2024 and is predicted to grow to around USD 585 Million by 2035 with a compound annual growth rate (CAGR) of 6.1% from 2025 and 2035. The animal blood bank market offers opportunities for developing transfusion technologies, growing pet ownership, improving veterinary care, and supporting research in regenerative medicine, zoonotic illnesses, and ethical blood sourcing methods.

Market Overview

The veterinary healthcare industry that deals with the collection, processing, distribution, and storage of animal blood and blood-derived components for medical, diagnostic, and research uses is known as the animal blood bank market. These blood products, which include whole blood, plasma, serum, red blood cells, and platelets, are mostly utilized in animal hospitals, veterinary clinics, and research facilities to treat immunological disorders, trauma, anemia, and surgical disorders of farm and companion animals.

The veterinary blood bank for pets market is focused on developing safe, moral, and easily available blood banking systems to improve emergency and chronic care for companion animals, improve transfusion services, and advance blood component technology. A number of important variables that represent the changing veterinary healthcare landscape are driving the animal blood bank market. Numerous interconnected elements influence the pet veterinary blood bank market. The primary factor is the growing number of pets owned worldwide, which has raised demand for cutting-edge veterinary care, including blood transfusions for ailments like anemia, trauma, and surgical complications.

Report Coverage

This research report categorizes the animal blood bank market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the animal blood bank market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the animal blood bank market.

Animal Blood Bank Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 305 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.1% |

| 2035 Value Projection: | USD 585 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Animal Type, By End User, By Region |

| Companies covered:: | Corning Inc., GeminiBio, Proliant Inc., Neogen Corp., PAN Biotech, Merck KGaA, Danaher Corp., Bio-Techne Corp., Moregate Biotech, Atlas Biologicals Inc., HiMedia Laboratories, Technologies India Pvt Ltd., Bovogen Biologicals Pty Ltd, Lampire Biological Laboratories, Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for transfusion services has increased as pet owners and veterinarians become more aware of their availability and advantages. Additionally, more money is being spent on veterinary diagnostics and research, where blood components are essential, as a result of the increased focus on animal welfare and the control of zoonotic illnesses. The safety and effectiveness of veterinary blood products have improved by technological developments in blood collection, storage, and transfusion methods. Stricter regulations have been adopted by veterinary groups and regulatory agencies to standardize transfusion processes, which has further aided animal blood bank market.

Restraining Factors

Limited donor availability, high operating costs, regulatory obstacles, ethical concerns about animal welfare, and a lack of awareness among pet owners, especially in developing nations, are all factors impeding the market for animal blood banks and limiting accessibility and market growth.

Market Segmentation

The veterinary blood bank for pets market share is classified into type and end user.

- The companion animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the animal blood bank market is divided into companion animals, livestock, and others. Among these, the companion animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing number of pets worldwide, increased knowledge of sophisticated veterinary care, and the growing prevalence of chronic and surgical illnesses in companion animals are the main factors propelling the companion animals’ market. The need for life-saving treatments like blood transfusions has been further spurred by the growing emotional bond between pet owners and their animals.

- The veterinary hospitals & clinics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the animal blood bank market is divided into veterinary hospitals & clinics, animal research institutes & universities, and mobile veterinary units/field services. Among these, the veterinary hospitals & clinics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing demand for sophisticated diagnostic and surgical techniques, the expanding prevalence of conditions requiring blood transfusions in animals, and the general accessibility of specialized veterinary services are the factors driving the veterinary hospitals and clinics segment.

Regional Segment Analysis of the Veterinary Blood Bank for Pets Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the animal blood bank market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the animal blood bank market over the predicted timeframe. The high percentage of pet owners, sophisticated veterinary healthcare infrastructure, and rising consciousness of animal health and welfare are what propel North America. A robust network of animal hospitals, research facilities, and veterinary clinics in the area actively use blood products for diagnosis and care. The increased demand for transfusion services in livestock and companion animals, bolstered by supportive regulatory frameworks and growing investments in veterinary innovation, has made the United States the market leader in the region.

Asia Pacific is expected to grow at a rapid CAGR in the veterinary blood bank for pets market during the forecast period. Growing knowledge of veterinary care, rising pet ownership, and developing infrastructure in emerging economies are the main drivers of Asia Pacific. The rising incidence of zoonotic diseases and easier access to veterinary clinics are driving up demand for animal transfusion services in nations like China, India, and Japan. Due to the region's unrealized potential, there are a lot of chances for investment and industry growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the veterinary blood bank for pets market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Corning Inc.

- GeminiBio

- Proliant Inc.

- Neogen Corp.

- PAN Biotech

- Merck KGaA

- Danaher Corp.

- Bio-Techne Corp.

- Moregate Biotech

- Atlas Biologicals Inc.

- HiMedia Laboratories

- Technologies India Pvt Ltd.

- Bovogen Biologicals Pty Ltd

- Lampire Biological Laboratories

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the veterinary blood bank for pets market based on the below-mentioned segments:

Global Animal Blood Bank Market, By Animal Type

- Companion Animals

- Livestock

- Others

Global Animal Blood Bank Market, By End User

- Veterinary Hospitals & Clinics

- Animal Research Institutes & Universities

- Mobile Veterinary Units / Field Services

Global Animal Blood Bank Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the animal blood bank market over the forecast period?The global animal blood bank market is projected to expand at a CAGR of 6.1% during the forecast period.

-

2. What is the market size of the veterinary blood bank for pets market?The global animal blood bank market size is expected to grow from USD 305 million in 2024 to USD 585 million by 2035, at a CAGR of 6.1% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the animal blood bank market?North America is anticipated to hold the largest share of the animal blood bank market over the predicted timeframe.

Need help to buy this report?