Global Anhydrous Hydrofluoric Acid Market Size, Share, and COVID-19 Impact Analysis, By Type (Fluorite-Based and Fluorosilicic Acid), By Application (Intermediate in Chemical Reactions, and Fuming Agents), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Anhydrous Hydrofluoric Acid Market Size Insights Forecasts to 2035

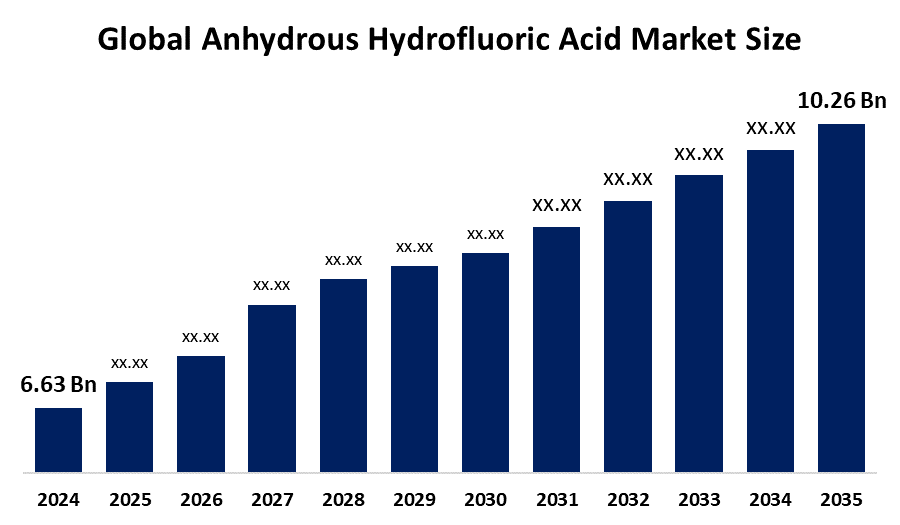

- The Global Anhydrous Hydrofluoric Acid Market Size Was Estimated at USD 6.63 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.05% from 2025 to 2035

- The Worldwide Anhydrous Hydrofluoric Acid Market Size is Expected to Reach USD 10.26 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Anhydrous Hydrofluoric Acid Market Size was worth around USD 6.63 Billion in 2024, Growing to 6.80 Billion in 2025, and is predicted to Grow to around USD 10.26 Billion by 2035 with a compound annual growth rate (CAGR) of 4.05% from 2025 to 2035. The growing demand for fluoropolymer and fluorochemical production, expanding applications in the electronics and pharmaceutical industries, and improvements in refining technologies particularly in emerging economies with growing industrial and manufacturing sectors present opportunities for the anhydrous hydrofluoric acid market.

Global Anhydrous Hydrofluoric Acid Market Forecast and Revenue Size

- 2024 Market Size: USD 6.63 Billion

- 2025 Market Size: USD 6.80 Billion

- 2035 Projected Market Size: USD 10.26 Billion

- CAGR (2025-2035): 4.05%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The global production, distribution, and use of pure, water-free hydrogen fluoride (HF), a colorless, corrosive liquid necessary for etching semiconductors, creating fluorochemicals, and creating pharmaceutical intermediates, are all included in the Anhydrous Hydrofluoric Acid (AHF) Market. AHF is a vital raw material for many industrial processes, such as the production of aluminum fluoride, fluorocarbons, and fluoropolymers, as well as a catalyst in the refining of petroleum. The market is made up of a number of producers, suppliers, end users, and regulatory agencies that work in a variety of industries, including as electronics, metallurgy, chemicals, and pharmaceuticals. For Instance, In October 2025, A major increase in manufacturing capacity has been announced by Tanfac Industries, a prominent leader in the fluorine chemicals industry. The company doubled its total capacity to 10,000 TPA (Tonnes Per Annum) on an Anhydrous Hydrofluoric Acid (AHF) basis by successfully commissioning the second phase of its Grade Dilute Hydrofluoric Acid plant. Technological developments, government investments in semiconductors and electronics, and robust manufacturing capabilities are the main drivers of the market. Use in metal treatment and glass etching procedures supports market expansion. Growth is also being driven by strong industrial development and technological advancements throughout the Asia Pacific region.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the Anhydrous Hydrofluoric Acid market during the forecast period.

