Global Anesthesia Machines Market Size, Share, and COVID-19 Impact Analysis, By Offering (Anesthesia Workstations, Anesthesia Delivery Systems, Portable Anesthesia Machines, Anesthesia Ventilators, Anesthesia Monitors, and Anesthesia Machine Accessories), By Application (Orthopedic, Cardiology, Neurology, Respiratory Care, Urology, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Anesthesia Machines Market Insights Forecasts to 2035

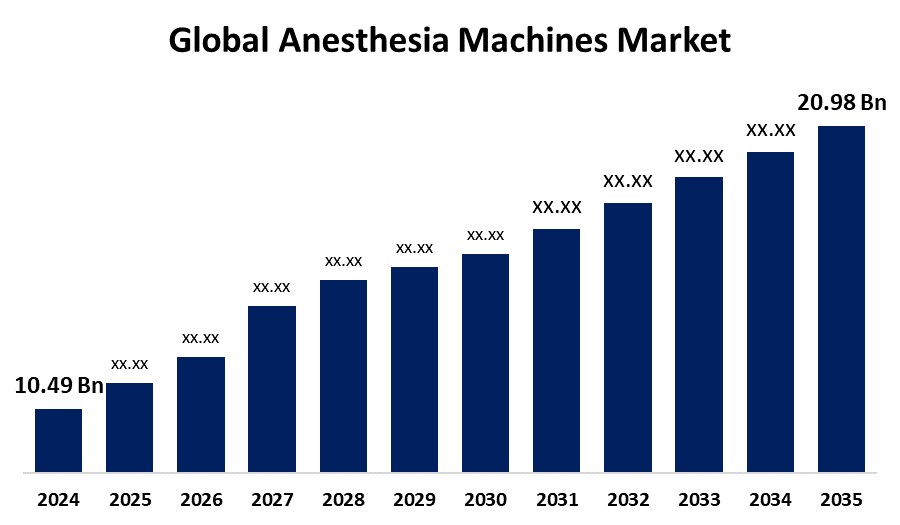

- The Global Anesthesia Machines Market Size Was Estimated at USD 10.49 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.50% from 2025 to 2035

- The Worldwide Anesthesia Machines Market Size is Expected to Reach USD 20.98 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Anesthesia Machines Market Size was worth around USD 10.49 Billion in 2024 and is predicted to Grow to around USD 20.98 Billion by 2035 with a compound annual growth rate (CAGR) of 6.50% from 2025 and 2035. The market is expected to increase as long as anesthesia machine technology continues to advance, including through the incorporation of artificial intelligence, remote monitoring capabilities, and improved user interfaces.

Market Overview

The sector devoted to the creation, manufacturing, and distribution of medical equipment used to deliver anesthesia during surgical procedures is known as the anesthetic machines market. To guarantee patient safety and sedation, these devices administer a regulated mixture of oxygen and anesthetic gases. The market for anesthetic machines is concentrated on improving patient safety, developing anesthesia delivery methods, and incorporating digital technology to increase surgical efficiency. The high rate of surgical procedure adoption, the rising incidence of chronic illnesses, the aging of the population, and technological developments in anesthetic devices are all factors driving the anesthesia machines market. The need for anesthesia machines is being driven by the increasing number of surgical procedures performed globally. These machines are necessary for the administration of anesthesia and for guaranteeing patient safety during surgeries. The effectiveness and safety of anesthesia machines are being improved by technical developments, such as the incorporation of anesthesia monitoring devices and improved safety features, which is driving the anesthesia machines market

Report Coverage

This research report categorizes the anesthesia machines market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the anesthesia machines market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the anesthesia machines market.

Global Anesthesia Machines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.49 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.50% |

| 2035 Value Projection: | USD 20.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Offering, By Application, and By Region |

| Companies covered:: | Medtronic PLC, Smiths Group plc, Ambu A/S, Koninklijke Philips NV, HEYER Medical AG, B. Braun SE, Draegerwerk AG, OSI Systems, Inc., Getinge AB, Fisher & Paykel Healthcare, GE HealthCare Technologies Inc., BPL Medical Technologies, Becton Dickinson and Company, Mindray Medical International Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for anesthesia machines is being driven by the growth of healthcare infrastructure, particularly in emerging nations, as medical facilities outfit themselves with the required equipment. Technological developments in anesthesia machines, including better ventilation modes, integrated monitoring systems, and increased patient safety features, are driving anesthesia machines market expansion. One of the main causes is the rise in surgical operations performed globally, which is being driven by the aging of the population and the occurrence of more chronic illnesses. The need for anesthesia machines is fueled in part by the rising incidence of chronic illnesses and the ensuing necessity for surgical procedures.

