Global Ammonium Thiosulphate Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial Grade, and Photo Grade), By End User (Water Treatment, Fertilizer, Photochemical, Mining, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ammonium Thiosulphate Market Size Insights Forecasts to 2035

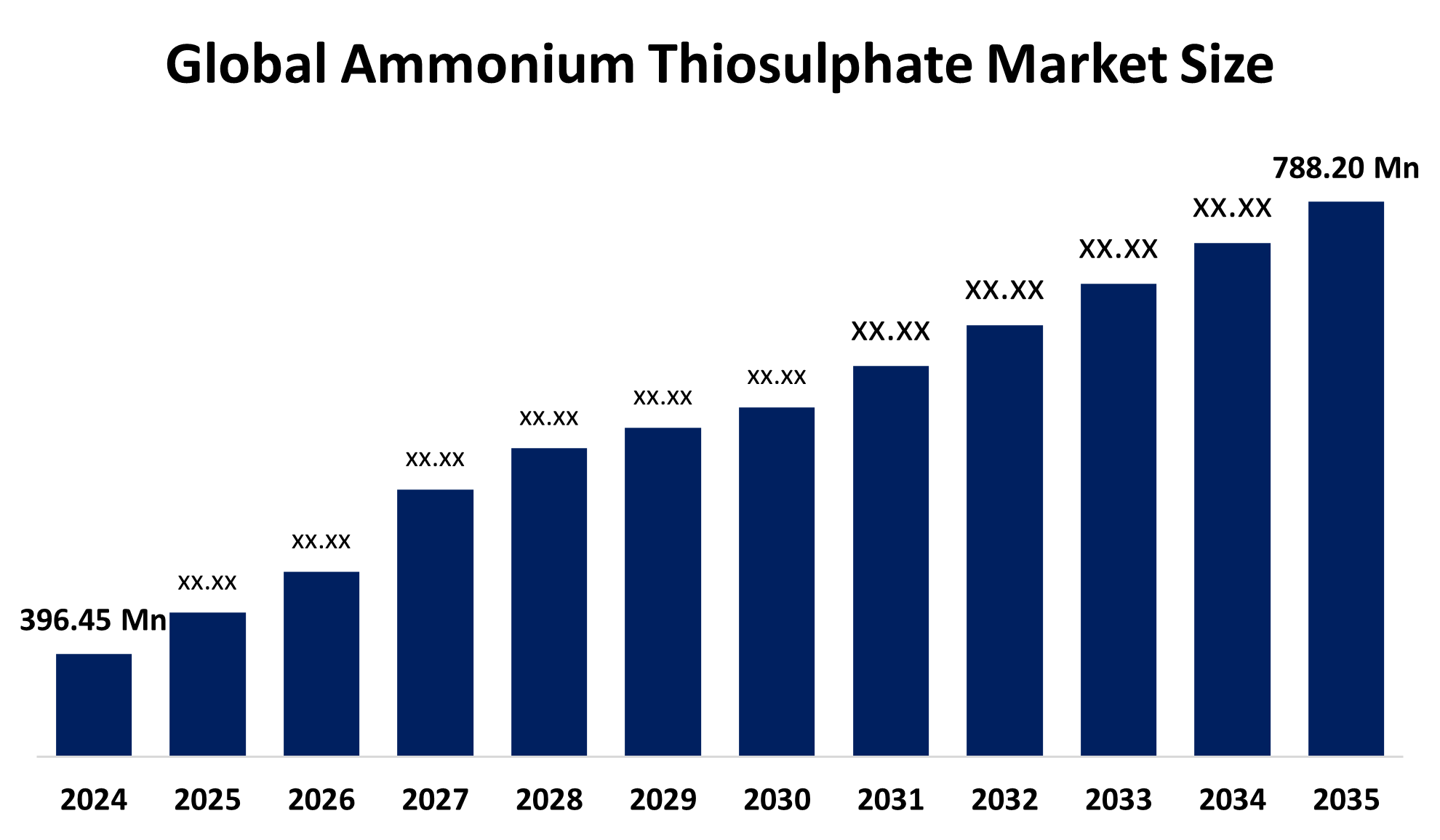

- The Global Ammonium Thiosulphate Market Size Was Valued at USD 396.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.45 % from 2025 to 2035

- The Worldwide Ammonium Thiosulphate Market Size is Expected to Reach USD 788.20 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Ammonium Thiosulphate Market Size was worth around USD 396.45 Million in 2024 and is Predicted to Grow to around USD 788.20 Million by 2035 with a Compound Annual Growth Rate (CAGR) of 6.45% from 2025 to 2035. The growing need for fertilizer, the use of precision agriculture, the increasing sulfur deficit in soils, wastewater treatment applications, the expansion of the mining industry, and developments in sustainable agricultural inputs make the ammonium thiosulphate market.