- In terms of Type, the fluorite-based segment is projected to lead the Anhydrous Hydrofluoric Acid market throughout the forecast period

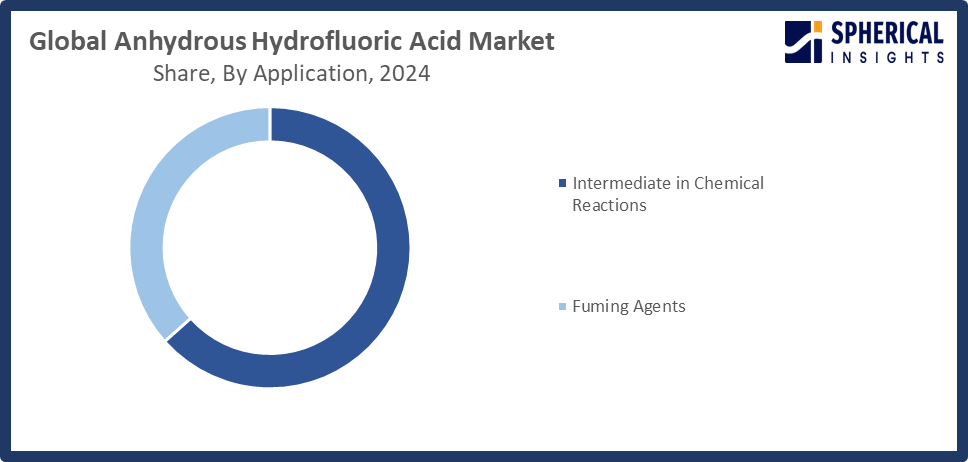

- In terms of application, the intermediate in chemical reactions segment captured the largest portion of the market

Anhydrous Hydrofluoric Acid Market Trends

- Tighter regulations affecting transportation and production

- Technological developments for handling and storing AHF safely

- Growing industrialization, particularly in Asia-Pacific emerging markets

- AHF is being used more often as an alkylation catalyst in petroleum refining

- Growing need for fluoropolymers in the electronics and automotive sectors

- Chemical demand is being driven by the expansion of semiconductor production.

Report Coverage

This research report categorizes the anhydrous hydrofluoric acid market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the Anhydrous Hydrofluoric Acid market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Anhydrous Hydrofluoric Acid market.

Global Anhydrous Hydrofluoric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.63 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.05% |

| 2035 Value Projection: | USD 10.26 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 155 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | BASF, Solvay, Arkema, LANXESS, Gulf Flour, SRF Limited, Donguye Group Ltd., Stella Chemifa Corporation, Honeywell International Inc., Orbia Flour & Energy Materials, Zhejiang Yonghe Refrigerant Co.,Ltd., Navin Flourine International Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors:

The rising demand for fluorinated compounds such as fluoropolymers and fluorocarbons, which are extensively employed in the chemical, automotive, and electronics sectors due to their chemical resistance and thermal stability, is one of the primary factors driving the growth of the market. The expanding chemical sector, where AHF is a necessary raw ingredient for the production of fluorocarbons and fluoropolymers, is one of the main growth engines. Due to its essential role in next-generation etching techniques, the requirement for high-purity AHF is significantly fueled by the shift toward smaller semiconductor nodes and 3D architectures. AHF is used to clean and etch silicon wafers, and as a result of ongoing technical improvements and the growing demand for consumer electronics, there is a market for high-purity AHF.

Restraining Factors:

Anhydrous hydrofluoric acid's high toxicity and corrosiveness, strict environmental and safety laws, difficulties in storing and transporting the chemical safely, and variable raw material prices are the main reasons impeding the market.

Market Segmentation

The global anhydrous hydrofluoric acid market is divided into type and application.

Global Anhydrous Hydrofluoric Acid Market, By Type:

Why is fluorite-based material preferred for producing anhydrous hydrofluoric acid?

The fluorite-based segment led the anhydrous hydrofluoric acid market, generating the largest revenue share. The most popular source of anhydrous hydrofluoric acid (AHF) dysprosium is fluorite-based referred to as fluorspar and the calcium fluoride mineral CaF2. It is used due to the dependable chemical structure, high purity, and well-established processing methods utilized by the industry. Due to its extensive application in important industries like chemical production, electronics manufacturing, and semiconductor manufacturing, the fluorite-based segment dominated the market.