Restraining Factors

The anesthesia machines market growth is restricted by the high expense of anesthesia equipment, negative anesthesia reactions, and strict regulations. The key factors restricting the market's expansion include limited awareness and acceptance, a lack of qualified personnel, and the costly maintenance requirements of anesthetic machines.

Market Segmentation

The anesthesia machines market share is classified into offering and application.

- The anesthesia workstations segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the offering, the anesthesia machines market is divided into anesthesia workstations, anesthesia delivery systems, portable anesthesia machines, anesthesia ventilators, anesthesia monitors, and anesthesia machine accessories. Among these, the anesthesia workstations segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The increase in chronic disease prevalence, the high number of annual surgical procedures, and the widespread use of anesthetic workstations in developed nations. A variety of equipment, such as anesthetic machines, physiologic monitoring, and add-ons including supplementary bag-valve-mask systems and active suction equipment, make up anesthesia workstations.

- The orthopedic segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the anesthesia machines market is divided into orthopedic, cardiology, neurology, respiratory care, urology, and others. Among these, the orthopedic segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. An increasing number of orthopedic surgeries, including joint replacements and spinal procedures, have led to the orthopedic category holding the greatest proportion of the anesthetic machines market. The increased frequency of musculoskeletal conditions like osteoarthritis and orthopedic injuries resulting in surgery is the reason for the orthopedic field.

Regional Segment Analysis of the Anesthesia Machines Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the anesthesia machines market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the anesthesia machines market over the predicted timeframe. North America has a high rate of chronic illness, a high annual surgical volume, and high healthcare costs. North America is due to the region's excellent health care system, rapidly advancing technology, growing senior population, and rising per capita income. The region's dominance is a result of its sophisticated medical technologies, well-established healthcare infrastructure, and high healthcare spending. The need for anesthesia machines is also increased by the growing number of surgical procedures and the incidence of chronic disorders.

Asia Pacific is expected to grow at a rapid CAGR in the anesthesia machines market during the forecast period. Growing surgical procedures, technological developments, and healthcare infrastructure expansion are driving the Asia-Pacific anesthetic machine market. An increasing senior population and an increase in elective and aesthetic procedures are driving up demand in nations like China, India, and Japan. Government programs, rising healthcare spending, and the use of cutting-edge anesthetic technologies to improve patient safety and procedural efficiency all contribute to the market's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the anesthesia machines market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic PLC

- Smiths Group plc

- Ambu A/S

- Koninklijke Philips NV

- HEYER Medical AG

- B. Braun SE

- Draegerwerk AG

- OSI Systems, Inc.

- Getinge AB

- Fisher & Paykel Healthcare

- GE HealthCare Technologies Inc.

- BPL Medical Technologies

- Becton Dickinson and Company

- Mindray Medical International Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2023, To enable anesthesiologists to administer precise anesthesia and ultimately improve patient safety and operational efficiency during the perioperative phase, Mindray launched innovative upgrades to its A7 and A5 anesthesia systems under the A series anesthesia. These upgrades included state-of-the-art technologies. As a result, the company's product sales increased.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the anesthesia machines market based on the below-mentioned segments:

Global Anesthesia Machines Market, By Offering

- Anesthesia Workstations

- Anesthesia Delivery Systems

- Portable Anesthesia Machines

- Anesthesia Ventilators

- Anesthesia Monitors

- Anesthesia Machine Accessories

Global Anesthesia Machines Market, By Application

- Orthopedic

- Cardiology

- Neurology

- Respiratory Care

- Urology

- Others

Global Anesthesia Machines Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the anesthesia machines market over the forecast period?The global anesthesia machines market is projected to expand at a CAGR of 6.50% during the forecast period.

-

2. What is the market size of the anesthesia machines market?The global anesthesia machines market size is expected to grow from USD 10.49 billion in 2024 to USD 20.98 billion by 2035, at a CAGR of 6.50% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the anesthesia machines market?North America is anticipated to hold the largest share of the anesthesia machines market over the predicted timeframe.

Need help to buy this report?