Market Overview

The industrial sector known as the Global Ammonium Thiosulphate Market includes all operations that create transport, and use ammonium thiosulfate. The system creates precision agriculture processes that decrease nitrogen leaching while enabling sulfur-deficient soils to produce higher crop yields through fertigation, foliar feeding, and soil application. Ammonium thiosulphate operates as a primary fertilizer solution that agriculture uses to boost crop yield, soil fertility, and farm production through its essential nitrogen and sulfur nutrients. Government initiatives and policies encourage the use of ATS for soil fertility and food security. The U.S. Department of Agriculture (USDA) provides funding for sustainable agriculture programs as part of its investment strategy.

In November 2025, the Government of India launched ammonium sulphate under the Nutrient-Based Subsidy (NBS) scheme beginning Rabi 2025–26, extending equal benefits to domestic and imported supplies. Offering Rs 9,479 per tonne for AS 20.5-0-0-23, the initiative aims to reduce urea dependence and encourage balanced fertilizer consumption nationwide. The ammonium thiosulphate market continues to expand through increasing demand for liquid ammonium thiosulfate formulations which customers prefer due to their nutritional value and simple application method.

Report Coverage

This research report categorizes the Global Ammonium Thiosulphate Market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ammonium thiosulphate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the ammonium thiosulphate market.

Global Ammonium Thiosulphate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 396.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.45% |

| 2035 Value Projection: | USD 788.20 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Grade, By End User |

| Companies covered:: | CF Industries Holdings Inc., Changsha Green Mountain Chemical Co. Ltd., Esseco Srl, GFS Chemicals Inc., Haifa Group, Hubei Yihua Chemical Industry Co. Ltd., ICL Group Ltd., Koch Nitrogen International Sarl, Kugler Co., Loveland Products Inc., Martin Midstream Partners, Nutrien Ltd., PCI Nitrogen and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The increasing demands of the world's population and the increased emphasis on enhancing crop yields and soil health, farmers and other agricultural stakeholders are using more sophisticated fertilizers to meet the demands of food production. Ammonium thiosulfate is widely employed as an effective fertilizer and nutrient management solution in the agriculture industry, which is the main driver of the ammonium thiosulphate expansion. Due to its wide range of uses in many sectors, ammonium thiosulfate is now seeing noteworthy expansion in the ammonium thiosulphate market.

Restraining Factors

The market for Global Ammonium Thiosulphate Market is restricted by factors such as price volatility for raw materials, strict environmental regulations, the availability of substitute sulfur fertilizers, storage and transportation issues, low farmer awareness, and shifting agricultural commodity prices that affect consumers' ability to make purchases.

Market Segmentation

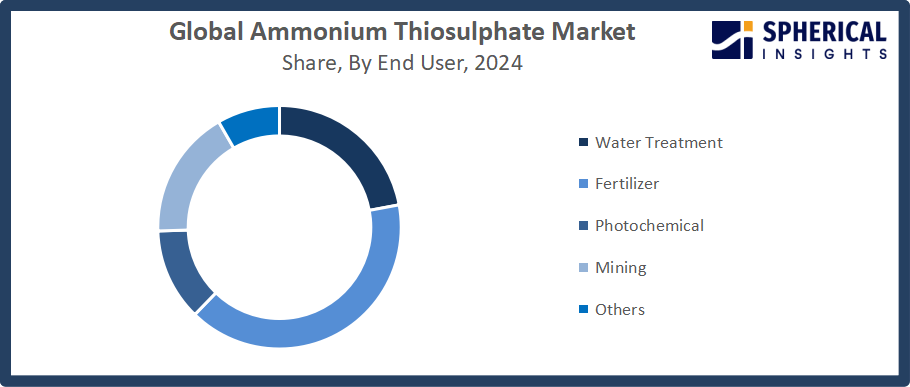

The ammonium thiosulphate market share is classified into grade and end user.

- The industrial grade segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the grade, the Global Ammonium Thiosulphate Market is divided into industrial grade and photo grade. Among these, the industrial grade segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. As a liquid nitrogen-sulfur fertilizer, industrial-grade ammonium thiosulphate is widely used to boost crop yield and address sulfur shortages in soil. Its demand among large-scale farming operations is further increased by its compatibility with liquid blending formulations and fertigation systems.