The fluorosilicic acid segment in the anhydrous hydrofluoric acid market is expected to grow at the fastest CAGR over the forecast period. The growing uses of fluorosilicic acid in metal surface treatment, water fluoridation, and as a precursor for other fluorine-based compounds are what are driving the expansion of this industry. The need for sustainable water treatment methods and increased environmental consciousness are also driving the demand for fluorosilicic acid.

Global Anhydrous Hydrofluoric Acid Market, By Application:

Why is the intermediate in chemical processes segment significant in the AHF market?

The intermediate in chemical reactions segment held the largest market share in the anhydrous hydrofluoric acid market. Anhydrous hydrofluoric acid (AHF), an intermediate in a chemical sequence, has many applications, chief among them being the synthesis of numerous significant fluorine-based compounds. The extensive usage of AHF as a crucial intermediary in the synthesis of numerous fluorine-containing chemicals, such as fluoropolymers, refrigerants, and medicines, is responsible for the intermediate in chemical processes segment.

Get more details on this report -

The fuming agents segment in the anhydrous hydrofluoric acid market is expected to grow at the fastest CAGR over the forecast period. The demand for fuming AHF in etching procedures, specialized chemical manufacture, and high-purity applications in semiconductor fabrication is driving the expansion of the fuming agents market. One of the main factors driving this segment's growth is the fast-growing electronics industry's increasing need for accurate etching and cleaning solutions.

Regional Segment Analysis of the Global Anhydrous Hydrofluoric Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Anhydrous Hydrofluoric Acid Market Trends

Get more details on this report -

What is driving the expansion of the Asia-Pacific anhydrous hydrofluoric acid (AHF) market?

The Asia-Pacific region's growing industrial base, especially in nations like China, India, Japan, and South Korea, is the main driver of its expansion. AHF is an essential chemical used in the fabrication of semiconductors, fluorocarbons, fluoropolymers, and aluminum fluoride, as well as in the refining of petroleum, all of which are expanding significantly in the Asia-Pacific region. anhydrous hydrofluoric acid market remained stable during the week of September 19th. Firmness emerged in China amid high fluorspar costs and strict mining rules, while steady refrigerant demand supported prices. Japan and the USA stayed reliant on imports.

Japan Anhydrous Hydrofluoric Acid Market Trends

What industries are driving the expanding demand for HF in Japan?

Japan is promoting technological innovation (safer HF generation, on-site procedures) and upstream (source of raw materials, production facilities) to strengthen its HF supply chain, lessen reliance on imports, and satisfy the expanding demands of the battery, electronics, and refrigerant industries. In Kitakyushu City Fukuoka Prefecture, Mitsubishi Heavy Industries (MHI) was awarded a contract to provide the front-end engineering and design (FEED) for a hydrogen fluoride plant.

China Anhydrous Hydrofluoric Acid Market Trends

Why is hydrofluoric acid considered an important raw material in China?

China possesses with a wealth of the raw materials needed to produce AHF (hydrofluoric acid itself is the second most important raw material), as well as sizable downstream industries and market demand. China's fast-growing high-growth industries, such as electronics, automotive, and air conditioning/refrigeration, are driving up demand for hydrofluoric acid raw materials, particularly AHF.

North America Anhydrous Hydrofluoric Acid Market Trends

What sectors are driving the demand for anhydrous hydrofluoric acid (AHF) in North America?

The growing demand from the chemical, electronics, and petroleum refining sectors is what propels North America. In the production of fluoropolymers, refrigerants, and semiconductors, AHF is necessary for the etching and cleaning procedures. The United States' substantial investments in high-tech manufacturing sectors and sophisticated industrial infrastructure have allowed it to dominate the regional market overall. In order to facilitate phasedown compliance and minimize disruptions to the refrigerant industry, the U.S. Environmental Protection Agency (EPA) announced the August 26, 2025, final rule that renews eligibility for HFC application-specific allowances under the AIM Act.

U.S Anhydrous Hydrofluoric Acid Market Trends

What role does petroleum refining play in the demand for AHF in the U.S.?