- The fertilizer segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the Global Ammonium Thiosulphate Market is divided into water treatment, fertilizer, photochemical, mining, and others. Among these, the fertilizer segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Ammonium thiosulphate, a liquid nitrogen-sulfur fertilizer, is essential for addressing sulfur deficiency and enhancing crop nitrogen uptake efficiency. The use of balanced fertilization solutions has grown dramatically as a result of the spread of high-yield farming techniques and the rise in global food demand.

Get more details on this report -

Regional Segment Analysis of the Ammonium Thiosulphate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the ammonium thiosulphate market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the Global Ammonium Thiosulphate Market over the predicted timeframe. Growing agricultural activity and the demand for effective fertilizers are the main drivers in North America. At about 65%, the United States has the highest market share, followed by Canada at 20%. Since ammonium thiosulfate is frequently used as a sulfur-containing fertilizer to improve the soil's fertility, rising demand from the agriculture sector is one of the main drivers driving growth in the USA ammonium thiosulfate market. Tessenderlo Group's opening of a liquid fertilizer factory in Illinois, which increases production capacity, and Koch Fertilizers' new 2-million-gallon ATS terminal in Fort Dodge, which is expected to be operational by 2025, are examples of recent announcements and advancements.

Asia Pacific is expected to grow at a rapid CAGR in the Global Ammonium Thiosulphate Market during the forecast period. Asia Pacific is fueled by growing agricultural production and the region's rapidly expanding population's increased demand for food. Japan's market for ammonium thiosulfate is expanding steadily due to its use in both industrial and agricultural settings. Several important companies, such as Haifa Group and OCI N.V., are based in China and India and are increasing their businesses to satisfy the rising demand. Government measures include China's policies supporting high-yield agriculture and food self-sufficiency, as well as India's programs encouraging balanced fertilizer subsidies and soil health cards to promote sulfur-inclusive products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global Ammonium Thiosulphate Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CF Industries Holdings, Inc.

- Changsha Green Mountain Chemical Co., Ltd.

- Esseco Srl

- GFS Chemicals, Inc.

- Haifa Group

- Hubei Yihua Chemical Industry Co., Ltd.

- ICL Group Ltd.

- Koch Nitrogen International Sarl

- Kugler Co.

- Loveland Products, Inc.

- Martin Midstream Partners

- Nutrien Ltd.

- PCI Nitrogen

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, Tessenderlo Kerley International launched an expanded Ammonium Thiosulphate portfolio by acquiring the marketing and sales operations of ATS fertilizers from Esseco Srl, strengthening its Thio-Sul range and enhancing distribution efficiency across European agricultural markets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Global Ammonium Thiosulphate Market based on the below-mentioned segments:

Global Ammonium Thiosulphate Market, By Grade

- Industrial Grade

- Photo Grade

Global Ammonium Thiosulphate Market, By End User

- Water Treatment

- Fertilizer

- Photochemical

- Mining

- Others

Global Ammonium Thiosulphate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the ammonium thiosulphate market over the forecast period?The global ammonium thiosulphate market is projected to expand at a CAGR of 6.45% during the forecast period.

-

2.What is the market size of the ammonium thiosulphate market?The global ammonium thiosulphate market size is expected to grow from USD 396.45 Million in 2024 to USD 788.20 Million by 2035, at a CAGR of 6.45 % during the forecast period 2025-2035.

-

3.Which region holds the largest share of the ammonium thiosulphate market?North America is anticipated to hold the largest share of the ammonium thiosulphate market over the predicted timeframe.

-

4.Who are the top companies operating in the global ammonium thiosulphate market?CF Industries Holdings, Inc., Changsha Green Mountain Chemical Co., Ltd., Esseco Srl, GFS Chemicals, Inc., Haifa Group, Hubei Yihua Chemical Industry Co., Ltd., ICL Group Ltd., Koch Nitrogen International Sarl, Kugler Co., Loveland Products, Inc., Martin Midstream Partners, Nutrien Ltd., PCI Nitrogen, and Others.

-

5.What factors are driving the growth of the ammonium thiosulphate market?Growth is driven by rising fertilizer demand, increasing sulfur deficiencies in soils, expansion of precision farming, higher cultivation of high-value crops, and supportive government initiatives promoting balanced nutrient management practices.

-

6.What are the market trends in the ammonium thiosulphate market?Increasing use of liquid fertilizers, integration with fertigation systems, focus on sustainable agriculture, improvements in nutrient formulation technology, and growing uses in mining and industrial processes are some of the major themes.

-

7.What are the main challenges restricting the wider adoption of the ammonium thiosulphate market?The volatility of raw material prices, strict environmental restrictions, the availability of substitute fertilizers, storage and transportation limitations, low farmer awareness, and shifting agricultural commodity prices impacting demand stability are some of the main obstacles.

Need help to buy this report?