The growing demand for anhydrous hydrofluoric acid (AHF) from sectors like semiconductor manufacturing, fluoropolymer synthesis, and petroleum refining is propelling the market in the United States. AHF prices in the United States hit about $2,460 per metric ton in the first quarter of 2025 due to limited availability of raw materials and growing manufacturing costs. In its May 27, 2025, report on Honeywell's Geismar site, the U.S. Chemical Safety Board called attention to corrosion-related HF leaks that may have been avoided and recommended stronger protections.

Canada Anhydrous Hydrofluoric Acid Market Trends

What are the vital uses of anhydrous hydrofluoric acid (AHF) in Canada?

The vital uses of anhydrous hydrofluoric acid (AHF) in several industries are expected to propel the market's steady expansion in Canada. In an effort to promote safer alternatives and lessen fluorochemical contamination of the environment, the Government of Canada recently announced plans to phase out PFAS in firefighting foams by September 26, 2025, under the CEPA. Consultations are open until November 2025.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global anhydrous hydrofluoric acid market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Anhydrous Hydrofluoric Acid Market Include

- BASF

- Solvay

- Arkema

- LANXESS

- Gulf Flour

- SRF Limited

- Donguye Group Ltd.

- Stella Chemifa Corporation

- Honeywell International Inc.

- Orbia Flour & Energy Materials

- Zhejiang Yonghe Refrigerant Co.,Ltd.

- Navin Flourine International Limited

- Others

Recent Development

- In October 2024, Honeywell International Inc. acquired Air Products for USD 1.8 billion, strengthening its process technologies in energy markets like LNG. This acquisition may boost fluorochemical use in cooling systems, indirectly driving increased demand for anhydrous hydrofluoric acid (AHF).

- In August 2024, Honeywell International Inc. acquired CAES, a provider of advanced electronics for aerospace and defense, including RF and microelectronic components. This strategic acquisition strengthens Honeywell’s position in semiconductor-related markets, where anhydrous hydrofluoric acid (AHF) is essential for etching and cleaning processes, potentially boosting AHF demand.

- In July 2023, Navin Fluorine announced a new capital expenditure of?450 crore (USD 54.22 million) to develop a facility for the production of 40,000 tons of anhydrous hydrofluoric acid (AHF) annually in Dahej, India. The facility, which is anticipated to be operational by early 2025, intends to improve the company's standing in the world market for fluorochemicals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the anhydrous hydrofluoric acid market based on the following segments:

Global Anhydrous Hydrofluoric Acid Market, By Type

- Fluorite-Based

- Fluorosilicic Acid

Global Anhydrous Hydrofluoric Acid Market, By Application

- Intermediate in Chemical Reactions

- Fuming Agents

Global Anhydrous Hydrofluoric Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Anhydrous Hydrofluoric Acid market over the forecast period?The global Anhydrous Hydrofluoric Acid market is projected to expand at a CAGR of 4.05% during the forecast period.

-

2. What is the market size of the Anhydrous Hydrofluoric Acid market?The global Anhydrous Hydrofluoric Acid market size is expected to grow from USD 6.63 billion in 2024 to USD 10.26 billion by 2035, at a CAGR 4.05% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Anhydrous Hydrofluoric Acid market?Asia Pacific is anticipated to hold the largest share of the Anhydrous Hydrofluoric Acid market over the predicted timeframe.

-

4. Who are the top companies operating in the global Anhydrous Hydrofluoric Acid market?BASF, Solvay, Arkema, LANXESS, Gulf Flour, SRF Limited, Donguye Group Ltd., Stella Chemifa Corporation, Honeywell International Inc., Orbia Flour & Energy Materials, Zhejiang Yonghe Refrigerant Co., Ltd., Navin Fluorine International Limited, and others.

-

5. What factors are driving the growth of the Anhydrous Hydrofluoric Acid market?The growth of the Anhydrous Hydrofluoric Acid market is driven by rising demand in semiconductor manufacturing, fluoropolymer production, expanding refrigerant applications, and increasing investments in high-purity acid technologies globally.

-

6. What are market trends in the Anhydrous Hydrofluoric Acid market?Market trends include increasing adoption in electronics and automotive sectors, technological advancements in high-purity production, regional supply chain expansions, and heightened regulatory focus on safety and environmental compliance.

-

7. What are the main challenges restricting wider adoption of the Anhydrous Hydrofluoric Acid market?Main challenges include stringent environmental regulations, raw material scarcity, high production costs, safety concerns related to handling, and complex logistics restricting broader market adoption.

Need help to buy this report?